U.S. Restaurant Point Of Sale Solutions Market Size, Share & Trends Analysis Report By Product Type, By Component (Hardware, Software, Services), By Deployment Mode, By End-user, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-355-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

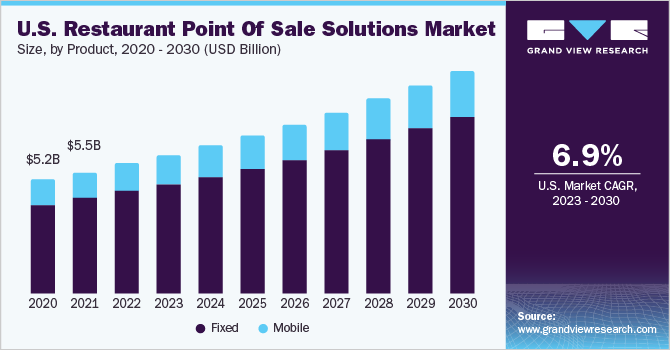

The U.S. restaurant point of sale solutions market size was valued at USD 5.91 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. The growth of the U.S. restaurant point-of-sale solution market can be attributed to factors such as the proliferation of food delivery apps integrated with restaurant point of sale (POS) solutions and the growing demand for cloud-based mobile POS solutions, among others. Growing food delivery applications has increased the demand for restaurant POS solution in the market. The U.S. is one of the leading countries generating revenue for online food delivery services after China.

Over the years, there has been unprecedented growth in the number of food delivery application users across the U.S. For instance, Uber Eats witnessed an increase in active users, approximately 81 million users, and DoorDash has 25 million active users. As a result, many active users are creating chaos for restaurant operators to manage incoming orders, transactions, and inventories. Integrating restaurant POS solutions with online food delivery service helps restaurant owners manage the restaurant floor plan, track inventory, automate account reports, update menu options, and manage staff and timesheets, streamlining the third-party delivery process and the in-dine process effectively. Henceforth, the growing partnership between restaurants and food delivery companies is fueling the demand for the restaurant point-of-sale solution market in the U.S.

The growing benefits and convenience of managing transactions through mobile devices have emerged in demand for the restaurant point of sale (POS) solution market. Replacing the POS cash register system with a mobile device or smartphone integrated with POS software has created the requirement for a cloud-based POS solution. Cloud computing providers offer online financial services for POS systems by effectively backing up data in remote vendor servers. The solution provides flexibility and reliability, following the restaurant's requirements and considering the security and cost structure. The best benefit of the cloud-based POS solution is exceptional control over the restaurant stocks and inventories.

The introduction of cloud kitchens, also known as ghost kitchens, in the U.S., has propelled the demand for the restaurant POS solution market. Around 51 percent of the restaurants in the U.S. has shifted to cloud/ ghost kitchen. The cloud-based POS solution enables restaurants to manage, optimize, and grow transactions and turn inventory into revenue. For instance, the Oracle cloud-based POS solution provides Payment Cloud Service that allows consumers to accept payments from different credit cards, Samsung Pay, debit cards, Apple Pay, and Google Pay. In addition, the company also offers online ordering & delivery options, real-time table management, multichannel kitchen displays, reservation, and wait-for lists, among others. This growth in software solution offerings integrated with benefits and comfort has driven the demand for the POS solution market among restaurants in the U.S.

Product Type Insights

The fixed POS segment of the market is expected to occupy more than 79% of the market in 2022 and is projected to witness the highest growth rate over 2023 - 2030. The benefits of the fixed POS segment include improved accuracy, efficiency, generation of sales and inventory reports, better security, and improved customer satisfaction, among others. All these factors have together contributed to the growth of the fixed POS segment over the forecast period. Large businesses needing continuous power supply, complex infrastructure, and high maintenance started opting for wide POS systems to streamline their business function. Moreover, large restaurant businesses wary of security concerns deployed fixed POS terminals to deploy the solution within the vendor firewall. Hence, large-scale business expansion is expected to boost the demand for fixed POS terminals.

The mobile POS segment is estimated to occupy over 20% of the market share in 2022 and is witnessing significant growth over 2023-2030. The mobile POS terminals offer low cost of installation and mobility, allow ease of payment during busy hours, help avoid loss of sales due to delays, and help improve customer satisfaction. Sale and payment transactions can be carried out at any part of a store or in the field using mPOS terminals, which are expected to be the key driving force for mobile and wireless terminals.

Component Insights

By component hardware segment is expected to dominate the market, holding more than 48% of the market share in 2022. Hardware components of a restaurant POS system are available in silos and in the individual system. Vendors prefer an all-in-one POS system to avoid computability issues from integrating different systems. Moreover, many vendors offer integrated POS solutions in all in one POS systems that can be further customized according to business-specific requirements.

The software segment is estimated to occupy more than 41% of the market share and is projected to grow significantly in the U.S. restaurant point-of-sale solution market from 2023 - 2030. The promising growth prospects of the software segment can be attributed to the growing demand for POS devices requiring tailor-made solutions according to industry functions. Moreover, advancements in cloud computing technology have increased the usage of Software-as-a-Service platform-based POS systems. Cloud-based POS software can integrate screen terminals and barcode scanners across POS systems and further provides data restoring and backup features. Software services include timely upgrades, while the hardware requires maintenance and repair services.

Deployment Mode Insights

The cloud deployment of the POS solution is projected to occupy more than 53% of the market in 2022, and is projected to witness the highest growth rate over the period 2023 - 2030. The rapid adoption of cloud-based POS solutions is favored due to low installation costs and high RoI. Moreover, deployment on the cloud eliminates the need for a data center or professional to manage data on the premises. However, software deployed on the cloud needs strong internet connectivity to function throughout the business operation. Weak internet connectivity can hinder transactions and other processes, halting business functions.

The on-premise deployment of the POS solution is estimated to hold over 46% of the market share in 2022, and is projected to witness significant growth over the forecast period. Large restaurant chains running multiple stores opt for on-premises deployment to protect data within their firewall and access POs system without relying completely on internet connectivity. The large volumes of confidential customer financial and identity data are of prime importance for QSR and FSRs. Small and medium size restaurant businesses still prefer cloud deployment as it is an economical choice considering the budget constraint.

End-user Insights

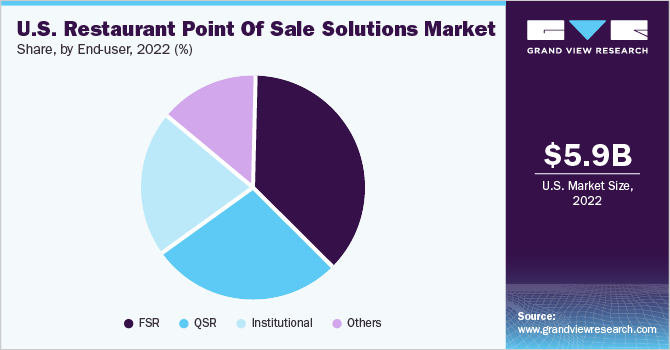

The full service restaurant (FSR) segment of the market is projected to occupy the largest market share, occupying more than 37% in 2022. The FSR segment is further bifurcated into fast dining and casual dining. Technology is reshaping how restaurants manage payment processing, taking orders, inventory management, and customer engagement. As U.S. restaurants have been at the forefront of the adoption of POS solutions, developing these terminals into a comprehensive management platform is driving the demand in the market. The transition from fragmented POS systems into an all-in-one technology platform supports payments and tasks such as ordering, gift card processing, loyalty programs, and CRM.

The quick service restaurant (QSR) segment is estimated to occupy more than 27% of the market share in 2022. POS systems for QSRs act as a central communication hub for restaurants that offer services via drive-thru or serve on-the-go food. These terminals record online or in-person orders for the kitchen, process payments, create sales analysis reports, and track sales and employee working hours. The availability of an increasing number of systems with all these functionalities to run a small or large QSR is driving the market growth. Lightspeed, Toast Inc., Revel System, TouchBistro, Lavu, and Square are some of the most popular and preferred POS solution providers in the U.S. market.

Key Companies & Market Share Insights

The key players operating in the U.S. restaurant point of sale solution market include Revel Systems, Lightspeed,Toast, Inc., and Square, Inc. To broaden their product offering, industry companies utilize a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions. For instance, in May 2022, Square Inc. acquired GoParrot, a marketing software provider to restaurants. The GoParrot platform offers a user-friendly experience through its powerful Omnichannel software. The acquisition will help Square Inc. enhance the customization and personalization of orders. Prominent players dominating the U.S. restaurant point of sale solutions market include:

-

Bepoz America LLC

-

Clover Network, Inc.

-

Harbortouch

-

Helcim Inc.

-

Ingenico

-

Lavu, Inc.

-

Lightspeed

-

NCR Corporation

-

Oracle

-

PAX Technology

-

Revel Systems

-

Square, Inc.

-

Squirrel Systems

-

Toast, Inc.

-

TouchBistro

U.S. Restaurant Point Of Sale Solutions Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 10.06 billion |

|

Growth Rate |

CAGR of 6.9% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

May 2023 |

|

Quantitative units |

Revenue in USD billion, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, component, deployment mode, end-user |

|

Country scope |

U.S. |

|

Key companies profiled |

Bepoz America LLC; Clover Network, Inc.; Harbortouch; Helcim Inc.; Ingenico; Lavu, Inc.; Lightspeed; NCR Corporation; Oracle; PAX Technology; Revel Systems; Square, Inc.; Squirrel Systems; Toast, Inc.; TouchBistro |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

|

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Restaurant Point Of Sale Solutions Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. restaurant point of sale solutions market report based on product type, component, deployment mode, and end-user.

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed POS

-

Mobile POS

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Full Service Restaurant (FSR)

-

Fine Dining

-

Casual Dining

-

-

Quick Service Restaurant (QSR)

-

Institutional

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. restaurant point of sale solution market size was estimated at USD 5.91 billion in 2022 and is expected to reach USD 6.29 billion in 2023.

b. The U.S. restaurant point of sale solution market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 10.06 billion by 2030.

b. The fixed product segment dominated the U.S. restaurant point of sale solution market and accounted for more than 75% of the global revenue share in 2022. large restaurant businesses wary of security concerns deployed fixed POS terminals to use solutions within the vendor firewall.

b. Bepoz America LLC, Clover Network, Inc., Harbortouch, Helcim Inc., Ingenico, Lavu, Inc., Lightspeed, NCR Corporation, Oracle, PAX Technology, Revel Systems, Square Inc., Squirrel Systems, Toast Inc., and TouchBistro are some of the prominent players in the U.S. restaurant point of sale solution market. These vendors have created a strong ecosystem of distributors, technology, and channel partners in the country, driving the U.S. restaurant POS solution market.

b. The rising demand for digital solutions for effectively managing restaurant business operations such as tracking employee attendance, inventory, online food order delivery status, and recording orders and sales is expected to drive the U.S. restaurant point of sale solution market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."