- Home

- »

- Medical Devices

- »

-

U.S. Wound Irrigation Systems Market Size Report, 2030GVR Report cover

![U.S. Wound Irrigation Systems Market Size, Share & Trends Report]()

U.S. Wound Irrigation Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Manual, Battery-operated), By Application (Burns, Chronic Wounds, Surgical Wounds), By End Use, And Segment Forecasts

- Report ID: GVR-4-68038-827-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The U.S. wound irrigation systems market size was estimated at USD 116.5 million in 2024 and is projected to grow at a CAGR of 3.8% from 2025 to 2030. The market is experiencing significant growth driven by several interrelated factors, including technological advancements, an increasing prevalence of chronic diseases, and a rise in surgical procedures. Technological innovations in wound irrigation systems, such as automated solutions and antimicrobial treatments, have greatly enhanced the efficacy of wound management.

The rising incidence of chronic wounds, particularly among the aging population, is driving market growth further. Conditions such as diabetes lead to a higher occurrence of diabetic foot ulcers and pressure ulcers, necessitating effective wound care interventions. As the aging demographic increases, along with the prevalence of comorbidities such as obesity, the demand for comprehensive wound management products is expected to rise substantially.

Moreover, the growing number of surgical procedures further highlights the need for effective wound irrigation systems. Surgical interventions frequently result in wounds requiring meticulous care to minimize infection risks. Notably, recent data highlights that approximately 14.5% of Medicare beneficiaries suffer from chronic wounds-a figure that has increased to 16.4% over five years. This trend underscores the necessity for innovative wound care solutions to address complex surgical wounds.

The well-established healthcare infrastructure in the U.S. significantly supports the adoption of advanced wound irrigation technologies. With annual expenditures exceeding USD 25 billion on wound-related complications, the healthcare system emphasizes effective prevention and management strategies. As awareness around infection control in healthcare settings grows, the urgency for efficient wound irrigation to mitigate surgical site infections continues to escalate, further propelling market demand.

Product Insights

Manual irrigation held the largest revenue share of 55.0% in 2024 due to its efficacy in treating deep surgical wounds and challenging conditions. These systems allow for controlled pressure application, facilitating effective wound cleaning and hydration, which is crucial for managing surgical site infections and diabetic foot ulcers.

The battery-operated segment is expected to grow at the fastest CAGR of 4.1% over the forecast period. These systems facilitate the swift removal of necrotic tissue and bacteria, markedly enhancing wound care outcomes. They are especially advantageous for chronic wounds and burns, ensuring thorough cleansing. Battery-operated devices minimize cross-contamination risks and improve patient comfort, making them ideal for clinical and home use while addressing diverse wound management needs.

Application Insights

Chronic wounds led the market in terms of revenue share in 2024, accounting for 33.7% of the global market, owing to the rising prevalence of diabetic foot ulcers, pressure ulcers, and venous leg ulcers. Advanced irrigation systems are essential for promoting healing, preventing infections, and addressing the needs of an aging and increasingly obese population.

The surgical wounds segment is expected to grow at the fastest CAGR of 3.9% over the forecast period, driven by the rising annual volume of surgeries conducted. Effective irrigation systems are crucial for cleaning and hydrating surgical sites, promoting faster healing, and minimizing the risk of surgical site infections.

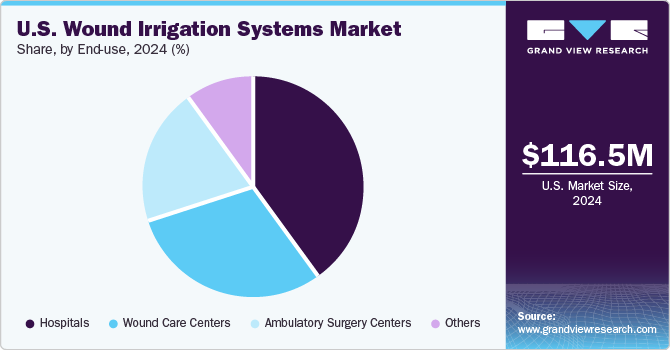

End Use Insights

Hospitals led the market with a revenue share of 39.7% in 2024. With around 15 million surgeries conducted annually (as reported by the Agency for Healthcare Research and Quality), wound irrigation systems are critical for effectively cleaning and hydrating surgical sites, minimizing the risk of surgical site infections. Increased treatment of chronic wounds and robust healthcare infrastructure, alongside investments in advanced wound care technologies, are driving segment growth further.

Wound care centers are projected to grow at the fastest rate of 4.2% over the forecast period. They offer specialized services that utilize innovative irrigation systems to promote healing through effective wound cleaning and hydration. The rising prevalence of chronic conditions such as diabetes and obesity increases the occurrence of non-healing wounds, thereby requiring specialized treatment and highly trained personnel for optimal patient outcomes.

Key U.S. Wound Irrigation Systems Company Insights

Some key companies operating in the market include WestMed Products, BIONIX LLC, and BD, among others. Strategic initiatives involve mergers, acquisitions, and partnerships to expand product offerings and market reach, alongside developing advanced irrigation systems and biologics to enhance patient outcomes in wound care.

-

BIONIX LLC specializes in innovative medical devices for wound irrigation, offering manual and battery-operated systems that enhance wound care by effectively removing debris and maintaining hydration.

-

BD produces wound irrigation solutions, notably the BD Surgiphor system, which utilizes an aqueous povidone-iodine solution to clean wounds and minimize surgical site infection risks effectively.

Key U.S. Wound Irrigation Systems Companies:

- WestMed Products

- BIONIX LLC

- BD

- CooperSurgical Inc.

- Stryker

- Essity Health & Medical

- Medline Industries, LP

- Zimmer Biomet

Recent Developments

-

In August 2024, Biomiq Inc. launched PureCleanse STAT, a non-toxic antimicrobial wound irrigation system featuring QuickTab technology, enhancing rapid and effective treatment for urgent and chronic wound care scenarios.

U.S. Wound Irrigation Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 120.7 million

Revenue forecast in 2030

USD 145.7 million

Growth rate

CAGR of 3.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end use

Country scope

U.S.

Key companies profiled

WestMed Products; BIONIX LLC; BD; CooperSurgical Inc.; Stryker; Essity Health & Medical; Medline Industries, LP; Zimmer Biomet

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wound Irrigation Systems Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. wound irrigation system market report based on product, application, and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Battery-operated

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Burns

-

Chronic Wounds

-

Diabetic Foot Ulcer

-

Venous Leg Ulcer

-

Pressure Ulcer

-

-

Surgical Wounds

-

Traumatic Wounds

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgery Centers

-

Wound Care Centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. wound irrigation systems market size was estimated at USD 116.5 million in 2024 and is expected to reach USD 120.7 million in 2025.

b. The U.S. wound irrigation systems market is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2030 to reach USD 145.7 million by 2030.

b. The manual system dominated the U.S. wound irrigation system market with a share of over 55.60% in 2024. This is attributable to the increasing number of surgical site infections and diabetic foot ulcers.

b. Some key players operating in the U.S. wound irrigation systems market include Westmed, Inc., Bionix, Inc., C.R. Bard, Inc., CooperSurgical, Inc., Stryker Corporation, BSN Medical, Centurion Medical Products (Medline Industries, Inc.), Zimmer Biomet.

b. Key factors that are driving the market growth include technological advancement, increasing prevalence of chronic diseases, rising number of surgical procedures, and rising geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.