- Home

- »

- Next Generation Technologies

- »

-

U.S. Machine Vision Market Size And Share Report, 2030GVR Report cover

![U.S. Machine Vision Market Size, Share & Trends Report]()

U.S. Machine Vision Market (2024 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software, Services), By Application (Measurement, Identification), By End-use Industry, By Product, And Segment Forecasts

- Report ID: GVR-4-68040-197-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

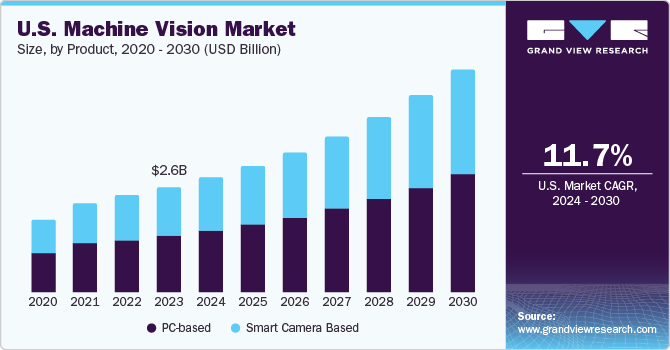

The U.S. machine vision market size was estimated at USD 2.6 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.7% from 2024 to 2030. The growing demand and necessity for automation and quality inspection in various industries as well as the incorporation of artificial intelligence (AI) and machine learning in machine vision (MV) technology, which increases the efficiency and accuracy of machine vision, is projected to fuel the market growth over the forecast period.

The automotive sector is among the largest sectors in the U.S. market. Machine vision systems can identify, measure, gauge, and examine automotive components for quality. Industrial cameras and sensors are used for identifying defects in welding, size compliance, assembly, and stamping, among other parameters. Therefore, machine vision is extensively used in the U.S. automotive industry for improving quality, thereby fueling the market growth in the U.S. market.

Many key players in the electronics and semi-conductor industry are present in the U.S. machine vision systems are implemented in investigating and reporting dimensions, alignment, and orientation of electronic components, which results in the production of uniform goods and reduced defects in the products. Hence, the electronics and semi-conductor industry is likely to boost the market growth for machine vision in the U.S. Printing electronic patterns, including RFID circuitry and patterns on flex circuits, are among the newest applications in the printing industry that can be automatically inspected using machine vision systems. The manual resources requirement has thus greatly reduced in this industry, which has helped the U.S. market significantly thereby fueling market growth.

The U.S. pharmaceutical and chemicals industry has extensively implemented machine vision across systems for conducting various functions which can range from quantity and condition checks to packaging checks, written directions checks, and dosage applicators inspections. These applications are boosting market demand for machine vision in the U.S. market. All these factors are expected to boost the U.S. market growth over the forecast period. However, inadequate training in implementing and operating machine vision equipment across various industries is a restraining factor for market growth.

Market Concentration & Characteristics

The market growth stage is medium and the rate of market growth is accelerating. The market is characterized by a high degree of innovation owing to the recent technological developments such as event-based vision sensors, shift from rule-based MV to AI-based MV, and more powerful hardware with artificial intelligence chips.

The U.S. market is highly fragmented with both the small and big players vying for an increased market share. The level of M&A activities by the key leading players in the U.S. market is high as the key players can maintain and gain market share by acquiring new technologies that are capable of significantly increasing the market growth.

The regulations in several industries in the U.S. such as healthcare, pharmaceuticals, and automotive lays down guidelines, which significantly necessitate the reduction in defects and quality as per the approved standards. Machine vision plays an integral role in maintaining compliance with these regulations. Hence, the regulations positively impact the market growth for machine vision.

Offering Insights

In 2023, the hardware segment held a market share of more than 60% and is anticipated to dominate the market over the forecast period. Based on offering, the market is segregated into hardware, software, and services segments. The hardware segment is further segregated into camera, frame grabber, optics, LED lighting, and processor sub-segments. The camera subsegment held the largest share in 2023, which can be attributed to the latest technological advancements in camera hardware with CMOS imaging sensors.

The software offering segment is anticipated to exhibit the fastest CAGR over the forecast period. This segment is further categorized into barcode reading, standard algorithm, and deep learning software sub-categories. Across the U.S., the method of barcoding of products is used extensively across all sectors. The barcode reading subsegment is expected to register a significant CAGR from 2024 to 2030. The deep learning software sub-segment is anticipated to register the fastest CAGR over the forecast period due to its enhanced image recognition and analysis capabilities, allowing for more accurate and sophisticated pattern recognition tasks.

Product Insights

Based on product, the market has been categorized into PC-based and smart camera-based segments. In 2023, the PC-based category held a revenue share exceeding 54% in the U.S. market and it is anticipated to register a CAGR exceeding 11% from 2024 to 2030. The segment is anticipated to continue growing and lead the market in terms of revenue over the estimated duration.

The smart camera-based systems are projected to register the fastest CAGR from 2024 to 2030. This considerable growth of the segment is attributable to the growing adoption of cameras in 3D imaging. As the U.S. has a large manufacturing industry, the greater adoption of smart cameras in these systems has led to the growth of this segment.

End-use Industry Insights

Based on end-use industry, the market has been categorized into automotive, pharmaceuticals & chemicals, electronics & semiconductor, pulp & paper, printing & labeling, food & beverage (packaging and bottling), glass & metal, postal & logistics, and others segments. In 2023, the automotive end-use industry held the largest market share of more than 20% in the U.S. market and is expected to register a significant CAGR from 2024 to 2030. Currently, the automotive industry has the largest adoption of machine vision systems in the U.S. and is expected to continue growing at a steady pace.

The demand in food & beverage industry in the U.S. is anticipated to witness the fastest CAGR over the forecast period. MV systems in the food & beverage industry are prominently used in bottling and packaging operations. Followed by the food & beverage end-use industry segment, the machine vision systems are likely to witness significant growth in the pharmaceuticals & chemicals, printing & labeling, and other industry verticals, which include agriculture, rubber & plastic processing, solar paneling, machinery & equipment, and security & surveillance.

Application Insights

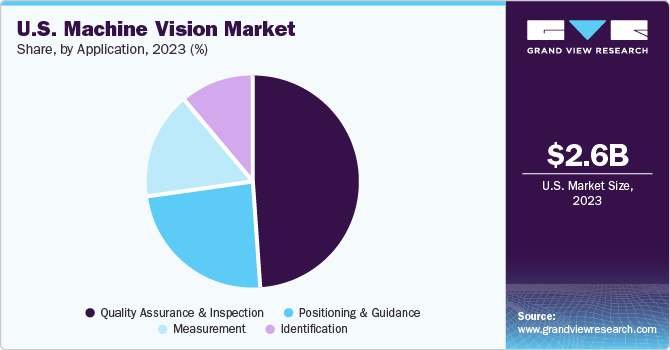

Based on application, the market has been segmented into quality assurance & inspection, positioning & guidance, identification, and measurement. In 2023, the quality assurance & inspection segment held the largest revenue share of 48.39% in the U.S. market and is anticipated to exhibit a CAGR of 11.5% from 2024 to 2030. These systems are responsible for automating most of the tasks related to identifying and scanning barcodes, labels, and texts, especially in the packaging sector.

Identification using machine imaging in camera surveillance, monitoring traffic, or recognizing number plates are some of the utilities. The segment is anticipated to register the fastest CAGR of 12.3% from 2024 to 2030 owing to several advantages and opportunities offered to the technology. Hence, the problem of shortage of labor in the U.S. is addressed by these systems. These systems also are time efficient, have minimal human errors, and thereby increase efficiency.

Key U.S. Machine Vision Company Insights

Some of the key companies functioning in the U.S. market include Basler AG, Cognex Corporation, Keyence Corporation, National Instruments Corporation., and OMRON Corporation.

-

In May 2023, Cognex Corporation launched the ‘Advantage 182’ vision system for the automation of complex location, classification, and inspection tasks, particularly in the life sciences industry. The system features advanced machine vision, barcode reading, and edge learning technology for automating tasks such as presence/absence detection, track-and-trace applications, high-precision alignment, and complex color inspections.

-

In June 2023, SICK announced its new multiScan100 family with the launch of the ‘multiScan136’, which uses time of flight (TOF) measurement to create a 3D perception of its surroundings. The multiScan136 provides 3D measurement data for accurate self-localization of vehicles, while simultaneously mapping the environment. It has been indicated for use in mobile robotics in logistics and manufacturing, and indoor & outdoor measurements.

Some of the emerging players in the market are USS Vision LLC and Teledyne FLIR LLC

-

USS Vision LLC, with headquarters in Livonia, MI, is a leader in Machine Vision Systems. With a strong commitment to innovation and a proven track record of delivering high-quality solutions, we specialize in empowering businesses across industries with advanced vision technology.

-

Teledyne FLIR LLC - Teledyne FLIR LLC, formerly FLIR Systems Inc, a subsidiary of Teledyne Technologies, specializes in the design and production of thermal imaging cameras and sensors.

Key U.S. Machine Vision Companies:

The following are the leading companies in the U.S. machine vision market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. machine vision companies are analyzed to map the supply network.

- Cognex Corporation

- Keyence Corporation

- National Instruments Corporation

- Basler AG

- SICK AG

- OMRON Corporation

- USS Vision LLC

- Allied Vision Technologies GmbH

- LMI Technologies, Inc.

- Teledyne FLIR LLC

Recent Developments

-

In May 2023, LMI Technologies announced the official release of its ‘GoPxL’ IIoT Vision Inspection Software for creating end-to-end, web-based, inline measurement and inspection solutions that are deployed on ‘Gocator’ 3D Smart Sensors. The GoPxL can be used in a range of industrial inspection tasks through a combination of on-sensor measurement filters and tools running on Gocator’s laser, snapshot, and line confocal sensors

-

In April 2023, Cognex Corporation launched the In-Sight 3800 Vision System for high-speed production lines. The company states it to offer twice the processing speed of earlier systems, with the presence of an extensive set of vision tools such as AI-based edge learning technology and traditional rule-based algorithms. It is powered by the In-Sight Vision Suite software that offers both EasyBuilder and Spreadsheet development environments.

U.S. Machine Vision Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 5.4 billion

Growth rate

CAGR of 11.4% from 2024 to 2030

Base year for estimation

2023

Actual estimates/Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Offering, product, application, end-use industry, region

Country scope

U.S.

Key companies profiled

Basler AG; Cognex Corporation; Keyence Corporation; LMI Technologies, Inc.; National Instruments Corporation; OMRON Corporation; Sick AG; USS Vision LLC; Allied Vision Technologies GmbH; Teledyne FLIR LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Machine Vision Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. machine vision market report based on offering, product, application, end-use industry, and region:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Camera

-

Frame Grabber

-

Optics/Lenses

-

LED Lighting

-

Processor

-

-

Software

-

Barcode Reading

-

Standard Algorithm

-

Deep Learning Software

-

-

Services

-

Integration

-

Solution Management

-

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

PC-based

-

Smart Camera Based

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Quality Assurance & Inspection

-

Positioning & Guidance

-

Measurement

-

Identification

-

-

End-use Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Pharmaceuticals & Chemicals

-

Electronics & Semiconductor

-

Pulp & Paper

-

Printing & Labeling

-

Food & Beverage (Packaging and Bottling)

-

Glass & Metal

-

Postal & Logistics

-

Others (Agriculture, Security & Surveillance, Rubber, Plastics, Solar Paneling, Machinery, and Others)

-

Frequently Asked Questions About This Report

b. The U.S. machine vision market size was estimated at USD 2.6 billion in 2023 and is expected to reach USD 2.80 billion in 2024.

b. The U.S. machine vision market is expected to grow at a compound annual growth rate of 11.7% from 2024 to 2030 to reach USD 5.4 billion by 2030.

b. Hardware dominated the U.S. machine vision market with a share of over 61.0% in 2023.

b. Some key players operating in the U.S. machine vision market include Cognex Corporation, National Instruments Corp, Teledyne Technologies Incorporated., and LMI TECHNOLOGIES INC.

b. Key factors driving the market growth include the increased industrial automation across end-use verticals and the adoption of Industry 4.0 in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.