Market Size & Trends

The U.S. mobile virtual network operator market size was valued at USD 27.96 billion in 2023 and is projected to grow at a CAGR of 7.5% from 2024 to 2030. A substantial increase in adopting 5G technology in the country, competitive pricing by MVNOs, and strategic partnerships between MVNOs and MNOs are key growth drivers for market expansion. Mobile Virtual Network Operators (MVNOs) do not possess or manage their cellular network infrastructure; instead, they acquire network capacity from established Mobile Network Operators (MNOs) at a reduced rate. Mobile virtual network operators in the U.S. offer competitive pricing plans for budget-conscious consumers. It has raised a large segment's demand for affordable plans, propelling market growth.

The increasing demand for data-centric mobile plans has created an excellent opportunity for MVNOs to offer flexible data packages at reasonable rates. The U.S. mobile subscription market has matured due to the country's high mobile penetration. It challenges traditional MNOs to acquire new consumers in a saturated market. MVNOs, with their targeted marketing strategies and niche service packages, are addressing the underserved segments in the existing market. Moreover, by offering a unique bundled service package, MVNOs are catering to the requirements of consumers seeking value-added services, which is a major driver for the widespread adoption of their services.

Improvements in virtualization technology have made it viable and cost-effective for mobile virtual network operators (MVNOs) to expand their operations. For instance, cloud-based solutions enable them to leverage existing MNO infrastructure without substantial investments. Furthermore, collaborative efforts between MNOs and MVNOs through spectrum-sharing agreements have led to optimized network utilization and improved network capacity for MVNO subscribers. These factors and a rise in the popularity of technologies such as the Internet of Things (IoT) and machine-to-machine (M2M) communication ensure promising growth prospects.

Type Insights

The discount segment led the market, accounting for a revenue share of 24.2% in 2023. MVNOs strategically offer discounted plans to price-conscious consumers, attracting them to choose affordable alternatives. Moreover, many discounted plans are prepaid, giving users greater control over their spending. This emphasis on value for money and customized offerings by combining call and data plans caters to the requirements of individual consumers, driving segment growth.

The machine-to-machine (M2M) segment is expected to register the fastest CAGR of 8.1% over the forecast period. It is owing to the exponential growth in adoption of connected devices nationwide. For instance, several devices are connected via IoT technology, collecting and transmitting data over the internet and creating a vast network of M2M communication. Additionally, the rising adoption of industrial automation, smart city networks, and automation in logistics and transport have created a fertile ground for the exponential growth of this segment in the U.S.

Operational Model Insights

The full MVNO segment accounted for the highest market revenue share in 2023. Compared to other types of MVNOs, full MVNOs possess greater control over their service offerings. It enables them to provide a wider range of services, custom billing, and better customer service, thus ensuring enhanced user experience. Furthermore, full MVNOs invest more in technology and infrastructure, which enhances their ability to innovate and provide high-quality and reliable services. This technological edge provides them with a competitive advantage and helps meet evolving customer demands in the country.

The service operator MVNO segment is expected to showcase the fastest growth rate from 2024 to 2030. Service operators have differentiated themselves by offering additional services such as international calling packages, roaming options, bundled entertainment subscriptions, and loyalty programs. This strategy has helped them to attract a growing segment of users seeking comprehensive mobile solutions at a competitive price. Additionally, their approach to targeting niche customer segments with tailored service bundles has ensured the development of a loyal customer base, aiding in service expansion.

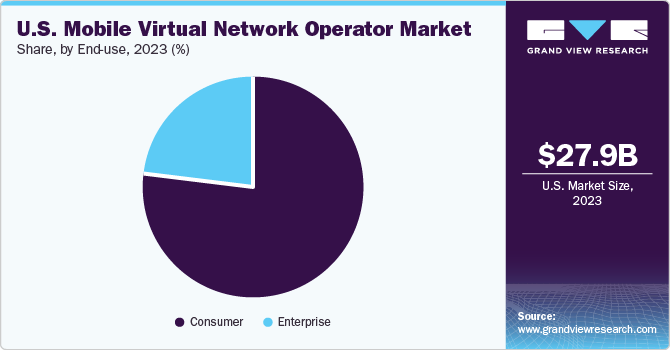

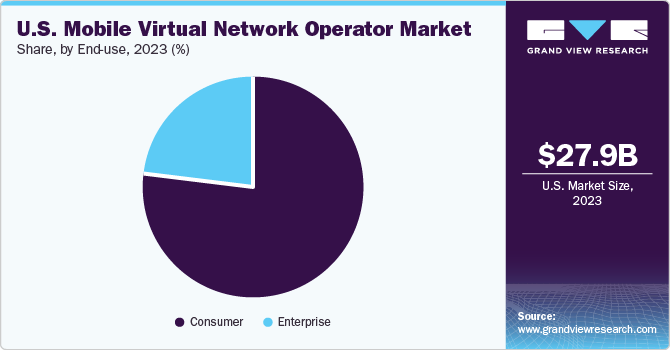

End-use Insights

The consumer segment held the largest revenue share in 2023. This segment encompasses a broad range of individual mobile phone users. MVNOs offer a wider variety of service packages such as basic value plans, data-centric packages, and family bundles to customers compared to their enterprise offerings. Mobile Virtual Network Operators (MVNOs) leverage innovative marketing strategies to attract and shift consumers from traditional MNOs. By employing targeted advertising, social media outreach, and customer feedback mechanisms, MVNOs enhance brand visibility and foster strong customer relationships, which are pivotal factors in sustaining their market leadership.

The enterprise segment is anticipated to register the fastest CAGR during the forecast period. It is attributed to a growing demand for customized and scalable communication solutions within businesses, driving enterprises to adopt MVNO services tailored to their specific requirements. Furthermore, rapid advancements in mobile technology, such as the deployment of 5G networks, have enabled mobile virtual network operators to offer innovative and high-performance solutions that support enterprises' growing data and connectivity requirements. These factors have fueled the adoption of MVNO services in the enterprise segment.

Key U.S. Mobile Virtual Network Operator Company Insights

Some key companies involved in the U.S. Mobile Virtual Network Operator (MVNO) market include AT&T, FreedomPop, and Verizon, among others.

-

AT&T is an American multinational telecommunication service provider. The company offers satellite television, optical fiber, mobile telephones, fixed-line telephones, and internet services. AT&T provides various data plans for prepaid customers; these tailored plans cater to customers' data use behavior, offering them internet services at a competitive rate, starting at USD 25 per month.

-

FreedomPop is a mobile virtual network operator (MVNO) and wireless service provider in the U.S. The company offers IP mobile services, broadband devices, and mobile phones. It provides unlimited 5G data plans starting at USD 10 per month. To serve America's rising population of senior citizens, FreedomPop partnered with veteran basketball player Julius Erving in March 2024 to be a brand ambassador for the company. Through this initiative, the company aims to attract senior consumers to its affordable plan offerings.

Key U.S. Mobile Virtual Network Operator Companies:

- DataXoom

- Verizon

- AT&T

- Cricket Wireless LLC

- Virgin Plus

- TRACFONE

- Comcast Corporation

- DISH Network L.L.C.

- FreedomPop

- Red Pocket Mobile

Recent Developments

-

In July 2024, Mediacom Communications launched its new mobile phone service, Mediacom Mobile, in partnership with Verizon. The service has been designed for pairing with the Mediacom Xtream Internet service, with the company planning to offer a high-speed and reliable internet service with affordable residential data plans.

-

In May 2024, Breezeline, a cable and internet service provider in the U.S., announced the launch of its mobile phone service in locations across several states in the country, including Pennsylvania, Connecticut, Ohio, Virginia, and New Hampshire, among others. The launch has been made via the company’s collaboration with the National Content & Technology Cooperative (NCTC) and their MVNO deal with AT&T.

U.S. Mobile Virtual Network Operator Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 30.0 billion

|

|

Revenue forecast in 2030

|

USD 46.31 billion

|

|

Growth rate

|

CAGR of 7.5% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2024 to 2030

|

|

Report Coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments Covered

|

Type, operational model, end-use

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

DataXoom; Verizon; AT&T; Cricket Wireless LLC; Virgin Plus; TRACFONE; Comcast Corporation; DISH Network L.L.C.; FreedomPop; Red Pocket Mobile

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Mobile Virtual Network Operator Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. mobile virtual network operator market report based on type, operational model, and end-use.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Business

-

Discount

-

M2M

-

Media

-

Migrant

-

Retail

-

Roaming

-

Telecom

-

Operational Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Full MVNO

-

Reseller MVNO

-

Service Operator MVNO

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)