- Home

- »

- Animal Health

- »

-

U.S. Veterinary Oncology Diagnostics Market Report, 2030GVR Report cover

![U.S. Veterinary Oncology Diagnostics Market Size, Share & Trends Report]()

U.S. Veterinary Oncology Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal Type (Canine, Feline), By Test Type (Biopsy, Genome Testing), By Cancer Type (Skin Cancers, Sarcomas), By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-541-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The U.S. veterinary oncology diagnostics market size was estimated at USD 992.87 million in 2024 and is expected to grow at a CAGR of 8.55% from 2025 to 2030. Key growth drivers include increasing the prevalence of cancer in pets, increasing R&D in early pet cancer diagnosis, and growing focus on animal safety. As per The Veterinary Cancer Society, Cancer is the top reason of death in 47% of canines, particularly those over 10 years old, and in 32% of felines. Around 1 in 4 dogs will experience abnormal tissue growth, or neoplasia, during their lifetime. With nearly 100 types of cancer affecting pets, a diagnosis can be overwhelming, yet advances in veterinary care have improved treatment success rates for both dogs and cats.

The increasing research and development in veterinary oncology will drive market growth by improving pet cancer diagnosis solutions. Investments in cancer diagnosis and treatments for companion animals are also contributing to this growth. For example, in May 2024, The AKC Canine Health Foundation (CHF) invested $3.6 million in active cancer research, marking Canine Cancer Awareness Month. This includes pilot studies on canine melanoma and osteosarcoma to develop innovative diagnostic tests and treatments that may also benefit human cancer research. CHF's ongoing support of molecular-level cancer studies and diagnostic advancements significantly improves veterinary oncology diagnostics.

Veterinary research organizations are also advancing the fight against pet cancer. In January 2024, the Morris Animal Foundation announced funding for eight new research grants to study various canine cancers, including lymphoma, bone cancer, and soft-tissue sarcomas. These studies aim to improve understanding, diagnosis, and treatment options for pet cancer, potentially benefiting both pets and humans. These ongoing R&D initiatives and investments by industry stakeholders are expected to drive significant growth in the veterinary oncology diagnostics market in the coming years.

Technology Landscape of Veterinary Oncology Diagnostics in the U.S.

Technology

Description

Examples

Impact

Liquid Biopsy

Non-invasive blood tests detecting circulating tumor DNA (ctDNA) for early cancer diagnosis.

FidoCure, PetDx

Early detection, less invasive

Next-Generation Sequencing (NGS)

Advanced genetic testing identifies specific cancer mutations.

VolitionRx, Sentinext

Precision medicine targeted therapies

Biomarker-based Tests

Detection of specific proteins or genetic markers linked to cancer.

IDEXX Laboratories, Antech

Improved accuracy, faster results

AI-Powered Diagnostics

AI algorithms analyzing imaging and pathology data to detect cancer patterns.

SignalPET, ImpriMed

Enhanced accuracy, faster diagnosis

Companion Diagnostics (CDx)

Tests are used alongside cancer treatments to identify eligible patients.

Guardant Health, FidoCure

Personalized treatment plans

Evolution of Veterinary Oncology Diagnostics in the U.S. with Key Product Launches

-

Early 2000s - Traditional Diagnostic Methods:

-

Veterinary oncology diagnostics primarily relied on physical exams, biopsies, and histopathology to detect cancer.

-

2004: Introduction of immunohistochemistry (IHC), allowing better classification of tumors by identifying specific cancer markers.

-

2010 - Advancements in Molecular Diagnostics:

-

The rise of PCR (Polymerase Chain Reaction) and FISH (fluorescence in situ hybridization) has improved the detection of genetic mutations linked to cancer.

-

In 2012, Idexx Laboratories launched VetStat Electrolyte and Blood Gas Analyzer, expanding in-clinic diagnostic capabilities.

-

2017 - Liquid Biopsy and Early Detection:

-

In 2017, PetDx introduced OncoK9, one of the first liquid biopsy tests that uses next-generation sequencing (NGS) to detect genomic alterations linked to multiple canine cancers.

-

Liquid biopsy provided a minimally invasive, blood-based alternative to traditional biopsies.

-

2020 - AI and Genomics Integration:

-

The adoption of artificial intelligence (AI) and machine learning enhanced diagnostic accuracy by analyzing complex genetic data.

-

In 2021, One Health Company launched FidoCure, offering personalized canine cancer treatment based on genetic profiling. This marked a shift toward precision medicine.

-

2024 - Multi-Cancer Detection and Home Testing:

-

In June 2024, Oxford BioDynamics launched the EpiSwitch SCB Test, which can detect six canine cancers using a single blood sample with over 80% accuracy.

-

In January 2025, IDEXX Laboratories introduced IDEXX Cancer Dx, an affordable blood test for early canine lymphoma detection that provides results within 2-3 days.

-

In January 2025, Affordable Pet Labs partnered with Oncotect to offer a non-invasive, at-home urine test detecting four common canine cancers, making early detection more accessible.

The U.S. veterinary oncology diagnostics market continues to evolve with technological innovations, early detection solutions, and accessible at-home testing, improving cancer care outcomes for pets.

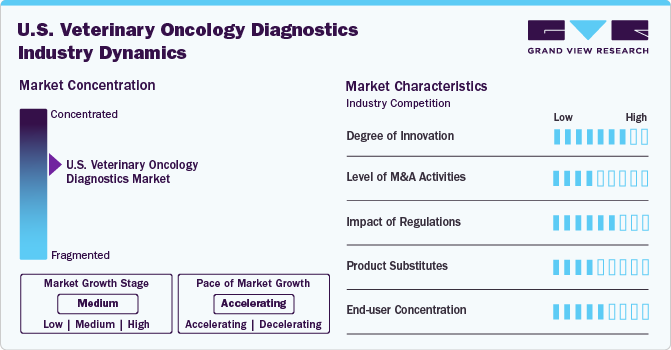

Market Concentration & Characteristics

The U.S. veterinary oncology diagnostics market is experiencing a high degree of innovation, driven by advancements in liquid biopsy, next-generation sequencing (NGS), and biomarker-based tests. Companies like FidoCure and VolitionRx are introducing personalized cancer diagnostics and early detection solutions, enhancing accuracy and treatment outcomes. The integration of AI-powered diagnostic tools also improves efficiency and precision.

The U.S. veterinary oncology diagnostics market is witnessing a moderate to high level of M&A activity as companies seek to expand their diagnostic portfolios and technological capabilities. For example, Zoetis Inc. acquired ZNLabs and Phoenix Lab to strengthen its veterinary diagnostic services. Similarly, IDEXX Laboratories frequently acquires smaller firms to enhance its oncology testing capabilities.

Regulation in the U.S. veterinary oncology diagnostics market has a moderate effect, ensuring the safety, accuracy, and reliability of diagnostic tests. The USDA's Center for Veterinary Biologics (CVB) and the FDA's Center for Veterinary Medicine (CVM) oversee the approval of diagnostic products. For example, the FDA's Veterinary Laboratory Investigation and Response Network (Vet-LIRN) regulates diagnostic quality standards, ensuring consistent and reliable cancer detection.

The U.S. veterinary oncology diagnostics market faces low to moderate threats from product substitutes, as conventional diagnostic methods like biopsy and cytology remain alternatives to advanced molecular tests. However, imaging techniques (e.g., X-rays, ultrasound) and general blood panels are sometimes used as substitutes, though they lack the specificity and sensitivity of specialized oncology diagnostics.

The U.S. veterinary oncology diagnostics market has a high end-user concentration, dominated by veterinary reference laboratories, specialty animal hospitals, and academic institutions. Large chains like BluePearl Veterinary Partners and VCA Animal Hospitals are key users, driving demand for advanced oncology diagnostics. Independent veterinary clinics also contribute, but to a lesser extent.

Animal Type Insights

The canine segment held the largest revenue share of 73.33% in 2024. This growth is due to the rising prevalence of cancer, growing awareness of early canine cancer diagnosis, and an increase in the development of advanced canine cancer diagnostics solutions. For instance, in June 2024, Oxford BioDynamics (OBD) developed the EpiSwitch Specific Canine Blood (SCB) test, a blood-based diagnostic that can detect six types of cancer in dogs. Using a 3D genomic approach, the test offers high accuracy and sensitivity, with results over 80% for most cancers. The test aims to improve cancer diagnosis, reduce unnecessary treatments, and help optimize veterinary care for cancer patients.

In addition, the increasing pet dog population also contributes to the segment's growth. According to the National Canine Cancer Foundation, Cancer is the leading cause of death in senior dogs, with approximately 1 in 4 dogs expected to develop cancer during their lifetime.

The feline segment is anticipated to witness significant growth throughout the forecast period. This growth is primarily attributed to the rising population of cats worldwide and the apparent rise in the associated diseases. According to the International Fund for Animal Welfare (IFAW), over 220 million pet cats are worldwide. Similarly, according to the American Veterinary Medical Association (AVMA), the pet cat population in the U.S. is estimated to be 73.8 million in 2024.

Test Type Insights

The biopsy segment dominated and had the largest revenue share in 2024. The rise in the development and launch of liquid biopsy tests by key players, enabling earlier and non-invasive cancer detection, contributes to segment growth. For instance, in February 2024, PetDx's newly validated OncoK9 Screen liquid biopsy test, published in JAVMA, offers over 70% sensitivity for detecting seven aggressive cancer types in dogs, including lymphoma and osteosarcoma, with a low false positive rate (<1.5%). This lower-cost, faster alternative to the OncoK9 Dx test uses cfDNA quantification and next-generation sequencing to improve early cancer detection during routine wellness visits. With its affordability and accessibility, the test enhances preventive care and contributes to developing standardized cancer screening protocols for dogs.

The genome testing segment is anticipated to witness exponential growth of over 9.62% throughout the forecast period. The demand for genetic and genome-based veterinary cancer diagnostic testing is growing due to its ability to provide early, accurate, and non-invasive detection, offering personalized treatment options and improving outcomes for pets with cancer. For instance, in February 2024, Virginia Tech researchers developed a novel, non-invasive urine-based cancer screening test for dogs using Raman spectroscopy. This rapid, cost-effective method detects unique cancer "fingerprints" with over 90% accuracy, surpassing traditional blood tests. The technology, still in clinical trials, holds promise for early cancer detection, monitoring treatment response, and evaluating tumor recurrence, with potential applications across veterinary and human health. By enabling early detection and monitoring of canine cancer, it addresses critical gaps in cost, speed, and noninvasiveness, paving the way for broader adoption and future market growth.

Cancer Type Insights

Skin cancer held the largest revenue share in 2024 and is expected to grow at the fastest CAGR of 8.71% during the forecast years. This growth can be attributed to the prevalence of squamous cell carcinoma in cats & dogs, and skin tumors are the most typical form of cancer in older dogs. For instance, according to research published in the PubMed Central Journal in April 2023, 56% of the total malignant tumors in dogs were found in the skin. Similarly, 69% of benign tumors were skin cancers. In cats, squamous cell carcinoma (SCC) commonly occurs in facial areas. However, it can happen anywhere, including the toes. For instance, the SCC of the toes comprises around 25% of all cat digital tumors. Mast cell tumors (MCTs) are the third most common type of tumor found in dogs, accounting for 11% of skin cancer cases. Thus, the rising prevalence of skin cancers in pets and the demand for early diagnosis fuel market growth.

The other segment is expected to grow significantly with a CAGR of 8.70% during the forecast period. The other segment comprises adenocarcinomas (e.g., anal sac adenocarcinoma), brain tumors, nasal tumors, oral tumors, and other cancers. The rising prevalence of various animal cancers boosts the demand for advanced veterinary cancer diagnostics. For instance, according to the article by MDPI in July 2024, the incidence of pulmonary carcinoma (PPC) is the highest in primary lung cancer among dogs. Under pulmonary carcinoma, the most common histological subtype is pulmonary adenocarcinoma, which accounts for 60-80% of incidences.

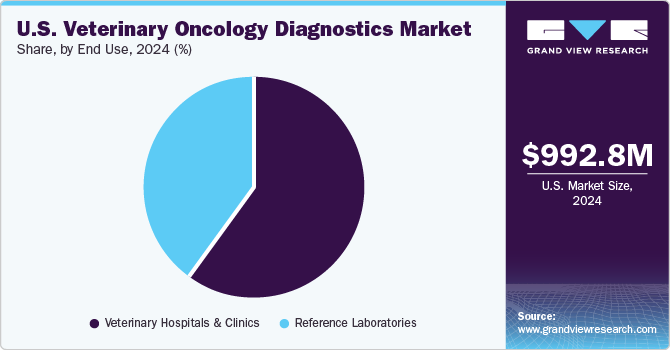

End Use Insights

Based on end use, the veterinary hospitals & clinics segment held the largest revenue share of 61.75% in 2024 due to the high patient volume, access to advanced diagnostic tools, and the presence of specialized veterinary oncologists. These facilities serve as primary points of care for pet owners seeking cancer diagnostics, offering a range of services, including biopsy analysis, imaging (MRI, CT scans), and molecular diagnostics. For instance, leading veterinary hospital networks like VCA Animal Hospitals and BluePearl Specialty and Emergency Pet Hospitals provide comprehensive oncology services, integrating cutting-edge diagnostic tests with personalized treatment plans. Additionally, the rising adoption of pet insurance and increasing pet owner awareness of early cancer detection contribute to the segment's dominance in the market.

The reference Laboratories segment is projected to grow significantly due to the rising demand for accurate, large-scale diagnostic services, increased adoption of advanced cancer screening tests, and expanding lab partnerships with veterinary clinics, offering quicker and more precise diagnostic solutions. For instance, in January 2025, Affordable Pet Labs partnered with Oncotect to provide an at-home urine-based cancer screening test for dogs, detecting lymphoma, melanoma, hemangiosarcoma, and mast cell tumors with 83% sensitivity and 96% specificity. The non-invasive test enables early detection and offers convenient, stress-free sample collection and mail-in results. As more non-invasive and high-precision tests become available, veterinarians rely on reference labs for comprehensive cancer profiling, advanced biomarker analysis, and expert consultation, driving market expansion.

Regional Insights

The U.S. veterinary oncology diagnostics market is witnessing growth due to the increasing prevalence of cancer in pets, particularly dogs. The National Cancer Institute estimates that an estimated 6 million dogs receive a cancer diagnosis each year, and a similar number of cats receive a cancer diagnosis, according to preliminary estimates of cancer incidence. This rise in cancer cases, driven by factors like aging pets and genetic predispositions, has increased the demand for advanced diagnostic tools. The development of new tests in June 2024, such as the EpiSwitch Specific Canine Blood Test, which can detect multiple types of cancer in dogs, further propels the market. These innovations enable earlier and more accurate diagnosis, improving treatment outcomes and driving the adoption of veterinary oncology diagnostics across the U.S.

Key U.S. Veterinary Oncology Diagnostics Company Insights

Major market players engage in various strategies, such as distribution agreements, mergers and acquisitions, and expansions. Most crucially, they exhibit a high degree of innovation in product research and development to improve their market penetration.

Key U.S. Veterinary Oncology Diagnostics Companies:

- Zoetis

- Antech Diagnostics, Inc. (Mars Inc.)

- IDEXX Laboratories, Inc.

- Neogen Corporation

- Gold Standard Diagnostics (Eurofins Technologies)

- Embark Veterinary, Inc

- VolitionRx Limited

- CANCAN DIAGNOSTICS

- Oncotect

- PetDx

Recent Developments

-

In January 2025, IDEXX Laboratories launched IDEXX Cancer Dx, an affordable and accessible blood test for early detection of canine lymphoma. The test, which will be available in the U.S. and Canada by March 2025, offers results within 2-3 days and can be integrated into routine wellness screenings, supporting earlier diagnosis and intervention.

-

In December 2024, Torigen Pharmaceuticals launched Torigen Specialty Pathology, a service providing fast, expert-reviewed cancer diagnostics for pets. Offering 3-to-5-day turnaround times and clear, actionable reports, the service supports veterinarians in making timely and informed treatment decisions. It also integrates seamlessly with Torigen's personalized cancer immunotherapy options.

U.S. Veterinary Oncology Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.06 billion

Revenue forecast in 2030

USD 1.60 billion

Growth rate

CAGR of 8.55% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Animal type, test type, cancer type, end use

Key companies profiled

Zoetis; Antech Diagnostics, Inc. (Mars Inc.); IDEXX Laboratories, Inc.; Neogen Corporation; Gold Standard Diagnostics (Eurofins Technologies); Embark Veterinary, Inc.; VolitionRx Limited; CANCAN DIAGNOSTICS; Oncotect, PetDx

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Veterinary Oncology Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. veterinary oncology diagnostics market report based on the animal type, test type, cancer type, and end use.

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Canine

-

Feline

-

Others

-

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Tests

-

Biopsy

-

Genome testing

-

Endoscopy

-

Urinalysis

-

Imaging

-

-

Cancer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lymphoma

-

Sarcomas

-

Mammary Gland Tumors

-

Skin Cancers

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Reference Laboratories

-

Veterinary hospitals and clinics

-

Frequently Asked Questions About This Report

b. The U.S. veterinary oncology diagnostics market size was estimated at USD 992.87 million in 2024 and is expected to reach USD 1.06 billion in 2025.

b. The global U.S. veterinary oncology diagnostics market is expected to grow at a compound annual growth rate of 8.55% from 2025 to 2030 to reach USD 1.60 billion by 2030.

b. Skin cancer held the largest market share in 2024 and is expected to grow at the fastest CAGR of 8.71% during the forecast years. This growth can be attributed to the prevalence of squamous cell carcinoma in cats & dogs, and skin tumors are the most typical form of cancer in older dogs.

b. Some key players operating in the telemedicine market include Zoetis, Antech Diagnostics, Inc. (Mars Inc.), IDEXX Laboratories, Inc., Neogen Corporation, Gold Standard Diagnostics (Eurofins Technologies), Embark Veterinary, Inc., VolitionRx Limited, CANCAN DIAGNOSTICS, Oncotect, and PetDx

b. Key factors that are driving the market growth include increasing the prevalence of cancer in pets, increasing R&D in early pet cancer diagnosis, and growing focus on animal safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.