- Home

- »

- Medical Devices

- »

-

U.S. Ketamine Clinics Market Size, Industry Report, 2030GVR Report cover

![U.S. Ketamine Clinics Market Size, Share, & Trends Report]()

U.S. Ketamine Clinics Market (2024 - 2030) Size, Share, & Trends Analysis Report By Treatment (Depression, Anxiety, PTSD, Others), By Therapy (On-site Therapy, Online Therapy), And Segment Forecasts

- Report ID: GVR-4-68040-092-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Ketamine Clinics Market Size & Trends

The U.S. ketamine clinics market size was estimated at USD 3.41 billion in 2023 and is expected to grow at a CAGR of 10.60% from 2024 to 2030. The U.S. market is expected to grow significantly, driven by an increase in use of ketamine for various therapies, along with the expanding number of clinics offering ketamine treatments for mental health disorders. Increasing investment and partnerships are significantly driving the growth of ketamine clinics. This trend is majorly driven by the rising recognition of ketamine's potential in treating various mental health disorders, such as depression and Post-Traumatic Stress Disorder (PTSD), which has attracted substantial interest from investors as well as healthcare providers.

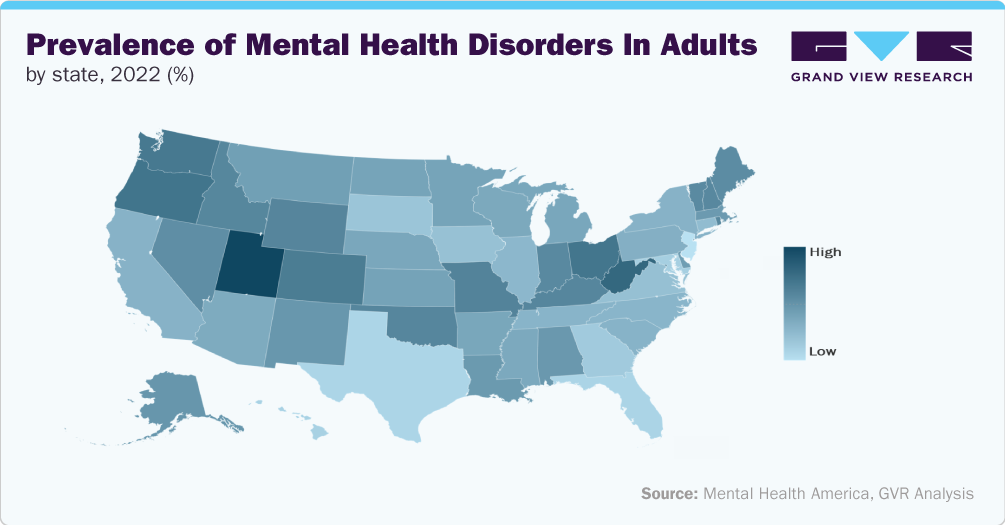

According to Mental Health America, the prevalence of adult mental illness in the U.S. ranges from 16.37% to 26.86%. On average, 19.86% of adults experience mental illness, which is equivalent to over 50 million Americans; among that, 4.91% are experiencing a severe mental illness.

The opioid crisis in the U.S. has contributed to the growth of the ketamine clinics market, as ketamine offers a nonopioid alternative for managing chronic pain. Ketamine can provide rapid relief of depressive symptoms, often within hours, compared to weeks for traditional antidepressants. This quick turnaround is crucial for patients with severe depression or suicidal ideation.

In a study conducted by the University of Michigan in February 2024, known as the Bio-K study, ketamine infusions were administered to 74 patients at four clinics in Minnesota, Maryland, and Michigan. The study reported that 52% of participants experienced significant relief from depression after receiving three ketamine infusions over the course of 11 days. Moreover, 50% of participants reported a significant decline in suicidal tendencies.

The increasing amount of research on ketamine's therapeutic potential has contributed to the market growth. For instance, in January 2022, the U.S. FDA approved a Phase 2 clinical trial for PharmaTher's experimental treatment for Amyotrophic Lateral Sclerosis (ALS), which involves the psychedelic ketamine. This trial aimed to enroll three groups of patients. The study used a multiple ascending dose design to determine if any doses of intravenous ketamine cause toxicity after 12 or 24 weeks (three or six months). Consequently, an increasing number of clinics are offering ketamine treatments, and ongoing research is exploring its potential benefits and long-term effects.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including degree of innovation, industry competition, service substitutes, the impact of regulations, level of partnerships & collaboration activities, and geographic expansion.

For instance, the U.S. market is fragmented, with the presence of many small players. The degree of innovation is medium, the level of partnerships & collaboration activities is also high, and service substitutes are low. The impact of regulations on the market is high, and the regional expansion of the market is low.

Several industry players launching new services to improve their industry penetration. For instance, in January 2023, Stella MSO LLC dba Field Trip Health and Wellness Ltd. launched the Field Trip Online Therapy program. It is an online ketamine therapy program for various mental health disorders, such as anxiety, PTSD, & depression.

Key industry players, including Innerwell (KBS, Inc.), Mindbloom, Inc.., and Stella MSO LLC dba Field Trip Health. are involved in partnerships to expand their industry presence. For instance, in April 2023, Mindbloom partnered with SHIFT, a tech-driven management consulting firm, to offer at-home ketamine therapy to its employees. This partnership allowed all SHIFT employees to access Mindbloom’s at-home ketamine therapy at a significantly reduced cost.

The impact of regulations on the U.S. ketamine clinics industry is high, encompassing both federal and state laws. The Corporate Practice of Medicine (CPOM) doctrine, where applicable, significantly influences the ownership and operation of ketamine clinics. The CPOM doctrine presents significant difficulties for those entering the ketamine market. Its application varies by state, making it crucial to understand local regulations when starting or funding a ketamine clinic.

Industry players leverage the strategy of service substitutes to increase their service capabilities and promote the reach of their service offerings. For instance, in March 2024, the University of Connecticut (UConn Health) launched a new esketamine service to help people suffering from severe depression and prevent suicide.

Some prominent companies in the industry are implementing various strategies, such as geographical expansion and launching new services, to consolidate their industry position across the country. For instance, in April 2024, The UC Davis Department of Psychiatry and Behavioral Sciences launched an Advanced Psychiatric Therapeutics (APT) Clinic at the Ambulatory Care Center on the Sacramento campus. This clinic is specifically designed to treat patients with treatment-resistant depression. The expansion of these clinics is intended to address the increasing demand from patients seeking ketamine treatment.

Treatment Insights

The depression segment dominated the market in 2023 with a market share of 30.15%. The growth of the segment can be attributed to the increase in the prevalence of major depressive disorder.During 2020-2021, the percentage of adults with depression and anxiety increased from 36.4% to 41.5%, according to the CDC. Moreover, the growing number of American adults burdened with severe major depression is expected to fuel the segment growth. According to the National Institute of Mental Health, in 2021, it was estimated that 14.5 million U.S. adults aged 18 and above suffered from at least one major depression episode, which represented 5.7% of all American adults.

The anxiety segment is anticipated to grow fastest during the forecast period. Anxiety disorders are the most widespread mental illness in the U.S. As per data provided by the Anxiety and Depression Association of America, approximately 6.8 million adults and more than 31.9% of adolescents aged 13 to 18 years were affected by anxiety disorders in 2021. Moreover, the COVID-19 pandemic has increased anxiety and stress levels, leading to an amplified need for treatment and support for anxiety disorders, thereby driving the segment growth.

Therapy Insights

The onsite therapy segment dominated the market in 2023 with a revenue share of 52.59%. Onsite therapy provides a controlled and supervised setting, ensuring the safety of patients and maximizing treatment results. During the therapy sessions, patients receive individualized care, monitoring, and support, which can improve the overall treatment experience and increase patient satisfaction.

This growing popularity has resulted in a significant rise in the number of ketamine clinics throughout the U.S. There are currently hundreds of these facilities across the country, and this number continues to grow yearly. This expansion reflects the growing acceptance of ketamine as a valuable form of mental health treatment, thereby driving the segment's growth.

The online therapy segment is expected to grow at the fastest growth rate during the forecast period. The growth of this segment is attributed to the rise of telehealth and remote healthcare services, the accessibility and convenience of online ketamine therapy have expanded significantly. The COVID-19 pandemic has further accelerated this trend, as virtual healthcare options gained prominence due to social distancing measures. As a result, the demand for online therapy has increased, contributing to the segment growth.

Key U.S. Ketamine Clinics Company Insights

The demand for ketamine clinic services has led to increased competition among companies in the U.S. market. Furthermore, increasing industry consolidation activities such as partnership & collaboration, acquisitions, and mergers by the top market players as well as growing initiatives in launching new services by key players are also anticipated to increase their share in the market.Some small players include Ketamine Clinics Los Angeles, Better U, Inc., and Innerwell (KBS, Inc.).

Key U.S. Ketamine Clinics Companies:

- Better U, Inc.

- Innerwell (KBS, Inc.)

- Ketamine Clinics Los Angeles

- Klarisana Health

- Klarity Clinic (Tebra Inc.)

- Mindbloom, Inc.

- Nue Life Health (NueCo Holdings, P.B.C.)

- NY Ketamine Infusions

- Stella MSO LLC dba Field Trip Health

- Vitalitas Denver Ketamine Infusion Center

Recent Developments

-

In February 2024, Innerwell (KBS, Inc.) expanded into in-network care by partnering with four major insurance providers in California and two in New York. This expansion is expected to broaden consumer access to Innerwell’s innovative treatments, which include traditional psychiatry, talk therapy, ketamine treatment, and EMDR.

-

In December 2023, Mindbloom, Inc. launched its Mastermind Series, the first expert-led psychedelic therapy program designed to address heartbreak, burnout, and other mental health issues. Developed in collaboration with leading experts, these programs integrate specialized teachings with ketamine therapy to boost neuroplasticity and promote lasting change.

-

In January 2023, Nue Life Health launched the Nue Network, a partnership program designed to expand access to its HIPAA-compliant, at-home ketamine treatment & integration therapy programs.

-

In March 2022, Field Trip Health partnered with Cerebral, facilitating a mutual referral system. Cerebral clinicians could refer eligible clients to Field Trip Health for ketamine-assisted therapy, while Field Trip could refer individuals seeking general psychiatry & teletherapy services to Cerebral. This collaboration aimed to offer personalized treatment options for individuals seeking to enhance their mental well-being.

U.S. Ketamine Clinics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 6.90 billion

Growth rate

CAGR of 10.60% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, therapy

Country scope

U.S.

Key companies profiled

Better U, Inc.; Innerwell (KBS, Inc.); Ketamine Clinics Los Angeles; Klarisana Health; Klarity Clinic (Tebra Inc.); Mindbloom, Inc.; Nue Life Health (NueCo Holdings, P.B.C.); NY Ketamine Infusions; Stella MSO LLC dba Field Trip Health; Vitalitas Denver Ketamine Infusion Center

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ketamine Clinics Market Report Segmentation

This report forecasts revenue growth, country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ketamine clinics market report based on treatment, and therapy:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Depression

-

Anxiety

-

PTSD

-

Others

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Site Therapy

-

Online Therapy

-

Frequently Asked Questions About This Report

b. The U.S. ketamine clinics market size was estimated at USD 3.41 billion in 2023 and is expected to reach USD 3.77 billion in 2024.

b. The U.S. ketamine clinics market is expected to grow at a compound annual growth rate of 10.60% from 2024 to 2030 to reach USD 6.90 billion by 2030.

b. The depression segment dominated the U.S. ketamine clinics market with a share of 30.15% in 2023, owing to the increasing prevalence of the major depressive disorder.

b. Some key players operating in the U.S. ketamine clinics market include NY Ketamine Infusions; Field Trip Health and Wellness Ltd.; Ketamine Clinics Los Angeles; Klarity Clinic; Vitalitas Denver Ketamine Clinic; Mindbloom, Inc; Nue Life Health, PBC. ; Better U, LLC; Innerwell; Klarisana

b. Key factors driving the U.S. ketamine clinics market growth include the increasing use of ketamine for various therapies and the expanding number of clinics offering ketamine treatments for mental health disorders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.