- Home

- »

- Medical Devices

- »

-

U.S. Ostomy Care And Accessories Market, Industry Report, 2030GVR Report cover

![U.S. Ostomy Care And Accessories Market Size, Share & Trends Report]()

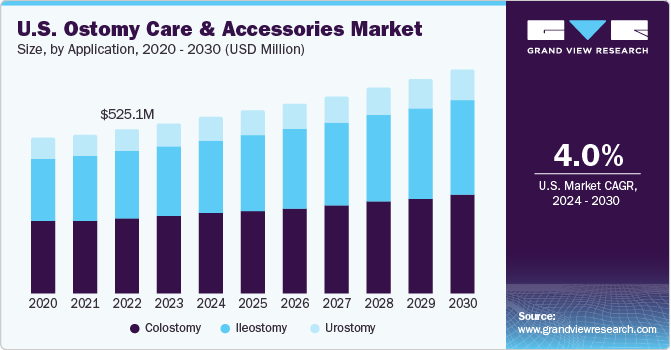

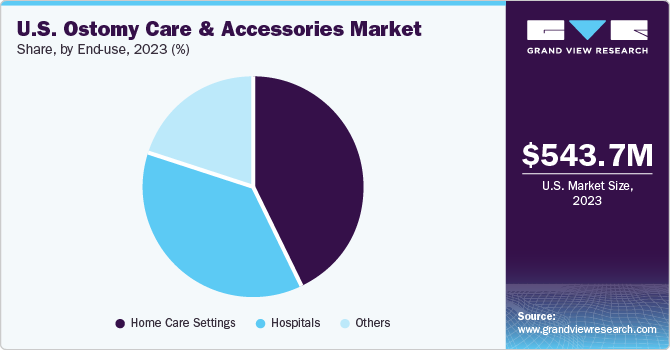

U.S. Ostomy Care And Accessories Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Bags, Accessories), By Application (Colostomy, Ileostomy, Urostomy), By End-use (Home Care Settings, Hospitals), And Segment Forecasts

- Report ID: GVR-4-68040-225-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The U.S. ostomy care and accessories market size was valued at USD 543.68 million in 2023 and is expected to grow at a CAGR of 4.0% from 2024 to 2030. The ostomy care and accessories market is driven by several factors, such as increasing initiatives to raise ostomy awareness, technological advancements, increasing prevalence of bladder cancer, rise in geriatric population, & increasing risk of colorectal cancer.

U.S. market for incontinence and ostomy care products is primarily driven by the increasing prevalence of diverticular disease and colorectal cancer. In addition, the growing development in the medical devices market is expected to contribute to market growth. According to Johns Hopkins University, around 200,000 procedures for Benign Prostatic Hyperplasia (BPH) are conducted in the U.S. annually. Hence, the increasing number of BPH-related surgical procedures and rising cases of bladder cancer are expected to boost market growth. The U.S. ostomy care and accessories market accounted for 15% of the global nerve repair and regeneration market in 2023.

A rising number of initiatives being undertaken by various private companies and nonprofit organizations to raise awareness regarding ostomy care and incontinence care are anticipated to drive the demand for incontinence and ostomy care products. United Ostomy Associations of America (UOAA), a nonprofit organization in the U.S., works to support individuals with ostomies. They offer educational resources and support groups to increase awareness about ostomy care & the quality of life. Several organizations conduct activities to raise awareness, such as educational programs, and support meetings, and run an electronic information network.

Market Characteristics & Concentration

The increasing healthcare expenditure by governments and private organizations is also contributing to the ostomy care and accessories industry growth. Key strategic initiatives include the development of new products, mergers & acquisitions (M&A), partnerships, collaborations, and geographic expansion.

The competitors are either adding more features to their existing products or launching new product lines to gain a larger market share. Coloplast Group; ConvaTec, Inc.; and Hollister are some of the key companies investing significantly in R&D to launch new products. For instance, in June 2022, Hollister Incorporated announced signing a new contract for Hollister ostomy care products and the renewal of a contract for its portfolio of continence care products.

Although new players are entering the market, but chances of them being acquired by major companies are considerably high. Companies are undertaking initiatives such as M&A and collaborations to expand their market presence. For instance, in June 2022, Premier, Inc. and Hollister Incorporated signed a contract through which Premier members will have access to the whole line of Hollister Ostomy products, including its ceramide-infused CeraPlus skin barriers, designed to shield the skin from dryness and preserve the peristomal skin health.

Ostomy care products and accessories are typically classified as medical devices by the FDA. Most products fall under the FDA's 510(k) clearance process, which requires demonstrating substantial equivalence to a legally marketed predicate device. Some higher-risk products may require Premarket Approval (PMA) through a more rigorous evaluation process. However, various initiatives undertaken by governments and nonprofit organizations, such as the United Ostomy Associations of America, are anticipated to drive the market growth over the forecast period.

Product Insights

The bags segment held the largest market share of 90.19 % in 2023 owing to its wide applications. Ostomy bags are prosthetic medical devices used to collect stool or urine. These pouches are air- and watertight, which allows users to continue leading a normal lifestyle. They are most commonly used with urostomies, ileostomies, & colostomies. Factors such as flexible adhesive and neutral gray textile material that suits the body type of individuals are expected to impact the segment’s growth positively.

The accessories segment is expected to grow at the highest CAGR during the forecast period. It includes adhesive remover, barrier film spray, paste, belt, rings, elastic tape, powder, and others that help prevent odor, leakage, and skin rashes. Accessories also includes customized solutions for specific needs or body shapes. Hence, it is projected to witness a high growth in the upcoming years.

Application Insights

The colostomy segment held the largest market share of 46.04 % in 2023 owing to the growing geriatric population and rising cases of colorectal cancer. Colorectal cancer often requires surgical procedures such as colostomy on the affected portion of rectum or colon. Furthermore, availability of drainable or closed system bags suitable for specific individual needs has significantly contributed to market growth.

The ileostomy segment is expected to grow at the highest CAGR during the forecast period. Growing prevalence of Inflammatory Bowel Diseases (IBDs), such as Crohn’s disease and ulcerative colitis, is expected to drive demand for one-piece ileostomy bags. Individuals with IBD experience high output, and changes in bowel habits, and liquid stools require a leak-proof secure seal around the stoma. These factors are expected to boost market growth.

End-use Insights

The home care segment held the largest market share of 43.30 % in 2023 owing to the rising demand for home healthcare. Homecare settings ensure ongoing ostomy care by trained nurses which offers the right patient care, significantly reduces ostomy-related risks and complications, and decreases emergency hospital visits. Patient-centric care offered by home healthcare is also expected to drive the market over the forecast period.

The hospital segment is expected to register a considerable CAGR during the forecast period. The Segment growth can be attributed to the increasing government spending on developing smart hospitals. As per NCBI, patients aged 70 years & above undergo permanent ostomy procedures more often than younger people, with extended hospital stays and higher mortality, which is anticipated to drive growth in the upcoming years.

Key U.S. Ostomy Care And Accessories Company Insights

Some of the prominent U.S. ostomy care and accessories companies operating in the market include Hollister Incorporated, ConvaTec Group Plc, Coloplast Corp, and B. Braun Melsungen AG. These companies have a strong presence and offer a wide range of ostomy care products & accessories.

Several initiatives are being undertaken by various nonprofit organizations and private companies to raise awareness regarding ostomy care. Coloplast is one of the leading companies that has undertaken several projects globally to create awareness about ostomy and develop & promote ostomy care guidelines. Key companies are developing innovative technologies for reducing skin infections. The development of hydrocolloids and innovative systems for minimizing the risk of skin irritation is expected to change the market dynamics.

Key U.S. Ostomy Care And Accessories Companies:

- Coloplast

- ConvaTec Inc.

- Hollister Incorporated

- Marlen Manufacturing & Development Company

- Perma-Type Company, Inc.

- Nu-Hope Laboratories, Inc.

- Perfect Choice Medical Technologies

- Fortis Medical Products

- Safe n' Simple

- AdvaCare Pharma

- Schena Ostomy Technologies, Inc.

- Cymed

- Eakin

- Alcare

- Others

Recent Developments

-

In February 2024, Convatec announced the launch of Esteem Body with Leak Defense. It is a soft yet water-repellent ’flocking’ material, that covers both sides of the pouch and hides content through its warm grey colors

-

In February 2024, Coloplast launched the Peristeen Light for people with bowel disorders. It is a hand-held device that instills water into rectum, thereby evacuating the stool from lower bowel.

-

In January 2022, Owens & Minor Inc. announced the acquisition of HME provider Apria Inc. as it would help the company expand its presence in-home healthcare as well the entire care continuum for patients

U.S. Ostomy Care And Accessories Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 563.56 million

Revenue forecast in 2030

USD 715.68 million

Growth rate

CAGR of 4.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Country scope

U.S.

Key companies profiled

Coloplast, ConvaTec Inc., Hollister Incorporated, Marlen Manufacturing & Development Company, Perma-Type Company, Inc., Nu-Hope Laboratories, Inc., Perfect Choice Medical Technologies, Fortis Medical Products, Safe n' Simple, AdvaCare Pharma, Schena Ostomy Technologies, Inc., Cymed, Eakin, Alcare, Others

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ostomy Care And Accessories Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. ostomy care and accessories market report on the basis of product, application, and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bags

-

One Piece

-

Two Piece

-

-

Accessories

-

Seals/Barrier Rings

-

Pouch Cover

-

Pouch Closures

-

Stoma Caps/Hat

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Colostomy

-

Ileostomy

-

Urostomy

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Care Settings

-

Hospitals

-

Others

-

Frequently Asked Questions About This Report

b. Some prominent players in the U.S. ostomy care and accessories market include Coloplast, ConvaTec Inc., Hollister Incorporated, Marlen Manufacturing & Development Company, Perma-Type Company, Inc., Nu-Hope Laboratories, Inc., Perfect Choice Medical Technologies, Fortis Medical Products, Safe n' Simple, AdvaCare Pharma, Schena Ostomy Technologies, Inc., Cymed, Eakin, Alcare, Others.

b. The demand for ostomy care and accessories is anticipated to upsurge owing to an increase in the number of patients suffering from urological diseases and ostomy surgeries.

b. The U.S. ostomy care and accessories market size was estimated at USD 543.68 million in 2023 and is expected to reach USD 563.56 million in 2024.

b. The U.S. ostomy care and accessories market is expected to grow at a compound annual growth rate of 4.0% from 2024 to 2030 to reach USD 715.68 million by 2030.

b. The bags segment held the largest market share of 90.19 % in 2023 owing to wide applications. Ostomy bags are prosthetic medical devices used to collect stool or urine. These pouches are air- and watertight, which allows users to continue leading a normal lifestyle. They are most commonly used with urostomies, ileostomies, & colostomies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.