- Home

- »

- Medical Devices

- »

-

U.S. Pen Needles Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Pen Needles Market Size, Share & Trends Report]()

U.S. Pen Needles Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Standard & Safety Pen Needles), By Needle Length (4mm, 5mm, 10mm, 12mm), By Therapy (Insulin, Glucagon-like-Peptide-1), And Segment Forecasts

- Report ID: GVR-4-68040-232-0

- Number of Report Pages: 95

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pen Needles Market Size & Trends

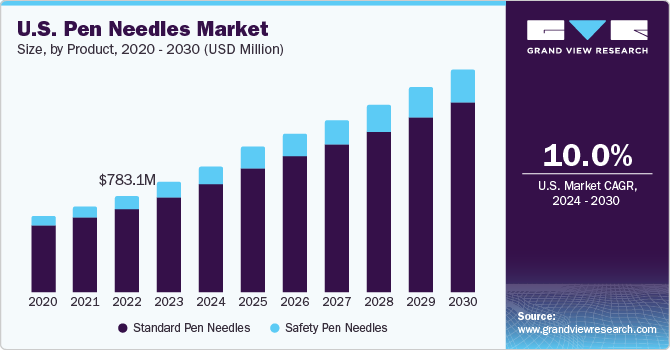

The U.S. pen needles market size was estimated at USD 888.2 million in 2023 and is expected to grow at a CAGR of 10.0% from 2024 to 2030. The rising prevalence of chronic diseases, advancement in needle technology, awareness and adoption of injector pens, and the rise in consumer awareness, patient comfort, and accessibility collectively contribute to the growth of the market. Furthermore, the escalating incidence of diabetes is driving an increased need for pen needles. The International Diabetes Federation (IDF) projects that by 2040, the number of people with diabetes will reach 642 million. Given the expanding diabetic population, the target market is anticipated to experience significant growth during the projected period.

The U.S. accounted for over 24.9% of the global pen needles market in 2023. The rise in chronic diseases, especially diabetes, necessitates the frequent and accurate administration of medications, thereby increasing the demand for pen needles. Pen injectors are frequently utilized by individuals with diabetes to administer insulin or other medications. People with obesity are particularly prone to diabetes, and insulin pens provide a convenient and rapid method for drug injection. The demand for pen needles is increasing in line with the growing need for insulin pens among diabetic patients. These devices, when used with insulin pens, assist in accurately delivering the drug dosage to the patient.

Innovations in needle technology, such as ultra-thin and painless needles, are enhancing convenience and accessibility, further driving the market. Moreover, growing awareness and adoption of injector pens for self-administration of medications are also boosting the demand. These pens offer benefits like ease of use, accurate dosing, and reduced risk of needlestick injuries. A focus on patient comfort and accessibility in healthcare has led to the development of innovative pen needle designs that improve the patient experience by reducing injection pain, thereby propelling market growth. In addition, continuous research and development have resulted in technological advancements like non-needle injection systems and needle-free microneedle arrays. These innovations promise to further reduce injection pain and enhance patient comfort, contributing to market expansion.

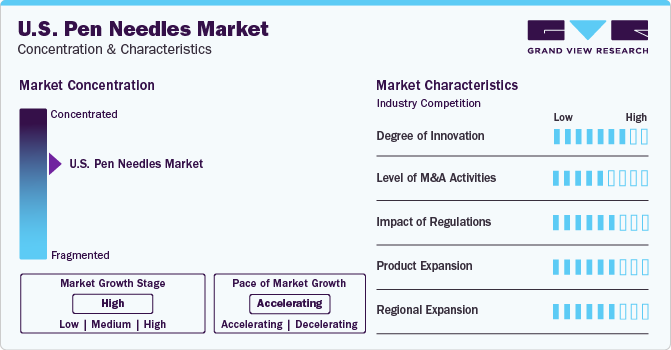

Market Concentration & Characteristics

The industry is highly concentrated and competitive. Key players are engaged in new product development through the introduction of improved technology, regional expansion, and mergers & acquisitions to target the unmet need for diabetic patients. Companies such as Novo Nordisk is focusing on expanding the GLP-1 industry, additionally traditional syringe-vial combinations for growth hormone therapy are being replaced by user-friendly injection pens, such as Omnitrope, especially for children with growth hormone deficiency. Companies are developing less painful pen needles to increase the product adoption.

The growth of the industry is expected to be propelled by innovation in various products. Companies are concentrating on developing new products, particularly in terms of needle length. For instance, in 2021, BD (Becton, Dickinson and Company) launched the BD Nano Ultra-Fine pen needle, which features a 4 mm needle length, enhancing patient comfort and ensuring reliable insulin delivery. Compared to traditional syringes and vials, insulin pens paired with needles are seen as a superior method for drug delivery. Conventional syringes are bulky and pose challenges in self-administration. In contrast, pen needles have fine tips that easily penetrate the patient’s muscle, facilitating safe insulin delivery among diabetic patients.

Leading participants in the industry are concentrating on strategies such as mergers, acquisitions, collaborations, and partnerships to boost their production capacities and introduce innovative products. These tactics are crucial for businesses to set themselves apart, broaden their industry footprint, and cater to the changing demands of consumers. Furthermore, partnerships and collaborations allow companies to capitalize on each other’s strengths, pool resources, and penetrate new industries more efficiently. For instance, in 2023, Novo Nordisk proposed a deal to take over Biocorp. This partnership was initiated in 2021, with the integration of Biocorp’s Mallya technology into Novo’s prefilled insulin pens. Furthermore, Novo Nordisk purchased all the remaining shares of Emisphere for a sum of USD 1.350 billion, and successfully concluded the acquisitions of Forma and Dicerna.

Safety measures and adherence to regulations is followed strictly in the industry. There is a growing trend among manufacturers to integrate safety mechanisms into pen needles to reduce hazards such as needlestick injuries. The evolution of regulatory guidelines to guarantee the safety and effectiveness of these devices is shaping industry trends and product development. For instance, the industry is influenced by the Section 510(k) premarket notification regulation. This rule mandates manufacturers to inform the FDA about their plan to sell a medical device 90 days prior. The device must be shown to be “substantially equivalent” to a legally sold device not needing premarket approval (PMA). Devices meeting this criterion are approved for marketing. This regulation, ensuring device safety and efficacy, impacts industry trends and product development.

Broadening the range of products enables businesses to address a variety of requirements, boost their competitive edge, and fulfill the growing demand. This demand is influenced by factors such as the escalating occurrence of diabetes, heightened awareness about the condition, and increased healthcare investments. Progress in insulin delivery systems is a major product expansion method taken by key players. The insulin needles industry is experiencing growth due to continuous improvements, such as the integration of safety features like auto-retracting needles and automatic injection mechanisms in pen needles. The goal of these technological advancements is to improve the safety and user experience during the administration of medication. For instance, in May 2022, Roche diabetic care launched Pen needles with ACCU-FINE technology for painless insulin administration.

With the rise in self-administration and focus on home healthcare, growth of industry in the developing regions is increasing at a rapid rate. There is a significant increase in the demand for pen needles in developing regional industries such as Asia-Pacific. This is due to heightened awareness of technological progress and increased healthcare spending. This trend indicates the expansion of business opportunities in these regions. For instance, Becton, Dickinson and Company’s (BD’s) financial results for the first quarter of fiscal 2024 indicated a robust increase in their China industry, primarily fueled by the sales of biopsy needles and filters, along with the ongoing worldwide adoption of Rotarex. This successful quarter underscores BD’s dedication to broaden its operations in the Asia-Pacific area, with a special emphasis on industries such as China.

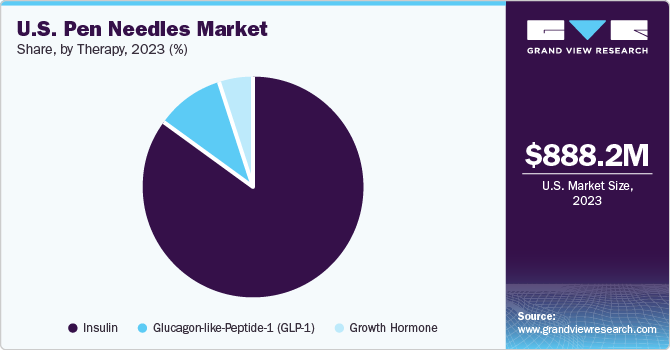

Therapy Insights

Insulin dominated the market with the highest revenue market share in 2023 of 84.7% and is also expected to grow at the fastest CAGR over the forecast period. Therapies are increasingly being shifted to home settings due to the rise of home healthcare and self-administration, leading to a surge in demand for insulin pen needles. These needles provide a convenient and less intrusive method for insulin injection. The growing prevalence of biosimilar drugs necessitates the need for compatible insulin pen needles, thereby driving market growth. Favourable reimbursement scenarios are fuelling the demand for this therapy. Moreover, awareness of self-administered insulin therapy growing among diabetes patients is also expected to boost the segment’s growth.

Glucagon-like-Peptide-1 (GLP-1) is expected to witness lucrative growth during the forecast period. This growth is primarily driven by the rising inclination towards GLP-1 therapies, increasing patient demand, the efficacy of GLP-1 receptor agonists in diabetes management, market trends that prioritize patient comfort, and ongoing technological enhancements in pen needle design specifically for GLP-1 medications. These elements collectively contribute to the rise of the GLP-1 segment in the market, indicating a significant increase in the demand for pen needles that are compatible with GLP-1-based therapies. The FDA has approved Lilly’s MounjaroTM, the first GIP and GLP-1 receptor agonist for type 2 diabetes management. GLP-1 therapy, which reduces blood glucose levels, is expected to grow significantly.

Product Insights

Standard pen needles dominated the market with the largest revenue share in 2023. This was largely due to the rise in frequent use of standard pen needles by diabetic patients who require larger doses. These needles are commonly used by individuals with dexterity issues. However, they are not the preferred choice due to the significant risk of needlestick injuries, which compromises their safe use. As a result, their demand is expected to decrease in the future. The growth of this segment is supported by the increasing diabetic population and the heightened awareness about the use of insulin pens. According to recent data, 37.3 million Americans or 11.3% of U.S. population are affected with diabetes.

Safety pen needles are expected to grow at the fastest CAGR of 11.8% during the forecast period due. This growth is attributed to ongoing technological advancements in this area. Safety pen needles (SPNs) help reduce the occurrence of needlestick injuries among patients and are currently viewed as the better mode of medication. For example, the National Library of Medicine reports that most needlestick injuries (NSIs) are due to defective needles. Safety pen needles are equipped with a built-in sharps injury prevention function (SIPF) that aids in preventing such injuries before, during, and after use.

Needle Length Insights

5mm dominated the market and accounted for the largest revenue market share of over 20.0% in 2023. Pen needles with a length of 5mm offer numerous benefits to patients. These needles, which are shorter and thinner, are appropriate for most people, making insulin administration more comfortable and straightforward. They are especially beneficial for those who have difficulty with hand strength, as these needles ensure the effective delivery of the full insulin dose. Moreover, these shorter 5mm needles facilitate the delivery of insulin just beneath the skin, eliminating the need for skin pinching during injections and reducing the risk of muscle tissue injections. Research has demonstrated that even in obese patients, needles shorter than 8mm are just as effective while reducing the chance of intramuscular injections.

4mm is anticipated to witness the fastest CAGR during the forecast period owing to its short length. Patients are progressively opting for the shortest and thinnest needles due to the enhanced comfort they provide compared to traditional injections. These needles, with their short length, can effortlessly access the patient’s subcutaneous tissue. Recent research indicates that these short-length needles are equally effective as the longer ones. For individuals with trypanophobia, these needles are a simple solution. Utilizing needles that are 4mm or smaller can mitigate the side effects of intramuscular injections and prevent inconsistent dosages, thus fulling the growth of this segment.

Key U.S. Pen Needles Company Insights

Leading companies in the U.S. pen needles market are employing various strategic measures such as partnerships, expansion of products and services, mergers and acquisitions, and R&D investments to gain a competitive edge through advanced applications. The market is dominated by key players like Novo Nordisk A/S, Becton, Dickinson and Company, TERUMO CORPORATION, Owen Mumford Ltd., Ypsomed, B. Braun Melsungen AG, HTL-STREFA, UltiMed, Inc., Allison Medical, Inc., and Artsana S.p.a. These major firms are undertaking initiatives like mergers and acquisitions, new product developments, and geographical expansions to meet the growing patient needs. For instance, in February 2023, Montmed Inc. announced the issuance of a second U.S. patent for the Sitesmart Pen Needles.

Key U.S. Pen Needles Companies:

- Novo Nordisk A/S

- Becton

- Dickinson and Company

- Terumo Corp.

- Owen Mumford Ltd.

- Ypsomed

- B. Braun Melsungen AG

- HTL-STREFA

- UltiMed, Inc.

- Allison Medical, Inc.

- Artsana S.p.A.

Recent Developments

-

In September 2022, Terumo India, a subsidiary of Terumo Corporation, has publicized the introduction of FineGlide, a Sterile Pen Needle. This product is intended for patients who need to administer insulin injections or other self-medication regularly.

-

In May 2022, Novo Nordisk A/S discontinued the production of NovoTwist 32G 5 mm needles. However, Novo Nordisk provides a variety of other needle choices, such as the NovoFine Plus, which is their smallest and slimmest needle, engineered to enhance the comfort of injections.

-

In February 2021, UltiMed Inc. announced their release of Ulticare safety pens that comes in two sizes, 5mm 30G and 8mm 30G. This technology hides the needle both before and after its use, aiding in the prevention of unintentional needle stick injuries. This innovation was made for safer injection and better customer experience.

U.S. Pen Needles Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.0 billion

Revenue forecast in 2030

USD 1.8 billion

Growth rate

CAGR of 10.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, needle length, therapy

Country scope

U.S.

Key companies profiled

Novo Nordisk A/S; Becton; Dickinson and Company; Terumo Corp.; Owen Mumford Ltd.; Ypsomed; B. Braun Melsungen AG; HTL-STREFA; UltiMed, Inc.; Allison Medical, Inc.; Artsana S.p.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pen Needles Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pen needles market report based on product, needle length, and therapy:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard Pen Needles

-

Safety Pen Needles

-

-

Needle Length Outlook (Revenue, USD Million, 2018 - 2030)

-

4 mm

-

5 mm

-

6 mm

-

8 mm

-

10 mm

-

12 mm

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Insulin

-

Glucagon-like-Peptide-1 (GLP-1)

-

Growth Hormone

-

Frequently Asked Questions About This Report

b. The U.S. pen needles market size was estimated at USD 888.2 million in 2023 and is expected to reach USD 1.0 billion in 2024.

b. The U.S. pen needles market is expected to grow at a compound annual growth rate of 10.00% from 2024 to 2030 to reach USD 1.8 billion by 2030.

b. Based on product, the standard pen needles segment dominated the U.S. pen needles market with a share of 86.6% in 2023 as a result of increasing preference and demand for standard pen needles among patients.

b. Some key players operating in the pen needles market include Novo Nordisk A/S, Becton, Dickinson and Company, TERUMO CORPORATION, Owen Mumford Ltd., Ypsomed, B. Braun Melsungen AG, HTL-STREFA, UltiMed, Inc., Allison Medical, Inc., and Artsana S.p.a.

b. Key factors that are driving the pen needles market growth include the growing prevalence of diabetes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.