- Home

- »

- Advanced Interior Materials

- »

-

U.S. Portable Spot Coolers Market Size & Share Report, 2033GVR Report cover

![U.S. Portable Spot Coolers Market Size, Share & Trends Report]()

U.S. Portable Spot Coolers Market (2025 - 2033) Size, Share & Trends Analysis Report By Capacity (Up To 2 Tons, 2 To 4 Tons, Above 4 Tons), By Application (Commercial, Industrial), And Segment Forecasts

- Report ID: GVR-4-68040-773-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Portable Spot Coolers Market Summary

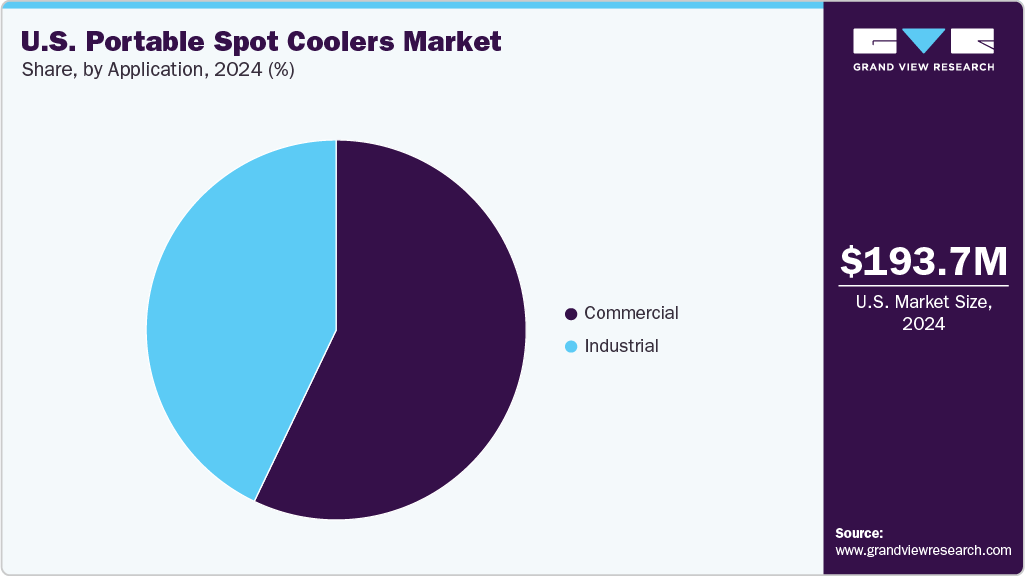

The U.S. portable spot coolers market size was estimated at USD 193.7 million in 2024 and is projected to reach USD 248.2 million by 2033, growing at a CAGR of 2.8% from 2025 to 2033. The market benefits from increasing demand for flexible and efficient cooling solutions in commercial and industrial settings where permanent HVAC systems may be impractical.

Key Market Trends & Insights

- The U.S. portable spot cooler market is projected to grow at a CAGR of 2.8% from 2025 to 2033.

- By capacity, the segment comprising portable spot coolers with a capacity going up to 2 tons is expected to grow at a CAGR of 3.1 % from 2025 to 2033 in terms of revenue.

- By application, the commercial segment is expected to grow at a CAGR of 3.5% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 193.7 Million

- 2033 Projected Market Size: USD 248.2 Million

- CAGR (2025-2033): 2.8%

Their portability and ease of installation allow tenants and businesses to quickly address cooling needs in dynamic or temporary environments. Advancements in cooling technology, including improved energy efficiency and quieter operation, further enhance their appeal. Additionally, growth in construction activity, particularly in commercial real estate, is driving the need for supplemental cooling, supporting the expansion of the U.S. portable spot cooler industry. The country’s regulations promoting energy-efficient equipment also incentivize the adoption of modern portable coolers with lower energy consumption.

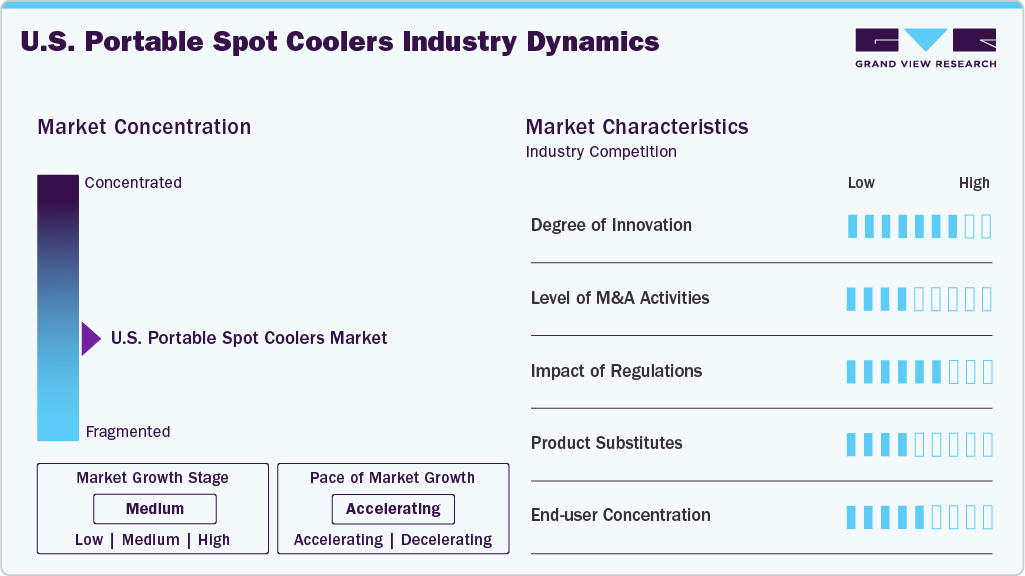

Market Concentration & Characteristics

The U.S. portable spot coolers market exhibits moderate concentration, with key established manufacturers holding significant share alongside several smaller players innovating niche products. Competition is driven by continuous technical innovation, including energy efficiency improvements, smart controls, and low-GWP refrigerant adoption. Increasing mergers and acquisitions among major HVAC companies aim to enhance product portfolios, geographic reach, and technological capabilities. Regulatory standards around energy efficiency and environmental impact heavily influence market dynamics, prompting ongoing product innovation and compliance investments.

Product substitutes such as VRF, split systems, and centralized HVAC offer alternatives, but portable spot coolers retain distinct advantages in flexibility and rapid deployment. The end-user base is diversified, ranging from small businesses to large commercial and industrial enterprises, with growing demand seen in retrofit projects and emerging commercial spaces. Service providers and contractors play a significant role in distribution and maintenance, sustaining customer retention through comprehensive after sales support.

The U.S. portable spot coolers market is characterized by steady innovation, regulatory pressures, and strategic collaborations shaping competitive positioning. Large HVAC manufacturers dominate, yet space for innovative smaller firms remains, especially in emerging product segments within the portable spot cooler market. This dynamic fosters ongoing adaptation to evolving energy, environmental, and operational priorities.

Drivers, Opportunities & Restraints

Rising investments in data centers and warehousing also spur demand for reliable spot cooling solutions that provide precision climate control to prevent equipment overheating. The evolving need for modular and scalable cooling in enterprises facing fluctuating cooling loads favors portable solutions over fixed systems. Furthermore, the growing emphasis on indoor air quality and worker comfort in commercial spaces encourages the use of spot coolers for localized temperature regulation. Government programs promoting energy efficiency upgrades and clean tech adoption indirectly bolster the market for advanced portable spot coolers.

Growing demand for retrofitting energy-inefficient commercial buildings presents significant opportunities for portable spot coolers as cost-effective, flexible cooling upgrades. Increased focus on environmentally friendly refrigerants and lower emissions aligns with the transition to next-generation portable units. Moreover, expansion in emerging commercial sectors, such as co-working spaces, hospitality, and e-commerce warehousing, offers new end-use markets.

The portable spot coolers market faces constraints such as competition from alternative HVAC technologies like variable refrigerant flow (VRF), split systems, and centralized HVAC solutions, which may offer better energy efficiency or scalability for some applications. Supply chain disruptions, particularly for critical components and refrigerants, can limit production and increase costs. Additionally, rising costs of low-GWP refrigerants and challenges related to regulatory compliance may slow adoption. Limited cooling capacity compared to fixed rooftop units can restrict application scope, making portable spot coolers less suitable for very large facilities.

Capacity Insights

The above 4 tons segment dominated the U.S. portable spot cooler industry in 2024, accounting for a revenue share of 50.1%, due to suitability for large commercial and industrial applications requiring substantial heating and cooling capacity. These high-capacity units efficiently manage extensive spaces such as mega malls, hospitals, large office complexes, and industrial plants, providing consistent and powerful climate control. Equipped with advanced technology like multi-stage compressors, variable frequency drives (VFDs), and integrated control systems, these are relatively more popular for their optimal energy efficiency and occupant comfort.

The compact size and ease of installation of portable spot coolers with a capacity up to 2 tons make them popular in commercial and industrial applications where targeted cooling is needed without extensive ductwork. Moreover, rising demand for energy-efficient, cost-effective cooling options drives the adoption of these portable units. They also offer operational convenience and lower upfront costs compared to central HVAC systems, boosting market growth.

Application Insights

The commercial segment dominated the U.S. portable spot cooler market in 2024, with a revenue share of 57.1% and is witnessing significant growth due to expanding commercial infrastructure such as offices, retail spaces, and warehouses requiring robust and reliable cooling solutions. Commercial facilities increasingly prioritize occupant comfort and energy efficiency to comply with regulations and reduce operational costs. The versatility of portable coolers in accommodating varying cooling demands across commercial settings also supports market expansion.

Increasing investments in manufacturing plants, warehouses, and large-scale industrial facilities requiring precise climate control are expected to foster segment growth. These environments demand robust, efficient HVAC solutions to maintain product quality, operational efficiency, and compliance with stringent occupational health and safety standards. Growing industrialization, expansion of data centers, and heightened focus on indoor air quality further support this growth.

Key U.S. Portable Spot Cooler Company Insights

Some of the key players operating in the market include MovingCool and Weltem.

-

MovinCool, a brand under DENSO Corporation, has been involved in the portable spot cooling industry for decades. Leveraging DENSO’s extensive engineering expertise, MovinCool offers a wide range of portable air conditioning solutions for industrial, commercial, and office environments, including models capable of cooling large warehouses, server rooms, and electronics-heavy spaces.

-

Weltem Co., Ltd specializes in portable air conditioners, heat pumps, and dehumidifiers for both residential and commercial applications. With over three decades of experience, the company offers compact and flexible units suitable for small rooms, large commercial spaces, and environments requiring both cooling and dehumidification.

Key U.S. Portable Spot Cooler Companies:

- MovinCool (DENSO Corporation)

- OceanAire Inc

- Weltem

- Koldwave

- ClimaTemp Portables

- WINMORE GROUP

- Shanghai Glomro Industrial Co., Ltd.

Recent Developments

-

Portable spot coolers manufacturers in the U.S. are increasingly adopting strategies focused on energy efficiency and smart technology integration to meet evolving customer demands. Companies are investing in R&D to develop units with lower energy consumption, quieter operation, and compatibility with low-GWP refrigerants to align with environmental regulations and sustainability goals.

-

Recent developments highlight a shift toward modular, high-capacity portable units tailored for industrial and data center applications, where precise temperature control is critical. Regulatory pressures and rising energy costs are prompting innovation in evaporative and hybrid cooling technologies, offering cost-effective alternatives in arid regions.

U.S. Portable Spot Coolers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 199.5 million

Revenue forecast in 2033

USD 248.2 million

Growth rate

CAGR of 2.8% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Capacity, application

Key companies profiled

MovinCool (DENSO Corporation); OceanAire Inc.; Weltem; Koldwave; ClimaTemp Portables; WINMORE GROUP; Shanghai Glomro Industrial Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Portable Spot Coolers Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. portable spot coolers market report based on capacity and application:

-

Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Up to 2 Tons

-

2 to 4 Tons

-

Above 4 Tons

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Healthcare

-

Office

-

Educational Institutes

-

Retails

-

Others

-

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. portable spot cooler market size was estimated at USD 193.7 million in 2024 and is expected to be USD 199.5 million in 2025.

b. The U.S. portable spot cooler market, in terms of revenue, is expected to grow at a compound annual growth rate of 2.8% from 2025 to 2033 to reach USD 248.2 million by 2033.

b. The commercial segment dominated the market in 2024, accounting for a 57.1% share driven by the increasing need for flexible, energy-efficient cooling solutions in dynamic environments such as offices, data centers, and healthcare facilities.

b. The commercial segment dominated the market in 2024, accounting for a 57.1% share driven by the increasing need for flexible, energy-efficient cooling solutions in dynamic environments such as offices, data centers, and healthcare facilities.

b. The U.S. portable spot cooler market is primarily driven by the increasing demand for energy-efficient and flexible cooling solutions in industrial, commercial, and residential applications. Additionally, rising ambient temperatures and the need for temporary or supplemental cooling in spaces like data centers, healthcare facilities, and construction sites further contribute to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.