- Home

- »

- Biotechnology

- »

-

U.S. MicroRNA Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. MicroRNA Market Size, Share & Trends Report]()

U.S. MicroRNA Market (2024 - 2030) Size, Share & Trends Analysis Report By Products & Services, By Application (Cancer, Infectious Diseases), By End-use (Biotechnology & Pharmaceutical Companies), And Segment Forecasts

- Report ID: GVR-4-68040-284-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. MicroRNA Market Size & Trends

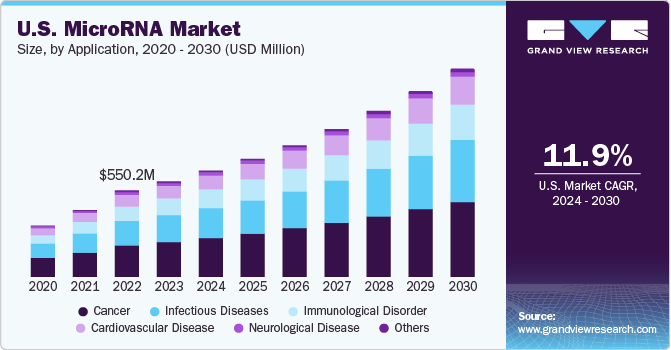

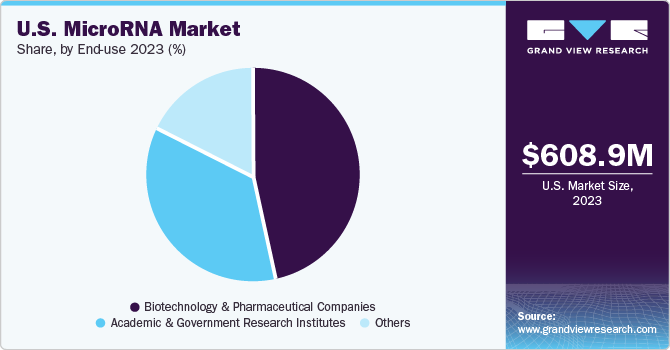

The U.S. microRNA market size was valued at USD 608.9 million in 2023 and is anticipated to grow at a CAGR of 11.86% from 2024 to 2030. The potential factors contributing to this growth include the high success rate of miRNA in clinical studies, recent developments in miRNA applications, and technological advances in nucleic acid studies. Moreover, increasing funding and healthcare investments in R&D activities to create novel therapeutics are expected to boost market growth over the forecast period.

The U.S. microRNA market accounted for a 42% share of the global microRNA market. Technological advancements such as high throughput screening, including NGS platforms, have enabled the discovery of new potential uses for miRNAs. Currently, miRNAs are being explored for diagnostic and therapeutic purposes, as well as for identifying targets in complex biological conditions, particularly cancer. Their significant promise as biomarkers in molecular diagnostics has boosted the creation of products tailored for microarray profiling of miRNAs and their functional assessment. Such advanced trends lead to growth opportunities for miRNA.

The biopharmaceutical sector is pivotal with a notable rise in research and development (R&D) spending. Numerous biopharmaceutical companies are actively engaged in advancing RNA-based therapeutics, particularly focusing on microRNAs (miRNAs) and small interfering RNAs (siRNAs). These companies are exploring the potential of miRNAs and siRNAs in developing innovative therapies for various diseases, showcasing a growing interest and investment in RNA-based treatments within the biopharmaceutical field.

Rapidly decreasing genome sequencing costs are a key driver in reshaping clinical genetics, transforming the identification and management of rare disorders, and opening doors for personalized medicine. This evolution promises tailored treatments and enhanced results for numerous patients grappling with uncommon genetic conditions. Furthermore, the rapid advancements in nucleic acid-based technology over the past decade have significantly expanded the capabilities of molecular information for advanced applications in detection and diagnosis. Key technologies like PCR, microarrays, and high-throughput sequencing have played crucial roles in driving progress in the microRNA market.

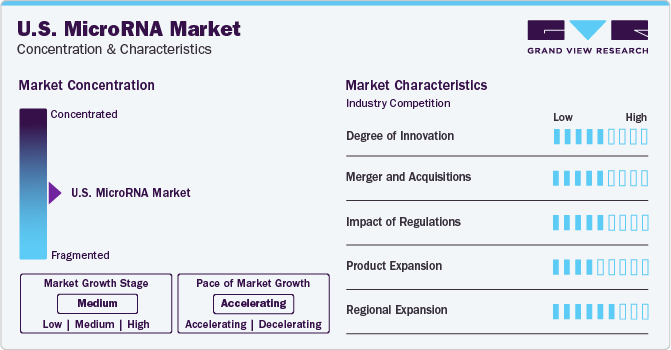

Market Concentration & Characteristics

The U.S. microRNA (miRNA) industry is characterized by high competition due to the presence of numerous biotechnology companies competing to leverage novel growth opportunities within the industry. These companies are actively striving to capitalize on the potential of miRNA-based products and therapies, leading to a competitive landscape where innovation, strategic partnerships, and advancements in technology play crucial roles in driving market growth and development.

Innovation is a fundamental driver of growth and development in the U.S. MicroRNA industry. Multiple research institutions are actively engaged in pioneering oligonucleotide therapeutics, contributing significantly to the industry's innovative landscape. For instance, in September 2023, Purdue University researchers developed a groundbreaking microRNA (miRNA) therapy that effectively inhibits tumor growth by simultaneously targeting multiple genes, showcasing the potential to surpass existing single-gene targeted treatments.

The regulatory framework for microRNA (miRNA) products in the U.S. is mainly overseen by the Food and Drug Administration (FDA), ensuring the safety and efficacy of medical products, including diagnostic tools and therapeutics. miRNA-based diagnostic tests are under the jurisdiction of FDA's Center for Devices and Radiological Health (CDRH).

The strategic approach of larger companies acquiring smaller ones serves as a strategic method to strengthen their industry positions, enhance capabilities, broaden product portfolios, and elevate competencies. This enables companies to expand and diversify their offerings, and leverage collaborations for growth and competitiveness. For instance, in October 2023, Thermo Fisher Scientific announced to invest $3.1 billion to acquire Olink Holding AB, aiming to broaden its life sciences portfolio and enhance capabilities in drug discovery.

Companies in the U.S. MicroRNA industry frequently employ a strategic approach focused on enhancing their production capabilities, expanding the market reach of their products, and improving accessibility across various geographic locations. This strategic initiative aims to bolster their market presence and competitiveness by leveraging a broader market reach and enhanced production capabilities. For instance, in August, 2023 Scale Biosciences announced the expansion of its commercial reach by introducing innovative single-cell methylation and single-cell RNA sequencing solutions, marking a significant advancement in the field of single-cell analysis and genomics.

Product & Services Insights

Services segment dominated the market with a share of 58% in 2023. This growth can be attributed to the increasing number of studies and clinical applications of microRNAs as potential biomarkers. The miRNA biomarkers further spur the need for miRNA functional studies, detection, and purification & profiling services thereby boosting the segment’s growth. Moreover, various companies offer miRNA isolation & purification kits and services to support various ongoing research.Companies such as Creative Biogene and System Biosciences, LLC offer miRNA cDNA synthesis services tailored for small-scale laboratories and research centers involved in microRNA studies. These rising efforts of key companies to provide microRNA-based services are expected to drive segment growth.

The product segment is expected to boost significantly from 2024 to 2030. The role of microRNA in regulating gene expression and substantial investments in genomics research have driven the rapid development of a robust product line in the market. Companies are actively developing new products to enhance market growth. Thermo Fisher Scientific, Agilent Technologies Inc., and QIAGEN N.V. leading the market with innovative products and services in the miRNA market and are projected to expand segment growth over the forecast period.

End-use Insights

Biotechnology & Pharmaceutical Companies segment accounted for 47% of revenue share in 2023 and is expected to grow at the fastest CAGR over the forecast period. Increasing preference of these companies for the development of miRNA-based therapies driving the segments’s growth. For instance, in July 2023, miRecule and Sanofi collaborated to develop innovative approaches in rare diseases, particularly advancing a novel RNA therapeutic for patients with the Facioscapulohumeral muscular dystrophy (FSHD). This partnership leverages miRecule's DREAmiR discovery platform, which analyzes genomic patient data to identify disease-causing genetic abnormalities, in combination with Sanofi's Nanobody technology.

Other segment is projected to expand at a significant CAGR from 2024 to 2030. The use of miRNAs in hospitals and clinics has emerged as a significant option, particularly in disease diagnosis, prognosis, and treatment monitoring. These miRNAs are pivotal in distinguishing between different cancer types, thereby improving the precision of treatment.

Application Insights

Cancer segment held the largest share of 37% in 2023. The segment’s growth is driven by the high investments in cancer research, particularly in adopting miRNA-based approaches. Increasing, clinical trials for miRNA-based therapies and diagnostic tests for distinguishing cancer subtypes and stages contributing to segments’ growth. The introduction of miRNA diagnostics into clinics has significantly advanced precision medicine in cancer treatment which is likely to fuel market growth.

The infectious diseases segment is anticipated to witness growth at the fastest CAGR from 2024 to 2030. Increasing preference for miRNA-based therapies to treat infectious diseases driving the segment's growth. miRNAs play a crucial role in modulating the host's response to infections by regulating proteins involved in both adaptive and innate immune responses. Such trends of miRNA in infectious diseases are further expected to boost market revenue.

Key U.S. MicroRNA Company Insights

Market growth is fueled by a range of factors, including the demand for improved DNA & RNA facilities, capacity enhancement, product diversification, and skill reinforcement. Additionally, innovation levels, M&A activities, regulatory influences, and expansion strategies are instrumental in meeting the market's unmet needs.

Key U.S. MicroRNA Companies:

- Thermo Fisher Scientific, Inc

- NanoString Technologies, Inc

- BioGenex

- GeneCopoeia, Inc.

- New England Biolabs

- Precision Nanosystems

- Cytiva

- PerkinElmer, Inc.

- Illumina, Inc.

- AptamiR Therapeutics

- Synlogic

Recent Developments

-

In March 2024, Exothera announced an expansion to accelerate RNA therapies in its presence into North America, aiming to enhance the accessibility and efficiency of nucleic acids services for the development and delivery of life-changing therapies.

-

In November 2023, Selecta Biosciences, Inc. merged with Cartesian Therapeutics, Inc., a clinical-stage biotechnology company specializing in RNA cell therapies for autoimmune diseases. This strategic merger aims to create a fully integrated advancing RNA cell therapy for the treatment of autoimmune diseases, with Cartesian's pipeline in patients with myasthenia gravis

U.S. MicroRNA Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.34 billion

Growth rate

CAGR of 11.86% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, applications, end-use

Country scope

U.S.

Key companies profiled

Thermo Fisher Scientific, Inc; NanoString Technologies, Inc; BioGenex; GeneCopoeia, Inc.; New England Biolabs; Precision Nanosystems; Cytiva; PerkinElmer, Inc.; Illumina, Inc.; AptamiR Therapeutics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. MicroRNA Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S.MicroRNA market report based on products & services, applications, and end-use:

-

Products & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Services

-

Type

-

Isolation & Purification

-

miRNA cDNA Synthesis

-

Profiling, Localization, & Quantification

-

Functional Analysis

-

Others

-

-

Specimen

-

Whole Blood

-

Serum

-

Plasma

-

FFPE

-

Fresh Frozen Tissue

-

Others

-

-

-

Products

-

Instruments

-

Technology

-

Real-Time PCR

-

Microarray

-

NGS

-

Others

-

-

Workflow

-

Isolation & Purification

-

miRNA cDNA Synthesis

-

Profiling, Localization, & Quantification

-

Functional Analysis & Others

-

Others

-

-

-

Consumables

-

Specimens

-

Whole Blood

-

Serum

-

Plasma

-

FFPE

-

Fresh Frozen Tissue

-

Others

-

-

Workflow

-

Isolation & Purification

-

miRNA cDNA Synthesis

-

Profiling, Localization, & Quantification

-

Functional Analysis

-

Others

-

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Infectious Diseases

-

Immunological Disorder

-

Cardiovascular Disease

-

Neurological Disease

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology & Pharmaceutical Companies

-

Academic & Government Research Institutes

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. microRNA market size was estimated at USD 608.98 million in 2023 and is expected to reach USD 677.85 million in 2024.

b. The U.S. microRNA market is expected to witness a compound annual growth rate of 11.86% from 2024 to 2030 to reach USD 1.34 billion in 2030.

b. The cancer segment accounted for the largest revenue share in 2023. The highest revenue share is due to high investments in cancer research adopting miRNA signatures.

b. The key players competing in the U.S. miRNA market include Thermo Fisher Scientific, Inc.; QIAGEN; Horizon Discovery Group plc; NanoString Technologies, Inc.; Merck KGaA; Takara Bio, Inc; LGC Limited; BioGenex; GeneCopoeia, Inc; New England Biolabs

b. The increasing prevalence of diseases such as cancer, cardiovascular diseases, and neurological disorders across the globe, as well as growing advancements in genomic technologies, are the prime factors that drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.