- Home

- »

- Clinical Diagnostics

- »

-

U.S. In Vitro Diagnostics Market Size, Industry Report, 2030GVR Report cover

![U.S. In Vitro Diagnostics Market Size, Share & Trends Report]()

U.S. In Vitro Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Reagents, Services), By Technology (Immunoassay, Molecular Diagnostics), By Application (Infectious Disease), By Test Location, By End Use, And Segment Forecasts

- Report ID: GVR-4-68039-256-6

- Number of Report Pages: 358

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. In Vitro Diagnostics Market Trends

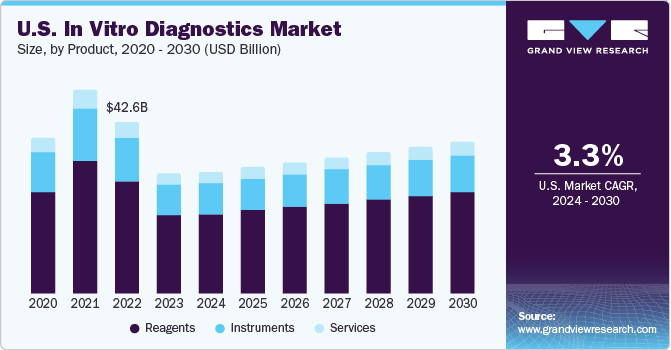

The U.S. in vitro diagnostics market size was estimated at USD 41.42 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2030. The market growth is declining due to a decrease in demand for COVID-19 tests during forecast period. However, the development of automated in vitro diagnostic systems for laboratories & hospitals to provide error-free, efficient, and accurate diagnosis is anticipated to drive the U.S. in vitro diagnostics market over the study period. In addition, the growing prevalence of infectious and chronic diseases is projected to boost adoption of in vitro diagnostic testing techniques in the U.S. For instance, according to American Cancer Society, in 2023, about 1.96 million new cancer cases were reported, and around 609,820 individuals died due to cancer.

Geriatric population in the U.S. is gradually increasing. According to America’s Health Rankings senior report, more than 54 million adults aged 65 & above are living in the U.S., accounting for 16.5% of the country’s population. By 2050, this number is estimated to surpass 85.7 million. Moreover, with rising age, the immune system is affected, which surges susceptibility to numerous diseases. Thus, a large geriatric population needs improved healthcare, especially for diagnosis of chronic diseases. In addition, geriatric population is more likely to suffer from COVID-19 due to decreased immune function, multimorbidity, and physiological changes associated with aging. According to the CDC data published in May 2023, the mortality rate due to COVID-19 is much higher in geriatric population. The risk of death in COVID-19 patients aged 65 and above increases more than 60 times compared to the age group of 18 to 29.

Technological advancements in terms of accuracy, cost-effectiveness, and portability are expected to be among high-impact rendering drivers for in vitro diagnostics market. Leading market participants are updating their range of testing options for qPCR instruments by undertaking research and development initiatives for the development of kits that target life-threatening conditions or by entering into collaborations with other kit manufacturing players. For instance, in March 2023, Atila Biosystems and Stilla Technologies agreed to market co-labeled digital PCR kits. The kits and assays are manufactured by Atila and would be used on naica systems, Stilla’s lead PCR instrument.In January 2023, QIAGEN launched EZ2 Connect MDx platform to propel its capabilities of automation in sample processing. The advancement would be compatible with PCR, dPCR, and other downstream applications.

Moreover, growing efforts from government and nongovernment organizations to promote development of rapid diagnostics solutions are expected to offer lucrative growth opportunities in U.S. in vitro diagnostics market. For instance, in October 2022, Day Zero Diagnostics, Inc., a leader in infectious disease diagnostics, announced that it has been awarded additional funding of USD 8.2 million from CARB-X for development of precise and cutting-edge diagnostic solutions for infectious diseases. In addition, active government support to develop rapid diagnostics solutions is another factor contributing to the U.S. in vitro diagnostics market growth. For instance, in October 2021, the NIH granted funding of USD 78 million to develop novel rapid diagnostics solutions for COVID-19. Ultimate aim of this funding was to develop PoC solutions for detecting multiple respiratory infections.

Market Dynamics

Growing demand for personalized IVD instruments to achieve the best diagnostic standards is putting pressure on the supply chain. The supply chain of diagnostic equipment and parts has received high attention following the turmoil in Chinese and Asian regions due to the pandemic. Increased freight prices and competition to acquire superior quality materials have intensified competitive rivalry among players. However, the rise in the number of vaccinated individuals is projected to reduce the burden on IVD tests.

The PCR capacity of the country has significantly increased owing to increased installations of PCR machines during the pandemic. To utilize this newly acquired capacity, owners are trying to push alternative diagnostic tests to consumers. The regulatory framework for IVD has changed in the past year, and emergency approvals have increased to help companies address the pandemic. However, this may impact the industry adversely once regulatory flexibility is removed in the post-pandemic era.

Stringent precision and calibration quality control mechanisms ensure the utmost quality of devices and analyzers. Outsourcing is also becoming a significant trend in the market, which ensures profitability and quality. For instance, the usual outsourcing destinations of U.S.-based companies are Asian nations such as China, Singapore, and India.

When compared to diagnostic equipment, the value chain is more complicated and highly impacted by fluctuations in the market due to its high demand. Hence, any changes in marketing environment may lead to a sudden surge or drop in demand, which makes inventory management difficult for companies. For instance, during the first wave of SARS-CoV-2 infection in the U.S., the sudden increase in demand for reagents led to shortage.

Product Insights

Reagent segment held the largest market share of 65.9% in 2024, owing to extensive R&D initiatives being undertaken by major market players for development of novel biomarker kits. Furthermore, introduction and commercialization of new reagents are expected to drive in vitro diagnostics market growth. For instance, in October 2022, Thermo Fisher Scientific launched TaqPath enteric bacterial select panel test to detect gastrointestinal bacterial infections within two hours. In addition, rising approval of in vitro diagnostics for emergency use by regulatory authorities is expected to fuel segment growth. For instance, in March 2021, the U.S. FDA granted 510(k) clearance for the BioFire Respiratory Panel 2.1 to identify multiple respiratory infections, including COVID-19.

In 2024, instruments accounted second largest revenue share of the market. Increasing technological advancements, such as the introduction of portable instruments like cobas 4800 developed by GeneXpert by Cepheid and Roche Diagnostics and may boost market growth during the projected timeframe. Furthermore, key players are also focused on developing new technologies with higher efficiency & accuracy, such as Ortho Vitros XT 7600 integrated system-digital chemistry technology-which was intended to perform two separate laboratory tests simultaneously. Moreover, leading market participants are entering into partnerships to strengthen their product portfolios and offer precise diagnostic solutions. For instance, in September 2022, bioMérieux and Brightsight, Inc. announced a partnership to develop clinical digital solutions for diagnostic testing.

Technology Insights

Immunoassay held the largest share in 2024, attributed to increasing adoption of rapid testing and point-of-care testing. The growth is attributed to its crucial role in detecting a wide range of diseases, including cancer, cardiovascular conditions, infectious diseases, and autoimmune disorders. Immunoassays, which utilize antibodies or antigens to detect specific biomolecules in patient samples, are widely used in clinical laboratories and point-of-care testing settings due to their high sensitivity, specificity, and rapid results. The growing prevalence of chronic diseases, advancements in assay technologies, and the increasing demand for personalized medicine are contributing to the expansion of this segment. Additionally, the adoption of immunoassays in monitoring therapeutic efficacy and disease progression is further fueling their use.

Coagulation is expected to be the fastest-growing segment over the forecast period, owing to its crucial role in detecting a wide range of diseases, including cancer, cardiovascular conditions, infectious diseases, and autoimmune disorders. Immunoassays, which utilize antibodies or antigens to detect specific biomolecules in patient samples, are widely used in clinical laboratories and point-of-care testing settings due to their high sensitivity, specificity, and rapid results. The growing prevalence of chronic diseases, advancements in assay technologies, and the increasing demand for personalized medicine are contributing to the expansion of this segment. Additionally, the adoption of immunoassays in monitoring therapeutic efficacy and disease progression is further fueling their use. For instance, in November 22, 2024, Roche announced the launch of three new coagulation tests specifically designed to monitor Factor Xa inhibitors, which are increasingly used in patients with conditions such as atrial fibrillation and deep vein thrombosis. These tests are aimed at meeting the rising demand for effective monitoring of these anticoagulants. The new assays will provide healthcare professionals with tools to better manage patient care, ensuring safety and efficacy in treatment.

Application Insights

In 2024, infectious diseases segment held the largest revenue share, and is expected to maintain its dominance throughout the projection period. Leading market participants are engaged in commercializing precise testing solutions for infectious diseases. For instance, in December 2021, Roche launched new tests for infectious diseases on the Cobas 5800 system in countries accepting CE marking. This launch expanded the company’s molecular diagnostics portfolio. Moreover, 57% of patients were reported to have colonized MDR bacteria during post-acute care admission. Prolonged hospitalization is also a source of MDR bacterial infections. The rate of getting a novel resistant gram-negative bacillus was 13.6% per 1,000 patient days of hospitalization. Hence, continuous monitoring and molecular tests for early detection are crucial for limiting the spread of hospital-acquired infections like HABP/VABP, bloodstream infections, and UTIs.

Oncology segment is anticipated to experience the fastest CAGR over the forecast period. Cancer is estimated to be the second most common cause of death in the U.S. Genomic and genetic variation molecular tests have become a crucial part in management of breast cancer. These tests can help predict breast cancer in patients with a family history of this condition. Furthermore, technological advancements in cancer diagnostics and rising interventions of AI in cancer diagnosis are facilitating segment expansion. For instance, in September 2022, Ibex Medical Analytics launched the Galen 3.0, a transformative solution for the diagnosis of multiple tissue types across digital pathology workflows. This product is expected to transform the diagnosis of breast, gastric, and prostate cancers.

Test Location Insights

Other test locations segment dominated the U.S. in vitro diagnostics market in 2024. This segment includes a range of settings beyond traditional clinical laboratories, such as outpatient clinics, remote testing locations, and point-of-care (POC) facilities. The dominance of this segment can be attributed to the growing demand for more accessible and immediate testing options, particularly in the wake of the COVID-19 pandemic. As healthcare systems increasingly prioritize convenience and speed, testing outside of hospitals and centralized labs has become a critical factor in expanding diagnostic access. Additionally, the rise of decentralized healthcare and the adoption of portable, user-friendly diagnostic devices have propelled the growth of the "Other test locations" segment. The flexibility of testing in diverse settings is increasingly valued, especially for routine tests, infectious disease diagnostics, and chronic disease monitoring, driving this segment's substantial market share.

Home-care segment is anticipated to experience the fastest CAGR over the forecast period. This segment encompasses in vitro diagnostic solutions tailored for home use, including self-testing kits, digital health platforms, and devices that allow patients to monitor health conditions from the comfort of their homes. The rapid growth in the home-care segment is largely driven by increased consumer preference for convenience, privacy, and cost-efficiency in managing healthcare. The proliferation of chronic diseases such as diabetes, cardiovascular conditions, and infectious diseases has also fueled demand for home-based diagnostic tests that enable patients to manage their conditions without frequent hospital visits.

End-use Insights

Hospitals segment dominated the U.S. in vitro diagnostics market in 2024. Due to rising hospitalization rates, doctors rely on diagnostic interpretation for treatment decisions. Diagnostic centers often collaborate with hospitals, which already have their diagnostics setups. Continuous development of healthcare infrastructure is expected to improve existing hospital facilities, driving demand for hospital-based in vitro diagnostic tests. Hospitals purchase and use in vitro diagnostic devices in large volumes. In 2022, the U.S. had over 6,093 hospitals that depend on in vitro diagnostic tests for prompt and precise decision-making due to their ability to provide fast and accurate results.

Home care segment is expected to exhibit the fastest CAGR during forecast period, due to the growing geriatric population and rising demand for home care in vitro diagnostic devices. With the increasing demand of molecular diagnosis, there is a growing need for a molecular diagnostics platform that can assist patients in conducting self-tests. ADEXUSDx HIV 1/2 Test, Home Access Express HIV-1 Test (Home Access Health Corp), and Home Access Hepatitis C Test (Home Access Health Corp) are few available home diagnostic tests. Regulatory authorities rigorously evaluate the performance of diagnostic tests to meet standards of performance, quality, and safety. For instance, as of January 2023, the U.S. FDA has approved around 30 at-home COVID-19 tests, which are available without a prescription at retail stores and online platforms. Most of the authorized OTC COVID-19 tests are antigen tests.

Key U.S. In Vitro Diagnostics Company Insights

Major players are opting for market strategies for strategic collaborations and partnerships through mergers & acquisitions in the country. Established market players are focusing on strategies such as mergers & acquisitions, collaborations, and development of new products. In addition, these companies aim to expand their businesses in developing economies to increase their market share. New entrants face high competition owing to the presence of well-established players.

Key U.S. In Vitro Diagnostics Companies:

- Abbott

- F. Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories, Inc.

- Siemens Healthcare GmbH

- Agilent Technologies, Inc.

- Qiagen

- bioMérieux

- Quidel Corporation

- BD (Becton Dickinson and Company)

Recent Developments

-

In March 2023, F. Hoffmann-La Roche Ltd., collaborated with Eli Lily and Company to support the development of Roche’s Elecsys Amyloid Plasma Panel (EAPP).

-

In February 2023, bioMérieux received CLIA waiver and 510(k) clearance and for BIOFIRE SPOTFIRE system and its BIOFIRE SPOTFIRE respiratory panel. Such initiatives are contributing for in vitro diagnostics market in the U.S.

U.S. In Vitro Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 43.70 billion

Revenue forecast in 2030

USD 57.43 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in number of tests & instruments, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, product, test location, end-use

Country scope

U.S.

Key companies profiled

Abbott; F. Hoffmann-La Roche Ltd.; Bio-Rad Laboratories, Inc.; Siemens Healthcare GmbH; Agilent Technologies, Inc.; Qiagen; bioMérieux; Quidel Corporation; BD (Becton Dickinson and Company).

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. In Vitro Diagnostics Market Report Segmentation

This report forecasts the volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. in vitro diagnostics market report based on product, technology, application, test location and end-use.

-

Product Outlook (Volume, Number of Tests and Instruments; Revenue, USD Billion, 2018 - 2030)

-

Instruments

-

Reagents

-

Services

-

-

Technology Outlook (Volume, Number of Tests and Instruments; Revenue, USD Billion, 2018 - 2030)

-

Immunoassays

-

Instruments

-

Reagents

-

Services

-

-

Hematology

-

Instruments

-

Reagents

-

Services

-

-

Clinical Chemistry

-

Instruments

-

Reagents

-

Services

-

-

Molecular Diagnostics

-

Instruments

-

Reagents

-

Services

-

-

Coagulation

-

Instruments

-

Reagents

-

Services

-

-

Microbiology

-

Instruments

-

Reagents

-

Services

-

-

Others

-

Instruments

-

Reagents

-

Services

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infectious Diseases

-

Upper respiratory

-

Gastrointestinal panel testing

-

Methicillin-resistant Staphylococcus Aureus (MRSA)

-

Clostridium difficile

-

Vancomycin-Resistant Enterococci (VRE)

-

Carbapenem-resistant bacteria

-

Flu

-

Respiratory Syncytial Virus (RSV)

-

Candida

-

Tuberculosis (TB) and drug-resistant TB

-

Meningitis

-

Chlamydia

-

Gonorrhoea

-

HIV

-

Hepatitis C

-

Hepatitis B

-

Other infectious disease

-

-

Diabetes

-

Oncology

-

Cardiology

-

Nephrology

-

Autoimmune Diseases

-

Drug Testing

-

Hematologic Diseases

-

Others

-

-

Test location Outlook (Revenue, USD Billion, 2018 - 2030)

-

Point of Care

-

Home-care

-

Others

-

-

End Use Outlook (Volume, Number of Tests and Instruments; Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Immunoassays

-

Instruments

-

Reagents

-

Services

-

-

Hematology

-

Instruments

-

Reagents

-

Services

-

-

Clinical Chemistry

-

Instruments

-

Reagents

-

Services

-

-

Molecular Diagnostics

-

Instruments

-

Reagents

-

Services

-

-

Coagulation

-

Instruments

-

Reagents

-

Services

-

-

Microbiology

-

Instruments

-

Reagents

-

Services

-

-

Others

-

-

Laboratories

-

Immunoassays

-

Instruments

-

Reagents

-

Services

-

-

Hematology

-

Instruments

-

Reagents

-

Services

-

-

Clinical Chemistry

-

Instruments

-

Reagents

-

Services

-

-

Molecular Diagnostics

-

Instruments

-

Reagents

-

Services

-

-

Coagulation

-

Instruments

-

Reagents

-

Services

-

-

Microbiology

-

Instruments

-

Reagents

-

Services

-

-

Others

-

-

Home-care

-

Immunoassays

-

Instruments

-

Reagents

-

Services

-

-

Hematology

-

Instruments

-

Reagents

-

Services

-

-

Clinical Chemistry

-

Instruments

-

Reagents

-

Services

-

-

Molecular Diagnostics

-

Instruments

-

Reagents

-

Services

-

-

Coagulation

-

Instruments

-

Reagents

-

Services

-

-

Microbiology

-

Instruments

-

Reagents

-

Services

-

-

Others

-

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. in vitro diagnostics market size was estimated at USD 41.42 billion in 2024 and is expected to reach USD 43.70 billion in 2025.

b. The U.S. in vitro diagnostics market is expected to grow at a compound annual growth rate of 5.62% from 2025 to 2030 to reach USD 57.43 billion by 2030.

b. Some key players operating in the U.S. in vitro diagnostics market include Abbott; bioMérieux SA; Bio-Rad Laboratories, Inc.; Siemens Healthineers; Qiagen; Quidel Corporation; F. Hoffmann-La Roche Ltd; & Becton Dickinson and Company.

b. Immunoassays dominated the U.S. in vitro diagnostics market with a share of 29.86% in 2024. This is attributable to increasing approvals and t and rising need for early diagnosis.

b. Key factors that are driving the U.S. in vitro diagnostics market growth include increasing installment base of instruments and increasing development of automated IVD systems to provide efficient, accurate, & error-free diagnosis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.