- Home

- »

- Electronic & Electrical

- »

-

U.S. Retail Vending Machine Market, Industry Report, 2033GVR Report cover

![U.S. Retail Vending Machine Market Size, Share & Trends Report]()

U.S. Retail Vending Machine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Snacks, Beverage), By Location (Offices, Public Places), By Mode Of Payment (Cash, Cashless), And Segment Forecasts

- Report ID: GVR-4-68040-563-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Retail Vending Machine Market Summary

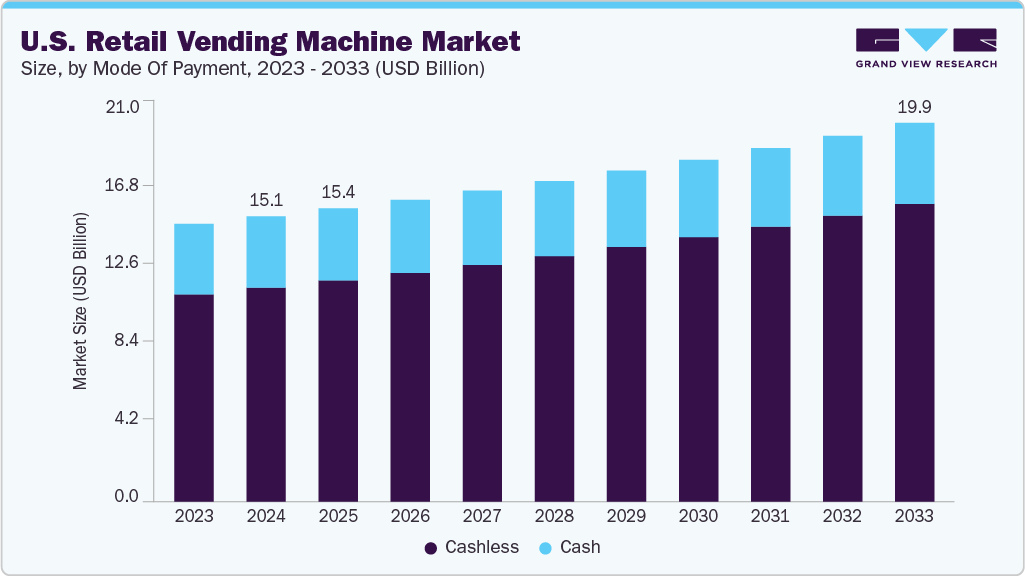

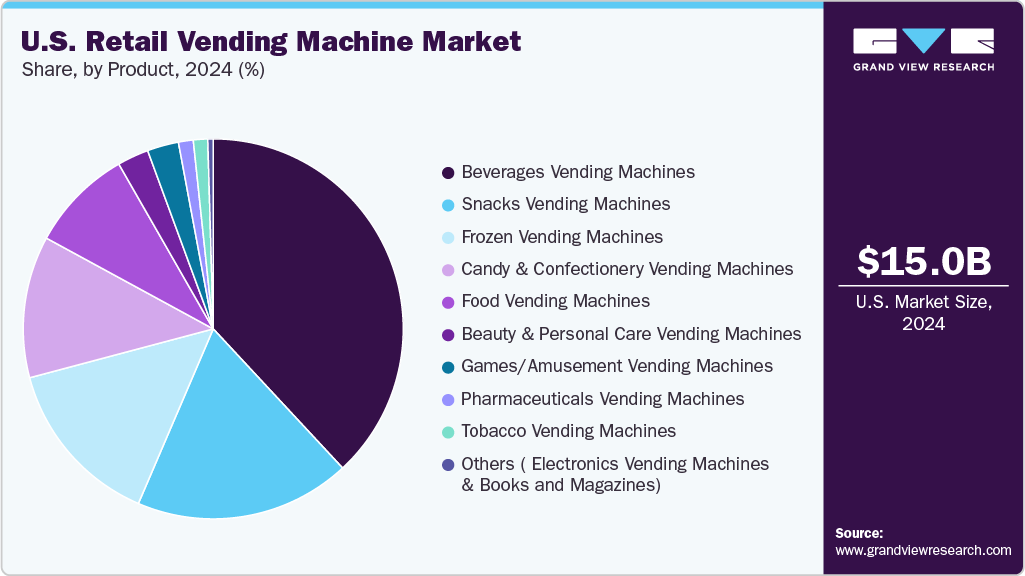

The U.S. retail vending machine market size was estimated at USD 15.02 billion in 2024 and is projected to reach USD 19.95 billion by 2033, growing at a CAGR of 3.2% from 2025 to 2033. The U.S. retail vending machine market is witnessing steady growth driven by rising demand for contactless and on-the-go snack and beverage options.

Key Market Trends & Insights

- By product, beverage vending machines accounted for a revenue share of 38.08% in 2024.

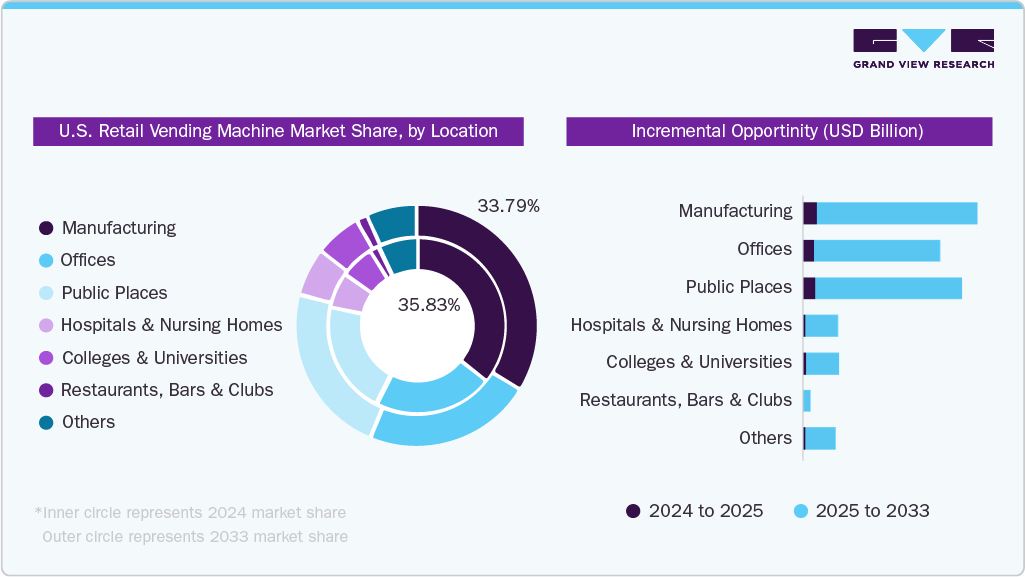

- By location, beverage machines for manufacturing accounted for a revenue share of 35.83% in 2024.

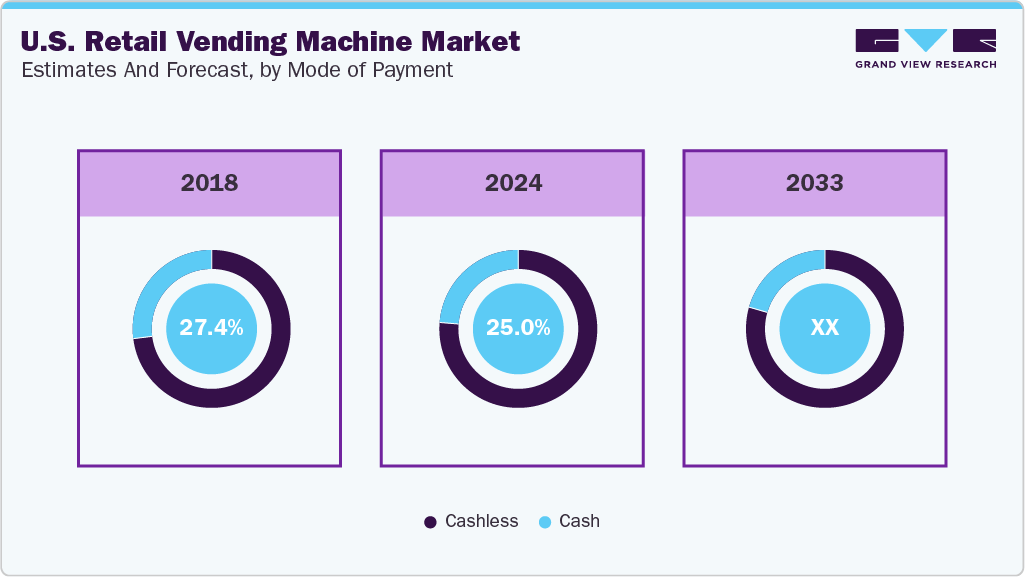

- By mode of payment, the cashless vending machines held the highest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.02 Billion

- 2033 Projected Market Size: USD 19.95 Billion

- CAGR (2025-2033): 3.2%

The integration of innovative technologies further enhances consumer convenience and operator efficiency. In the U.S., the retail vending machine market is being driven by rising demand for quick, contactless access to food, drinks, and everyday essentials, especially in urban centers, workplaces, and educational institutions. American consumers increasingly prefer self-service models due to their convenience and speed, particularly in post-pandemic settings. The integration of technologies like mobile payments (e.g., Apple Pay, Google Pay), touchless interfaces, and AI-powered inventory systems is enhancing the consumer experience while reducing operational costs. Additionally, the growing availability of healthier and premium product options aligns with evolving U.S. consumer preferences, further fueling market growth.The U.S. retail vending machine market is being propelled by a rising demand for convenience and contactless service, particularly in densely populated urban areas, transit hubs, and workplaces. Consumers increasingly seek 24/7 access to snacks, beverages, and personal essentials without waiting in lines or relying on staffed retail outlets. For instance, vending machines in office buildings now often offer a mix of ready-to-eat meals and hygiene products, catering to busy professionals and remote workers using shared spaces. The COVID-19 pandemic accelerated this trend, as contactless interaction became a preferred mode of consumption.

Technological innovation is a major enabler of this market’s growth. Many U.S. vending operators have adopted smart vending machines that feature cashless payment systems, mobile app integrations, and AI-driven restocking capabilities. Brands like Farmer’s Fridge and Chowbotics by DoorDash offer refrigerated vending units with fresh, chef-prepared salads and bowls, tailored to health-conscious consumers. These machines use real-time data to track inventory and consumer preferences, improving operational efficiency and reducing waste. Additionally, partnerships with digital wallets like Apple Pay and Google Pay have increased adoption, particularly among younger consumers.

Diversification of product offerings is another driving factor in the U.S. market. Modern vending machines now go beyond candy bars and sodas, featuring items such as organic snacks, protein shakes, over-the-counter medicines, and even electronics. Airports and malls have machines selling tech accessories (like FuelRod portable chargers) and cosmetics (such as those by Benefit or Sephora). This expansion into niche categories allows vending operators to target specific demographics and maximize revenue across varied locations. By combining product variety with technological upgrades and round-the-clock availability, vending machines are evolving into dynamic, mini-retail hubs that reflect the fast-paced lifestyle of American consumers.

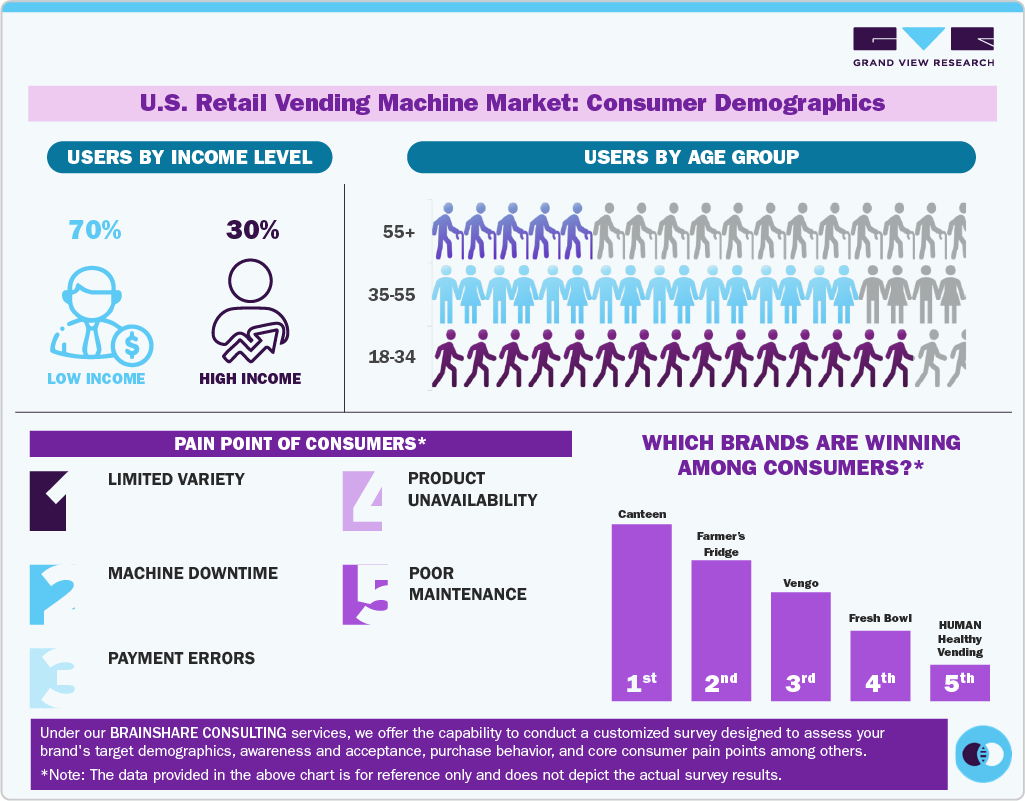

Consumer Insights

In the U.S., age is a major determinant of vending machine usage. Young adults between 18 and 35 are the most frequent users, drawn by the convenience, speed, and tech features such as mobile payments and touchless access. They typically encounter vending machines in universities, gyms, and urban transit areas, preferring healthier or trend-forward snacks. Adults aged 35 to 55 use vending machines primarily in professional or time-constrained environments such as offices, hospitals, or highways. Their choices are often functional-coffee, drinks, or quick bites during work hours. Meanwhile, adults aged 55 and above interact less frequently with vending machines, often using them in community spaces or medical centers, favoring classic and familiar product types.

Income level significantly influences usage patterns and access. Low- to middle-income consumers make up the majority of vending machine users, relying on them for affordable, quick-access snacks and beverages in everyday settings like laundromats, bus stations, and schools. These machines offer a convenient solution in areas with limited food retail options. High-income individuals represent a smaller but growing segment that interacts with vending machines occasionally, often in premium locations such as airports, luxury gyms, or executive workplaces. Their usage is shaped by interest in high-quality, healthy, or gourmet offerings rather than frequency or cost-efficiency.

Despite their convenience, vending machines present recurring user pain points that impact satisfaction. Common issues include limited variety, where users are faced with repetitive or unhealthy choices; machine downtime, where equipment is out of service; payment errors, often involving card or mobile systems; and product unavailability, where popular items are missing. These operational problems can undermine trust and discourage repeat use, especially in environments where vending machines serve as the only accessible option.

A mix of traditional giants and innovative disruptors shapes the U.S. vending ecosystem. Canteen leads with large-scale operations across corporate and institutional spaces. Farmer’s Fridge and Chowbotics offer fresh, tech-enabled meals in smart fridges targeting health-conscious, urban consumers. HUMAN Healthy Vending emphasizes nutritious products in schools and wellness spaces, while 365 Retail Markets powers self-checkout micro-markets in office environments.

Location Insights

Vending machines for manufacturing accounted for a revenue share of 35.83% in 2024, due to their critical role in improving workplace efficiency, safety, and inventory control. In industrial and manufacturing environments, vending machines are widely used to dispense personal protective equipment (PPE), tools, and maintenance supplies, ensuring employees have 24/7 access to essential items without relying on staffed supply rooms. These machines reduce downtime, prevent stock misuse, and allow for real-time usage tracking, which is especially valuable in large-scale operations. Companies like Fastenal and SupplyPro have tailored industrial vending solutions to meet OSHA compliance and lean inventory goals, making vending systems an integral part of modern manufacturing logistics in the U.S.

Vending machines for offices are expected to grow at a CAGR of 3.5% from 2025 to 2033, largely driven by changing workplace dynamics and employers’ increasing focus on convenience and employee well-being. As full-service cafeterias become less common especially in small to mid-sized offices vending machines offer a cost-effective alternative for providing snacks, beverages, and even fresh meals. This shift is evident in tech parks, co-working spaces, and corporate campuses, where 24/7 refreshment access supports flexible work hours. Moreover, the integration of healthier options, touchless payment systems, and real-time inventory monitoring aligns with the evolving expectations of the modern U.S. workforce.

Mode of Payment Insights

Cashless vending machines accounted for a 75.0% revenue share in 2024 in the U.S. due to the country's strong digital payment ecosystem and consumer preference for fast, touch-free transactions. Americans are widely accustomed to using mobile wallets like Apple Pay, Google Pay, and contactless cards, especially in urban areas, corporate campuses, universities, and airports. The COVID-19 pandemic accelerated this shift, as hygiene concerns pushed both consumers and operators toward cashless upgrades. U.S.-based vending operators benefit from extensive fintech partnerships and digital payment infrastructure, making it easier to install and manage smart, connected machines that cater to convenience-driven consumer habits.

The cash vending machine market is expected to grow at a CAGR of 1.5% from 2025 to 2033 in the U.S. as it retains relevance in cash-preferred environments. Despite the rise of digital transactions, cash-operated machines continue to be important in lower-income neighborhoods, senior communities, public parks, and rural towns where internet connectivity may be inconsistent and users still rely on cash. Additionally, in some transit stations and standalone community spots particularly in the South and Midwest vending operators maintain cash-based units due to lower maintenance costs and local demand. While slower growing, this segment remains a functional part of the U.S. vending landscape.

Vending machines today operate in both cash and cashless formats, with payment modes often aligning with the type of product offered and the location. Cash vending machines remain common for low-cost items like candy, snacks, and beverages, especially in public places and manufacturing sites. In contrast, cashless machines accepting cards, mobile payments, or QR codes are increasingly preferred for higher-value or tech-driven products like electronics, beauty items, pharmaceuticals, and books, typically found in offices, colleges, and airports. The shift toward cashless vending is especially prominent in urban and high-security locations, where convenience and hygiene are key.

Product Insights

Beverage vending machines in the U.S. accounted for a revenue share of 38.08% in 2024, largely due to the country’s deeply ingrained grab-and-go culture and high per capita consumption of packaged drinks. Americans have long relied on vending machines for quick access to cold beverages, especially soda, energy drinks, and bottled water, across everyday settings like workplaces, schools, transit stations, and public parks. Unlike in many other countries, the U.S. has a vast footprint of beverage vending machines in outdoor and high-traffic areas, supported by aggressive placement strategies from dominant players like Coca-Cola and PepsiCo. Additionally, the popularity of supersized portions, refrigerated units, and impulse-buy behaviors at breakrooms and rest areas reinforces their strong market performance.

The U.S. snack vending machines in the U.S. are expected to grow at a CAGR of 3.2% from 2025 to 2033, driven by shifting consumer habits toward convenient, on-the-go snacking and the expansion of vending services into non-traditional spaces. With Americans increasingly seeking quick energy boosts during workdays, commutes, or between classes, snack vending machines are becoming common in coworking spaces, colleges, healthcare facilities, and even apartment complexes. The rising demand for healthier options-like protein bars, baked chips, and gluten-free snacks-has encouraged operators to diversify offerings beyond traditional candy and chips.

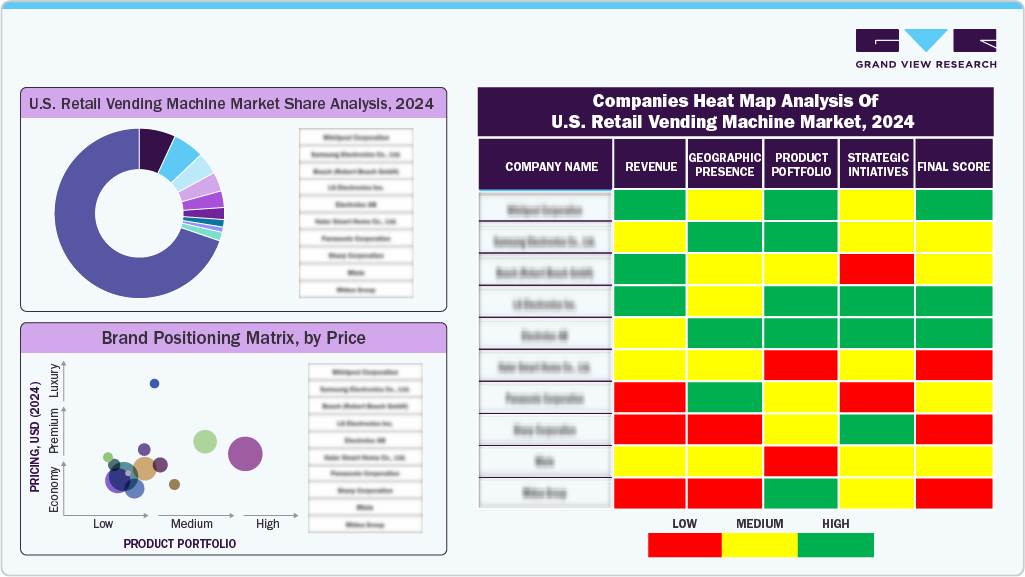

Key U.S. Retail Vending Machine Company Insights

The U.S. retail vending machine market features a strong presence of established players that benefit from widespread brand recognition, long-standing industry experience, and strategic placement across high-traffic areas. These companies operate vast machine networks in offices, airports, train stations, hospitals, and industrial zones, allowing them to maintain consistent visibility and consumer reach. Their partnerships with local and international food and beverage brands further enhance product variety and appeal.

The market competition is fueled by innovation, with companies increasingly adopting smart technologies such as AI-powered inventory tracking, real-time analytics, and digital payment integration.

Companies are aligning their marketing and product development efforts accordingly as consumer expectations evolve, particularly around convenience, nutrition, and sustainability. Investments in targeted promotions, data-driven product curation, and regional customization help brands stay relevant. The market’s competitive dynamics are shaped not only by pricing and scale but also by how well players adapt to changing consumer behaviors and workplace needs.

Key U.S. Retail Vending Machine Company:

- Canteen

- Compass Group

- 365 Retail Markets

- Farmer’s Fridge

- HUMAN Healthy Vending

- Selecta Group (U.S. operations)

- Crane Merchandising Systems

- Avanti Markets

- Vengo Labs

- USConnect

Recent Developments

-

In September 2023, B.T.R. Nation was launched to transform the vending machine experience by offering clean-label, functional snacks that prioritize health without compromising on taste. Founded by Ashley Nickelsen after a personal journey through hospitals with limited, sugary vending options, the company introduced plant-based protein bars and superfood truffle cups made without added sugar, dairy, or soy. With ingredients like adaptogenic mushrooms and MCT oil, the products reflect growing U.S. consumer demand for wellness-focused convenience foods. Following strong online growth, the brand is now entering vending distribution to bring better-for-you snacks directly to high-traffic, on-the-go settings.

U.S. Retail Vending Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.44 billion

Revenue forecast in 2033

USD 19.95 billion

Growth rate

CAGR of 3.2% from 2025 to 2033

Actual data

2018 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, location, production, and mode of payment

Key companies profiled

Canteen; Compass Group; 365 Retail Markets; Farmer’s Fridge; HUMAN Healthy Vending; Selecta Group (U.S. operations); Crane Merchandising Systems; Avanti Markets; Vengo Labs; USConnect

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Retail Vending Machine Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. retail vending machine market report based on product, location, production, and mode of payment:

-

Product Outlook (Revenue, USD Million, 2018 - 2033)

-

Beverages Vending Machines

-

Hot Beverage Vending Machines

-

Cold Beverage Vending Machines

-

-

Snack Vending Machines

-

Food Vending Machines

-

Frozen Vending Machines

-

Tobacco Vending Machines

-

Games/Amusement Vending Machines

-

Beauty & Personal Care Vending Machines

-

Candy & Confectionery Vending Machines

-

Pharmaceuticals Vending Machines

-

Electronics Vending Machines

-

Book & Magazine Vending Machines

-

-

Location Outlook (Revenue, USD Million, 2018 - 2033)

-

Manufacturing

-

Offices

-

Colleges & Universities

-

Hospitals & Nursing Homes

-

Restaurants, Bars & Clubs

-

Public Places

-

Others

-

-

Mode of Payment Market Outlook (Revenue, USD Million, 2018 - 2033)

-

Cash

-

Cashless

-

Frequently Asked Questions About This Report

b. The U.S. retail vending machine market size was estimated at USD 15.02 billion in 2024 and is expected to reach USD 19.95 billion in 2025.

b. The U.S. retail vending machine market is expected to grow at a compounded growth rate of 3.2% from 2025 to 2033 to reach USD 19.95 billion by 2033.

b. Beverage vending machines dominated the U.S. retail vending machine market with a share of 38.08% in 2024. The increasing demand for healthier beverages, such as cold-pressed juices, functional drinks, and premium coffee, has expanded vending machine offerings beyond traditional soft drinks. Businesses are also leveraging vending machines as a cost-effective, 24/7 retail solution, fueling market growth.

b. Some key players operating in the U.S. retail vending machine market include Canteen; Compass Group; 365 Retail Markets; Farmer’s Fridge; HUMAN Healthy Vending; Selecta Group (U.S. operations); Crane Merchandising Systems; Avanti Markets; Vengo Labs; USConnect

b. Key factors driving the market is driven by the increasing demand for convenient, on-the-go food and beverage options, technological advancements such as cashless payment systems and smart vending machines, and the growing trend of automation in retail are driving the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.