- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Recycling Equipment Market, Industry Report, 2030GVR Report cover

![U.S. Recycling Equipment Market Size, Share & Trends Report]()

U.S. Recycling Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Equipment (Baler Press, Shredders, Granulators, Agglomerators), By Processed Material (Metal, Plastics, Paper), And Segment Forecasts

- Report ID: GVR-4-68040-209-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Recycling Equipment Market Trends

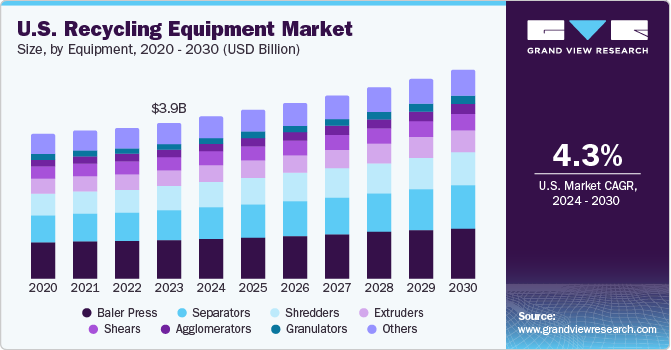

The U.S. recycling equipment market size was estimated at USD 3.95 billion in 2023 and is anticipated to register a compound annual growth rate (CAGR) of 4.3% from 2024 to 2030. Technological innovations have played a significant role in the growth of Recycling Equipment products and services by enhancing their efficiency and effectiveness, resulting in the growth of the market. Furthermore, the increasing awareness about environmental sustainability, the need to reduce carbon emissions, and the demand for eco-friendly and renewable products in the country are driving the market growth.

Recycling machinery and equipment can be applied to manage, handle, and recycle diverse types of waste materials. Further, these recycled materials can be utilized to produce a wide range of products, including packaging, construction materials, and consumer goods. The comparatively lower cost of recycled materials compared to raw materials is a key factor that propels the growth of the market. This price discrepancy is likely to attract manufacturers who are seeking to reduce the cost of their products. Moreover, the adoption of recycled materials helps to lessen reliance on virgin raw materials, which in turn contributes to the conservation of natural resources and reduces the environmental impact of resource extraction and processing. The increasing demand for recycling equipment products and services is driven by factors such as urbanization, population growth, and changing consumer preferences in the U.S., also drives the market growth significantly. Furthermore, the continuous reduction in production and installation costs of recycling equipment solutions, driven by economies of scale, technological advancements, and increased competition, is making these solutions more affordable and attainable.

Although the COVID-19 virus spread rapidly throughout the United States in 2020, resulting in nationwide lockdowns, the situation for recycling varied across states. For instance, in California, scrap recycling was deemed an essential service, resulting in the process remaining operational, but business was slow. Due to border closures and less waste generation from end-use industries, the demand for recycling equipment was negatively impacted in 2020. However, the rising concern about greenhouse gas emissions and strict regulations by regulatory bodies for waste recycling is likely to have a positive effect on the market over the forecast period. Recycling offers various environmental benefits, such as conserving natural resources, reducing greenhouse gas emissions, and diverting material from landfills. The above-mentioned factors are anticipated to boost market growth over the forecast period.

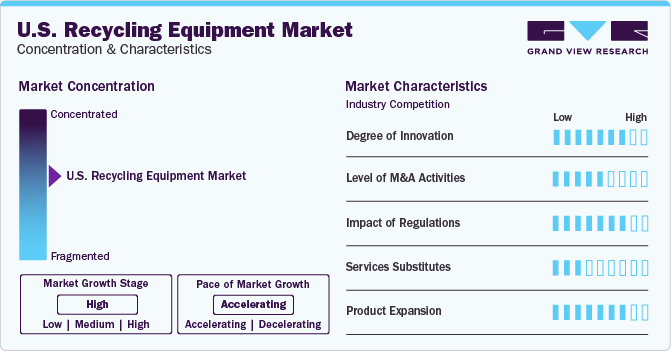

Market Concentration & Characteristics

The U.S. Recycling Equipment Market tends to be concentrated as there are various players in the market. However, a few dominant firms hold the market share and influence due to factors such as extensive resources, technological superiority, and robust brand recognition.

The market is marked by a high level of innovation owing to the frequent new product launches, continuous enhancement, and development in technologies. This level of innovation drives competition in the market, stimulating customer interest, and leading to dynamic market conditions. For instance, in 2022, a system to enhance the purity of recovered commodities, be low maintenance, and safeguard workers has been developed by the CP Group.

In addition, the market is significantly impacted by the regulations. Stringent regulations may create challenges for new entrants. Regulations affect business in terms of operational practices, market entry strategies, and product development. However, regulations also ensure compliance and consumer protection, which is crucial for businesses.

Furthermore, there is a high level of product expansion in the market owing to the constant diversification of the products by the companies to cater to the needs of their customers. The development of the product line by the company results in increased competitiveness and innovation, leading to the growth of the market. For instance, American Baler Company has announced upgrades to their 2-Ram Baler models in 2021. The W828 and W721 balers now feature a power unit and manifold block that incorporates off-the-shelf Parker Din Cartridge valves on the manifold, as well as standard Directional Control Valves.

Equipment Insights

Baler Press dominated the market with the largest market share of 24.9% in 2023, The reason for this growth is the increasing use of baler presses to compress recyclable materials such as paper, cardboard, aluminum, plastic, and non-ferrous metals into dense bundles called bales. Different types of baler presses, including horizontal balers, vertical balers, liquid extraction balers, and two ram balers, are available in the market. The baler press, which is a large steel chamber with a pressing plate, compresses the material inside the chamber until it reaches the desired bale size.

The Separators segment held a significant market share in 2023 and is projected to show productive growth over the forecast period due to its ability to be one of the most important recycling processes for categorizing scrap material. Various types of separation equipment, including magnetic separators, air separators, eddy current separators, screeners, vibratory screeners, rod decks, disc screeners, and star screeners, are used. Magnetic separators are utilized for separating ferrous materials from non-ferrous materials.

The shredding equipment accounted for a considerable market share in 2023 and is anticipated to experience productive growth over the forecast period because of the increasing demand from the tire industry. The shredding equipment is used to break down processed materials into smaller and more manageable parts before converting them into a more convenient form for reuse. Shredders are used for material reduction across numerous recycling applications, including scrap metal, plastic recycling, wood recycling, tire shredding, and e-waste recycling.

The extruder equipment segment accounted for a significant market share in 2023 due to its use in recycling applications, ensuring high output rates and steady production. There is a growing demand for recycled plastics from consumers, leading to an increasing demand for extruders that are explicitly designed for recycling applications. In addition, companies are focusing on reducing raw material costs and increasing the use of recycled plastics in their products as part of their sustainability goals. Thus, the factors mentioned above are expected to drive the demand for recycling extruders over the forecast period.

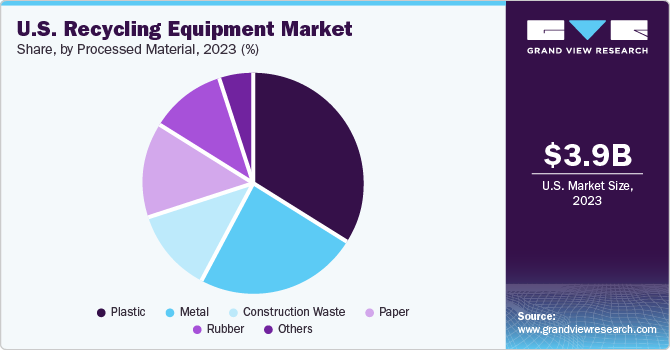

Processed Material Insights

The plastic segment dominated the market and held the largest market share of 33.9% in 2023. This growth was attributed to the increased use of recycled plastic in various end-use industries such as construction, automotive, and electrical & electronics. The process of producing plastics involves converting petroleum or natural gas into their constituent monomers, which is highly energy-intensive and leads to greenhouse gas emissions.

The metal segment had a significant market share in 2023. The main reason for this growth was the ability of scrap metal material to be recycled multiple times while retaining its properties. The demand for metals is increasing, and there is a growing focus on natural resource conservation and reduction in greenhouse gas emissions, which is expected to drive the demand for metal recycling and recycling equipment.

The paper segment accounted for a substantial market share in 2023, due to the various advantages it offers. Paper recycling helps conserve water, energy, and landfill space. It also reduces greenhouse gas emissions, and recycled fiber is a cost-effective and sustainable resource that can be used for making new paper products

The construction waste segment had a significant market share in 2023 due to rapid industrialization and urbanization, particularly in emerging economies, which is expected to drive the construction industry and increase the volume of construction waste. Construction waste is generated during the construction of new buildings, as well as during the renovation or demolition of existing structures. It typically includes wood, concrete, asphalt, metals, plastics, metals, glass, and bricks, among others.

Key U.S. Recycling Equipment Company Insights

The U.S. recycling equipment market is fiercely competitive, as it is home to both local and international manufacturers. Major players in this market include Recycling Equipment Manufacturing, CP Manufacturing Inc., American Baler Company, and Marathon Equipment, among others. These companies focus on a variety of factors, such as research, distribution, and the development of new products.

-

Key players operating in the market include American Baler Company; General Kinematics Corporation; and CP Manufacturing Inc.

-

American Baler Company provides bailing solutions to customers across various industries. Its range of products includes single ram horizontal balers with manual-tie and auto-tie features, as well as two ram auto-tie balers that cater to both low-volume and high-production applications.

-

General Kinematics Corporation is a manufacturer of vibrating equipment for bulk materials processing. Its products and services are available to multiple industries, such as foundry & metal casting, mining & minerals, bulk processing, and wood processing.

-

Himes Service Company; Mayfran International and Marathon Equipment are some other participants in the U.S recycling equipment market

-

Marathon Equipment specializes in the manufacturing of onsite compactors and waste balers for recycling. The company operates through three business verticals, namely Compacting Solutions, Recycling Solutions, and Renewable Energy Solutions.

Key U.S. Recycling Equipment Companies:

- American Baler Company

- CP Manufacturing Inc.

- General Kinematics Corporation

- Mayfran

- Spaleck USA LLC

- Himes Service Company

- Revolution Systems

- Marathon Equipment

- Recycling Equipment Manufacturing

- Plexus Recycling Technologies

Recent Developments

-

In July 2023, MSS Inc. (CP Group), a leading manufacturer of optical sorting equipment in the United States, formed a strategic partnership with Recycleye, a British technology company, to introduce innovative technology to the recycling and waste sorting industries in North America. MSS has combined its optical sorting solution with Recycleye's AI technology to create a new offering called MSS Vivid AI, which provides better sorting and recycling solutions.

-

In March 2023, General Kinematics (GK) displayed the Finger-Screen 2.0 metal separation technology at the Institute for Scrap Recycling Industries (ISRI) Convention & Exhibition in Nashville, Tennessee. The Finger-Screen 2.0 is designed to handle difficult materials such as garbage bags, yard waste, and other lightweight, flexible materials, and offers improved energy efficiency, faster travel speed, and higher lift. The unit's longer displacement allows it to effectively manage the elastic range of these materials.

-

In January 2023, Marathon Equipment, a division of Environmental Solutions Group (ESG) and Dover (NYSE: DOV), launched two new initiatives to help waste generators such as retailers, manufacturers, universities, and other institutions achieve cost savings, improve efficacy, and advance their sustainability goals. The "Back of Store" solutions and Marathon Certified Remanufactured (MCR) program are both aimed at providing better waste management solutions to these entities.

U.S. Recycling Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.11 billion

Revenue forecast in 2030

USD 5.29 billion

Growth rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Equipment, processed material

Country scope

U.S.

Key companies profiled

American Baler Company; CP Manufacturing Inc.; General Kinematics Corporation; Mayfran; Spaleck USA LLC; Himes Service Company; Revolution Systems; Marathon Equipment; Recycling Equipment Manufacturing; Plexus Recycling Technologies.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Recycling Equipment Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. recycling equipment market report based on equipment, and processed material:

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Baler Press

-

Shredders

-

Granulators

-

Agglomerators

-

Shears

-

Separators

-

Extruders

-

Others

-

-

Processed Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal

-

Plastic

-

Construction Waste

-

Paper

-

Rubber

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. recycling equipment market size was estimated at USD 3.95 billion in 2023 and is expected to reach USD 4.11 billion in 2024.

b. The U.S. recycling equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 and reach USD 5.29 billion by 2030.

b. Baler press equipment segment dominated and accounted for 24.9% of the U.S. recycling equipment market in 2023. The reason for this growth is the increasing use of baler presses to compress recyclable materials such as paper, cardboard, aluminum, plastic, and non-ferrous metals into dense bundles called bales.

b. Some of the key players operating in the U.S. recycling equipment market include American Baler Company; CP Manufacturing Inc.; General Kinematics Corporation; Mayfran; Spaleck USA LLC; among others.

b. The key factors that are driving the U.S. recycling equipment market include the market growth is expected to be driven by the technological innovations have played a significant role in the growth of Recycling Equipment products and services by enhancing their efficiency and effectiveness, resulting in the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.