U.S. Surgical Microscope Market Trends

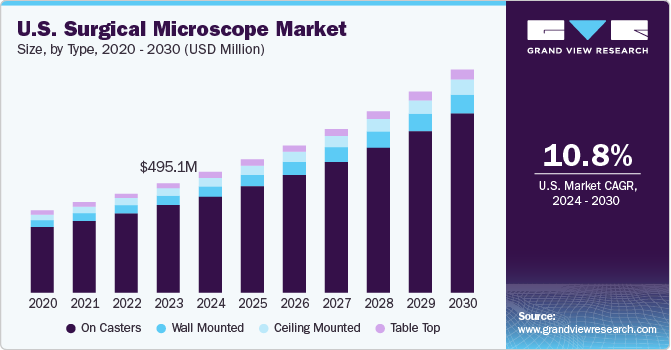

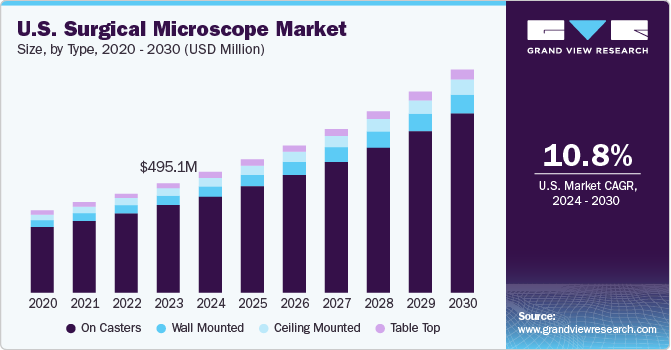

The U.S. surgical microscope market size was valued at USD 495.1 million in 2023 and is projected to grow at a CAGR of 10.8% from 2024 to 2030. According to the CDC, approximately 5% of adults aged 20 and older in the U.S. are diagnosed with Coronary Artery Disease (CAD), while 805,000 people experience a heart attack annually, with 605,000 being first-time occurrences. The growing prevalence of chronic diseases, such as cancer and cardiovascular diseases, is driving demand for surgical microscopes in the U.S.

Surgical microscopes are vital components in the ultra-surgical operation due to they give the surgeon a highly enlarged, clear view of the operating area. Industry growth in the U.S. is driven by several key factors, including technological advancements, increasing surgical procedures, and growing incidence of chronic diseases. The continuous innovation in surgical microscope technology, led by major players enhancing precision and efficiency in surgeries. This is particularly evident in fields such as neurosurgery, oncology, and ophthalmology, where minimally invasive surgeries require advanced visualization and control.

The demand for surgical microscopes is also fueled by the rising number of surgeries, particularly in outpatient settings, which are becoming increasingly popular due to cost-effectiveness, convenience, and faster recovery times. Moreover, the growing prevalence of chronic diseases, such as cancer, necessitates the use of surgical microscopes for accurate diagnosis and treatment. The oncology segment is expected to experience rapid growth due to the rising cancer cases in the U.S.

The market is also driven by significant investments in healthcare infrastructure, particularly in ambulatory surgical centers (ASCs), which are increasingly adopting advanced surgical technologies to enhance patient care. Furthermore, the need for high-speed diagnostics in surgical settings drives the adoption of advanced surgical microscopes, which facilitate quicker decision-making during procedures. As a result, hospitals and healthcare organizations are prioritizing the acquisition of highly developed surgical microscopes to meet the growing challenge of patients seeking proficient surgical techniques.

Type Insights

The on casters type segment dominated the market with a revenue share of 79.8% in 2023 as it offers unparalleled portability, allowing for effortless movement around the operating theater. This flexibility is particularly valuable for procedures requiring simultaneous top and side views of human anatomy. Its versatility makes it an ideal choice for hospitals and surgical centers seeking a single, multi-specialty microscope solution.

Wall-mounted surgical microscopes are expected to register the second-fastest CAGR of 10.9% over the forecast period. Wall-mounted surgical microscopes are a prevalent choice in healthcare facilities due to their compact design, which enables space optimization in the operating room. These microscopes offer enhanced flexibility, allowing for gradual positioning and mobility without interference, making them ideal for surgeries requiring precise movements and visibility.

Application Insights

Ophthalmology led the application segment with a revenue share of 37.4% in 2023. The growing geriatric population and changes in lifestyles have led to an increase in patients with cataracts, glaucoma, macular degeneration, and diabetic retinopathy. Surgical microscopes have advanced to improve visualization acuity, depth perception, and ease of use for ophthalmic surgeons, contributing to minimally invasive procedures and shorter recovery times. Moreover, surgical microscopes also prove vital in helping surgeons perform these practices without inflicting so much harm on the patients.

ENT surgery is projected to be the fastest-growing application segment with a CAGR of 11.2% in the forecast period. Operations performed on the ear, nose, and throat are frequently performed and are amongst the most delicate to perform hence the use of surgical microscopes. Moreover, the advancements have become very vital in ENT surgeries due to new types of surgical microscopes that have enhanced visualization, magnification, and illumination. In addition, excessive precision is important in the performance of ENT surgeries since it helps in the reduction of any harm that may come to the patients. Surgical microscopes allow doctors to get highly detailed and clear images and depth of field vision resulting in highly detailed and accurate surgeries.

End Use Insights

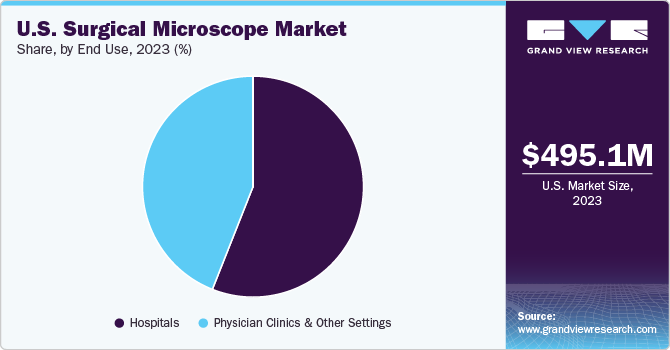

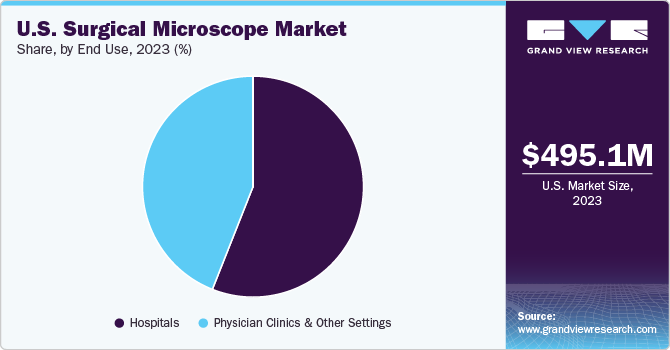

Hospitals held the largest market share of 56.0% in 2023. Hospitals tend to perform several complicated surgeries in different intensive areas including neurology, ENT, dental surgery, and others. These procedures need precision and augmented vision technologies like surgical microscopes. Hospitals usually provide care that entails a higher number of operations in contrast to other outpatient offices. Moreover, hospitals have elaborate health facilities and systems for delivering care, which increases their chances of acquiring modern technologies such as surgical microscopes to improve patient care.

The physician clinics and other settings segment is expected to register the fastest CAGR of 11.7% in the forecast period. Physician clinics and other healthcare facilities are easier for patients to access when compared with hospitals and thus, the people can easily undergo surgical operations in these healthcare facilities. Moreover, the majority of operations done in physician clinics are less expensive compared to the same operations done in hospitals, mainly due to it attracts patients who are in search of cheaper procedures without necessarily requiring substandard treatment.

Key U.S. Surgical Microscope Company Insights

Some key companies in the U.S. surgical microscope market include ZEISS Group; Leica Microsystems; haag-streit.com; Alcon Inc.; and ARI Medical Technology Co., Ltd.; among others. Companies are prioritizing the development of technologically advanced products with enhanced accuracy and efficiency, leveraging competitive pricing strategies, including discounts and low-cost service contracts, to drive market penetration.

-

ZEISS Group is a renowned global technology company, specializing in optics and optoelectronics. Its medical division, Carl Zeiss Meditec AG, develops cutting-edge surgical microscopes for ophthalmology and neurosurgery, leveraging advanced imaging solutions to enhance precision, facilitate minimally invasive surgeries, and improve patient outcomes.

-

Olympus America, a subsidiary of Olympus Corporation, is a leading provider of medical technologies, including endoscopy and surgical microscopy. The company’s high-quality imaging systems enhance visualization and precision in various surgical applications, with a focus on innovation and customer-centric solutions for minimally invasive surgeries.

Key U.S. Surgical Microscope Companies:

- ZEISS Group

- Leica Microsystems

- haag-streit.com

- Alcon Inc.

- ARI Medical Technology Co., Ltd.

- Seiler Instrument Inc.

- Olympus America

- Synaptive Medical

- TOPCON CORPORATION

Recent Developments

-

In May 2024, Haag-Streit launched the 3D imaging alternative for its Imaging Module 910. This innovative addition to their product line aims to enhance the capabilities of the Imaging Module 910, providing healthcare professionals with superior imaging technology for improved diagnostic accuracy and patient care.

-

In March 2024, ZEISS announced the launch of the ZEISS ARTEVO 850 3-D heads-up ophthalmic microscope, which offers superior visualization capabilities by providing surgeons with a heads-up display for high-resolution 3D images during eye surgical procedures.

U.S. Surgical Microscope Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 545.9 million

|

|

Revenue forecast in 2030

|

USD 1.0 billion

|

|

Growth rate

|

CAGR of 10.8% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, application, end use, region

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

ZEISS Group; Leica Microsystems; haag-streit.com; Alcon Inc.; ARI Medical Technology Co., Ltd.; Seiler Instrument Inc.; Olympus America; Synaptive Medical; TOPCON CORPORATION

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Surgical Microscope Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. surgical microscope market report based on type, application, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

On Casters

-

Wall Mounted

-

Table Top

-

Ceiling Mounted

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)