- Home

- »

- Petrochemicals

- »

-

U.S. Industrial Lubricants Market Size, Industry Report, 2033GVR Report cover

![U.S. Industrial Lubricants Market Size, Share & Trends Report]()

U.S. Industrial Lubricants Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Process Oils, General Industrial Oils), By Application (Metalworking, Textiles, Energy), By Region (Northeast, Southwest, Mideast, Southeast), And Segment Forecasts

- Report ID: GVR-2-68038-273-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Industrial Lubricants Market Summary

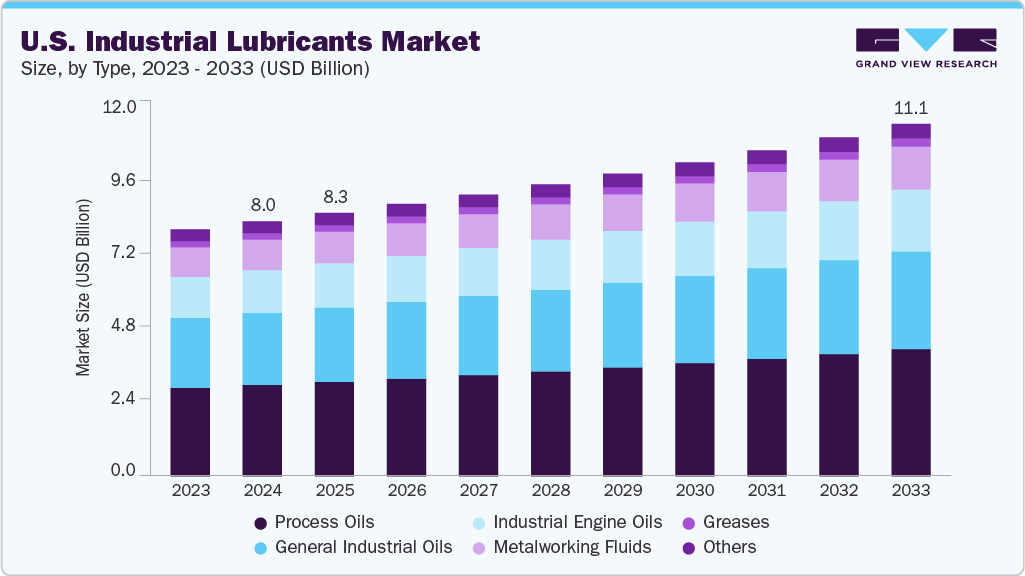

The U.S. industrial lubricants market size was estimated at USD 8,051.4 million in 2024 and is projected to reach USD 11,131.1 million by 2033, growing at a CAGR of 3.7% from 2025 to 2033. The growth is primarily driven by the rising demand for high-performance lubricants across manufacturing, construction, and energy sectors.

Key Market Trends & Insights

- By product, the metalworking fluids segment is expected to grow at a CAGR of 4.0% from 2025 to 2033 in terms of revenue.

- The process oils segment dominated the market with the largest revenue share of 35.85% in 2024.

- By application, the energy segment is expected to grow at a CAGR of 3.9% from 2025 to 2033 in terms of revenue.

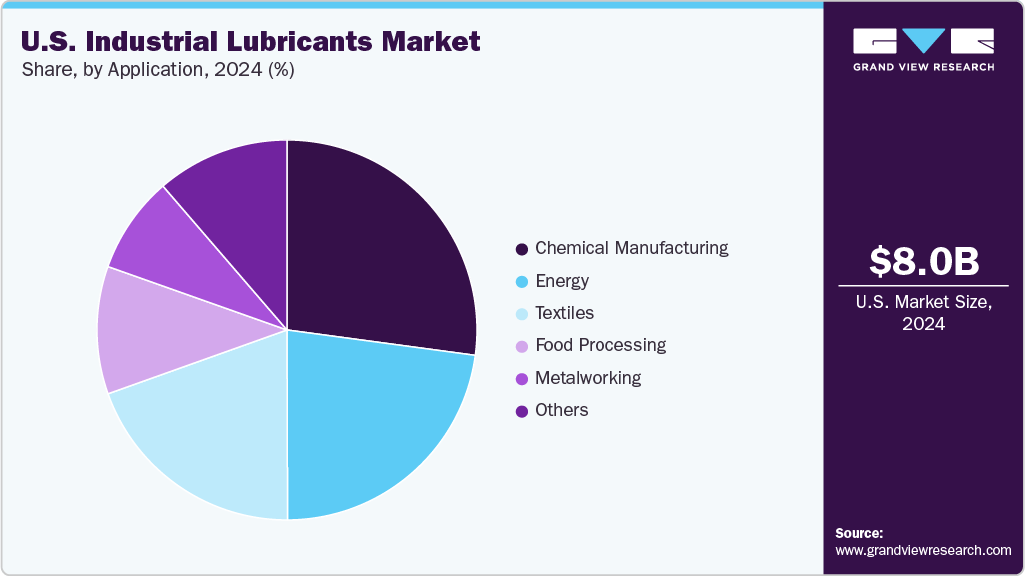

- The chemical manufacturing segment captured the largest revenue share of 27.13% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8,051.4 Million

- 2033 Projected Market Size: USD 11,131.1 Million

- CAGR (2025-2033): 3.7%

Increasing industrial automation and the need for efficient machinery maintenance have accelerated the adoption of advanced lubricants that enhance equipment lifespan and reduce downtime. Moreover, the growing focus on energy efficiency and emission reduction is encouraging the use of synthetic and bio-based lubricants that offer superior thermal stability and environmental compatibility.One of the key opportunities in the industry lies in the growing shift toward bio-based and sustainable lubricants. With rising environmental awareness and stricter U.S. regulations on emissions and waste disposal, industries are increasingly moving toward eco-friendly alternatives. Bio-based lubricants made from renewable sources offer lower toxicity, better biodegradability, and improved safety for workers. This trend is creating strong growth potential for manufacturers investing in green formulations and innovation, especially in sectors like automotive, marine, and manufacturing.

The industry faces challenges due to the rapid growth of electric and hybrid-electric vehicles in the U.S., which is expected to reduce lubricant consumption significantly. Unlike conventional vehicles that require frequent engine oil changes, electric vehicles operate on battery power and have minimal need for engine lubricants. Although they still use greases and specialty fluids in components such as bearings and transmissions, the overall demand is much lower. As the adoption of EVs and hybrids accelerates, driven by strict emission norms and consumer preference for low-maintenance vehicles, lubricant manufacturers are under pressure to diversify their product offerings and adapt to this technological shift.

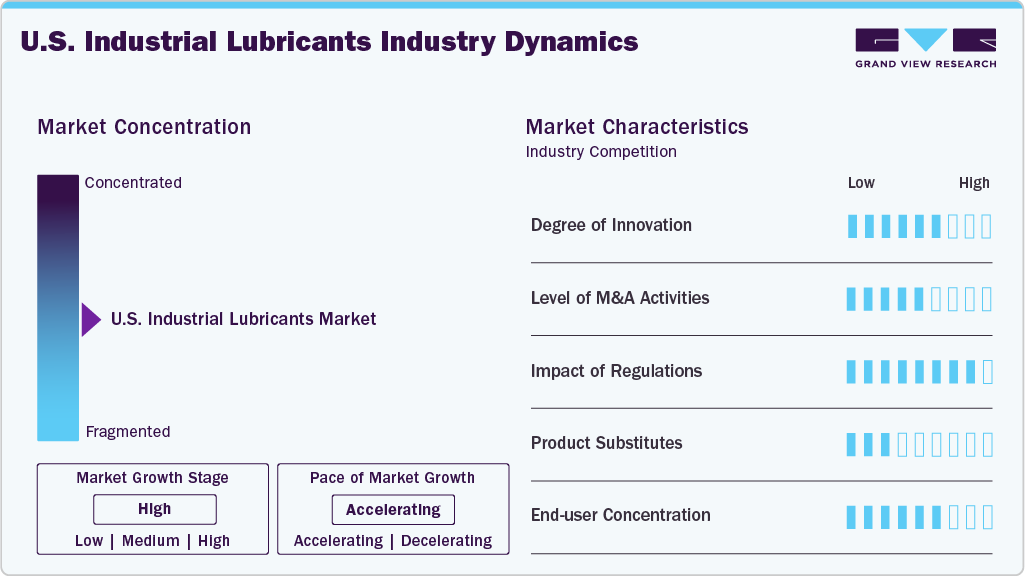

Market Concentration & Characteristics

The industry is moderately consolidated, led by a few major players with strong distribution networks and advanced formulation technologies. The market is shaped by the Region’s large manufacturing base, high automation levels, and strict environmental regulations promoting cleaner and longer-lasting lubricants. Innovation in synthetic and bio-based formulations, along with the push for energy-efficient machinery maintenance, defines the key characteristics of the market.

Key companies operating in the industry include ExxonMobil Corporation, Chevron Corporation, Royal Dutch Shell Plc, BP p.l.c., and Valvoline Inc., among others. These players focus on expanding their product portfolios with high-performance synthetic and bio-based lubricants to cater to the growing demand for efficiency and sustainability. Strategic partnerships, R&D investments, and regional distribution expansion remain central to their market positioning. Additionally, companies are increasingly adopting digital monitoring solutions and offering value-added services such as condition-based maintenance to strengthen customer relationships and enhance operational reliability.

Product Insights

The process oils segment dominated the market with the largest revenue share of 35.85% in 2024, primarily due to their wide use in industrial applications to finish and manufacture products such as defoamers, fertilizers, crop protection spray oils, hot-melt adhesives, explosives, petroleum jelly, optical cable fill gels, thermoplastic elastomers, textiles, and leather auxiliaries, among others. They are also used as a main ingredient in the manufacturing of tires. The increasing demand for radial and low-rolling resistance tires is likely to fuel the demand for process oils in the coming years.

Themetalworking fluids segment is expected to grow with a CAGR of 4.0% over the forecast period. These fluids are used to cool and lubricate metal parts during machining, grinding, and milling operations, helping reduce heat and friction between the cutting tool and the workpiece. They also enhance tool life, improve surface finish, and remove fine metal particles for better product quality. Rising demand from industries such as automotive, construction, and metal fabrication is driving their rapid growth, supported by the ongoing expansion of precision manufacturing in the region.

Application Insights

The chemical manufacturing segment captured the largest revenue share of 27.13% in 2024, primarily driven by the continuous expansion of specialty chemical production and diverse downstream industries. Operations involving pumps, compressors, and reactors require high-performance lubricants that ensure smooth functioning under harsh chemical conditions. Strict safety and environmental regulations are also pushing demand for synthetic lubricants that reduce leakage and emissions. Additionally, the growing emphasis on efficiency, reliability, and preventive maintenance in chemical plants is driving the adoption of long-lasting lubricants designed to enhance equipment performance and minimize downtime.

The energy segment is expected to grow with a CAGR of 3.9% over the forecast period, driven by the rapid expansion of renewable energy projects and ongoing activity in the oil and gas sector. Wind turbines, solar tracking systems, and natural gas generators increasingly require advanced lubricants to enhance efficiency and reduce wear under demanding operating conditions. High-performance synthetic lubricants are gaining traction for their ability to withstand extreme temperatures and extend equipment life. Additionally, the growing focus on preventive maintenance and cost optimization in energy operations is fueling steady demand for reliable and long-lasting lubricant solutions.

Regional Insights

The U.S. industrial lubricants market is supported by steady growth in manufacturing, construction, and energy infrastructure projects. The market is estimated to grow at a significant CAGR of 3.7% from 2025-2033, driven by increasing investments in automation and advanced machinery are driving the need for high-quality lubricants that enhance equipment reliability and reduce maintenance costs. The Region’s focus on reshoring manufacturing and strengthening domestic production capacity is also boosting lubricant demand across key industries. Moreover, the growing adoption of digital monitoring and smart maintenance systems is creating new opportunities for lubricant manufacturers to offer performance-optimized and technology-integrated solutions.

Southwest U.S. Industrial Lubricants Market Trends

The Southwest U.S. held the largest revenue share of 32.77% in 2024, driven by rapid growth in the manufacturing and energy sectors. The region hosts key industries such as defense, aerospace, automotive, electronics, and oil & gas, all of which require high-performance lubricants for smooth operations. Major investments, including Apple’s USD 500 billion plan and TSMC’s semiconductor manufacturing expansion in Arizona, are further boosting industrial activity. These large-scale projects are creating strong demand for specialized lubricants used in advanced machinery, semiconductor production, and heavy industrial equipment.

Texas holds the largest share in the Southwest U.S. industrial lubricants market, driven by its strong oil & gas, manufacturing, and energy sectors. The state’s extensive network of refineries, drilling operations, and petrochemical plants creates consistent demand for high-performance lubricants. Additionally, rapid industrial expansion in cities like Houston and Midland, along with increasing investments in renewable energy and heavy machinery, continues to strengthen Texas’s position as the leading consumer of industrial lubricants in the region.

West U.S. Industrial Lubricants Market Trends

The West region is emerging as the fastest-growing area in the U.S. industrial lubricants market, supported by a surge in high-tech manufacturing, renewable energy development, and industrial modernization. Growing production of electric vehicles and aerospace components across California and Washington has increased the need for precision-grade lubricants. The region’s commitment to sustainability is also encouraging the use of eco-friendly formulations, while the expansion of transportation and logistics networks continues to generate steady demand for industrial lubricants across multiple sectors.

California accounts for the largest share of the West region’s industrial lubricants market, owing to its diverse industrial landscape and strong technology-driven economy. The state’s expanding EV manufacturing, aerospace engineering, and renewable energy sectors rely heavily on precision equipment that requires specialized lubricants. Ongoing investments in advanced manufacturing and clean infrastructure are further boosting consumption, making California a key growth hub for innovative and sustainable lubricant solutions in the U.S. market.

Northeast U.S. Industrial Lubricants Market Trends

The Northeast U.S. is witnessing steady growth in the industrial lubricants market, supported by the expansion of its manufacturing and renewable energy sectors. The region has successfully evolved from traditional manufacturing to advanced production, with states like Massachusetts and New Jersey emerging as key industrial centers. New projects, such as Sika AG’s upcoming mortar production facility in New Jersey, are driving demand for high-performance lubricants used in modern machinery and production lines. Additionally, growing investments in offshore wind farms across Massachusetts and Maine are creating new opportunities for lubricant suppliers, as renewable energy plants rely heavily on specialized lubricants for turbines and related equipment.

New England is becoming an important growth area for the U.S. industrial lubricants market, supported by its strong presence in precision manufacturing, medical devices, and clean energy industries. States such as Massachusetts, Connecticut, and Rhode Island are home to advanced production facilities that demand high-quality lubricants to ensure accuracy and reliability in equipment performance. The region’s focus on sustainability and energy innovation, including offshore wind and battery storage projects, is also stimulating demand for specialized synthetic lubricants. Moreover, the steady expansion of high-value industries and infrastructure upgrades continues to create new opportunities for lubricant manufacturers in New England.

Mideast U.S. Industrial Lubricants Market Trends

The Mideast U.S. is witnessing steady growth in the industrial lubricants market, driven by renewed investments in advanced manufacturing and workforce development across states such as Ohio, Pennsylvania, and West Virginia. Government-backed initiatives, including the Appalachian Regional Commission’s POWER program, are fostering economic diversification and revitalizing manufacturing ecosystems in traditionally coal-dependent areas. These programs are improving infrastructure, expanding technical education, and equipping industries with automation and robotics capabilities-all of which enhance the need for high-performance lubricants to support modern machinery.

Southeast U.S. Industrial Lubricants Market Trends

The Southeast U.S. is emerging as a major hub for industrial lubricants demand, driven by rapid industrialization and the adoption of advanced manufacturing technologies across key sectors such as automotive, aerospace, and electric vehicles. The region’s strong emphasis on digital transformation and automation is creating greater reliance on high-performance lubricants to ensure the smooth operation of precision machinery and equipment. Growing investments from global manufacturers are further strengthening the region’s industrial ecosystem, with several states becoming preferred destinations for large-scale production facilities due to favorable land availability and pro-manufacturing policies.

Key U.S. Industrial Lubricants Companies Insights

Key players operating in the U.S. industrial lubricants market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include ExxonMobil Corporation, Fuchs, The Lubrizol Corporation, and Shell USA, Inc.

-

Fuchs operates as a subsidiary of Fuchs Petrolub SE, a German lubricants producer. The company produces lubricants for a variety of industries that include mining, energy, transportation, industrial manufacturing, construction, consumer goods, and agriculture. The product portfolio includes compressor oils, corrosion preventatives, engine oils, food grade, gear oils, glass lubricants, grease, hydraulic oils, metalworking & motorcycle. It has a total of 54 operating companies with 34 production plants across the globe.

-

Shell Plc, previously known as Royal Dutch Shell Plc, is an integrated gas and oil company that explores and produces gas and oil from conventional fields and sources like shale, tight rock, and coal formations. The company operates refining and petrochemical complexes worldwide. Shell offers a variety of products, including lubricants, liquefied petroleum gas, bitumen, and petrochemicals, which serve as raw materials for coatings, plastics, and detergents. Additionally, Shell is a significant producer of biofuel in Brazil. The company markets its products through distributors across North America, Asia, Europe, Africa, Oceania, and South America.

Key U.S. Industrial Lubricants Companies:

- ExxonMobil Corporation

- Fuchs

- The Lubrizol Corporation

- Shell USA, Inc.

- Phillips 66

- Lucas Oil Products, Inc.

- Amsoil, Inc.

- Calumet Branded Products, LLC (Bel-Ray Company, Inc.)

- TotalEnergies

- Kluber Lubrication

- Valvoline International, Inc.

- Chevron Corp.

- Clariant

- Quaker Chemical Corp.

- Castrol

- Blaser Swisslube, Inc.

- Calumet Specialty Products Partners, L.P.

- Petronas Lubricant International

- Idemitsu Kosan Co., Ltd.

U.S. Industrial Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8,317.0 million

Revenue forecast in 2033

USD 11,131.1 million

Growth rate

CAGR of 3.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

Northeast; Southwest; Mideast; Southeast; West

Key companies profiled

ExxonMobil Corporation; Fuchs; The Lubrizol Corporation; Shell USA, Inc.; Phillips 66; Lucas Oil Products, Inc.; Amsoil, Inc.; Calumet Branded Products, LLC (Bel-Ray Company, Inc.); TotalEnergies; Kluber Lubrication.; Valvoline International, Inc.; Chevron Corp.; Clariant; Quaker Chemical Corp.; Castrol; Blaser Swisslube, Inc.; Calumet Specialty Products Partners, L.P.; Petronas Lubricant International; Idemitsu Kosan Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to Region, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Industrial Lubricants Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. industrial lubricants market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Process Oils

-

General Industrial Oils

-

Gear Oil

-

Compressor Oil

-

Vacuum Pump Fluid

-

Hydraulics

-

Others

-

-

Metalworking Fluids

-

Industrial Engine Oils

-

Greases

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Metalworking

-

Textiles

-

Energy

-

Chemical Manufacturing

-

Food Processing

-

Others

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Northeast

-

Southwest

-

Mideast

-

Southeast

-

West

-

Frequently Asked Questions About This Report

b. The U.S. industrial lubricants market size was estimated at USD 8,051.4 million in 2024 and is expected to reach USD 8,317.0 million in 2025.

b. The U.S. industrial lubricants market is expected to grow at a compound annual growth rate of 3.7% from 2025 to 2033 to reach USD 11,131.1 million by 2033.

b. Chemical Manufacturing application dominated the U.S. industrial lubricants market with a share of 27.1% in 2024, primarily driven by continuous expansion of specialty chemical production and diverse downstream industries. Operations involving pumps, compressors, and reactors require high-performance lubricants that ensure smooth functioning under harsh chemical conditions.

b. Some key players operating in the U.S. industrial lubricants market include ExxonMobil Corporation; Fuchs; The Lubrizol Corporation, Shell USA, Inc., Phillips 66, Lucas Oil Products, Inc., Amsoil, Inc., Calumet Branded Products, LLC (Bel-Ray Company, Inc.), TotalEnergies, Kluber Lubrication., Valvoline International, Inc., Chevron Corp., Clariant, Quaker Chemical Corp., Castrol, Blaser Swisslube, Inc., Calumet Specialty Products Partners, L.P., Petronas Lubricant International, Idemitsu Kosan Co., Ltd.

b. The market is driven by growing manufacturing output, increasing adoption of advanced machinery, and rising need for efficient maintenance solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.