- Home

- »

- Homecare & Decor

- »

-

U.S. Laundry Care Market Size, Share, Industry Report 2030GVR Report cover

![U.S. Laundry Care Market Size, Share & Trends Report]()

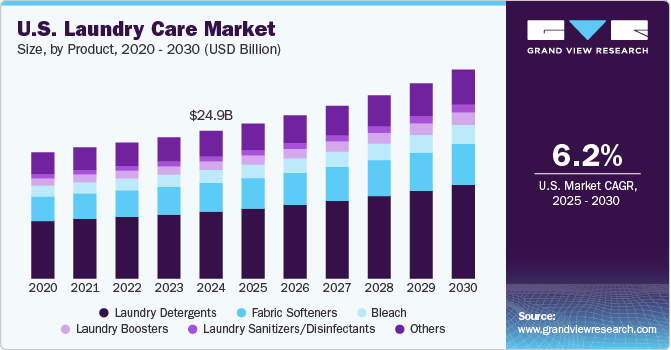

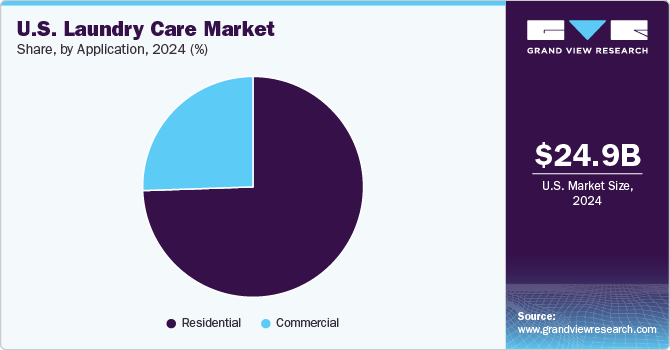

U.S. Laundry Care Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Laundry Detergents, Fabric Softeners, Bleach, Laundry Boosters, Laundry Sanitizers/Disinfectants), By Application (Residential, Commercial), And Segment Forecasts

- Report ID: GVR-4-68040-485-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2025

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Laundry Care Market Size & Trends

The U.S. laundry care market size was estimated at USD 24.87 billion in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2030. The demand for laundry care products in the U.S. has been steadily increasing, driven by consumers' growing focus on cleanliness and hygiene. During the COVID-19 pandemic, as people spent more time at home, laundry loads increased, making fabric care an essential part of daily life. This trend has continued, with consumers now washing clothes more frequently. As a result, there has been consistent growth in the laundry detergent market, with both liquid and powder detergents remaining popular. Additionally, a greater awareness of the importance of fabric care has led to a higher demand for products that offer superior cleaning and stain removal capabilities.

Over the years, liquid laundry detergents have become more dominant in the U.S. market, replacing powdered products in many households. Consumers favor liquids for their convenience, ease of use, and ability to dissolve quickly in water. Unit-dose pods have also seen a rise in popularity due to their pre-measured convenience. Many consumers prefer these products because they eliminate the guesswork of measuring detergent. Additionally, liquid detergents are often perceived as more modern and effective in removing stains, making them a popular choice among American households.

Despite the rise of liquids and pods, powdered laundry detergents still maintain a strong presence in the U.S. market, particularly among price-conscious consumers. Powders continue to appeal to those who value affordability and the large quantities often available in bulk. While liquid detergents are generally preferred for their ease of use, powdered detergents are seen as a more economical choice, especially for larger families or those with heavy laundry needs. This balance between convenience and cost reflects the variety of consumer preferences within the U.S. laundry care market.

As sustainability becomes a growing concern, eco-friendly laundry care products are gaining traction in the U.S. market. Many consumers are now seeking biodegradable, plant-based, and fragrance-free options to reduce their environmental impact. The rise in awareness about the harmful chemicals often found in traditional laundry detergents is driving this shift. Brands offering plant-based ingredients or promoting recyclable packaging are appealing to environmentally conscious shoppers. This trend is expected to continue, with more companies focusing on innovation and sustainability to capture a segment of consumers who prioritize greener alternatives.

In response to economic pressures, many consumers are shifting toward value-oriented laundry products. With rising costs of living and inflation impacting budgets, more shoppers are turning to store brands or discount options that offer lower prices without sacrificing cleaning performance. This shift toward budget-friendly options is evident in the increased popularity of private-label detergents. However, despite these price-conscious trends, premium brands still capture demand, particularly for consumers who prioritize performance or specific fabric care needs. The market shows a clear split between those seeking value and those willing to pay for higher-end products.

Product Insights

Laundry detergents accounted for the largest share of 45.3% in 2024. Demand for laundry detergents in the U.S. remains high due to ongoing price sensitivity and inflation, with value-based options gaining traction. Despite premium brands like Tide witnessing declined demand due to sale of more affordable detergents, including private label products. Consumer preferences are also shifting toward convenient, sustainable options, such as waterless detergent sheets and eco-friendly formulas. Companies like Carbona and Dropps have capitalized on this trend, driving growth through innovation and e-commerce channels. Overall, the market continues to be resilient, with consumers prioritizing cost-effective, eco-conscious solutions for their laundry needs.

Demand for laundry sanitizers/disinfectants is expected to rise at a CAGR of 7.1% from 2025 to 2030. This is due to heightened consumer awareness of hygiene, amplified by the Covid-19 pandemic. As consumers become more concerned about eliminating harmful bacteria, viruses, and allergens from clothing, the need for effective sanitizing products has grown, especially in households with babies. Technological advancements in product formulations, along with a shift toward eco-friendly alternatives, are also driving this trend, making sanitizers more convenient and accessible for consumers.

Application Insights

U.S. residential laundry care market accounted for a share of 73.6% in 2024. Post pandemic people are washing clothes frequently, which is creating a demand for laundry detergents, fabric conditioners, and stain removers has surged. Companies like Reckitt Benckiser have tapped into the growing trend by offering plant-based alternatives, meeting consumer demand for sustainability without sacrificing performance. The ease and accessibility of online platforms like Amazon have further fueled growth, especially in households seeking convenient and effective laundry solutions.

Demand for laundry care in commercial spaces is expected to grow at a CAGR of 6.7% from 2025 to 2030. This is due to innovative product launches offering enhanced cleaning and sustainability. Additionally, advancements in formulations addressing tougher stains and odors will drive increased usage in hotels, healthcare, and other commercial sectors. In May 2024, Procter & Gamble’s line of professional cleaning products, P&G Professional, expanded its laundry care range with the launch of Downy Professional Fabric Softener and Tide Professional Commercial Laundry Detergent. These products were designed to enhance efficiency by tackling tough stains and softening fabrics in just one wash. Aimed at businesses in industries like hospitality, healthcare, and restaurants, the new lineup helps streamline laundry processes, allowing business owners to save time and reduce costs while maintaining high cleaning standards.

Regional Insights

The U.S. laundry care market was valued at USD 24.87 billion in 2024 and is projected to reach USD 35.19 billion by 2030. The market is witnessing a shift towards premium and niche products, with consumers increasingly willing to pay for specialty items like fragrance-infused detergents and plant-based formulations. Brands are capitalizing on this trend by launching luxury laundry products, such as collaborations with high-end perfume houses. Additionally, there is a rising demand for ultra-concentrated detergents that offer convenience and sustainability, like Whirlpool's Swash, which reduces packaging waste. As consumers prioritize personalization and unique scents, social media platforms like TikTok are driving viral success for certain detergent brands.

Key U.S. Laundry Care Company Insights

The U.S. laundry care market is consolidated in nature. The market is characterized by the presence of a diverse array of players-from large corporations to smaller, regional/local providers. Some of the leading players in the market are Procter & Gamble, Unilever, Colgate-Palmolive, Henkel, Church & Dwight among others. Players are engaging in acquisitions, product launches, and promotional activities to increase their customer base and brand loyalty.

Key U.S. Laundry Care Companies:

- Procter & Gamble

- Unilever

- Colgate-Palmolive

- Henkel

- Church & Dwight

- Ecolab

- Reckitt Benckiser

- The Clorox Company

- Solenis

- Seventh Generation

Recent Developments

-

In May 2024, Henkel’s brand Persil laundry detergent underwent a rebranding, introducing new formulas to help clothes stay newer for longer. As part of the update, Persil launched a specialized Activewear variant designed for athletic and performance fabrics, targeting sweat, odor, and fabric care. The brand also revamped its unit-dose format with Persil Ultra Pacs, featuring improved dissolvability and less film waste. The refreshed look and products aimed to meet consumers' evolving needs for fabric care, color protection, and freshness.

-

In April 2024, all Laundry Detergent launched its new product, All Sensitive Fresh, designed for sensitive skin. This hypoallergenic detergent features a "Spring Breeze" scent and is free of dyes, removing 99% of common allergens. Recognized as a 2024 Product of the Year U.S. winner in the laundry detergent category, the new product combines gentle care with a light, fresh fragrance, addressing consumer demand for both skin sensitivity and scent.

-

In July 2023, Solenis acquired Diversey Inc. This merger combined two industry leaders, enhancing Solenis' global reach and capabilities in water management, hygiene, and cleaning solutions. With this acquisition, Solenis expanded its operations to over 130 countries, employing more than 15,000 people, while Bain Capital retained a minority stake in the company.

U.S. Laundry Care Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 26.10 billion

Revenue forecast in 2030

USD 35.19 billion

Growth rate (Revenue)

CAGR of 6.2% from 2025 to 2030

Historical data

2018 - 2025

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Procter & Gamble; Unilever; Colgate-Palmolive ; Henkel; Church & Dwight; Ecolab; Reckitt Benckiser; The Clorox Company; Solenis; and Seventh Generation

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Laundry Care Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. laundry care market report by product and application:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Laundry Detergents

-

Fabric Softeners

-

Bleach

-

Laundry Boosters

-

Laundry Sanitizers/Disinfectants

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Laundromats

-

Food Service

-

Hospitality

-

Healthcare

-

Education Institutes

-

Marine Industry

-

Correctional Facilities

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. laundry care market was estimated at USD 24.87 billion in 2024 and is expected to reach USD 26.10 billion in 2025.

b. The U.S. laundry care market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030 to reach USD 35.19 billion by 2030.

b. The U.S. laundry detergent market accounted for a share of about 45% in the overall U.S. laundry care market. This is due to its essential role in cleaning clothes, effectiveness in stain removal, and widespread consumer demand.

b. Key players in the U.S. laundry care market are Procter & Gamble; Unilever; Colgate-Palmolive ; Henkel; Church & Dwight; Ecolab; Reckitt Benckiser; The Clorox Company; Solenis; and Seventh Generation.

b. Key factors that are driving the U.S. laundry care market growth include increasing consumer focus on convenience, eco-friendly products, and advancements in detergent technology for better stain removal and fabric care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.