- Home

- »

- Medical Devices

- »

-

U.S. Medical Device Outsourcing Market Size Report, 2030GVR Report cover

![U.S. Medical Device Outsourcing Market Size, Share & Trends Report]()

U.S. Medical Device Outsourcing Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Quality Assurance, Contract Manufacturing), By Application (Cardiology, Diagnostic Imaging, IVD), By Class (Class I, Class II, Class III), By Country, And Segment Forecasts

- Report ID: 978-1-68038-600-4

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

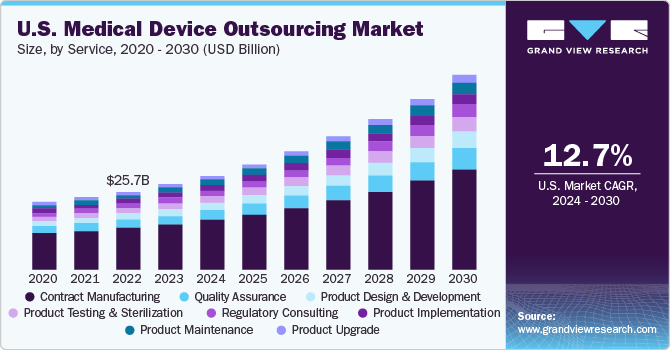

The U.S. medical device outsourcing market size was valued at USD 30.96 billion in 2024 and is expected to grow at a CAGR of 13.0% over the forecast period. Market growth is primarily driven by regulatory pressures, cost optimization needs, and technological advancements. Stringent FDA regulations and changing quality standards, such as ISO 13485 and EU MDR compliance for global market access, encourage OEMs to partner with outsourcing providers specializing in regulatory support, testing, and manufacturing. Rising R&D costs and pricing pressures from value-based healthcare models are accelerating outsourcing trends, aiding OEMs to reduce capital expenditures and enhance operational efficiency.

In addition, the increasing complexity of medical devices, particularly in minimally invasive surgery, diagnostics, and wearable health technologies, drives demand for contract development and manufacturing organizations (CDMOs) with expertise in precision engineering, advanced materials, and digital health integration. Furthermore, the growing prevalence of chronic diseases, aging demographics, and rapid adoption of AI-driven and IoT-enabled medical devices are expanding outsourcing opportunities across design, prototyping, and post-market services.

Regulatory approval procedures are becoming more stringent and time-consuming, and market players aim to receive product approvals at the first attempt to gain higher market share. Medical device companies have to manage continuous changes in regulatory requirements, which span different business activities. Noncompliance with changing regulatory requirements may result in penalties and delays, which may lead to revenue loss. Product expansion by medical device companies aimed at speedy approvals in the U.S. is expected to further contribute to an increase in the adoption of outsourcing models for regulatory affairs services.

The U.S. medical device outsourcing industry is developing due to stricter FDA regulations, which require manufacturers to seek specialized compliance support. In February 2024, the U.S. FDA completed the transition from the Quality System Regulation (QSR) to ISO 13485 alignment to highlight risk management and quality assurance, increasing demand for regulatory consulting services. Additionally, the Medical Device Single Audit Program (MDSAP) has become essential for market access, driving outsourcing in regulatory submissions and quality audits.

The medical device industry is encountering strong headwinds, as sharp reductions in public spending in the U.S. create significant challenges for manufacturers. Increasing prices, profitability pressure, and growing competition coupled with a high degree of industry maturity have a great impact on the medical device outsourcing market. Medical device manufacturers face pricing pressures from healthcare providers, insurers, and group purchasing organizations (GPOs), forcing OEMs to seek cost-efficient outsourcing solutions. In addition, the expansion of value-based care models and reimbursement cuts by CMS and private payers has increased the push for leaner supply chains and lower production costs.

Outsourcing allows manufacturers to reduce operational expenses by utilizing low-cost production hubs, automation, and contract manufacturing efficiencies. With the average cost of bringing a Class III medical device to market exceeding $100 million, companies are increasingly partnering with CDMOs for R&D, regulatory support, and scale manufacturing. Rising raw material costs, labor expenses, and inflationary pressures have further accelerated outsourcing demand, particularly for precision manufacturing, assembly, and testing services. In the IVD and diagnostic imaging sectors, outsourcing enabled OEMs to mitigate cost fluctuations while maintaining compliance with stringent FDA regulations. Additionally, the adoption of AI-driven automation and additive manufacturing by outsourcing firms contributed to reducing lead times and production costs.

Market Opportunities

The U.S. medical device outsourcing industry presents significant opportunities for medical device OEMs, outsourcing service providers, and consulting firms. This market is driven by the increasing complexity of regulatory compliance, cost pressures, and the need for accelerated time to market. The following key opportunities highlight areas driving future market growth.

The evolving regulatory landscape, including FDA guidelines and EU MDR compliance for U.S. exports, will drive demand for specialized regulatory consulting services. Outsourcing firms providing regulatory expertise will experience growth as medical device companies seek assistance with clinical trials, quality assurance, and market approvals to accelerate product launches.

The increasing demand for minimally invasive surgical instruments, wearable medical devices such as remote monitoring, and digital health devices is creating opportunities for specialized outsourcing service providers. Outsourcing firms with expertise in precision engineering, miniaturization, and software integration will witness increased demand, contributing to technological advancements in medical devices.

The growing adoption of IoT-enabled and AI-driven medical devices, such as smart implants and remote patient monitoring, is increasing the need for software development and cybersecurity outsourcing.

The increasing complexity of medical devices is stimulating OEMs to form long-term strategic alliances with outsourcing providers for end-to-end services, including R&D, design, and manufacturing. This shift will consolidate the market, with larger outsourcing firms gaining competitive advantages, leading to improved supply chain efficiency and faster time-to-market for novel devices.

The rising emphasis on product safety and efficacy is increasing the need for outsourced analytical testing, biocompatibility testing, and failure analysis. Thus, the expansion of accredited testing laboratories and partnerships with OEMs will drive innovation in materials testing and compliance with evolving regulatory standards.

Rising concerns over supply chain disruptions and geopolitical uncertainties are prompting medical device companies to outsource manufacturing and services nearshore or domestically. U.S.-based contract manufacturers and service providers will benefit from OEMs' focus on localized, reliable partners, boosting the domestic outsourcing market.

The adoption of 3D printing for personalized medical devices, prosthetics, and implants is driving demand for specialized outsourcing providers

Technology Landscape

The market is rapidly transforming due to evolving regulatory requirements, cost pressures, and the need for faster time to market. OEMs increasingly rely on outsourcing partners to utilize innovative technologies, enhance manufacturing efficiency, and ensure regulatory compliance. Key players, including CMOs and Engineering Service Providers (ESPs), invest in advanced manufacturing, digital technologies, and automation to offer end-to-end solutions.

Additive manufacturing (3D printing) transforms prototyping and production by enabling complex, patient-specific designs, reducing material waste and time-to-market. This shift enhances the competitiveness of outsourcing providers specializing in rapid manufacturing. Meanwhile, artificial intelligence (AI) and machine learning (ML) are optimizing product design, predictive testing, and quality control, significantly lowering costs and improving regulatory compliance. AI-powered algorithms allow contract manufacturers to streamline processes, minimizing product failures and expediting FDA approvals.

The growing trend of miniaturization and microfabrication is increasing the demand for outsourcing firms skilled in precision engineering, particularly in developing minimally invasive devices and smart implants. As smart and connected medical devices become mainstream, the Internet of Medical Things (IoMT) transforms patient care with real-time monitoring and remote diagnostics. However, this trend also increases cybersecurity risks, requiring outsourcing partners to enhance data security and compliance capabilities.

Additionally, automated and robotic-assisted manufacturing improves production efficiency and consistency, reduces human errors, and enables high-volume production while maintaining stringent quality standards. This shift is particularly critical for contract manufacturers aiming to meet OEM demands for scalability and cost efficiency. Advanced biomaterials and bioresorbable polymers are further developing implantable devices and drug delivery systems, requiring outsourcing firms to invest in material science expertise to maintain a competitive edge.

Furthermore, cloud-based regulatory compliance and quality management system (QMS) solutions are simplifying compliance with stringent FDA and ISO standards. Outsourcing partners integrating automation into regulatory tracking and documentation to reduce compliance risks for OEMs while enhancing seamless market entry. These advancements are collectively driving the expansion of medical device outsourcing, making it a significant enabler of innovation and efficiency in the U.S. healthcare sector.

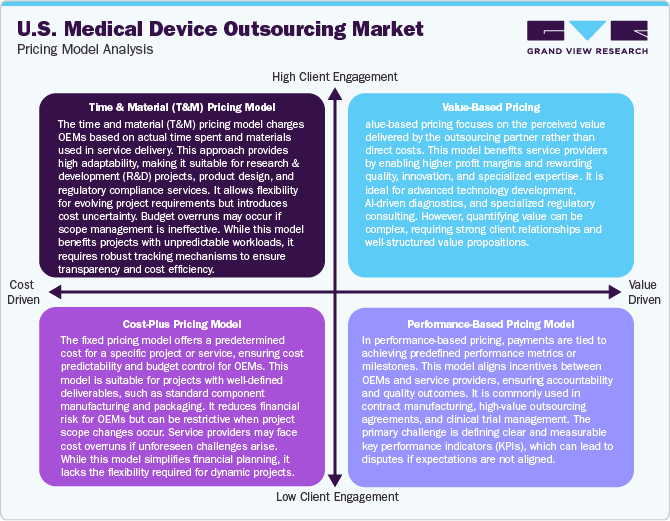

Pricing Model Analysis

The U.S. medical device outsourcing industry is driven by cost containment pressures, stringent regulatory compliance, and increasing complexity in device development. OEMs utilize outsourcing for cost efficiency, faster time-to-market, and access to specialized expertise. Service providers, including contract manufacturers and engineering firms, employ various pricing models to cater to diverse client needs.

Pricing models in this industry depend on the type of service, such as contract manufacturing, regulatory consulting, testing & validation, packaging & logistics, and factors such as project complexity, volume, and duration. The fixed price model is commonly used for standardized services such as packaging and sterilization, offering cost predictability but potentially inflating prices to cover unforeseen risks. The Time & Material (T&M) Model is preferred for R&D, engineering, and prototyping projects where flexibility is required, though it can lead to budget overruns if project timelines are extended. Meanwhile, the Cost-Plus Model is widely adopted in long-term contract manufacturing, enhancing transparency but sometimes lacking incentives for cost optimization.

Moreover, milestone-based and outcome-based pricing are gaining traction in regulatory consulting and high-risk projects. Milestone-based pricing aligns payments with project progress, reducing financial strain on OEMs but requiring well-defined deliverables. Outcome-based pricing, where compensation is tied to performance metrics like defect rates or regulatory approvals, is emerging as a risk-sharing strategy but poses challenges in defining success criteria.

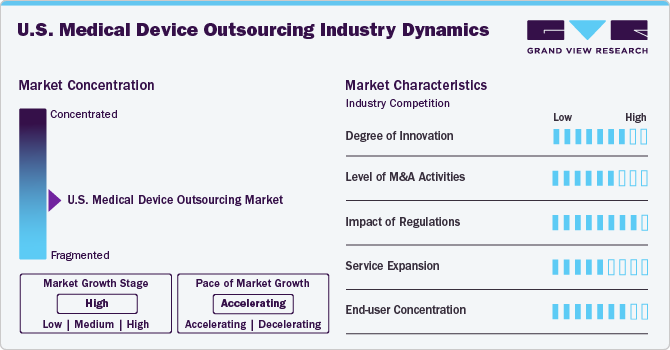

Market Concentration & Characteristics

The market witnessed moderate innovation. The market is driven by continuous innovation in manufacturing, AI integration, and digital health technologies. Contract service providers invest in advanced R&D capabilities to support OEMs in rapid product development. Innovations in materials and miniaturization further enhance outsourcing demand.

Mergers and acquisitions are reshaping the competitive landscape as companies seek to expand service offerings and geographic reach. Larger outsourcing firms acquire specialized players to strengthen regulatory expertise and technology portfolios, fostering consolidation and increasing market efficiency.

Stringent FDA regulations and evolving global compliance standards significantly driving outsourcing demand in the U.S. As service providers constantly upgrade quality systems to comply with changing regulatory frameworks. Regulatory complexity encourages OEMs to partner with experienced outsourcing firms for seamless market entry.

Contract service providers are broadening service offerings to regulatory consulting, post-market surveillance, and digital health solutions. Providers are integrating AI-driven analytics and automation to enhance service efficiency, offering comprehensive end-to-end solutions for OEMs.

Market demand is driven by a concentrated pool of large OEMs with stringent quality expectations. While startups and mid-sized companies are entering the space, established players dominate outsourcing partnerships, necessitating customized service models to meet diverse client needs.

Service Insights

The contract manufacturing segment accounted for the largest share of 46.74% in 2024. The segment growth is owing to increasing cost pressures, stringent FDA regulatory requirements, and the growing complexity of medical devices. OEMs increasingly depend on outsourcing partners to streamline production efficiency, enhance compliance, and accelerate time-to-market. Advanced robotics, AI-driven quality control, and additive manufacturing further enhance the capabilities of contract manufacturers, particularly in high-growth segments like IVD, drug delivery systems, and Class III implants. In addition, rising demand for personalized medical devices, such as 3D-printed orthopedic implants and customized surgical instruments, is accelerating segmental growth.

On the other hand, the quality assurance services segment is anticipated to grow at the fastest CAGR over the forecast period. The increasing adoption of connected medical devices, AI-driven diagnostics, and implantable technologies strengthened the demand for thorough testing, validation, and certification services. Moreover, the increasing adoption of contract quality assurance services among OEMs for cost efficiency, faster market entry, and adherence to ISO 13485 and FDA QSR standards is anticipated to boost segmental revenue growth in the forthcoming years.

Application Insights

Based on application, the cardiology segment dominated the market in 2024. The growing demand for cardiovascular devices due to the high prevalence rate of cardiovascular diseases (CVDs) is attributed to the growth of outsourcing these devices. Additionally, the high complexity of cardiovascular devices and the need for specialized technical expertise drive demand for drug development and manufacturing outsourcing. Furthermore, the growing shift toward minimally invasive procedures and AI-driven diagnostics is creating significant market growth opportunities in the near future.

On the other hand, the general & plastic surgery segment is anticipated to grow at the fastest CAGR over the forecast period. The high segmental growth is attributed to rising cosmetic and reconstructive procedures, technological advancements, and stringent regulatory requirements. The American Society of Plastic Surgeons (ASPS) reported over 1.58 million cosmetic procedures performed in 2023, stimulating demand for implants, dermal fillers, and surgical instruments. Increasing FDA oversight and the Class III regulatory pathway for implants are pushing manufacturers to outsource R&D, regulatory compliance, and precision manufacturing.

Class Insights

Based on the class segment, the class II segment dominated the market in 2024 and is anticipated to grow lucratively over the analysis period. The key factor contributing to the growth of the segment is the majority of the devices; almost 43% fall under this category, and the cost of medical devices is also high. The class II type devices include blood pressure cuffs, catheters, syringes, contact lenses, surgical gloves, pregnancy test kits, and blood transfusion kits. The FDA’s 510(k) clearance pathway accelerates market entry for moderate-risk devices like diagnostic imaging systems, orthopedic implants, and diabetes monitors, fueling outsourcing demand.

On the other hand, the class I segment is projected to expand at a considerable growth rate over the forecast period. The market growth is driven by increasing demand for cost-effective manufacturing and regulatory compliance support. These segments include low-risk devices, including bandages, surgical instruments, and diagnostic accessories, which benefit from streamlined FDA approvals, thereby accelerating outsourcing demand.

Key U.S. Medical Device Outsourcing Company Insights

Some of the players operating in the market includeSGS SA, Laboratory Corporation Of America Holdings, Eurofins Scientific, Pace Analytical Services, Inc., TÜV SÜD, Charles River Laboratories, Freyr, Global Regulatory Partners, Parexel International Corporation, Genpact, Criterium, Inc., Promedica International, Medpace, ICON Plc., IQVIA Inc., Integer Holdings Corporation, Jabil Inc., Flex Ltd., Plexus Corp., and West Pharmaceutical Services, Inc. These players continuously expand their facilities, collaborate, and engage in partnerships, mergers, and acquisitions to gain a competitive edge in the market. For instance, in February 2025, Freyr announced the launch of the latest service line, market Intelligence, to enhance its comprehensive service portfolio. The service is tailored specifically for medical device organizations. Market Intelligence provides real-time data on evolving regulatory requirements, market trends, and competitive analysis. By leveraging this service, companies can navigate compliance challenges more effectively and optimize their market entry strategies.

Key U.S. Medical Device Outsourcing Companies:

The following are the leading companies in the U.S. medical device outsourcing market. These companies collectively hold the largest market share and dictate industry trends:

- SGS SA

- Laboratory Corporation Of America Holdings

- Eurofins Scientific

- Pace Analytical Services, Inc.

- TÜV SÜD

- Charles River Laboratories

- Freyr

- Global Regulatory Partners

- Parexel International Corporation

- Genpact

- Criterium, Inc.

- Promedica International

- Medpace

- ICON Plc.

- IQVIA Inc.

- Integer Holdings Corporation

- Jabil Inc.

- Flex Ltd.

- Plexus Corp.

- West Pharmaceutical Services, Inc.

Recent Developments

-

In March 2025, Flex Ltd. announced the launch of a new product introduction (NPI) center near Boston, enhancing its support for healthcare customers in bringing medical devices to market faster and more efficiently. This center streamlines end-to-end product development, from prototyping and preclinical builds to design verification and production transfer, reducing risk and accelerating commercialization.

-

In February 2025, Jabil Inc. entered into a collaboration agreement with Ebeam Applications S.A. to expand its service in medical device sterilization outsourcing. By installing a Be-Wide X-ray solution at Jabil’s new greenfield site in Byhalia, Mississippi, the partnership enhances sterilization capabilities for medical device manufacturers.

-

In September 2024, Eurofins Scientific announced the acquisition of Infinity Laboratories, Inc., aimed to expand its biopharma product testing offering in the U.S. The expansion of biopharma product testing aligns with the increasing demand for outsourced testing services, particularly for sterility, biocompatibility, and quality assurance of medical devices.

U.S. Medical Device Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 34.41 billion

Revenue Forecast in 2030

USD 63.40 billion

Growth rate

CAGR of 13.0% from 2025 to 2030

Actual estimates/Historical data

2018 - 2024

Forecast period

2025 - 2030

Market representation

Revenue in USD million and CAGR from 2025 to 2030

Key companies profiled

SGS SA; Laboratory Corporation Of America Holdings; Eurofins Scientific; Pace Analytical Services, Inc.; TÜV SÜD; Charles River Laboratories; Freyr; Global Regulatory Partners; Parexel International Corporation; Genpact; Criterium, Inc.; Promedica International; Medpace; ICON Plc.; IQVIA Inc.; Integer Holdings Corporation; Jabil Inc.; Flex Ltd.; Plexus Corp.; West Pharmaceutical Services, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Device Outsourcing Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. medical device outsourcing market on the basis of service, application, and class:

-

Service Outlook (Revenue, USD Million; 2018 - 2030)

-

Quality Assurance Services

-

Regulatory Affairs Services

-

Clinical Trial Applications & Product Registration

-

Regulatory Writing & Publishing

-

Legal Representation

-

Others

-

-

Product Design and Development Services

-

Designing & Engineering

-

Machining

-

Molding

-

Packaging

-

-

Data Management and Biostatistics

-

Product Testing & Sterilization Services

-

Product Implementation Services

-

Product Upgrade Services

-

Product Maintenance Services

-

Contract Manufacturing

-

Accessories Manufacturing

-

Assembly Manufacturing

-

Component Manufacturing

-

Device Manufacturing

-

-

Others

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Cardiology

-

Diagnostic Imaging

-

Orthopedic

-

IVD

-

Ophthalmic

-

General & Plastic Surgery

-

Drug Delivery

-

Prefilled Syringe

-

Autoinjectors

-

Infusion Pump

-

Others

-

-

Dental

-

Endoscopy

-

Diabetes Care

-

Others

-

-

Class Outlook (Revenue, USD Million; 2018 - 2030)

-

Class I

-

Class II

-

Class III

-

-

Application by Class Outlook (Revenue, USD Million; 2018 - 2030)

-

Cardiology

-

Class I

-

Class II

-

Class III

-

-

Diagnostic Imaging

-

Class I

-

Class II

-

Class III

-

-

Orthopedic

-

Class I

-

Class II

-

Class III

-

-

IVD

-

Class I

-

Class II

-

Class III

-

-

Ophthalmic

-

Class I

-

Class II

-

Class III

-

-

General & Plastic Surgery

-

Class I

-

Class II

-

Class III

-

-

Drug Delivery

-

Class I

-

Class II

-

Class III

-

-

Dental

-

Class I

-

Class II

-

Class III

-

-

Endoscopy

-

Class I

-

Class II

-

Class III

-

-

Diabetes Care

-

Class I

-

Class II

-

Class III

-

-

Others

-

Class I

-

Class II

-

Class III

-

-

Frequently Asked Questions About This Report

b. The U.S. medical device outsourcing market size was estimated at USD 30.96 billion in 2024 and is expected to reach USD 34.41 billion in 2025.

b. The U.S. medical device outsourcing market is expected to grow at a compound annual growth rate of 13.0% from 2025 to 2030 to reach USD 63.40 billion by 2030.

b. Contract manufacturing dominated the U.S. medical device outsourcing market with a share of 46.74% in 2024. The segment growthis driven by cost efficiency, advanced manufacturing technologies, regulatory expertise, rising demand for minimally invasive devices, AI-driven production, supply chain optimization, and increased OEM reliance on specialized CDMOs.

b. Some key players operating in the U.S. medical device outsourcing market include SGS SA; Laboratory Corporation Of America Holdings; Eurofins Scientific; Pace Analytical Services, Inc.; TÜV SÜD; Charles River Laboratories; Freyr; Global Regulatory Partners; Parexel International Corporation; Genpact; Criterium, Inc.; Promedica International; Medpace; ICON Plc.; IQVIA Inc.; Integer Holdings Corporation; Jabil Inc.; Flex Ltd.; Plexus Corp.; West Pharmaceutical Services, Inc.

b. Key factors that are driving the market growth include rising price competition and requirement to reduce costs, increasing complexity, product design, &engineering, and rise in surgical procedures and increasing demand for surgical equipment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.