- Home

- »

- Medical Devices

- »

-

U.S. Medical Device Cleaning Market, Industry Report, 2030GVR Report cover

![U.S. Medical Device Cleaning Market Size, Share & Trends Report]()

U.S. Medical Device Cleaning Market (2024 - 2030) Size, Share & Trends Analysis Report By Device (Non-critical, Semi-critical), By Technique (Cleaning, Disinfection), By EPA Classification (High Level, Intermediate Level), And Segment Forecasts

- Report ID: GVR-4-68040-286-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Medical Device Cleaning Market Trends

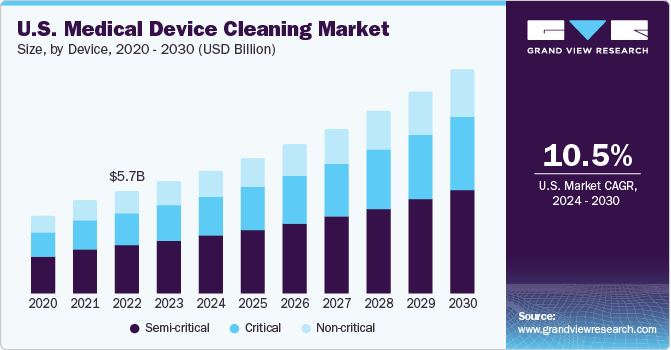

The U.S. medical device cleaning market size was estimated at USD 6.23 billion in 2023 and is expected to grow at a CAGR of 10.5% from 2024 to 2030. The overall market is expected to grow steadily due to the rise in Hospital-Acquired Infections (HAIs), including Urinary Tract Infections (UTIs), Surgical Site Infections (SSIs), and Methicillin-Resistant Staphylococcus Aureus (MRSA) infections. Strict regulations for reprocessing reusable medical devices are in place to reduce these infections. The increasing number of hospitals and clinics is driving demand for medical device reprocessing materials. This growing demand for advanced cleaning and sterilizing materials has attracted new market players.

The U.S. accounted for over 29.2% of the global medical device cleaning market in 2023. Governments and various organizations are seeking to improve healthcare infrastructure. Growing demand for specialized healthcare services in developing countries is anticipated to fuel the potential demand for inpatient room care facilities. The growing trend of paying for various procedures in daycare and patient settings is propelling the demand for superior room care services. Moreover, healthcare professionals indicate that the recent rise in the elderly population is a crucial element propelling the market growth. The increasing occurrence of comorbid illnesses due to lifestyle diseases, such as diabetes and obesity, is also resulting in a higher rate of hospitalizations.

Research published in NCBI indicates that UTIs constitute 25.0% of all bacterial infections. A report from the NNIS System reveals that the majority of hospital-acquired UTIs are linked with CA-bacteriuria, and catheterization is the most common healthcare-associated infection, contributing to up to 40% of hospital-acquired infections in the U.S. annually. This is expected to further fuel market growth. Furthermore, a rise in the incidence of SSIs is predicted to enhance the adoption of infection control measures.

Research published in NIH in 2018 estimated that SSIs accounted for 40% to 60% of infections. The ongoing application of infection prevention and control measures has led to a notable decrease in the number of hospital-acquired infection cases, and this trend is likely to continue in the future if these measures continue to be implemented at the current rate. A 2022 report from the Centers for Disease Control and Prevention (CDC) stated that the SSI Standardized Infection Ratio (SIR) related to all combined NHSN operational procedure categories saw a reduction of about 5% in 2020 compared to the previous year.

The COVID-19 pandemic positively influenced the market. The need for thorough cleaning and disinfection of surfaces in healthcare settings, especially where COVID-19 patients are present, was increased. This applies to both traditional healthcare facilities and non-traditional isolation venues. The pandemic also opened opportunities for local manufacturers. International border restrictions disrupted the supply chain of major players, allowing local manufacturers to meet the increased demand. These companies adopted strategies to secure a larger market share. The surge in COVID-19 cases has led to a shortage of medical supplies, prompting local manufacturers to increase production.

Market Characteristics & Concentration

Companies in the U.S. medical device cleaning market are actively participating in activities such as product innovation, mergers and acquisitions, and regional expansion to fortify their position. For example, Metrex launched surface disinfectant wipes 2.0 CaviWipes in April 2021. These wipes are fully certified for the EPA’s Emerging Viral Pathogen Claim and can combat 42 diseases, including SARS-CoV-2. With a universal contact time of two minutes, CaviWipes are perfect for single-step cleaning and disinfection of hard, non-porous surfaces in healthcare settings. This move is anticipated to boost the company’s presence.

Major corporations, are focusing on developing innovative solutions to combat the spread of coronavirus. For instance, in April 2020, the FDA approved the use of Steris, maX2, and maX low-V-PRO 1 Plus temperature sterilization equipment in hospitals treating COVID-19 patients to decontaminate roughly 750,000 N95 respirators and comparable masks every day. This could help the company's reputation. Despite the COVID-19 pandemic, healthcare-associated infections affect a high percentage of patients in developed economies. These infections have not only compromised patient safety in healthcare settings but have also increased healthcare expenditure. These infections account for approximately 37,000 and 99,000 deaths in Europe and the U.S, respectively.

Firms are also adopting several strategies such as collaborations and mergers and acquisitions to gain a higher market share. For instance, in August 2021, the Association for Experts in Infection Control and Epidemiology (APIC), the biggest association for Infection Prevention and Control (IPC) professionals, established a strategic relationship with Metrex Research, LLC. The APIC Strategic Partner program builds long-term connections with industry partners share the goal of lowering infection risk. Thus, the market is expected to grow rapidly in the coming years.

Regulatory bodies have a major impact on sterile processing and surgical standards during the forecast period. Companies operating in the medical device cleaning market must comply with the regulations, safety process and procedures. The FDA does not have the supremacy to regulate emissions to the environment from industrial sterilization processes. However, FDA’s review is focused on medical devices, namely their sterility and the process that achieves medical device sterility, (EtO sterilization). The U.S. EPA reviews and administers the Clean Air Act regulations for sterilization facilities that releases EtO from the facilities to ensure they are monitoring the emissions and protecting the public from significant risk of EtO exposure.

The U.S. market has been experiencing growth over the past few years owing to the local presence of major market players and ongoing global expansion activities. The key market players in the region are adopting strategies such as intensive R&D and expansion of manufacturing & R&D facilities in Europe and Asia. In September 2021, Sterigenics Germany GmbH and Nelson Laboratories, Inc. announced opening a newly expanded center of excellence for microbiological laboratory testing, as well as increased sterilization capacity. This expansion was prompted by an increase in demand for such services in the pharmaceutical and medical devices sector.

Device Insights

Semi-critical segment dominated and held the largest revenue market share of 45.9% in 2023. Semi-critical devices, which include dental equipment, endoscopes, and certain surgical instruments that encounter mucus membranes, are among the items in this category. These devices need to be sterilized before use, primarily through heat or chemical methods due to the high frequency of sterilization required. When these sterilization methods are not applicable, disinfectants approved and registered by the U.S. Environmental Protection Agency (EPA) are utilized. These disinfectants encompass peracetic acid, ortho-phthalaldehyde, glutaraldehyde, and hydrogen peroxide. Despite the high availability and usage of cleaning, disinfectant, and sterilization products, the market is projected to grow slowly in the forecast period. The market growth is influenced by factors such as the rising use of disposable devices, price reductions due to intense competition, and strict regulatory guidelines set by the Centers for Disease Control and Prevention (CDC).

Critical is anticipated to witness the fastest growth rate of 10.9% the forecast period. This category encompasses devices that pierce body tissues. These devices undergo sterilization before they are packaged, and most of them are designed for single use. Heat sterilization and ethylene oxide (EtO) are the most common sterilization methods used in hospitals. Most of the commercially available single-use surgical equipment is sterilized using radiation, but this process is not carried out within hospital settings and is therefore not included in this report’s scope. As with semi-critical devices, the growing adoption of single-use devices has lessened the demand for cleaning, disinfecting, and sterilizing critical devices, which is expected to impede market growth.

Techniques Insights

Disinfection dominated and held the largest market share of 59.5% in 2023. Disinfection is an important step in reprocessing semi-critical and critical medical devices. The disinfectants used in this step are generally categorized as bactericidal, fungicidal, and virucidal. Selection of these materials generally depends on the type of medical equipment. However, selection of such materials for processing devices such as endoscopes is difficult. For example, decisions regarding selection of method- sterilization or high-level disinfection. Disinfectants in combination with detergents are also considered in this segment. The segment is expected to exhibit lucrative growth owing to factors such as the development of novel products to counter resistant strains.

Sterilization is expected to grow at the highest CAGR of 11.2% during the forecast period. Sterilization includes removal of any microorganism present on medical devices. Out of the various methods used for sterilization of medical devices, steam sterilization and EtO sterilization methods are mostly employed in hospital settings. Introduction of surgical devices made of materials other than stainless steel has led to the need for finding alternatives for heat sterilization. Trends of forming central sterile services department (Sterile processing department) is increasing demand for the advanced sterilization equipment to optimize time and money required in the process.

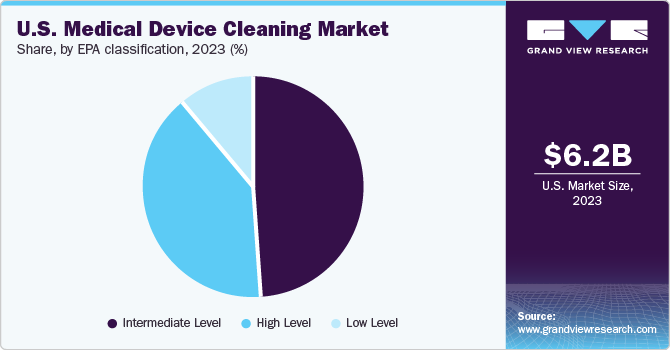

EPA Classification Insights

The intermediate level segment held the largest share of over 48.9% in 2023. The high-level segment is expected to register the fastest CAGR during the forecast period. Noncritical things that come into touch with skin are disinfected using low-level disinfectants. This includes shared patient-care items, such as hard surfaces like bed rails and equipment like blood pressure cuffs, that personnel would utilize on several patients throughout the course of any given workday.

High-level is expected to register the fastest CAGR of 11.5%bduring the forecast period. High-level disinfection refers to the treatment of dental instruments and medical equipment for inhibiting microorganisms. It includes the reprocessing of heat-sensitive semi-critical medical equipment and dental instruments. Some of the most used high-level disinfectants are glutaraldehydes, special hydrogen peroxide, and special peracetic acid products.

Key U.S. Medical Device Cleaning Company Insights

The U.S. market is a highly competitive space, wherein, major medical device cleaning companies are adopting strategies such as partnerships, product and service expansion, mergers & acquisitions, and R&D investments to gain a competitive edge. These strategies aim to increase their global market share and customer base. For instance, in August 2021, Ecolab launched its Healthcare Advanced Design Center to collaborate with medical device industry customers on infection prevention solutions. This initiative aims to develop innovative solutions for hospitals and operation centers, focusing on enhancing infection control, managing operational costs and efficiencies, and improving patient outcomes through custom-designed sterile barriers and equipment drapes. These developments are expected to increase the demand for such products, thereby driving market growth in the future.

Key U.S. Medical Device Cleaning Companies:

- Steris plc.

- Getinge AB

- Advanced Sterilization Products (ASP)

- The Ruhof Corp.

- Sklar Surgical Instruments

- Sterigenics International LLC

- Biotrol

- Metrex Research, LLC

- Cantel Medical Corp.

- Ecolab

- 3M

Recent Developments

-

In August 2021, the Association for Professionals in Infection Control and Epidemiology, Inc. (APIC), the largest association for Infection Prevention and Control (IPC) professionals, established a strategic relationship with Metrex. The APIC Strategic Partner program builds long-term connections with industry partners that share the goal of lowering infection risk.

-

In June 2021, Steris plc declared that it completed the acquisition of Cantel Medical, which was previously announced in January 2021. This expanded & enhanced the service & product capabilities and global reach of STERIS.

-

In January 2020, Getinge AB completed the acquisition of Applikon Biotechnology B.V., a developer and supplier of advanced bioreactor systems for production of vaccines & antibodies, as well as enzymes & bioplastics for industrial biotechnology.

U.S. Medical Device Cleaning Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 12.45 billion

Growth rate

CAGR of 10.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device, technique, EPA classification

Country scope

U.S.

Key companies profiled

Steris plc.; Getinge AB; Advanced Sterilization Products (ASP); The Ruhof Corp.; Sklar Surgical Instruments; Sterigenics International LLC; Biotrol; Metrex Research, LLC; Cantel Medical Corp.; Ecolab; 3M

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Device Cleaning Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical device cleaning market report based on device, technique, and EPA classification:

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-critical

-

Semi-critical

-

Critical

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Cleaning

-

Detergents

-

Buffers

-

Chelators

-

Enzymes

-

Others

-

Disinfection

-

Chemical

-

Alcohol

-

Chlorine & Chorine Compounds

-

Aldehydes

-

Phenolics

-

-

Metal

-

Ultraviolet

-

Others

-

Sterilization

-

Heat Sterilization

-

Ethylene Dioxide (ETO) Sterilization

-

Radiation Sterilization

-

-

EPA Classification Outlook (Revenue, USD Million, 2018 - 2030)

-

High Level

-

Intermediate Level

-

Low Level

-

Frequently Asked Questions About This Report

b. The U.S. medical device cleaning market size was estimated at USD 6.23 billion in 2023 and is expected to reach USD 6.8 billion in 2024.

b. The U.S. medical device cleaning market is expected to grow at a compound annual growth rate of 10.5% from 2024 to 2030 to reach USD 12.45 billion by 2030.

b. Semi-critical segment held the largest market share in 2023. Semi-critical devices include those that are exposed to mucus membrane. Dental equipment, endoscopes, and some surgical instruments are a few examples of the devices in this category.

b. Some key players operating in the U.S. medical device cleaning market include Steris plc.; GetingeAB; Advanced Sterilization Products; The Ruhof Corp.; Sklar Surgical Instruments; Sterigenics International LLC; Biotrol; Metrex Research, LLC; Oro Clean Chemie AG; Cantel Medical Corp.; Ecolab; 3M

b. The rising prevalence of Hospital-Acquired Infections (HAIs) is expected to be a major factor responsible for the steady growth of the overall market during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.