- Home

- »

- Paints, Coatings & Printing Inks

- »

-

U.S. Pigment Dispersion Market Size & Share Report, 2030GVR Report cover

![U.S. Pigment Dispersion Market Size, Share & Trends Report]()

U.S. Pigment Dispersion Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Organic, Inorganic), By Formulation, By Application (Coatings, Adhesives, Sealants, Elastomers), And Segment Forecasts

- Report ID: GVR-2-68038-372-0

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

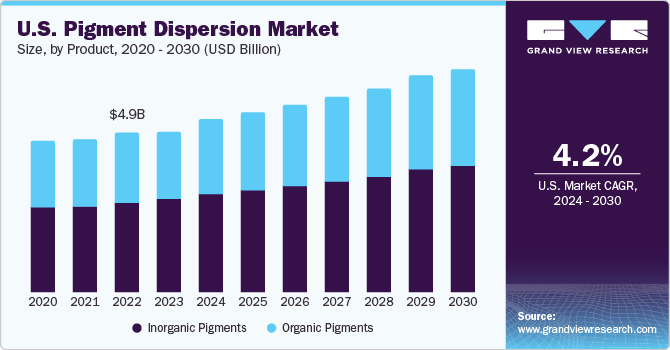

The U.S. pigment dispersion market size was valued at USD 4.94 billion in 2022 and is expected to grow at a compounded annual growth rate (CAGR) of 4.3% from 2023 to 2030. Pigment dispersion is a method used to impart color to various substrates in the automotive, building and construction, and packaging industries. The growth is attributed to the factors such as the growing demand for coatings from various end-use industries such as automotive, electrical & electronics, and medical. Expansion of the paints and coatings industry is expected to present significant growth opportunities for pigment manufacturers. On the downside, raw material unavailability and strict environmental regulations are expected to challenge market growth.

Demand for pigment dispersion is driven by several factors such as the increased use of colored packaging materials for food packaging, consumer preference for thermal barrier coatings in residential construction, and the rising use of automotive coatings to meet the requirements of a continuously expanding automotive sector.

The constantly growing automotive industry in the U.S. is aiding to increase in demand for coatings and paints required for different automotive parts thus, driving the pigment dispersion market. For instance, according to the International Trade Administration, in 2020, the U.S. became the second largest market for automotive production and sales in the world with the production of 5 million vehicles in the same year.

Colors play an important role in influencing the choice of a consumer while purchasing a food product. Brightly packaged food products are more likely to attract the attention of consumers in comparison to food products that come in plain packaging. Colors are also used by food processing manufacturers to differentiate their brands from competitors. They can also play an important role in effectively communicating the benefits offered by a product to consumers. These factors are expected to fuel demand in the expanding fast-food and packaged food industries in the U.S.

Organic pigments are fast emerging as an alternative to some of the more toxic inorganic ones, especially those containing mercury, cadmium, lead, and hexavalent chromium metals. However, organic variants are expensive, and not all exhibit properties superior to those exhibited by inorganic pigments. Manufacturers are investing in research and development activities to replace metals in the formulation to produce environment-friendly yellow and red synthetic pigments. This is sure to benefit the market.

Type Insights

The inorganic pigment segment dominated the market with a revenue share of 55.9% in 2022. This growth is attributed to the fact that, unlike inorganic pigment dispersion, the organic ones fade away when exposed to sunlight. Additionally, inorganic ones are more economical than organic ones and offer easier dispersion properties on different substrates owing to their small particle size as compared to organic ones. Iron Oxide and titanium dioxide are among the commonly used types of inorganic pigment dispersion.

Titanium Dioxide in inorganic pigment dominated the market with a revenue share of 42.4% in 2022. This growth is attributed to the fact that titanium dioxide is derived from minerals such as rutile, ilmenite, and anatase in a small particle size of about 220 nm thus, having a high refractive index and high brightness.

Organic pigments are formed of carbon rings and carbon chains and are transparent due to their large particle size. Based on their properties such as resistance to alkali, sunlight, heat, acid, flooding, and dispersion property, they are mainly used in printing inks, coatings, plastics, rubber, and other applications.

Azo in organic pigments dominated the market with a revenue share of 65.6% in 2022. This growth is attributed to the fact that they have good lightfastness and excellent coloring properties mainly in the red, orange, and yellow range.

Formulation Insights

The solvent-based segment dominated the market with a revenue share of 63.8% in 2022. The growth is attributed to the fact that solvent-based formulations have several functional properties such as fast drying and high print quality thus, majorly used in the automotive and printing industries.

Water-based formulation is another segment expected to witness growth over the forecast period. This growth is attributed to the fact that they are used as a substitute for dyes in applications that require thermal stability and opacity. These are designed to be opaquer than dyes; some of these pigments are transparent and designed for custom applications. Some of the key applications include construction lumber coatings, architectural coatings, latex products, and general industrial applications.

Application Insights

The coatings segment dominated the market with a revenue share of 77.5% in 2022. This growth is attributed to the growing building & construction spending in the U.S. driving the demand for coatings and paints. For instance, in March 2020, the U.S. government announced an investment amounting to USD 2 trillion for the development of infrastructure as a part of the coronavirus response including roads, hospital buildings, and other infrastructure.

Pigments are used in various plastics, paper, and paperboard materials as well as inks based on their application in food packaging. Varied colors play a major role in making the packaged product attractive. Pigments that impart an attractive color and suit a wide array of materials have been witnessing greater demand and growth. Pigment dispersion in inks is slated to witness the highest growth in terms of both revenue and volume.

Various plastics such as polyurethane, polypropylene, and polystyrene are used for the packaging of foods such as tortillas and breakfast cereals, which require longer shelf life. Plastics require pigments that can offer higher heat resistance, greater opacity, and improved dispersibility properties.

Key Companies & Market Share Insights

The U.S. pigment dispersion market is highly fragmented with the presence of a large number of well-diversified small-scale and large-scale players. The major players engage in mergers & acquisitions, product development, strategic partnerships, and joint ventures to strengthen their market position. For example, BASF SE, a major player in 2019 announced its partnership with Landa Labs for introducing its 2nd stir-in pigment eXpand! Blue used for outdoor and automotive coatings under the name Colors & Effect brand. Some prominent players in the U.S. pigment dispersion market include:

-

DIC CORPORATION

-

AArbor Colorants Corporation

-

CLARIANT

-

American Elements

-

DECORATIVE COLOR & CHEMICAL, INC.

-

Heubach GmbH

-

Organic Dyes and Pigments

-

Ferro Corporation

-

Flint Group

-

REITECH CORPORATION

U.S. Pigment Dispersion Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 6.90 billion

Growth rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, formulation, application

Key companies profiled

DIC CORPORATION; AArbor Colorants Corporation; CLARIANT; American Elements; DECORATIVE COLOR & CHEMICAL, INC.; Heubach GmbH; Organic Dyes and Pigments; Ferro Corporation; Flint Group; REITECH CORPORATION

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pigment Dispersion Market Report Segmentation

This report forecasts volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pigment dispersion market report based on type, formulation, and application:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Inorganic Pigments

-

Calcium Carbonate

-

Titanium Dioxide

-

Iron Oxide

-

Carbon & Vegetable Black

-

Ultramarine Blue

-

Chrome Green

-

-

Organic Pigments

-

Azo Pigments

-

Polycyclic Pigments

-

Others

-

-

-

Formulation Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Water-based Formulation

-

Solvent-based Formulation

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Coatings

-

Adhesives

-

Sealants

-

Elastomers

-

Frequently Asked Questions About This Report

b. The U.S. pigment dispersion market size was estimated at USD 4.94 billion in 2022 and is expected to reach USD 5.16 billion in 2023.

b. The U.S. pigment dispersion market is expected to grow at a compound annual growth rate of 4.3 % from 2023 to 2030 to reach USD 6.90 billion by 2030.

b. Inorganic type dominated the U.S. pigment dispersion market with a share of 55.9% in 2022. This is attributable to rising demand from food packaging materials such as plastic, paper, and paperboard.

b. Some key players operating in the U.S. pigment dispersion market include BASF Corporation; Clariant AG; RPM International, Inc.; and Akzo Nobel N.V.

b. Key factors that are driving the market growth include U.S. pigment dispersions application to impart color to various substrates in automotive, building and construction, and packaging industries, and its application in paints and coatings industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.