- Home

- »

- Biotechnology

- »

-

U.S. Human Primary Cell Culture Market Size Report, 2030GVR Report cover

![U.S. Human Primary Cell Culture Market Size, Share & Trends Report]()

U.S. Human Primary Cell Culture Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Primary Cells, Primary Cell Culture Media), By Application, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-501-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

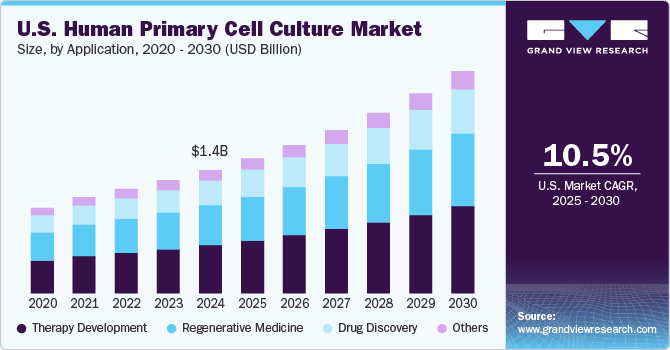

The U.S. human primary cell culture market size was estimated at USD 1.43 billion in 2024 and is expected to grow at a CAGR of 10.5% from 2025 to 2030. This growth is driven by increasing applications of primary cell cultures in drug discovery, cancer research, and regenerative medicine. Rising demand for personalized medicine and cell-based technology advancements are fueling market expansion. In addition, the focus on reducing animal testing in research is boosting the adoption of human primary cells. Companies are investing in innovative cell culture products to meet the growing need for reliable and efficient research tools.

The COVID-19 pandemic accelerated growth in the U.S. human primary cell culture industry by driving increased investments in biomedical research. Government and private sector funding prioritized advancements in diagnostics and therapeutics, significantly boosting demand for human primary cell cultures. These technologies became critical for studying disease pathways and supporting precision medicine development. The pandemic also highlighted inefficiencies in traditional research models, encouraging the adoption of innovative solutions. This shift drove rapid growth in advanced cell culture technologies, such as 3D culture systems and organ-on-a-chip platforms, positioning the market for sustained expansion and innovation.

Moreover, the country's rising number of cancer cases is the major factor propelling the market. The American Cancer Society estimated that over 1.9 million new cancer patients will be diagnosed in the U.S. in 2023. Moreover, as per the U.S. Department of Health & Human Services, in 2020, the country reported 1,603,844 new cancer cases and 602,347 deaths. It further reports that around 20% of deaths in the U.S. are caused by cancer. NGS helps determine novel and rare cancer mutations, identifies familial cancer mutation carriers, and helps find suitable targeted treatments. Therefore, it is anticipated that an upsurge in cancer cases and patients across the globe can drive the demand for clinical oncology in NGS in the country market.

In addition, innovations in the U.S. human primary cell culture industry are driving growth by enabling the use of primary cells to create patient-specific models for personalized medicine and advanced therapies. Technologies like organoids and spheroids are gaining traction in regenerative medicine for developing tissue replacements and addressing conditions such as organ failure and genetic disorders. These advancements also reduce the need for animal testing by providing more ethical and accurate alternatives. The increasing focus on personalized healthcare and progress in gene therapy is further accelerating the adoption of 3D culture systems. As these technologies advance, they open new avenues for research, treatment development, and healthcare innovation, propelling market growth.

Furthermore, the U.S. human primary cell culture industry is experiencing significant growth due to increased investment in biomedical research. Government initiatives, such as funding for advanced healthcare technologies and substantial contributions from private organizations, are driving innovation in cell culture systems. These investments enable developing and adopting cutting-edge technologies, such as 3D culture models and organ-on-a-chip platforms, which enhance research accuracy and efficiency. The focus on improving drug discovery, developing precision medicine, and addressing complex diseases has further accelerated the demand for advanced primary cell culture systems. This financial support fosters technological advances and strengthens the market's position as a critical component of modern biomedical research.

Market Concentration & Characteristics

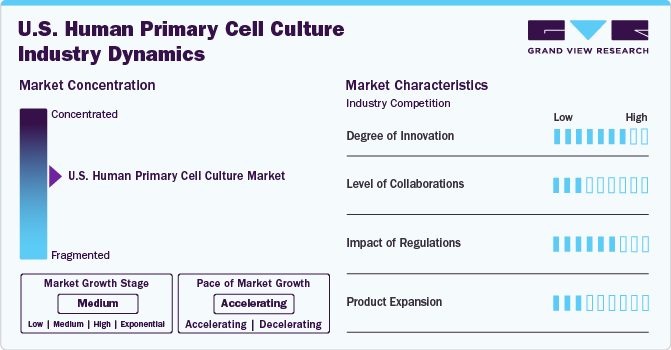

Innovation in the U.S. human primary cell culture industry is accelerating, driven by advancements in 3D culture systems, organ-on-a-chip platforms, and co-culture techniques. Increased funding for biomedical research, growing demand for precision medicine, and shifting away from traditional animal models fuel this progress. Furthermore, collaborations between academic institutions, biotech firms, and pharmaceutical companies are fostering the development of novel solutions, enhancing the market's capacity to support drug discovery and complex disease research.

The U.S. human primary cell culture industry features moderate collaboration among industry players, including partnerships between biotech firms, pharmaceutical companies, and research institutions. These collaborations focus on advancing cell culture technologies, improving product offerings, and addressing complex research needs, ultimately driving innovation and enhancing the market's growth potential. For instance, in December 2024, BioCentriq signed a long-term lease for a new manufacturing facility in Princeton, NJ, which will serve as its headquarters. The USD 12M investment will enhance its capabilities in cell therapy development and production.

Regulatory frameworks significantly influence the U.S. human primary cell culture industry. Stringent guidelines for product safety, quality, and ethical research practices drive the adoption of advanced technologies and standardized processes. Regulations promoting alternatives to animal testing further boost demand for human cell culture systems. Compliance with these policies ensures reliability and fosters trust among researchers and stakeholders, supporting market growth.

The U.S. human primary cell culture industry is experiencing rapid growth and product expansion due to several key factors. These include increasing demand for precision medicine and personalized therapies, cell culture technologies like 3D systems and organ-on-a-chip platforms advancements, and growing investment in biomedical research. Moreover, a shift toward reducing animal testing and the rising focus on regenerative medicine and oncology research are further fuelling innovation and market expansion.

Application Insights

Therapy development held the largest revenue share of over 39.12% in 2024, driven by the increasing use of primary cell cultures in creating advanced treatments, including regenerative therapies and targeted drugs. Cell cultures' ability to mimic human physiological conditions makes them crucial for precision medicine and personalized treatment development, fueling their dominance in the market. These advantages are anticipated to support the segment's growth over the forecast period.

The regenerative medicine segment is expected to register the highest CAGR of 10.83% over the forecast period, driven by the growing use of primary cell cultures in tissue regeneration, stem cell research, and therapeutic development. These cultures are essential for creating more effective treatments and addressing complex diseases, providing a reliable model for regenerative therapies. Their ability to closely mimic human biology enhances research and accelerates clinical applications. These advantages are anticipated to support the segment growth over the forecast period.

Product Insights

Based on the product, the market is segmented into Primary Cells, Reagents and Supplements, and Primary Cell Culture Media. The primary cells segment held the largest revenue share of 35.08% in 2024, driven by their widespread use in drug discovery, toxicology studies, and personalized medicine. Their ability to closely mimic human physiological conditions makes them essential for reliable research outcomes. Increasing adoption in oncology, immunology, and regenerative medicine and advancements in primary cell isolation and culture techniques further contributed to their dominant market position.

Primary cell culture media is expected to grow at the fastest CAGR over the forecast period in the product segment. This growth is driven by increasing demand for high-quality media to support the viability and functionality of primary cells in advanced research applications, such as drug discovery and regenerative medicine. Innovations in media formulations tailored to specific cell types further contribute to its rapid market expansion.

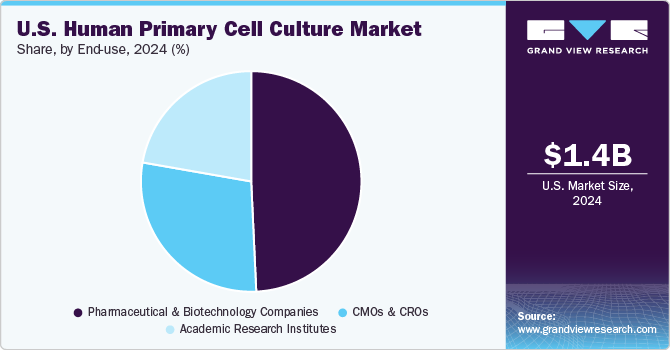

End-use Insights

The pharmaceutical and biotechnology companies segment held the largest market share, accounting for over 49.27% of the revenue in 2024. This is due to the high demand for primary cell cultures in drug discovery, toxicology studies, and therapeutic development. Pharmaceutical and biotech firms utilize these cultures to enhance the accuracy of preclinical testing and improve drug efficacy. With increased investments in R&D and advancements in cell culture technologies, the segment continues to expand. These advantages are anticipated to support the segment growth over the forecast period.

As an end use, CMOs & CROs are expected to witness the highest CAGR over the forecast period due to the increasing demand for outsourced research and manufacturing services. These organizations rely on primary cell cultures for drug development, testing, and production, offering specialized expertise to pharmaceutical and biotechnology companies. The need for cost-effective, efficient, and scalable solutions in clinical trials and manufacturing processes further fuels this growth. These advantages associated are anticipated to support the segment growth over the forecast period.

Key U.S. Human Primary Cell Culture Company Insights

Numerous participants operate in the market. Firms in the industry are undertaking numerous strategies, such as launching novel products, partnerships, and collaborations, to maintain their market presence.

Key U.S. Human Primary Cell Culture Companies:

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Lonza Group

- Corning Incorporated

- Danaher Corporation

- QIAGEN N.V.

- STEMCELL Technologies

- Becton, Dickinson and Company (BD)

- Bio-Techne Corporation

- Charles River Laboratories

Recent Developments

-

In December 2024, PeproMene Bio secured a USD 11 million investment from IFLI to support the development of its BAFF-R CAR T-cell therapy for relapsed or refractory follicular lymphoma.

-

In October 2024, BioCentriq signed a long-term lease for a new manufacturing facility in Princeton, NJ, which will serve as its headquarters. The USD 12M investment will enhance its capabilities in cell therapy development and production.

-

In April 2024, PromoCell introduced Cryo-SFM Plus, an advanced cryopreservation medium tailored for the human primary cell culture market. It ensures the integrity and viability of human and animal cells during long-term storage.

U.S. Human Primary Cell Culture Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.58 billion

Growth rate

CAGR of 10.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Country scope

U.S.

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; Lonza Group; Corning Incorporated; Danaher Corporation; QIAGEN N.V.; STEMCELL Technologies; Becton, Dickinson and Company (BD); Bio-Techne Corporation; Charles River Laboratories

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Human Primary Cell Culture Market Report Segmentation

This report forecasts revenue growth and analyzes the latest trends in each of the sub-segments from 2018 to 2030. Grand View Research has segmented the U.S. human primary cell culture market report based on product, application, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary Cells

-

Hematopoietic Cells

-

Skin Cells

-

Hepatocytes

-

Gastrointestinal Cells

-

Lung Cells

-

Renal Cells

-

Heart Cells

-

Skeletal and Muscle Cells

-

Other Primary Cells

-

-

Primary Cell Culture Media

-

Serum-free Media

-

Serum-containing Media

-

Others

-

-

Reagents and Supplements

-

Attachment Solutions

-

Buffers and Salts

-

Sera

-

Growth Factors and Cytokines

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery

-

Therapy Development

-

Regenerative Medicine

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

CMOs & CROs

-

Academic Research Institutes

-

Frequently Asked Questions About This Report

b. The U.S. human primary cell culture market size was estimated at USD 1.43 billion in 2024 and is expected to reach USD 1.57 billion in 2025.

b. The U.S. human primary cell culture market is expected to grow at a compound annual growth rate of 10.46% from 2025 to 2030 to reach USD 2.58 billion by 2030.

b. The primary cells segment held the largest market share of 35.08% in 2024 for the product segment due to their widespread use in drug discovery, toxicology studies, and personalized medicine.

b. Some key market players operating in the U.S. human primary cell culture market are Thermo Fisher Scientific, Inc.; Merck KGaA; Lonza Group; Corning Incorporated; Danaher Corporation; QIAGEN N.V.; STEMCELL Technologies; Becton, Dickinson and Company (BD); Bio-Techne Corporation; and Charles River Laboratories.

b. Increasing applications of primary cell cultures in drug discovery, cancer research, and regenerative medicine drive U.S. human primary cell culture market growth. Rising demand for personalized medicine and advancements in cell-based technologies are also fueling market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.