- Home

- »

- Next Generation Technologies

- »

-

U.S. Industrial Automation And Control Systems Market, 2030GVR Report cover

![U.S. Industrial Automation And Control Systems Market Size, Share & Trends Report]()

U.S. Industrial Automation And Control Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Control Systems (DCS, PLC, SCADA), By Component Type, By Vertical, And Segment Forecasts

- Report ID: GVR-4-68040-201-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

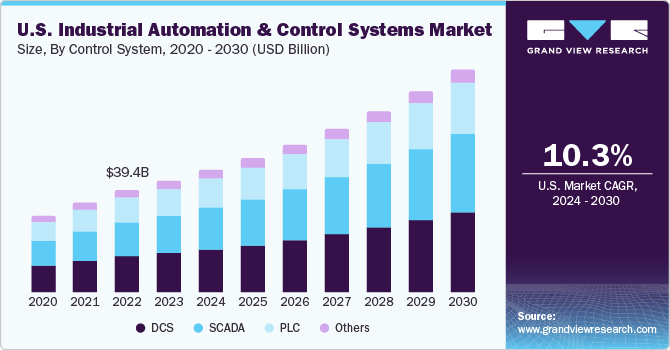

The U.S. industrial automation and control systems market size was estimated at USD 47.04 billion in 2024 and is expected to grow at a CAGR of 10.6% from 2025 to 2030. The increasing demand for enhanced operational efficiency is driving the market growth. With the rise of Industry 4.0, manufacturers are focusing on smart factories that leverage data analytics, AI, and IoT to improve machine performance, reduce downtime, and streamline production. Additionally, labor shortages and the need to reduce human intervention in hazardous environments are pushing industries to adopt automation, which is expected to present lucrative opportunities for the U.S. industrial automation and control systems industry in the coming years.

The U.S. industrial automation and control systems industry’s growth is driven by the increasing shift toward the adoption of cloud-based solutions for data management, offering manufacturers real-time insights into operations, enabling predictive maintenance, and improving overall decision-making. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) algorithms into automation systems, allowing for smarter and more autonomous control processes. Furthermore, the rise of industrial IoT (IIoT) is facilitating enhanced connectivity between devices, enabling the collection of valuable operational data that drives further improvements in efficiency and predictive analytics.

Additionally, emerging technologies, such as 5G networks, edge computing, and digital twins, are also propelling the U.S. industrial automation and control systems industry expansion. 5G networks are expected to enable ultra-low latency and high-speed communication, making real-time monitoring and control more efficient, particularly in sectors like autonomous vehicles and robotics. Edge computing, which processes data closer to the source rather than sending it to a central cloud, is enhancing the speed and reliability of control systems. Digital twins, virtual replicas of physical systems, are also gaining traction, offering manufacturers a better understanding of asset performance and allowing for predictive maintenance and optimization strategies.

The evolution of robotics, artificial intelligence (AI), and machine learning (ML) has significantly improved the capabilities of automation systems. These innovations enable more precise control, increased efficiency, and faster decision-making processes, allowing companies to optimize operations, reduce human errors, and achieve greater production flexibility. As these technologies continue to advance and become more cost-effective, their adoption within manufacturing processes is expected to rise, further accelerating market growth.

Workforce challenges, such as labor shortages and the need for highly skilled workers, are driving the adoption of industrial automation in the U.S. With the aging workforce and a gap in skilled labor, companies are turning to automation to bridge the gap and maintain productivity levels. By integrating automated systems into operations, businesses can reduce their dependence on manual labor for repetitive and hazardous tasks, allowing companies to focus human resources on higher-value tasks, such as innovation and problem-solving, thereby improving overall workforce efficiency, thereby propelling the U.S. industrial automation and control systems industry growth.

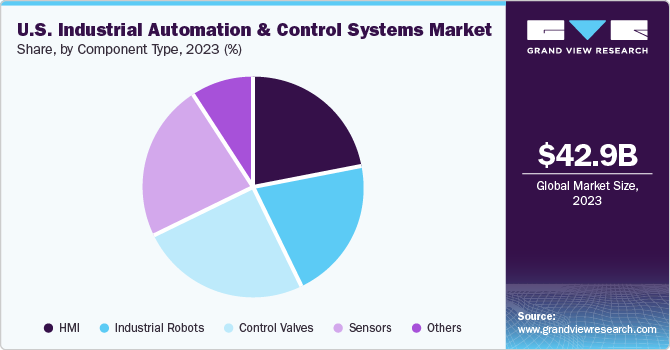

Component Type Insights

The control valves segment recorded the largest revenue share of over 25% in 2024, owing to the increasing demand for precise flow control in industrial processes. Control valves are essential in managing the flow of liquids, gases, and steam across a variety of industries, such as chemicals, oil and gas, power generation, and water treatment. As industries continue to focus on optimizing operations and improving efficiency, control valves play a critical role in regulating these processes, reducing waste, and ensuring system stability. The continuous advancements in valve technology, such as smart valves integrated with IoT for real-time monitoring and control, further contribute to the growth of this segment.

The industrial robots segment is projected to register the fastest CAGR of 12.6% from 2025 to 2030, driven by the increasing demand for automation in manufacturing environments. As companies seek to enhance productivity, reduce operational costs, and ensure consistent quality, industrial robots are becoming integral to a variety of industries, including automotive, electronics, and consumer goods. The advancements in robot technology, such as greater flexibility, precision, and improved human-robot collaboration, are making robots more accessible and cost-effective for a broader range of manufacturing processes. This trend, combined with the need for faster production cycles and higher operational efficiency, is expected to fuel significant growth in the industrial robots segment in the coming years.

Control System Insights

The DCS segment accounted for the largest revenue share in 2024, owing to its widespread use in industries that require highly reliable and efficient control over complex processes. DCS systems are essential in sectors such as oil and gas, power generation, and chemicals, where continuous monitoring and precise control are critical for maintaining operational safety and efficiency. With the increasing demand for automation, as well as the integration of IIoT (Industrial Internet of Things) technologies for better system monitoring and management, the DCS segment is well-positioned for sustained growth in the market.

The SCADA segment is anticipated to record the fastest CAGR from 2025 to 2030, driven by the ongoing adoption of Industry 4.0 and the increasing need for real-time monitoring and control across industries. SCADA systems are crucial in sectors such as energy, utilities, manufacturing, and transportation, where they enable centralized management of industrial operations and provide instant data for decision-making. The growing demand for smarter, more efficient production processes, coupled with advancements in IoT and cloud technologies, is fueling the adoption of SCADA systems. This trend is anticipated to drive the segment’s rapid growth in the coming years.

Vertical Insights

The manufacturing segment held the largest market share in 2024, fueled by the growing adoption of Industry 4.0 technologies, such as robotics, artificial intelligence (AI), and IoT-based control systems. These innovations enable manufacturers to optimize production processes, improve operational efficiency, and reduce labor costs while ensuring precision and consistency in output. Additionally, the integration of advanced networking architectures and real-time data analytics has further enhanced predictive maintenance and streamlined workflows, addressing challenges like rising labor costs and skilled worker shortages.

The healthcare segment is expected to grow at the fastest CAGR from 2025 to 2030, driven by the increasing adoption of automation and control systems to enhance patient care, reduce operational inefficiencies, and improve treatment precision. Automation in healthcare facilitates tasks such as patient monitoring, diagnostic imaging, and robotic-assisted surgeries, allowing for higher accuracy and reduced human error. With the growing demand for better healthcare services, remote monitoring, and data-driven decision-making, the healthcare industry is increasingly integrating automation technologies to improve outcomes, making it one of the fastest-growing segments in the market.

Key U.S. Industrial Automation And Control Systems Company Insights

Some of the key players operating in the market include ABB Ltd. and Honeywell International, Inc.

-

ABB Ltd. is a technology company specializing in automation solutions, motion, and electrification and operates through several business segments, including Robotics & Discrete Automation, Motion, Electrification, Industrial Automation, and Corporate. ABB's Industrial Automation segment offers process and discrete control solutions, advanced process control software, measurement and analytical instrumentation, and electric ship propulsion systems.

-

Honeywell International, Inc. offers a comprehensive portfolio of products, software, solutions, and services that cater to various industrial needs. Honeywell's industrial automation solutions focus on enhancing safety, sustainability, resilience, and productivity across different sectors. In the U.S. market, company provides advanced control systems, including distributed control systems (DCS), supervisory control and data acquisition (SCADA) systems, and safety systems.

Some of the emerging market players in the market include Rockwell Automation, Inc., and Yogokawa Electric Corporation., among others

-

Rockwell Automation, Inc. is a provider of industrial automation and digital transformation technologies. The company’s product portfolio includes well-known brands such as Allen-Bradley and FactoryTalk software, which cater to various industrial sectors including aerospace, automotive, and food and beverage. The company focuses on simplifying complex industrial challenges through innovative automation solutions and digital technologies.

-

Yokogawa Electric Corporation is a Japanese multinational corporation that specializes in industrial automation, control systems, and measurement technologies. The company operates globally with a strong presence in sectors such as oil and gas, chemicals, pharmaceuticals, and power generation. The company is known for its advanced control systems, including distributed control systems (DCS) and process automation solutions that enhance operational efficiency and safety for its clients.

Key U.S. Industrial Automation And Control Systems Companies:

- ABB Ltd.

- Dwyer Instruments

- Emerson Electric Co.

- Honeywell International, Inc.

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Electric Corporation

- OMRON Corporation

- Rockwell Automation, Inc.

- Schneider Electric Corporation

- Siemens AG

- Yokogawa Electric Corporation

Recent Developments

-

In March 2025, Schneider Electric Corporation launched a major new Energy Innovation Center in Houston, Texas, as part of its continued investment in advancing automation and energy sectors in North America. This 10,500 square-foot facility is strategically located in Houston's energy corridor and serves as a hub for showcasing AI-driven solutions, providing real-world plant simulations, and training for process control engineers.

-

In March 2025, Siemens AG announced significant investments in the US, including over USD 10 billion in manufacturing, AI, and software infrastructure. This includes opening new manufacturing facilities in Fort Worth, Texas, and Pomona, California, which will more than double Siemens' production capacity for electric equipment. Additionally, Siemens is acquiring Altair, a Michigan-based software company, to enhance its AI-powered design and simulation capabilities.

-

In January 2025, ABB Ltd. announced a USD 120 billion investment to expand its US manufacturing operations. The investment includes a new 320,000-square-foot facility in Selmer, Tennessee, with USD 80 billion allocated for its construction. Additionally, ABB will invest USD 40 billion to expand its existing facility in Senatobia, Mississippi.

U.S. Industrial Automation and Control Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 51.63 billion

Revenue forecast in 2030

USD 85.55 billion

Growth rate

CAGR of 10.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component type, control system, vertical

Key companies profiled

ABB Ltd.; Emerson Electric Co.; Honeywell International, Inc.; Kawasaki Heavy Industries, Ltd.; Mitsubishi Electric Corporation; OMRON Corporation; Rockwell Automation, Inc.; Schneider Electric Corporation, Siemens AG; Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Industrial Automation and Control Systems Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. industrial automation and control systems market report based on component type, control system, and vertical:

-

Component Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

HMI

-

Industrial Robots

-

Control Valves

-

Sensors

-

Others

-

-

Control System Outlook (Revenue, USD Billion, 2018 - 2030)

-

DCS

-

PLC

-

SCADA

-

Others

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Chemical

-

Energy & Utilities

-

Food & Beverage

-

Healthcare

-

Manufacturing

-

Mining & Metal

-

Oil & Gas

-

Transportation

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. industrial automation and control systems market size was valued at USD 47.04 billion in 2024 and is expected to reach USD 51.63 billion in 2025.

b. The U.S. industrial automation and control systems market is expected to grow at a compound annual growth rate (CAGR) of 10.6% from 2025 to 2030 to reach USD 85.55 billion by 2030.

Which segment accounted for the largest U.S. industrial automation and control systems market share?b. The DCS control system segment dominated the U.S. industrial automation and control systems market with a share of over 35% in 2024. This segment is growing as a result of the fast pace of adoption of IIOT preference of industrialists to deploy automated control systems.

b. Some key players operating in the U.S. industrial automation and control systems market include ABB Ltd.; Emerson Electric Co.; Honeywell International, Inc.; Kawasaki Heavy Industries, Ltd.; Mitsubishi Electric Corporation; OMRON Corporation; Rockwell Automation, Inc.; Schneider Electric; Siemens AG; Yokogawa Electric Corporation.

b. The factors driving the U.S. industrial automation and control systems market include the introduction of sophisticated technologies such as robotics and AI, the advent of Industry 4.0, and the penetration of the Internet of Things (IoT) in factory automation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.