- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Molded Pulp Packaging Market, Industry Report, 2030GVR Report cover

![U.S. Molded Pulp Packaging Market Size, Share & Trends Report]()

U.S. Molded Pulp Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Wood Pulp, Non-wood Pulp), By Molded Type (Thermoformed, Transfer), By Product, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-324-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Molded Pulp Packaging Market Trends

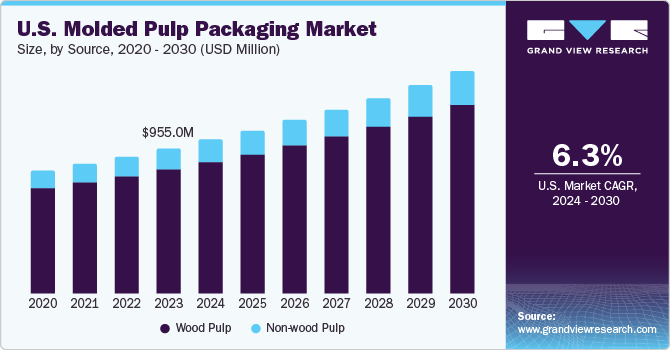

The U.S. molded pulp packaging market size was estimated at USD 995.0 million in 2023 and is projected to grow at a CAGR of 6.3% from 2024 to 2030. This growth can be attributed to the increasing consumer demand for sustainable packaging solutions, stringent government regulations regarding plastic use, and the versatility of molded pulp packaging in various industries. In addition, advancements in manufacturing technologies and the development of high-quality, cost-effective products are further propelling the market growth.

The U.S. molded pulp packaging market accounted for a share of 18.3% of the global molded pulp packaging market revenue in 2023. Regulations significantly impact the market, driving innovation and ensuring sustainability. Key regulations include the U.S. Food and Drug Administration (FDA) guidelines, which stipulate that materials used in food packaging must be safe for contact with food. In addition, the Federal Trade Commission's (FTC) Green Guides require accurate environmental marketing claims, influencing companies to adopt eco-friendly practices in molded pulp packaging. State-level regulations also play a crucial role, such as California's SB 1335, which mandates the use of recyclable or compostable packaging in state facilities. These regulations encourage using molded pulp packaging as an environmentally preferable alternative to plastic, promoting advancements in sustainable packaging solutions and pushing manufacturers to meet stringent safety and environmental standards.

Source Insights

The wood pulp segment held a share of 85.3% in 2023. This dominance can be attributed to the abundant availability of wood pulp and its cost-effectiveness. Wood pulp is a renewable resource, and its use aligns with the growing consumer demand for sustainable packaging solutions. Additionally, wood pulp offers excellent molding and shock-absorbing properties, making it an ideal material for protective packaging in various industries, including electronics, food & beverage, and healthcare. The widespread adoption of wood pulp is a testament to its versatility and effectiveness as a packaging material.

The non-wood pulp segment is expected to grow at a CAGR of 6.8% from 2024 to 2030. These materials are rapidly renewable and often considered waste products, making their use in packaging both environmentally friendly and cost-effective. The growing interest in non-wood pulp can be attributed to these advantages and ongoing innovations in non-wood pulp processing and molding technologies. As these technologies continue to advance, the use of non-wood pulp in molded packaging is expected to increase significantly.

Molded Type Insights

The transfer molded pulp packaging segment held a share of 56.6% in 2023. This preference stems from its ability to deliver a high-quality finished surface on both sides. While possessing a slightly reduced thickness compared to thick molded packaging, transfer molded pulp offers a compelling balance of flexibility and rigidity. It is primarily used in the food industry for packing fruits, vegetables, eggs, and beverages. The advantages of air permeability and hygroscopic properties result in the extended shelf life of transported food and beverage products. Additionally, this packaging offers superior impact resistance, minimizing the risk of product damage during transport. Expanding retail chains in developing countries that prefer sophisticated packaging are expected to strongly impact segment growth.

The thermoformed segment is predicted to witness the fastest revenue growth at a CAGR of 7.6% from 2024 to 2030. Thermoformed molded pulp packaging, also known as thin wall molded pulp packaging, is gaining traction due to its manufacturing process that involves heated molds pressing the pulp for a smoother finish and better dimensions. This type of packaging is commonly used in the food service industry for trays, bowls, cups, and plates. Thermoformed molded pulp packaging offers a compelling alternative to traditional plastic options due to its superior rigidity, smooth finish, and full recyclability. This shift aligns with growing environmental concerns surrounding the challenges associated with single-use plastics.

Product Insights

The trays segment held the largest revenue share in 2023. Trays are mainly employed in the food and food service sectors due to the high convenience they offer. Within the food sector, molded pulp trays serve as a dominant form of primary packaging for eggs throughout retail channels. The demand for molded pulp trays is expected to grow year-on-year owing to several drawbacks of plastic trays. Molded pulp trays are microwave-compatible and can be used in microwave and conventional ovens. However, the evolution and development of bioplastics have been posing a challenge for molded pulp trays due to the exceptional benefits offered by bioplastic trays, as these trays are microwavable and biodegradable.

The clamshells segment is predicted to expand at a CAGR of 7.4% from 2024 to 2030. This growth is driven by the high demand for retail egg packaging. The plastic clamshell packaging market has experienced a decline in recent years, mainly due to the growing adoption of molded pulp-based clamshells, which offer superior convenience for consumers in terms of portability and disposal. Despite plastic clamshells offering high moisture barrier properties, regulatory restrictions on single-use plastics hamper market growth for plastic clamshells. In addition, the use of clamshell packaging for fresh produce and the rising adoption of environmentally friendly packaging for fruits and vegetables is expected to boost market growth. Furthermore, the increasing consumption of food away from home and the prevalence of take-out from restaurants will likely expand the application of clamshells in food packaging and food service sectors over the forecast period.

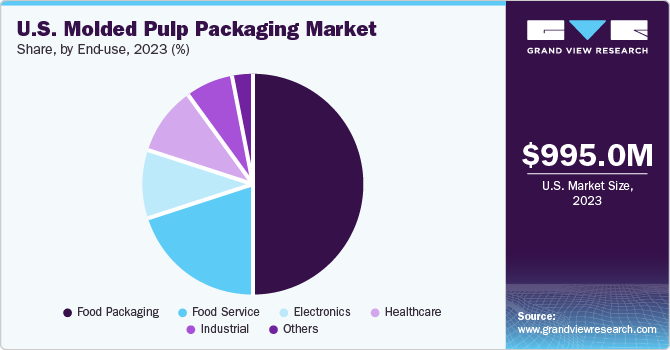

End-use Insights

The food packaging segment held around 50.0% of the revenue share in 2023. This can be attributed to the extensive use of molded pulp packaging products like trays and clamshells in the food industry, particularly for egg packaging. These products are favored due to their cushioning and low price. Besides, molded pulp trays provide extended freshness to the eggs due to the ventilation they offer. It has been observed that the breakage of eggs has been drastically reduced due to the adoption of molded pulp packaging in recent years. Fruits and vegetables, including apples, oranges, strawberries, and tomatoes, are packed in molded pulp products for exports and imports. Molded pulp products help regulate fruit respiration and maintain ethylene density, the hormone responsible for fruit ripening. Furthermore, the increasing diet-conscious population has been driving fruit consumption worldwide, which, in turn, is expected to bolster fruit exports and imports between countries, thus requiring molded pulp packaging.

The electronics segment is predicted to witness the fastest revenue growth of CAGR of 7.8% from 2024 to 2030. Molded pulp packaging, including trays, clamshells, and end caps, is extensively employed in the electronics industry to package delicate devices. The electronics industry is characterized by frequent product launches owing to technological advancements, which are anticipated to drive demand. Molded pulp packaging products offer an alternative to those manufactured using expanded polystyrene (EPS). EPS is not easy to recycle, and if not recycled properly, it can have a negative impact on the environment. Thus, many electronic product manufacturers and consumers demand sustainable packaging solutions, which is expected to benefit market growth over the forecast period further.

Key U.S. Molded Pulp Packaging Company Insights

Some of the key players operating in the market include Smurfit, Sonoco, Huhtamaki, and Western Pulp Products Company:

-

Sonoco Products Company is known for its cost-effective, durable, and aesthetically pleasing molded pulp packaging solutions, which are widely used in consumer goods and packaging applications

-

Smurfit Kappa, an Irish packaging giant, is another key player in the U.S. market. The company is a renowned provider of paper packaging solutions, manufacturing, distributing, and marketing a variety of paper-based packaging products, including molded pulp packaging

Key U.S. Molded Pulp Packaging Companies:

- Sonoco Products Company

- Smurfit Kappa

- Western Pulp Products Company

- Huhtamaki Group

- DS Smith

- Hartmann

- Novolex

- Omni-Pac Group

- Pulp-Tec Limited

- Eco-Products, Inc.

Recent Developments

-

In June 2024, Knoll Packaging developed a sustainable clamshell container for Infiniment Coty Paris' new fragrances, utilizing 100% Knoll Ecoform molded pulp

-

In November 2023, Huhtamaki expanded its sustainable packaging offerings in the U.S. by introducing molded pulp egg cartons crafted entirely from recycled materials. Production for these eco-friendly cartons is underway at Huhtamaki's Hammond, Indiana facility

-

In October 2023, Suzano Ventures invested USD 5 million in Bioform Technologies. This strategic investment aims to validate Bioform's technology for high-speed, cost-competitive production of bio-based plastic alternatives through modifications to existing pulp and paper industry processes

U.S. Molded Pulp Packaging Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.5 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, trends

Segments covered

Source, product, molded type, end-use

Key companies profiled

Sonoco Products Company; Smurfit Kapp; Western Pulp Products Company; Huhtamaki Group; DS Smith; Hartmann; Novolex; Omni-Pac Group; Pulp-Tec Ltd.; Eco-Products, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Molded Pulp Packaging Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. molded pulp packaging market report based onsource, molded type, product, and end-use:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Wood Pulp

-

Non-wood Pulp

-

-

Molded Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thick Wall

-

Transfer

-

Thermoformed

-

Processed

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Trays

-

End Caps

-

Bowls & Cups

-

Clamshells

-

Plates

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food Packaging

-

Food Service

-

Electronics

-

Healthcare

-

Industrial

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. molded pulp packaging market was estimated at USD 995.0 million in 2023.

b. The U.S. molded pulp packaging market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030, reaching USD 1.5 billion by 2030.

b. The wood pulp segment held a share of 85.3% in 2023. This dominance can be attributed to the abundant availability of wood pulp and its cost-effectiveness. Wood pulp is a renewable resource, and its use aligns with the growing consumer demand for sustainable packaging solutions.

b. Some of the key players operating in the market include Smurfit, Sonoco, Huhtamaki, and Western Pulp Products Company.

b. The U.S. molded pulp packaging market is growing rapidly, driven by the demand for sustainable packaging solutions, stringent government regulations regarding plastic use, and the versatility of molded pulp packaging in various industries. In addition, advancements in manufacturing technologies and the development of high-quality, cost-effective products are further propelling the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.