- Home

- »

- Advanced Interior Materials

- »

-

U.S. Thermal Paper Market Size And Share, Report, 2030GVR Report cover

![U.S. Thermal Paper Market Size, Share & Trends Report]()

U.S. Thermal Paper Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (POS, Tags & Label, Lottery & Gaming), By Width, By Technology, And Segment Forecasts

- Report ID: GVR-4-68040-324-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2024 - 2030

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Thermal Paper Market Size & Trends

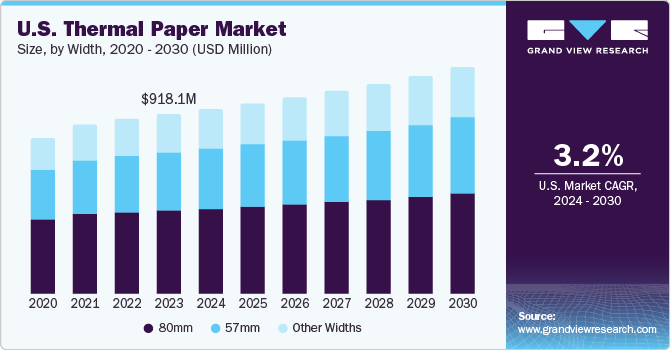

The U.S. thermal paper market size was estimated at USD 918.1 million in 2023 and is anticipated to grow at a CAGR of 3.2% from 2024 to 2030. The widespread adoption of Point-of-Sale (POS) systems in warehouses and retail environments is a key market driver. The market is also driven by the increasing demand for shipping labels, packing slips, and invoices in the growing e-commerce sector. Advancements in printing technology and favorable government initiatives promoting eco-friendly paper alternatives further fuel market expansion. In addition, integrating RFID in healthcare and growing use of recycled fibers in manufacturing the base product are projected to propel market growth.

The U.S. thermal paper market accounted for a share of 22.1% of the global thermal paper market revenue in 2023. The market has been significantly impacted by various regulations aimed at addressing environmental and health concerns. One prominent example is the Toxic Substances Control Act (TSCA), under which the Environmental Protection Agency (EPA) has placed restrictions on the use of bisphenol A (BPA), a common component in thermal paper, due to its potential health risks. The EPA's Safer Choice program also encourages the use of safer chemicals in manufacturing processes, prompting many companies to shift towards BPA-free alternatives, such as bisphenol S (BPS). In addition, several states have enacted stringent regulations; for instance, California's Proposition 65 necessitates warning labels for products containing chemicals known by the state to cause cancer, congenital disabilities, or reproductive harm, impacting the formulation of thermal papers used within the state.

Width Insights

The 80mm thermal paper segment led the market in 2023, driven by its versatility and applicability in various sectors. This width is ideal for cash register receipts, parking tickets, ATM receipts, and even lottery tickets. Its prevalence can be attributed to the fact that it accommodates a larger format, allowing for more detailed information to be printed on the receipt. For instance, cash register receipts often include itemized lists, logos, and marketing messages, better suited for a broader canvas.

The 57mm thermal paper segment is expected to grow rapidly in the coming years. Its smaller size makes it perfect for applications where compactness is vital. Due to their space constraints, it's a popular choice for credit card terminals and mobile point-of-sale (POS) devices. The narrow format ensures that receipts can still be generated efficiently without compromising portability.

Technology Insights

The direct thermal technology segment held the dominant position in 2023. This can be attributed to its simplicity and cost-effectiveness. This method utilizes heat-sensitive paper that reacts directly with the thermal printhead, creating a quick and affordable way to print receipts, parking tickets, and other short-lived documents. However, the downside lies in its impermanence. Direct thermal prints tend to fade over time, especially when exposed to light and heat.

On the other hand, thermal transfer offers a solution for applications requiring durability. This technology produces high-quality, long-lasting prints ideal for applications like shipping labels, product tags, and medical records. While thermal transfer offers superior longevity, it comes at the cost of increased complexity and expense due to the additional ribbon requirement. The projected growth in the thermal transfer segment reflects a growing demand for resilience in labels and tags.

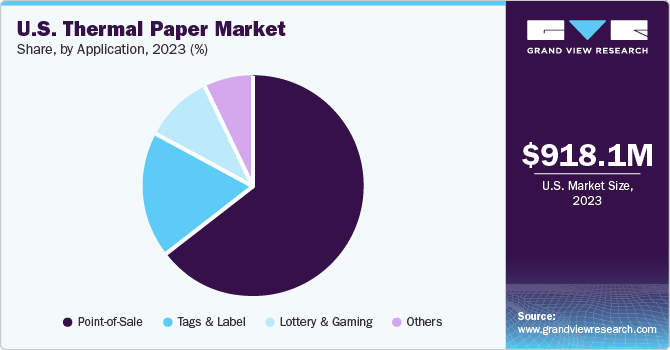

Application Insights

The PoS application segment held a share of 64.1% in 2023. Thermal paper is commonly used in PoS terminals as it provides excellent barcode scanning, moisture resistance, and high-temperature stability. PoS terminals utilize thermal paper for transactions in various industries, including retail, hospital, entertainment, and warehouse, owing to its ability to last. The increasing adoption of PoS systems, particularly in warehouses and retail, is a significant contributor to the segment growth. Notably, even with the rise of digital receipts, thermal papers have retained a substantial market share in PoS applications.

The tags & labels application segment is predicted to grow at a CAGR of 4.3% from 2024 to 2030. The increased use of thermal paper in e-commerce, logistics, and labeling applications is projected to drive this growth. Thermal transfer labels find applications in diverse sectors, such as retail for product labeling, pricing, and barcodes, manufacturing for asset tracking, inventory management, and compliance labeling, and healthcare for patient identification, laboratory specimen labeling, and medical records. The rising e-commerce usage is anticipated to drive increased demand for thermal paper applications in labeling and tagging.

Key U.S. Thermal Paper Company Insights

Some of the key players operating in the market include Appvion Operations, Ricoh Company, Koehler Group, and Oji Holdings:

-

Ricoh has a significant presence in the U.S. thermal paper market, with strong R&D and manufacturing resources

-

Oji Holdings is another major player with a strong market presence and overseas business bases

Key U.S. Thermal Paper Companies:

- Koehler Group

- Appvion Operations, Inc.

- Ricoh Company, Ltd.

- Mitsubishi Paper Mills (MPM) Limited

- Oji Holdings Corporation

- Thermal Solutions International Inc

- Hansol Paper Co. Ltd.

- Henan Province JiangHe Paper Co., Ltd.

- Gold Huasheng Paper Co., Ltd.

- Kanzaki Specialty Papers Inc. (KSP)

Recent Developments

-

In February 2024, Italian specialty paper manufacturer Fedrigoni strategically expanded its presence in North America by acquiring select assets of Mohawk. This acquisition helped strengthen Fedrigoni's position as a key player in the region

-

In November 2023, Wynnchurch Capital, L.P. completed the acquisition of a majority ownership interest in Appvion Holding Corp., enabling growth investments and additional resources

-

In June 2023, Appvion unveiled its new patent-pending direct thermal coating formulation that eliminates the use of phenolic developers and delivers high-performing labels, tickets, and tags with excellent heat stability and clear, dark images

U.S. Thermal Paper Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.2 billion

Growth rate

CAGR of 3.2% from 2024 to 2030

Base year for estimation

2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, trends

Segments covered

Width, technology, application

Key companies profiled

Koehler Group; Appvion Operations, Inc.; Ricoh Company, Ltd.; Mitsubishi Paper Mills (MPM) Ltd.; Oji Holdings Corp.; Thermal Solutions International Inc.; Hansol Paper Co. Ltd.; Henan Province JiangHe Paper Co., Ltd.; Gold Huasheng Paper Co., Ltd.; Kanzaki Specialty Papers Inc. (KSP)

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Thermal Paper Market Report Segmentation

This report forecasts revenue and volume growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. thermal paper market report based on width, technology, and application:

-

Width Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

57mm

-

80mm

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Direct Transfer

-

Thermal Transfer

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

POS

-

Tags & Label

-

Lottery & Gaming

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. thermal paper market is expected to grow at a compound annual growth rate of 3.2% from 2023 to 2030 to reach 1.2 billion by 2030.

b. POS dominated the U.S. thermal paper market with a share of 64.1% in 2023 due to the expansion of retail chain stores in countries, resulting in increased monetary transactions.

b. Some of the key players operating in the thermal paper market include NAKAGAWA Manufacturing (USA), Inc., Twin Rivers Paper Company, Iconex LLC, and Domtar Corporation.

b. The key factors that are driving the U.S. thermal paper market include the increasing usage of POS terminals for monetary transactions due to the expansion of e-commerce and packaging industry in the country.

b. The U.S. thermal paper market size was estimated at USD 918.1 million in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.