- Home

- »

- Medical Devices

- »

-

Vacuum Therapy Devices Market Size & Share Report, 2030GVR Report cover

![Vacuum Therapy Devices Market Size, Share & Trends Report]()

Vacuum Therapy Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Vacuum Constriction Devices), By Type, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-417-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vacuum Therapy Devices Market Trends

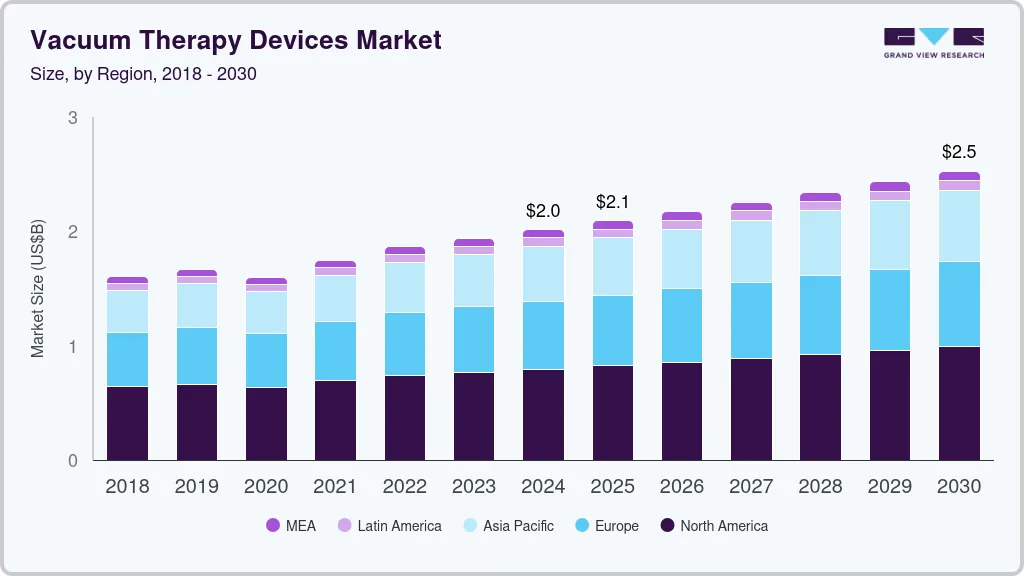

The global vacuum therapy devices market size was estimated at USD 2.01 billion in 2024 and is projected to reach USD 2.52 billion by 2030, growing at a CAGR of 3.9% from 2025 to 2030. This growth is attributed to the increasing prevalence of chronic wounds, rising incidences of surgeries, and the expanding geriatric population, which is more susceptible to conditions such as diabetes and pressure ulcers. Chronic wounds, including diabetic foot ulcers, venous leg ulcers, and pressure ulcers, represent a significant burden on healthcare systems worldwide. According to the report published by the National Library of Medicine in December 2023, chronic wounds affect approximately 10.5 million Medicare beneficiaries in the U.S., and these wounds impact the quality of life for around 2.5% of the U.S. population, with the elderly being disproportionately affected.

The increasing prevalence of chronic conditions such as diabetes and obesity has led to a higher incidence of chronic wounds globally. Chronic wounds, particularly diabetic foot ulcers, are common complications of diabetes, necessitating advanced wound care solutions such as Negative Pressure Wound Therapy (NPWT). According to estimates published in the British Journal of Nursing in February 2024, diabetes impacts approximately 537 million individuals globally, with up to 34% of them affected by diabetic foot ulcers due to inadequate glycemic control. In addition, the growing elderly population, which is more susceptible to conditions leading to chronic wounds, further contributes to the rising demand for NPWT devices. The World Health Organization projects that the global population aged 60 years and older will double by 2050, underscoring the increasing need for effective wound management solutions.

The rising incidence of surgical procedures in orthopedics, cardiovascular care, and plastic surgery has also driven demand for vacuum therapy devices, which are essential for managing surgical wounds, reducing edema, and accelerating recovery. According to the report published by the National Library of Medicines in June 2024, in the U.S., 1 in 9 individuals reported undergoing at least one surgical procedure, with rates notably higher among those aged 65 and older and Medicare beneficiaries, where approximately 1 in 5 individuals in these groups have had surgery. Recent advancements, such as lightweight NPWT devices and the integration of digital technologies, such as smart sensors and mobile apps for real-time monitoring, have further fueled market growth. These innovations not only enhance patient outcomes but also expand market reach, particularly in home care settings. In addition, regulatory approvals and new product introductions are propelling market expansion as companies invest in research and development to meet diverse patient needs.

Vacuum therapy, particularly NPWT, has gained widespread acceptance as an effective treatment for various conditions due to its ability to promote faster healing, reduce infection rates, and minimize hospital stays, thereby lowering overall healthcare costs. Companies in this market have introduced innovative products with unique features that enhance treatment efficacy and contribute to the overall growth of the market. For instance, Smith & Nephew’s PICO system represents a significant advancement in vacuum therapy, offering NPWT benefits in a compact, user-friendly format. Its small, lightweight design facilitates daily use, and its single-use, disposable nature enhances hygiene by eliminating the need for reprocessing. The device's simple application process allows for quick setup by both healthcare professionals and patients, making the PICO system particularly suitable for outpatient and home care settings, which drives its increased adoption.

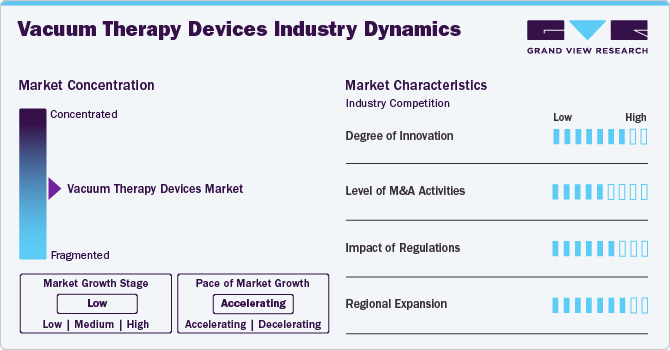

Market Concentration & Characteristics

The market for vacuum therapy devices is moderately concentrated, with a high degree of product differentiation based on features such as portability, ease of use, and technological integration. Leading companies such as Smith & Nephew, Mölnlycke Health Care, and Boston Scientific hold significant market shares due to their extensive product portfolios, established distribution networks, and strong brand recognition. Smaller companies and new entrants face challenges in competing at the same scale due to high entry barriers, including the need for advanced research and development (R&D), regulatory approvals, and significant capital investment. The market is also characterized by long-term contracts with healthcare providers and institutions, which further solidifies the position of leading companies.

The degree of innovation in the market is relatively high, driven by the continuous demand for improved patient outcomes and more efficient wound care solutions. Technological advancements have led to the development of portable and lightweight NPWT devices that are user-friendly and adaptable to home care settings. For example, Acelity’s V.A.C. VERAFLO Therapy System represents a significant advancement in NPWT by integrating negative pressure with instillation therapy. This dual approach allows for the direct application of topical antiseptics or antibiotics to the wound while maintaining negative pressure, thereby enhancing wound cleansing and reducing infection rates. The system's flexibility, with adjustable settings for both instillation and pressure, enables personalized treatment for complex wounds. This innovative combination improves clinical outcomes and broadens the range of therapeutic options available to healthcare providers, making it a critical tool in advanced wound care.

The market has seen notable levels of mergers and acquisitions (M&A) as companies seek to expand their market share, diversify their product offerings, and gain access to new technologies. Major players in the industry have been actively acquiring smaller companies and innovative startups to strengthen their competitive positions and accelerate the development of advanced wound care solutions. For instance, in October 2019, 3M acquired Acelity, a leading provider of NPWT systems, for approximately USD 6.7 billion, significantly bolstering its position in the wound care market. This acquisition allowed 3M to expand its product portfolio and leverage Acelity's established customer base.

The regulatory framework for vacuum therapy devices is stringent, particularly in key markets such as the U.S., Europe, and Japan, where these devices are classified as medical devices. Regulatory bodies such as the FDA and EMA enforce rigorous approval processes to ensure safety, efficacy, and quality, which require extensive clinical trials and post-market surveillance. Recent regulatory developments emphasize digital health solutions, leading to new guidelines for devices with remote monitoring capabilities. The global harmonization of regulations, such as the EU's Medical Device Regulation (MDR), aims to streamline approval processes and maintain consistent standards. Successfully navigating these challenges is crucial for market success.

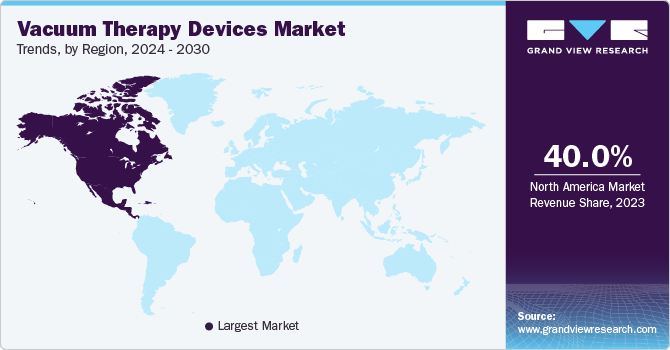

The market is experiencing significant expansion in emerging regions such as Asia-Pacific, Latin America, and the Middle East & Africa, driven by rising demand for advanced wound care solutions, increased healthcare spending, and improved infrastructure. Asia-Pacific, particularly China and India, is expected to see the fastest CAGR due to large patient populations and the adoption of advanced medical technologies. Strategic partnerships and the development of cost-effective, portable NPWT devices are enabling companies to tap into these emerging markets, diversify revenue streams, and reduce reliance on saturated regions.

Product Insights

The market is segmented into negative pressure wound therapy (NPWT) devices and vacuum constriction devices (VCDs) in terms of product. In 2023, the NPWT segment held the largest share of more than 60.0%. This dominance is attributed to its broad clinical applications, the growing prevalence of chronic wounds, and technological advancements in NPWT. NPWT involves applying negative pressure to a wound, which helps remove exudate, reduce edema, and promote granulation tissue formation. This method has been particularly successful in treating chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, prevalent among patients with diabetes, obesity, and those who are bedridden.

The 2023 International Working Group on the Diabetic Foot Guideline (IWGDF) recommended NPWT as a supplementary treatment for post-surgical diabetic foot management. Studies published by the National Library of Medicine in September 2023 indicate that NPWT can significantly enhance wound healing by promoting granulation tissue formation, reducing the size of diabetic foot ulcers (DFUs), and shortening overall healing time compared to conventional dressing methods. This evidence supports NPWT as a valuable addition to standard care for improving outcomes in diabetic foot wound treatment.

VCDs provide a non-invasive, drug-free alternative for managing Erectile Dysfunction (ED), appealing to patients seeking safer, less intrusive, and more affordable solutions compared to traditional treatments. Unlike pharmacological options that may cause side effects such as headaches, dizziness, or more severe cardiovascular risks, VCDs offer a safer option by avoiding systemic medication complications. In addition, VCDs have a long lifespan and can be reused, making them a cost-effective investment, especially in regions with limited healthcare resources and high out-of-pocket expenses. This affordability and durability drive their increasing adoption.

End Use Insights

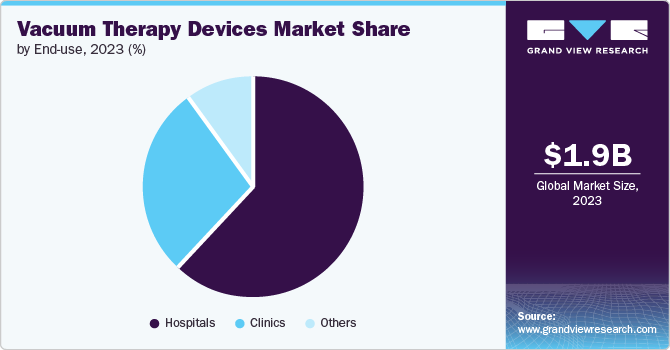

In 2023, hospitals held the largest share of more than 60.0% of the market. Hospitals remain the primary setting for the use of vacuum therapy devices due to their capacity to manage severe and multifaceted cases that require continuous and specialized care. The prevalence of chronic conditions such as diabetes and obesity, which often lead to complex wound management scenarios, significantly contributes to this trend. For example, diabetic foot ulcers and pressure ulcers, which are common among aging and diabetic populations, necessitate advanced treatment solutions that hospitals are well-equipped to provide. The latest models of NPWT devices, featuring real-time monitoring capabilities, automated pressure adjustments, and data logging functionalities, are essential for managing complex wounds in a hospital setting. These devices enable healthcare professionals to deliver precise and tailored treatment, thus improving patient outcomes and streamlining care processes.

The segment, which includes other devices such as Ambulatory Surgery Centers (ASCs), long-term care facilities, and home care settings, is projected to experience the fastest CAGR of 5.1%. ASCs are becoming increasingly popular due to their cost-effectiveness, convenience, and efficiency in performing various surgical procedures that necessitate wound management. These centers often handle a substantial number of outpatient surgeries that benefit from vacuum therapy devices, especially for post-operative wound care. The rise in minimally invasive and outpatient procedures aligns with the growing use of vacuum therapy in these settings, driven by the need for effective, portable wound care solutions that support rapid recovery and discharge. Long-term care facilities are also seeing an increase in the population of elderly and chronically ill patients who require ongoing management of chronic wounds and ulcers.

Type Insights

The non-portable vacuum therapy devices segment held the largest share of 58.1% in 2023. This significant market share is due to the critical role these devices play in managing complex and severe medical conditions, their widespread use in hospital settings, and the higher cost associated with these advanced systems. Non-portable vacuum therapy devices are predominantly used in healthcare facilities for treating severe chronic wounds, extensive burns, and post-surgical wounds that require intensive care. Their ability to provide continuous and controlled negative pressure is crucial for managing large or deep wounds that necessitate consistent and powerful therapy over extended periods. The advanced features of these devices, such as precise pressure control, larger capacity for wound exudate management, and integration with other hospital-based technologies, make them indispensable in treating critical patients. For instance, in August 2023, Medela introduced the Invia Integrated Dressing, designed for use with its NPWT Liberty and Motion pumps. This new sterile dressing is suitable for all wound types, including surgical incisions, and can be used for up to seven days in both hospital and home care settings. It features a three-layer fluid handling pad with a skin-friendly silicone adhesive and a Quick-connector for easy integration with NPWT systems.

Portable vacuum therapy devices are expected to grow at the fastest CAGR of 4.6% during the forecast period. The rise in demand for portable devices is driven by their ability to offer effective wound care management with the added benefit of mobility, crucial for patients who require continuous therapy but are not confined to a healthcare facility. In addition, the shift toward outpatient and home-based care, accelerated by the COVID-19 pandemic, has increased demand for portable solutions that can be used outside traditional healthcare settings. The integration of digital health technologies, such as remote monitoring capabilities, allows for continuous oversight by healthcare providers while enabling patients to maintain their independence and quality of life.

Application Insights

The chronic wounds segment dominated the market in 2023, capturing a significant share of more than 50.0%. This dominance is attributed to the high prevalence of chronic wounds, the effectiveness of vacuum therapy in treating these conditions, and ongoing advancements in device technology. Chronic wounds, including diabetic foot ulcers, pressure ulcers, and venous leg ulcers, represent a significant healthcare burden worldwide. In the U.S. alone, chronic wounds affect approximately 10.5 million Medicare beneficiaries, a number that has risen markedly over the past decade. The high prevalence of these conditions is driven by the aging population and increasing rates of diabetes and obesity. According to the International Diabetes Federation, approximately 537 million adults globally have diabetes, many of whom develop chronic wounds as a complication. These wounds not only impair quality of life but also lead to substantial healthcare costs, estimated to be in the billions annually in direct and indirect expenses.

The erectile dysfunction segment is expected to grow at the fastest CAGR of 5.1% over the forecast period. Erectile dysfunction is a common condition affecting millions of men worldwide, particularly as the population ages. According to the Massachusetts Male Aging Study, the prevalence of ED is expected to affect 322 million men globally by 2025. The increasing prevalence of conditions such as diabetes, cardiovascular diseases, and obesity-major risk factors for ED-contributes to this rising number. VCDs work by creating a vacuum around the penis, drawing blood into the corpora cavernosa to induce an erection. A constriction band is then applied to maintain the erection. This method is particularly useful for men who cannot take oral ED medications due to contraindications, side effects, or ineffectiveness. The increasing awareness of ED and the availability of VCDs are driving demand in this segment, leading to its anticipated rapid growth. For instance, in May 2024, Vacurect India launched an innovative solution for erectile dysfunction, offering a non-invasive, drug-free approach. The device is designed to be easy to use, providing effective and immediate results for men suffering from erectile dysfunction. This advancement is expected to offer a reliable alternative to traditional treatments, enhancing the quality of life for patients. The company aims to make this solution widely accessible across India, addressing a significant need in men's health.

Regional Insights

North America vacuum therapy devices market dominated globally in 2023 with the largest revenue share of around 40.0%. This dominance is attributed to the high prevalence of chronic wounds and a large number of surgical procedures, supported by advanced healthcare infrastructure and robust healthcare spending. According to the National Library of Medicine, nearly nine major surgeries were performed for every 100 older people in the U.S. in July 2021, and over one in seven Medicare beneficiaries underwent a major surgery over five years, representing nearly 5 million unique older individuals. The presence of major market players and continuous innovations in product design and functionality further fuel market growth in this region.

U.S. Vacuum Therapy Devices Market Trends

The vacuum therapy devices market in the U.S. held the largest share in 2023, driven by the high prevalence of chronic wounds and conditions such as diabetes and obesity, which lead to wound complications. According to a CDC report published in February 2024, an estimated 129 million people in the U.S. have at least one major chronic disease, including cancer, heart disease, obesity, diabetes, and hypertension. The high adoption rate of advanced medical technologies and substantial healthcare expenditure support the market for these devices. In addition, the U.S. market benefits from strong reimbursement policies and a well-established regulatory framework, facilitating the introduction and widespread use of new products.

Europe Vacuum Therapy Devices Market Trends

The vacuum therapy devices market in Europe is expected to experience significant growth during the forecast period. This growth is driven by an aging population, rising prevalence of chronic wounds, and increasing healthcare expenditures. European countries have well-developed healthcare infrastructures and strong healthcare policies that promote the adoption of advanced wound care solutions. The introduction of new and innovative products, such as those compliant with the EU's Medical Device Regulation (MDR), is driving growth. Countries such as the UK, France, and Germany are leading this growth, supported by increasing awareness of advanced wound care solutions and favorable reimbursement policies.

The vacuum therapy devices market in the UK is projected to grow profitably over the forecast period. This growth is driven by the rising incidence of chronic wounds and an aging population requiring advanced wound care. The National Health Service (NHS) has increasingly embraced modern wound care technologies, which has further accelerated market expansion. In August 2023, NHS emergency departments experienced a surge in activity, with 2.1 million attendances and 524,000 emergency admissions. However, ongoing industrial action within the NHS significantly impacted patient care, with nearly 400,000 appointments rescheduled between June and August 2023 due to strikes by junior doctors, consultants, dentists, and radiographers. Despite these disruptions, the NHS made progress in reducing long waiting times, with the number of patients waiting over 78 weeks dropping to 7,289 in August 2023, down nearly 85% from a peak of 124,911 in September 2021. This dynamic healthcare environment, coupled with the NHS's efforts to enhance service delivery and patient outcomes, underscores the growing importance of advanced wound care solutions, positioning the market for sustained growth.

The vacuum therapy devices market in France is expected to grow profitably during the forecast period. This growth is attributed to the rising demand for effective wound care solutions. France's healthcare system is well-equipped and supportive of advanced medical technologies, including vacuum therapy devices. The French government's focus on enhancing healthcare infrastructure and promoting innovative treatments further supports market growth. Additionally, favorable reimbursement policies and increasing healthcare awareness contribute to the positive outlook for the vacuum therapy devices market in France.

Asia Pacific Vacuum Therapy Devices Market Trends

The vacuum therapy devices market in the Asia-Pacific region is projected to grow at a remarkable CAGR of 4.5% during the forecast period. This significant growth is driven by increasing healthcare expenditures, a growing prevalence of chronic wounds, and improving healthcare infrastructure across the region. Countries such as China and India are major contributors to this growth due to their large patient populations and rising adoption of advanced medical technologies. The expansion of healthcare facilities and increased awareness of modern wound care solutions are also driving market growth.

The vacuum therapy devices market in Japan is poised for significant growth, driven rapidly aging population and resulting rise in chronic wounds and conditions requiring advanced wound care. According to the World Health Organization, Japan’s population over 65 is projected to more than double from 12.4% in 2020 to 28.4% by 2060, with those over 80 expected to quadruple from 2.3% to 9.6%. This demographic shift underscores the increasing demand for advanced medical solutions. Additionally, the Japanese government’s commitment to enhancing healthcare services and supporting cutting-edge medical technologies further bolsters the market’s growth prospects.

The China vacuum therapy devices market is anticipated to grow significantly due to the increasingly urbanized population, along with rising healthcare expenditures, which supports the demand for advanced wound care solutions. The prevalence of chronic wounds and conditions such as diabetes, which are common in China, further drives the need for effective vacuum therapy devices. According to a report published by the Shanghai Municipal People's Government in July 2023, China's elderly population, comprising 190 million people, faces a significant public health issue due to chronic diseases. The National Health Commission reports that 75% of those over 60 have one chronic disease, and 43% have at least two. Chronic diseases are the leading cause of death in China, accounting for 86.6% of all deaths.

Latin America Vacuum Therapy Devices Market Trends

The vacuum therapy devices market in Latin America is experiencing significant growth, driven by a confluence of factors, including the increasing prevalence of chronic wounds, rising healthcare expenditures, and evolving healthcare infrastructure. Regulatory oversight in Latin America is managed by national health authorities that ensure the safety, efficacy, and quality of medical devices. In Brazil, the Brazilian Health Regulatory Agency (ANVISA) is responsible for the regulation and approval of medical devices, including vacuum therapy devices. ANVISA’s stringent regulatory processes help maintain high standards for device performance and patient safety. Similarly, other countries in the region have their respective regulatory bodies that oversee the approval and market entry of medical devices, ensuring compliance with regional standards.

The Brazil vacuum therapy devices market is anticipated to grow over the forecast period. Chronic diseases such as diabetes and obesity are prevalent, with the International Diabetes Federation estimating that over 16 million adults in Brazil have diabetes, contributing to a high incidence of chronic wounds and ulcers. The Brazilian government is actively improving healthcare access and quality through initiatives such as the "Mais Médicos" program and investments in healthcare infrastructure, which enhances the availability of advanced medical treatments, including vacuum therapy devices.

MEA Vacuum Therapy Devices Market Trends

Governments are investing in healthcare improvements and infrastructure development to meet the rising demand for advanced medical technologies. Initiatives such as the UAE’s "Healthcare 2021" vision and Saudi Arabia’s Vision 2030 emphasize the adoption of innovative treatments and enhancements in healthcare delivery. Recent developments in this region include the launch of advanced NPWT devices designed to be both cost-effective and efficient, addressing regional economic and healthcare needs. Regulatory bodies, including the Saudi Food and Drug Authority (SFDA) and the UAE’s Ministry of Health and Prevention (MOHAP), are responsible for the rigorous evaluation and approval of medical devices, ensuring that they meet regional safety and performance standards, which contributes to a growing need for effective wound care solutions.

The vacuum therapy devices market in Saudi Arabia is expected to grow significantly due to several driving factors. The healthcare sector is undergoing substantial transformation under Vision 2030, with a focus on improving healthcare services and increasing access to advanced medical technologies. The prevalence of chronic conditions such as diabetes is high in Saudi Arabia, with the International Diabetes Federation estimating that around 4.3 million adults in the country have diabetes, which contributes to a growing need for effective wound care solutions.

The vacuum therapy devices market in Kuwait is expected to experience substantial growth, driven by rising healthcare expenditures, an increasing prevalence of chronic wounds, and ongoing improvements in healthcare infrastructure. The prevalence of chronic diseases, including diabetes, is also on the rise. According to the International Diabetes Federation, prevalence rate of diabetes in adults in Kuwait exceeds 25.0%, further fueling the demand for advanced wound care solutions.

Key Vacuum Therapy Devices Company Insights

The vacuum therapy devices market is characterized by the presence of several key players who dominate the landscape with substantial market share. These companies are leading the industry through technological innovations, extensive distribution networks, and a broad portfolio.

Key Vacuum Therapy Devices Companies:

The following are the leading companies in the vacuum therapy devices market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Augustus Medical Systems

- Boston Scientific Corporation

- Cardinal Health

- Coloplast Corp

- Smith & Nephew

- Vacurect

- ConvaTec Inc.

- Molonlycke Healthcare AB

Recent Developments

-

In April 2024, Smith & Nephew launched its new Renasys Edge negative pressure wound therapy system, designed for both acute and chronic wounds, including ulcers. This portable, lightweight device offers improved functionality with a digital interface, enabling better wound management and patient comfort. It is intended to support faster healing in various care settings, from hospitals to home care.

-

In November 2023, Mölnlycke introduced the Avance Solo, a portable negative pressure wound therapy (NPWT) system designed to improve post-surgical patient care. The device is single-use, compact, and features a simple, user-friendly interface that allows for easier management of surgical incisions and wounds.

“For years, patientshave dealt with the negatives of ciNPT like painful blistering, skin maceration, dressings that dislodge early, and excessive device alarms. Avance Solo puts an end to these challenges. That means a more positive experience for patients and less time troubleshooting for busy surgeons and staff - a win for everyone.”

- Kacee Huguely, Vice President, Wound Care Marketing at Mölnlycke.

-

In September 2023, Cork Medical introduced the Nisus Touch NPWT System, a new negative pressure wound therapy device designed to enhance patient care. It is portable, lightweight, and features an intuitive interface for ease of use in various healthcare settings. It is aimed at improving wound healing efficiency and patient comfort by offering adjustable pressure settings and extended battery life.

Vacuum Therapy Devices Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.09 billion

Revenue forecast in 2030

USD 2.52 billion

Growth Rate

CAGR of 3.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

3M; Augustus Medical Systems; Boston Scientific Corporation; Cardinal Health; Coloplast Corp; Smith & Nephew; Vacurect; ConvaTec Inc.; Molonlycke Healthcare AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vacuum Therapy Devices Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vacuum therapies devices market report based on product, type, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Negative Pressure Wound Therapy

-

Vacuum Constriction Devices

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Portable Vacuum Therapy Devices

-

Portable Vacuum Therapy Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic wounds

-

Acute Wounds

-

Erectile Dysfunction

-

-

End Use (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Singapore

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global vacuum therapy devices market was valued at USD 1.9 billion in 2023 and is anticipated to reach USD 2.0 billion in 2024.

b. The global vacuum therapy devices market is anticipated to grow at a compound annual growth rate (CAGR) of 3.9 % from 2024 to 2030 to reach USD 2.5 billion in 2030.

b. In 2023, the chronic wounds segment dominated the vacuum therapy devices market, capturing a significant share of more than 50.0%.

b. Some of the key players operating in the vacuum therapy devices market include 3M; Augustus Medical Systems; Boston Scientific Corporation; Cardinal Health; Coloplast Corp; Smith & Nephew; Vacurect; ConvaTec Inc.; Molonlycke Healthcare AB.

b. The market growth is attributed to the increasing prevalence of chronic wounds, rising incidences of surgeries, and expanding geriatric population, which is more susceptible to conditions such as diabetes and pressure ulcers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.