- Home

- »

- Communication Services

- »

-

U.S. Supply Chain Management Market, Industry Report, 2030GVR Report cover

![U.S. Supply Chain Management Market Size, Share & Trends Report]()

U.S. Supply Chain Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (On-premise, Cloud-based), By Enterprise Size, By Vertical, And Segment Forecasts

- Report ID: GVR-4-68040-250-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. SCM Market Size & Trends

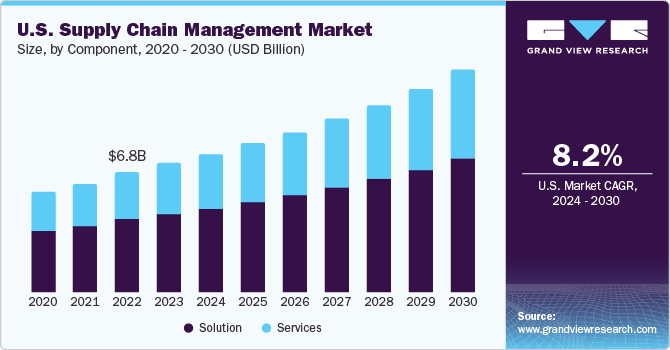

The U.S. supply chain management market size was valued at USD 6765.89 million in 2023 and is projected to grow at a CAGR of 8.2% from 2024 to 2030. The growth in the U.S. supply chain management (SCM) market can be attributed to several factors such as the rapid rise of e-commerce in the U.S. that has increased the demand for efficient SCM solutions to meet customers' expectations for fast and reliable deliveries. In addition, the rising demand for SCM solutions that offer real-time tracking, traceability, and data analytics is another key factor for propelling market growth. Moreover, the emergence of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), the Internet of Things (IoT), and big data analytics is transforming the SCM landscape, which in turn, is fueling its market growth.

In 2023, the U.S. accounted for approximately 29.0% share of the global supply chain management market. In recent years, there has been a significant increase in investments in supply chain management across various industries. This trend is driven by the recognition that a well-managed supply chain can provide significant competitive advantages to businesses. Organizations can optimize the supply chain to ensure that the right products are delivered to customers at the right time and cost. Moreover, effective supply chain management can also help businesses mitigate risks associated with supply chain disruptions, such as geopolitical issues, natural disasters, and supplier bankruptcies. Artificial Intelligence (AI) and Machine Learning (ML) technologies are increasingly being adopted to optimize various aspects of supply chain management, including demand forecasting, inventory management, transportation optimization, and risk management. By analyzing historical data and using advanced algorithms, AI and ML can predict future demand more accurately compared to traditional methods. This enables businesses to reduce stockouts, optimize inventory levels, and improve customer satisfaction. The advantages offered by SCM are expected to fuel further market growth in the coming years.

The growth of e-commerce has also led to an increase in customer expectations. Consumers expect fast and reliable delivery, free shipping, and hassle-free returns. This has compelled e-commerce companies to optimize their supply chains and provide a seamless customer experience. Supply chain management solutions can help e-commerce companies achieve this by providing real-time visibility into inventory levels, order statuses, and delivery schedules. This can help companies improve their order fulfillment process, reduce shipping times, and enhance customer experience. As e-commerce continues to evolve and become more convenient and personalized, its popularity among consumers is likely to increase, thus driving the necessity of SCM and thereby its market growth.

The implementation cost of supply chain management solutions can be high, which is a significant challenge for many organizations. The cost of implementing supply chain management solutions can vary widely depending on the solution's scope and complexity, the organization's size, and the level of customization required. One of the main factors contributing to the high cost of supply chain management solutions is the need for technology infrastructure. Supply chain management solutions require a range of components, including hardware, software, and network infrastructure. This can be expensive, particularly for smaller organizations, which may not have the resources to invest in the necessary infrastructure.

Market Concentration & Characteristics

The stage of market growth is medium and the pace is accelerating. The U.S. SCM market is highly competitive with intense rivalry among existing players. The market has numerous established SCM software providers and service companies, such as SAP, Oracle Corporation, and IBM Corporation, competing for market share. Competitors differentiate themselves through product features, industry expertise, integration capabilities, customer support, and pricing models. Key companies are adopting strategic mergers and acquisitions and acquiring or collaborating with small companies to increase their market share as well as gain access to cutting-edge technologies.

The degree of innovation in the U.S. SCM industry is high. Artificial Intelligence and the Internet of Things are revolutionizing supply chain management by enabling accurate demand forecasting and real-time asset tracking. Flexible supply chains, powered by diversified supplier bases and real-time inventory management, are becoming crucial in today’s volatile market. Big data analytics and robotics are enhancing decision-making and operational efficiency across supply chains. In addition, innovations in last-mile delivery and a heightened focus on cybersecurity are reshaping the future of supply chain management.

In addition, cloud-based solutions provide a scalable and flexible infrastructure for supply chain management. Cloud computing facilitates collaborative planning, real-time data sharing, and seamless integration across different stakeholders within the supply chain. It enhances accessibility, agility, and cost-effectiveness in the management of supply chain operations.

Government regulations significantly impact the U.S. supply chain management industry. Regulatory compliance, such as safety standards and environmental regulations, often necessitates changes in operational procedures, potentially increasing costs. Trade policies and tariffs can affect the cost and availability of raw materials, influencing sourcing strategies. Data protection laws impact how companies manage information within their supply chains, requiring robust cybersecurity measures. Overall, while these regulations aim to ensure fair trade, protect consumers, and maintain security, they also pose challenges that supply chain managers must navigate to maintain efficiency and profitability.

The threat of substitutes in the supply chain management market is low to moderate. SCM software and services are critical in streamlining and optimizing supply chain operations for businesses. At the same time, some companies may still rely on manual or traditional methods for SCM, the advantages of digitalization and automation prompt businesses to adopt more advanced approaches to improve efficiency, enhance visibility, and optimize their supply chain processes.

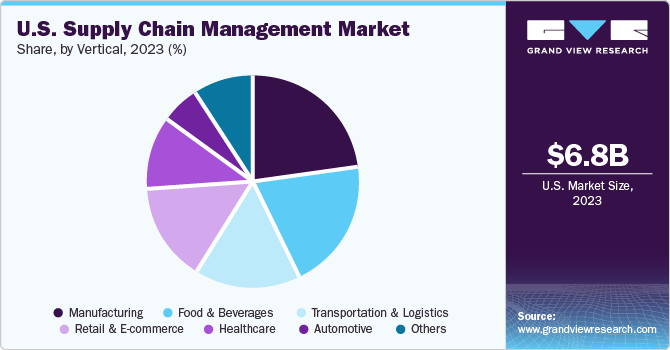

Vertical Insights

Based on vertical, the U.S. market has been segmented into retail & e-commerce, healthcare, automotive, transportation & logistics, food & beverages, manufacturing, and others. The manufacturing segment held the largest revenue share of more than 23% in 2023. The large share can be attributed to the increasing demand for automation in the supply chain process in the manufacturing industry. SCM helps industrial companies optimize their manufacturing processes and reduce waste. By implementing lean manufacturing principles and process improvement initiatives, industrial companies can reduce cycle times, improve quality, and increase productivity. SCM can aid in lean manufacturing by providing the necessary materials, parts, and components to support production processes while minimizing waste and reducing costs.

The retail and e-commerce segment is anticipated to witness the fastest CAGR of 11% over the forecast period. The growth of e-commerce has accelerated the adoption of SCM in the retail industry. The management of e-commerce supply chains is centered around procuring raw materials, production processes, and timely distribution of finished products. It encompasses coordinating supply and demand, inventory management, order processing, warehousing, and customer delivery. E-commerce companies must manage inventory levels across multiple channels, including online and offline stores, warehouses, and third-party logistics providers. Therefore, the adoption of SCM in e-commerce is driven by the need to manage complex supply chains involved in fulfilling online orders and to manage transportation and delivery logistics to ensure that products are delivered to customers on time and at the right location. Owing to the aforementioned advantages, the segment is expected to grow significantly over the forecast period.

Component Insights

Based on component, the U.S. market is categorized into solutions and services segments. The solution segment is further classified into the transportation management system (TMS), planning & analytics, warehouse & inventory management system, procurement & sourcing, and manufacturing execution system. The solution segment held the largest revenue share of more than 61% in 2023. SCM solutions provide quality assurance, supplier management, and logistics management. SCM solutions when implemented have several advantages such as higher visibility, increased efficiency, analytics, lower costs, greater agility, and increased compliance over the complex supply chain. They aid in the automation of key processes such as processing orders, billing, and order tracking resulting in reduced time and administration expenses. SCM systems also identify excess materials and costs connected with shipping, warehousing, and manufacturing, which helps reduce excess inventory.

The transportation management system subsegment held the largest share in 2023 among the solution subsegments. A transportation management system (TMS) can help companies address the growing complexities of transportation management by providing real-time tracking of shipments, automating carrier selection, and optimizing shipping routes. TMS facilitates route optimization, carrier selection, shipment tracking, freight auditing and payment, and reporting and analytics. By automating these processes, TMS enables companies to increase transportation efficiency, reduce transportation costs, and improve customer satisfaction. TMS plays a critical role in supply chain management by helping companies streamline their logistics operations, optimizing transportation routes, and improving overall supply chain performance.

The services segment is further segmented into professional services and managed services. The services segment is anticipated to register the fastest CAGR of 8.7% over the forecast period. Organizations may face several challenges, including increasing complexity, continued globalization, evolving regulatory landscape, and changing customer demands, while managing their supply chain operations. Professional and managed services can help organizations in addressing these challenges and in improving their supply chain performance. Providers providing these services hold specific expertise in SCM and can hence help organizations with the best practices in line with the industry benchmarks and emerging trends.

Deployment Insights

Based on deployment, the SCM market is segmented into on-premises and cloud-based. The on-premises segment held the largest revenue share of more than 55% in 2023. On-premises supply chain management solution is installed on the servers located within the company’s premises and managed by the company’s in-house IT staff. This approach allows the company to have complete control over its supply chain data and operations. On-premises SCM solutions can also be integrated with the company’s other enterprise systems, such as the enterprise resource planning (ERP) system and customer relationship management (CRM). Companies operating in specific strictly regulated industries and industry verticals may not be allowed to store confidential data in a public cloud environment. Such companies typically opt for on-premises installation despite the fact that most supply chain management solutions operate on a cloud-based model.

The cloud-based segment is anticipated to register the fastest CAGR of 9.3% over the forecast period. Cloud-based supply chain management solutions offer numerous advantages for businesses. One of the most significant benefits is cost savings. Companies can avoid the significant capital expenditures associated with implementing and maintaining an on-premises solution by opting for cloud-based solutions, since the software is hosted on remote servers and businesses have to pay only for the necessary service rather than investing in dedicated hardware or infrastructure. As the software is hosted remotely, businesses can access it from anywhere via an internet connection, thereby making it convenient for teams to collaborate and work together, regardless of the location. This enhanced accessibility and collaboration can help businesses optimize their supply chain processes, reducing lead times, and improving customer satisfaction.

Enterprise Size Insights

Based on enterprise size, the market has been segmented into small & medium enterprises (SMEs) and large enterprises. The large enterprises segment held the largest revenue share in 2023 of more than 53%. Large enterprises have complex supply chains that involve multiple suppliers, distributors, and customers across different geographic locations. Therefore, efficient supply chain management is crucial for large enterprises to ensure that their products are delivered to clients on schedule and with the required quality. Supply chains are becoming more complex due to the growth of e-commerce and globalization, which is making the use of SCM solutions crucial. Due to these reasons, large enterprises have implemented SCM software to manage such complexities and ensure the timely delivery of goods to customers. Hence, the SCM software market is experiencing significant growth due to the increasing demand from large enterprises.

The small and medium-sized enterprise (SME) segment is anticipated to witness the fastest CAGR of 8.9% during the forecast period. SMEs are rapidly adopting supply chain management to boost their operational effectiveness and gain a competitive edge. SCM solutions and services help SMEs optimize their supply chain processes, reduce costs, and increase profitability. SCM systems can be customized to an organization's unique needs, whether in a single location or across multiple regions. SMEs can reduce costs and increase profitability by streamlining supply chain processes and optimizing inventory management. SCM systems also help SMEs identify areas for improvement, enabling them to implement cost-saving measures and increase their overall efficiency.

Key U.S. Supply Chain Management Company Insights

Some of the key companies operating in the U.S. market for supply chain management include Oracle; Blue Yonder Group, Inc.; and IBM Corporation among others.

-

Oracle offers a comprehensive range of products and services designed to meet the needs of businesses across various industries. Its primary focus is developing and marketing database management systems, cloud-based applications, and integrated software solutions. Oracle provides various enterprise applications, including customer experience management, human capital management, supply chain management, and enterprise resource planning (ERP).

-

IBM Corporation provides computer hardware and software and consulting, hosting, and infrastructure services. IBM Corporation provides supply chain consulting services that help in improving supply chain management and assist businesses in creating sustainable supply networks. IBM also offers retail supply chain solutions with improved visibility, tracking, and transparency. The supply chain visibility tools and solutions from IBM offer customers access to order, inventory, delivery, and interruption data in real-time.

Infor and Coupa Software are some of the emerging companies in the U.S. SCM industry.

-

Infor serves various industry-specific markets, including manufacturing, consumer goods, services, public sector, energy, aerospace and defense, automotive, chemical, distribution, fashion, financial services, food and beverage, healthcare, logistics services, and discrete manufacturing. Infor's ERP system designs and implementations leverage the industry’s best practices for successful enterprise resource planning and execution.

-

Coupa Software is a cloud-based business spend management (BSM) platform supplier for organizations. It offers procurement and cost management software to the government, engineering, education, healthcare, retail, and staffing industries. The platform provides procurement, financing, and supply chain solutions for the auto, banking, investing, business services, and healthcare industries. The company's supply chain management software offers specialized solutions, including planning and designing.

Key U.S. Supply Chain Management Companies:

- Oracle

- Blue Yonder Group, Inc.

- Infor

- Manhattan Associates

- Coupa Software Inc.

- IBM

- SAP SE

- Logility, Inc.

- Anaplan. Inc.

- Epicor Software Corporation

Recent Developments

-

In March 2024, Oracle announced new generative AI capabilities within the Oracle Fusion Cloud Applications Suite that will help customers improve decision-making and enhance the employee and customer experience. The latest AI additions include new generative AI capabilities embedded in existing business workflows across finance, supply chain, HR, sales, marketing, and service, as well as an expansion of the Oracle Guided Journeys’ extensibility framework to enable customers and partners to incorporate more generative AI capabilities to support their unique industry and competitive needs.

-

In February 2024, Blue Yonder, a leading supply chain solutions provider, announced its acquisition of Flexis AG, a flexible, innovative software technology provider specializing in production optimization and transportation planning and execution. With a robust customer base in the automotive and industrial original equipment manufacturer (OEM) sectors, flexis strengthens Blue Yonder’s capabilities to help companies with highly configurable products and expansive suppliers to plan and optimize their complex production facilities and network structures.

-

In November 2023, Epicor, a global leader of industry-specific enterprise software designed to promote business growth, announced it has acquired Elite EXTRA, a leading provider of cloud-based last-mile delivery solutions. The acquisition expands Epicor's ability to help its customers across the make, move, and sell industries simplify last-mile logistics and compete in a hyper-competitive market more effectively. Financial terms were not disclosed.

U.S. Supply Chain Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7263.82 million

Revenue forecast in 2030

USD 11,679.7 million

Growth rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, deployment, enterprise size, vertical

Country scope

U.S.

Key companies profiled

Oracle; Blue Yonder Group Inc.; Infor; Manhattan Associates; SAP SE; Coupa Software Inc.; IBM; Logility, Inc.; Anaplan, Inc.; Epicor Software Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Supply Chain Management Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. supply chain management market report based on component, deployment, enterprise size, and vertical:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Transportation Management System

-

Planning & Analytics

-

Warehouse & Inventory Management System

-

Procurement & Sourcing

-

Manufacturing Execution System

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premises

-

Cloud-based

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small & Medium Sized Enterprises

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail & E-commerce

-

Healthcare

-

Automotive

-

Transportation & Logistics

-

Food & Beverages

-

Manufacturing

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. supply chain management market size was estimated at USD 6765.89 million in 2023 and is expected to reach USD 7263.82 million in 2024.

b. The U.S. supply chain management market is expected to grow at a compound annual growth rate of 8.2% from 2024 to 2030 to reach USD 11,679.7 million by 2030.

b. The transportation management system segment dominated the U.S. supply chain management market with a share of over 32% in 2023.

b. Some key players operating in the U.S. supply chain management market include Oracle; Blue Yonder Group, Inc.; and IBM Corporation among others.

b. Key factors driving the market growth include the rapid rise of e-commerce in the U.S. which has increased the demand for efficient SCM solutions to meet customers' expectations for fast and reliable deliveries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.