- Home

- »

- Medical Devices

- »

-

Pessary Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Pessary Market Size, Share & Trends Report]()

Pessary Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Gellhorn, Ring, Donut), By End Use (Hospitals, Ambulatory Surgical Centers, Clinics), By Region (North America, Europe, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68038-299-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pessary Market Summary

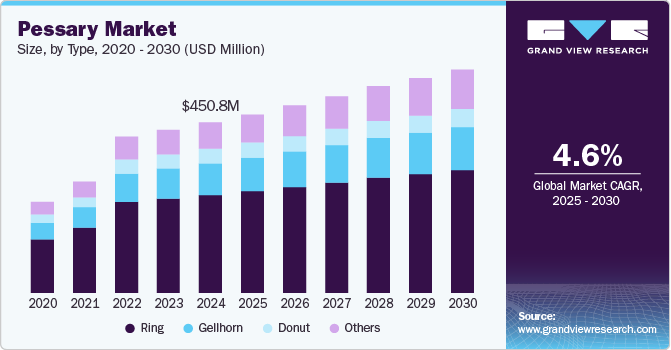

The global pessary market size was valued at USD 450.8 million in 2024 and is projected to reach USD 590.5 million by 2030, growing at a CAGR of 4.6% from 2025 to 2030. The growth is driven by factors such as the increasing prevalence of pelvic organ prolapse and stress urinary incontinence, a growing geriatric population susceptible to these conditions, advancements in non-invasive treatment options, rising awareness of pelvic health, and enhanced accessibility of pessary devices through various distribution channels.

Key Market Trends & Insights

- North America pessary market dominated the global industry and accounted for 41.4% of revenue share in 2024.

- The pessary market in the U.S. held a significant share of North America's pessary market in 2024.

- By type, the ring segment led the market with a revenue share of 57.3% in 2024.

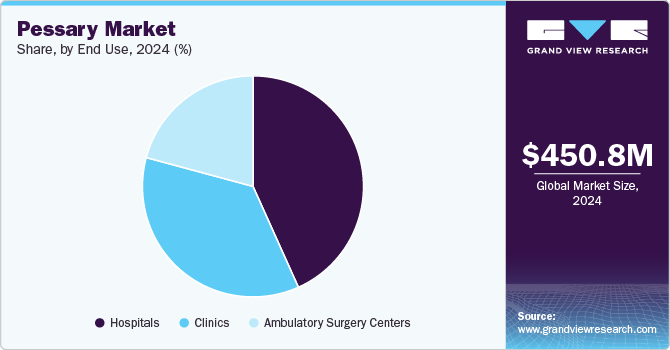

- By end use, the hospital segment held the largest market revenue share of 43.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 450.8 Million

- 2030 Projected Market Size: USD 590.5 Million

- CAGR (2025-2030): 4.6%

- North America: Largest market in 2024

For instance, according to the article published in Frontiers in Public Health Journal in September 2022, in the U.S., the number of women affected by pelvic organ prolapse (POP) is projected to rise by approximately 50% by 2050. In addition, a study conducted in the Gambia revealed that while 46% of women exhibited some prolapse upon examination, only 12.5% reported symptoms related to POP. These statistics underscore the widespread nature of the condition, both symptomatic and asymptomatic, driving the demand for effective management solutions such as pessary devices.

The increasing prevalence of stress urinary incontinence symptoms is a key driver of the industry. For instance, a study published in BMC Women’s Health Journal in September 2024, involving 386 Palestinian women, with a response rate of 85.8%, found that 26.9% experienced stress urinary incontinence (SUI) symptoms. The study also revealed that women with a family history of SUI were 2.5 times more likely to report symptoms, while those who were overweight or obese were 2 times more likely to experience SUI compared to women with normal or low weight. These findings highlight the widespread nature of stress urinary incontinence and underscore the growing demand for effective, non-invasive solutions such as pessary devices to manage symptoms. The prevalence of such conditions, combined with risk factors such as family history and obesity, is expected to further fuel market growth as more individuals seek treatment options.

The growing geriatric population is a significant driver of the industry, as older adults are particularly susceptible to conditions such as pelvic organ prolapse and stress urinary incontinence. For instance, according to the World Health Organization (WHO), by 2030, it is projected that 1 in 6 people globally are expected to be aged 60 years or older, with the number of individuals in this age group increasing from 1 billion in 2020 to 1.4 billion. By 2050, the world’s population of people aged 60 and older is expected to double to 2.1 billion, and the number of people aged 80 or older is anticipated to triple, reaching 426 million. As the aging population continues to grow, the prevalence of conditions such as pelvic organ prolapse and urinary incontinence is expected to rise, creating a greater demand for non-invasive management solutions, such as pessary devices.

Technological advancements in pessaries are driving market growth by improving treatment outcomes and patient satisfaction. For instance, a study published in Urogynecology (Phila) Journal in March 2023 involving eight women showed that switching from a standard pessary to a patient-specific pessary treatment led to significant improvements in prolapse symptoms, as measured by the Pelvic Organ Prolapse Distress Inventory-6. In addition, there was an increase in overall pessary satisfaction, with a median change of +2.0 on a visual analog scale. All patients reported either an improvement or no change in ease of use, comfort, and the support provided by the pessary. Customized pessary designs tailored to an individual’s anatomy can lead to better outcomes, increasing patient satisfaction and contributing to the growing demand for these devices.

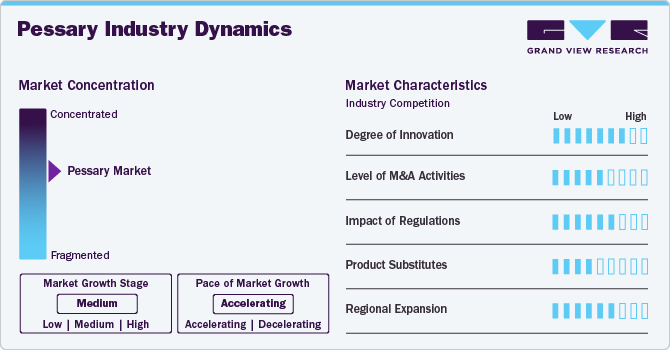

Industry Concentration & Characteristics

The market exhibits a moderate level of industry concentration, with a combination of established multinational corporations and emerging enterprises competing for market share. Key players leverage advanced technological solutions, extensive distribution networks, and significant investments in research and development to maintain their dominance. Prominent companies such as CooperSurgical Inc., Bliss GVS Pharma Limited, MedGyn Products, Inc., Panpac Medical Corp., Bioteque America Inc., Personal Medical Corp., Dr. Arabin GmbH & Co. KG, INTEGRA LIFESCIENCES lead in innovation, driving the development of advanced pessary devices. These market leaders benefit from strong brand recognition, comprehensive product portfolios, and a global presence, providing them with a competitive advantage. Concurrently, emerging firms are introducing innovative technologies and focusing on specialized solutions to address unmet patient needs, thereby contributing to the market's dynamic growth.

The industry is characterized by a high degree of innovation, driven by the growing demand for more personalized, comfortable, and effective treatments for pelvic organ prolapse and incontinence. One significant area of advancement is the use of 3D printing technology, which allows for the creation of custom-fit pessaries tailored to a patient's unique anatomy, ensuring a better fit, increasing comfort, and improving effectiveness, as standard-sized pessaries often lead to irritation or discomfort for some patients. Another notable innovation is the development of biodegradable pessaries, made from sustainable materials that break down over time, reducing environmental impact while providing patients with a safe and comfortable alternative to traditional devices. Materials innovation has also played a key role in the market, with medical-grade silicone, known for its flexibility, durability, and hypoallergenic properties, increasingly being used in pessary design. Soft elastomers and other advanced materials have enhanced comfort and longevity, making the devices more user-friendly and suitable for long-term wear.

The impact of regulation on the industry is significant. Regulations play a critical role in the pessary market by ensuring the safety, efficacy, and quality of products. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose strict guidelines on the design, manufacturing, and testing of pessaries, ensuring that only safe and effective devices are made available to patients. These regulations mandate extensive clinical testing and compliance with standards for biocompatibility and durability. While these requirements may increase development costs and extend the time required to bring new products to market, they ultimately protect patient safety. The evolving nature of these regulations encourages innovation, pushing manufacturers to develop new materials, designs, and technologies to meet compliance standards. In markets with stricter regulatory frameworks, such as the European Union, the pace of product introduction may be slower, whereas, in emerging markets, less stringent regulations may allow for quicker market entry but pose a higher risk of substandard products.

The level of mergers and acquisitions (M&A) activities has been steadily increasing as companies seek to expand their product portfolios, enhance innovation, and strengthen their market presence. These activities are driven by the need for strategic collaborations and the desire to integrate complementary technologies and expertise. For instance, Bliss GVS Pharma Limited has sought to grow its market share by acquiring smaller companies with innovative gynecological solutions, including pessaries, in the last two years to enhance its product offerings and distribution capabilities. These M&A deals allow these companies to diversify their offerings, penetrate new geographic markets, and improve distribution networks, further boosting their position in the growing pessary market.

Several product substitutes are available that offer alternative treatments for pelvic organ prolapse, incontinence, and other pelvic health conditions. One prominent substitute is pelvic floor exercises, such as Kegel exercises, which help strengthen the pelvic muscles and may reduce the need for pessaries in mild cases. Another alternative is surgical interventions, including hysterectomy or pelvic organ repair surgeries, which aim to correct prolapse or other pelvic issues but typically require longer recovery times and greater risks compared to non-invasive options such as pessaries. Hormonal therapy is another alternative, particularly in cases of incontinence or prolapse associated with menopause, as it aims to restore muscle tone and tissue integrity. Newer technologies, such as intra-abdominal pressure management devices and biofeedback therapies, are emerging as alternatives, offering non-invasive methods to manage pelvic health issues. While these substitutes offer different benefits, pessaries remain a popular option due to their non-surgical nature, affordability, and effectiveness, particularly for patients seeking a conservative approach to managing pelvic organ prolapse and incontinence.

Regional expansion in this market is driven by growing awareness of pelvic health issues, an aging population, and increasing healthcare infrastructure in emerging markets. In developed regions, such as North America and Europe, there is a high demand for advanced pelvic health solutions, with companies focusing on expanding their product offerings and improving distribution networks to cater to the growing number of women experiencing pelvic organ prolapse and incontinence. For instance, CooperSurgical Inc. has expanded its presence in North America and Europe, acquiring companies that complement its portfolio of women’s health products, including pessaries. As companies continue to focus on regional expansion, they are forming strategic partnerships, localizing manufacturing, and adapting their marketing efforts to align with the specific needs and regulations of each region, positioning themselves to capitalize on the expanding global demand for pessaries.

Type Insights

The ring segment led the market with a revenue share of 57.3% in 2024. This dominance can be attributed to the ring pessary’s ease of use, comfort, and effectiveness in managing pelvic organ prolapse and incontinence. Ring pessaries are designed to provide support to the pelvic organs while being relatively simple to insert and remove, making them a preferred choice for both patients and clinicians. Their flexible design allows for a more comfortable fit, minimizing irritation and discomfort, which is essential for long-term use. In addition, the ring pessary’s versatility, with different sizes and shapes available, ensures it can be tailored to the individual needs of patients, further contributing to its widespread use. The growing preference for non-surgical, non-invasive treatment options for pelvic health conditions, combined with the ease of fitting and minimal side effects, is expected to continue driving the growth of the ring segment throughout the forecast period.

The others segment in the pessary market is anticipated to experience significant growth throughout the forecast period due to increasing awareness about alternative pessary designs tailored for specific medical needs. This segment includes niche designs such as cube, and inflatoball pessaries, which cater to patients with unique anatomical or medical requirements. Factors driving this growth include advancements in material technology, enhancing comfort and durability, and rising demand for customizable solutions for managing conditions such as advanced pelvic organ prolapse. In addition, increasing healthcare accessibility in developing regions and targeted awareness campaigns by healthcare providers are expected to support the segment's expansion in the coming years.

End Use Insights

The hospital segment held the largest market revenue share of 43.6% in 2024, driven by the extensive use of pessaries in post-operative and bedridden in-patients. The growing awareness of conditions such as organ prolapse and urinary incontinence, along with the inclusion of pessaries in private insurance coverage, are key factors contributing to the segment's growth. In addition, hospitals are increasingly adopting minimally invasive procedures for pessary placement, which help reduce post-operative complications and promote faster recovery times, further boosting the demand for pessaries in healthcare settings. The integration of advanced medical technologies in hospitals also enhances the accuracy and effectiveness of pessary fittings, improving patient outcomes.

The clinic segment is projected to witness the fastest CAGR of 5.2% during the forecast period. This growth is attributed to the affordability of pessary fitting procedures, shorter stay durations, and the increased convenience they offer for the geriatric population. In addition, clinics provide a more personalized and accessible environment for patients, enhancing patient satisfaction and encouraging continued use of pessaries. In addition, ambulatory surgical centers are expected to see substantial growth, driven by the rising awareness of these centers among the general population, offering a cost-effective and efficient alternative to hospital-based treatments.

Regional Insights

North America pessary market dominated the global industry and accounted for 41.4% of revenue share in 2024. This dominance can be attributed to the region's robust healthcare infrastructure, widespread awareness of pelvic health issues, and the growing prevalence of conditions such as pelvic organ prolapse and urinary incontinence. In the United States, approximately 3.3 million women suffer from pelvic organ prolapse, contributing to increased demand for non-surgical treatments such as pessaries. In addition, the region's high healthcare spending, alongside the inclusion of pessaries in both private insurance and Medicare coverage, has enhanced accessibility for patients. The presence of leading medical device companies such as CooperSurgical and MedGyn Products, which offer a variety of pessary products, further supports North America's dominant position. In addition, the increasing preference for non-invasive treatments in hospitals and clinics, coupled with a shift towards more patient-centered care, has fueled the market's growth.

U.S. Pessary Market Trends

The pessary market in the U.S. held a significant share of North America's pessary market in 2024. The growth of the market is driven by a combination of high prevalence rates of pelvic health conditions, advanced healthcare systems, and increasing awareness of non-surgical treatment options. With a large aging population, especially women over the age of 50, the demand for pessaries is substantial, as conditions such as pelvic organ prolapse and urinary incontinence are more common in this demographic. For instance, according to the U.S. Department of Health and Human Services, nearly one in four women experience some form of pelvic organ prolapse, which significantly boosts the demand for pessaries as a preferred non-invasive treatment. In addition, the integration of pessaries into private insurance plans and Medicare has made these devices more accessible to a wider range of patients, further increasing their adoption.

Europe Pessary Market Trends

The pessary market in Europe is experiencing significant growth, driven by the increasing prevalence of pelvic health disorders such as pelvic organ prolapse and urinary incontinence. With a rapidly aging population, particularly in countries such as Germany, France, and the UK, the demand for non-surgical treatments, including pessaries, has risen substantially. In addition, greater awareness of pelvic health issues and the availability of pessaries through public health systems and private insurance plans have made these devices more accessible to patients. European healthcare providers are increasingly adopting minimally invasive procedures for pessary placement, enhancing patient comfort and recovery times. The presence of key market players and the development of innovative pessary products further support the market's expansion. These factors collectively contribute to the steady growth of the pessary market in Europe.

The UK pessary market is experiencing steady growth, driven in part by technological advancements in the development of pessary products. Innovations in materials and design have led to the creation of more comfortable, durable, and customizable pessaries, improving patient outcomes and driving adoption. The increasing use of minimally invasive techniques for pessary fitting, supported by advancements in medical devices, has also contributed to the market's growth by enhancing patient comfort and reducing recovery times. For instance, according to the UK National Health Service (NHS), pelvic organ prolapse affects approximately 50% of women over the age of 50, contributing to the rising demand for pessaries as a non-surgical treatment. As healthcare providers continue to embrace new technologies to improve pelvic health treatments, the UK pessary market is expected to expand steadily.

The pessary market in France is expanding due to the rising healthcare expenditures, which are facilitating the availability and accessibility of advanced pelvic health treatments. With increasing public and private investments in healthcare infrastructure, French hospitals and clinics are increasingly adopting pessaries as a non-invasive treatment option for pelvic organ prolapse and urinary incontinence. For instance, according to a report from the French Ministry of Health, over 30% of women aged 60 and above experience some form of pelvic floor disorder, which contributes to the growing demand for pessaries. In addition, technological advancements in pessary design, such as improved materials and customizable sizes, are enhancing patient comfort and encouraging wider usage.

Germany pessary market is primarily driven by technological advancements in pessary design and the expanding geriatric population. These advancements are particularly beneficial for elderly patients, who often require non-surgical treatments for pelvic organ prolapse and urinary incontinence. For instance, according to the German Federal Statistical Office, the country's aging population, with over 20% of individuals aged 65 and above, has contributed significantly to the growing demand for pessaries. As the geriatric population continues to rise, the need for accessible, non-invasive pelvic health treatments is expected to further boost the market. These factors, combined with the ongoing development of advanced pessary designs, are driving the expansion of the German pessary market.

Asia Pacific Pessary Market Trends

The pessary market in Asia Pacific is experiencing significant growth, driven by increasing awareness about women’s health and the growing adoption of non-invasive treatment options. As awareness of pelvic health issues such as pelvic organ prolapse and urinary incontinence rises across the region, more women are seeking effective treatments, leading to a greater demand for pessaries. Educational campaigns and health initiatives in countries such as China, India, and Japan are helping to break the stigma surrounding pelvic health disorders, encouraging women to seek timely medical intervention. In addition, the region is witnessing a shift towards non-invasive treatment options, as patients increasingly prefer alternatives to surgery due to concerns over recovery time, costs, and potential complications.

Japan pessary market is experiencing notable growth, driven by the rising prevalence of pelvic organ prolapse (POP) and urinary incontinence, coupled with the expanding geriatric population. As Japan has one of the fastest aging populations globally, with over 28% of its population aged 65 or older, the incidence of pelvic health disorders, particularly POP and urinary incontinence, has been increasing. For instance, according to the Japanese Urological Association, these conditions affect a significant portion of the elderly population, driving the demand for effective non-surgical treatments such as pessaries. The growing recognition of pelvic health issues among the aging population, along with the preference for non-invasive solutions, is contributing to the rising adoption of pessaries in Japan.

The pessary market in China is experiencing significant growth, driven by the growing preference for affordable and effective treatments and a shift towards minimally invasive procedures. As the healthcare system in China evolves, there is a rising demand for cost-effective solutions for managing pelvic health issues such as pelvic organ prolapse and urinary incontinence. In addition, there is a growing trend towards minimally invasive procedures in the country, as patients and healthcare providers seek treatments that involve less risk, quicker recovery times, and fewer complications. These factors are expected to continue driving the growth of the pessary market in China.

India pessary market is expected to witness exponential growth, driven by increasing awareness about women’s health and the growing adoption of non-invasive treatment options. As awareness about pelvic health issues such as pelvic organ prolapse and urinary incontinence increases through healthcare campaigns and educational initiatives, more women opting for timely and effective solutions. This shift in awareness is encouraging the adoption of pessaries as a preferred treatment option. In addition, the rising demand for non-invasive treatments in India, particularly among women who prefer alternatives to surgery, is fueling market growth.

Latin America Pessary Market Trends

The pessary market in Latin America is experiencing steady growth, driven by growing awareness of women’s health and the rising demand for non-invasive treatment options for pelvic health disorders. Increasing education on women’s health, particularly pelvic organ prolapse and urinary incontinence has encouraged more women to seek treatment, leading to greater adoption of pessaries as an effective solution. For instance, in Brazil, the prevalence of pelvic organ prolapse is estimated to affect over 20% of women aged 40 and above, contributing to the growing demand for pessaries as a non-surgical treatment option. Healthcare providers are increasingly offering pessaries as a non-invasive alternative to surgery, which is often more expensive and invasive. This preference for non-invasive treatments aligns with the broader healthcare trend in Latin America, where cost-effective solutions are gaining popularity.

Middle East & Africa Pessary Market Trends

The pessary market in the Middle East & Africa is growing rapidly due to the growing adoption of non-invasive treatment options and technological advancements in pessary design. As more patients seek alternatives to surgical interventions, particularly for managing pelvic organ prolapse and urinary incontinence, pessaries are becoming a preferred choice due to their effectiveness and minimal recovery time. For instance, according to a study by the Saudi Health Council, approximately 30% of women over the age of 50 in Saudi Arabia experience pelvic health disorders, increasing the demand for non-surgical solutions.

Key Pessary Company Insights

The scenario in the pessary market is highly competitive, with key players such as CooperSurgical Inc., Bliss GVS Pharma Limited, MedGyn Products and others. The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Pessary Companies:

The following are the leading companies in the pessary market. These companies collectively hold the largest market share and dictate industry trends.

- CooperSurgical Inc.

- Bliss GVS Pharma Limited

- MedGyn Products, Inc.

- Panpac Medical Corp.

- Bioteque America Inc.

- Personal Medical Corp.

- Dr. Arabin GmbH & Co. KG

- INTEGRA LIFESCIENCES

Recent Developments

-

In February 2023, the American Urogynecologic Society introduced updated guidelines for using pessaries in the management of pelvic organ prolapse. These guidelines aim to standardize pessary application, ensuring consistency in clinical practices and enhancing patient outcomes through improved care strategies.

-

In December 2022, INTEGRA LIFESCIENCES completed the acquisition of Surgical Innovation Associates (SIA), a company specializing in the development of advanced solutions for reconstructive and plastic surgery. This strategic acquisition is expected to enhance Integra's portfolio, particularly in the area of soft tissue reconstruction, by integrating SIA's FDA-cleared product, DuraSorb.

-

In November 2021, CooperSurgical, Inc. announced the signing of a definitive agreement to acquire Generate Life Sciences, a leading provider of cryopreservation services. This acquisition aligns with CooperSurgical’s mission to enhance reproductive and genetic health services, expanding its capabilities in supporting families across their reproductive and regenerative health needs.

Pessary Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 472.1 million

Revenue forecast in 2030

USD 590.5 million

Growth rate

CAGR of 4.6% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

CooperSurgical Inc.; Bliss GVS Pharma Limited; MedGyn Products, Inc.; Panpac Medical Corp.; Bioteque America Inc.; Personal Medical Corp.; Dr. Arabin GmbH & Co. KG; INTEGRA LIFESCIENCES

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pessary Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pessary market report on the basis of type, end use and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gellhorn

-

Ring

-

Donut

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgery Centers

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pessary market size was estimated at USD 450.8 million in 2024 and is expected to reach USD 472.1 million in 2025.

b. The global pessary market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2030 to reach USD 590.5 million by 2030.

b. North America dominated the pessary market with a share of 41.4% in 2024. This is attributed to factors such as strong medical infrastructure, high chronic disease burden, and advancements in minimally invasive procedures.

b. Some key players operating in the pessary market include MedGyn Products, Inc.; PanPac Medical; Thomas Medical, Wallach Surgical Devices.; and Bioteque America.

b. The increasing number of chronic respiratory diseases, growing prevalence of obesity, and rising geriatric population along with the growing prevalence of organ prolapse are some of the key factors that are driving the pessary market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.