- Home

- »

- Medical Devices

- »

-

U.S. Hospice Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Hospice Market Size, Share & Trends Report]()

U.S. Hospice Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Routine Home Care, Continuous Home Care, Inpatient Respite Care), By Location (Hospice Center, Home Hospice Care), By Diagnosis (Dementia, Cancer), And Segment Forecasts

- Report ID: GVR-3-68038-696-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Hospice Market Size & Trends

The U.S. hospice market was estimated at USD 29.92 billion in 2024 and is projected to grow at a CAGR of 4.61% from 2025 to 2030. The growth of the market is attributed to the rising prevalence of chronic diseases among rapidly growing geriatric populations. In addition, increasing need for quality healthcare services at home along with growing Medicare reimbursement for hospice care is expected to further drive the market growth over the forecast period.

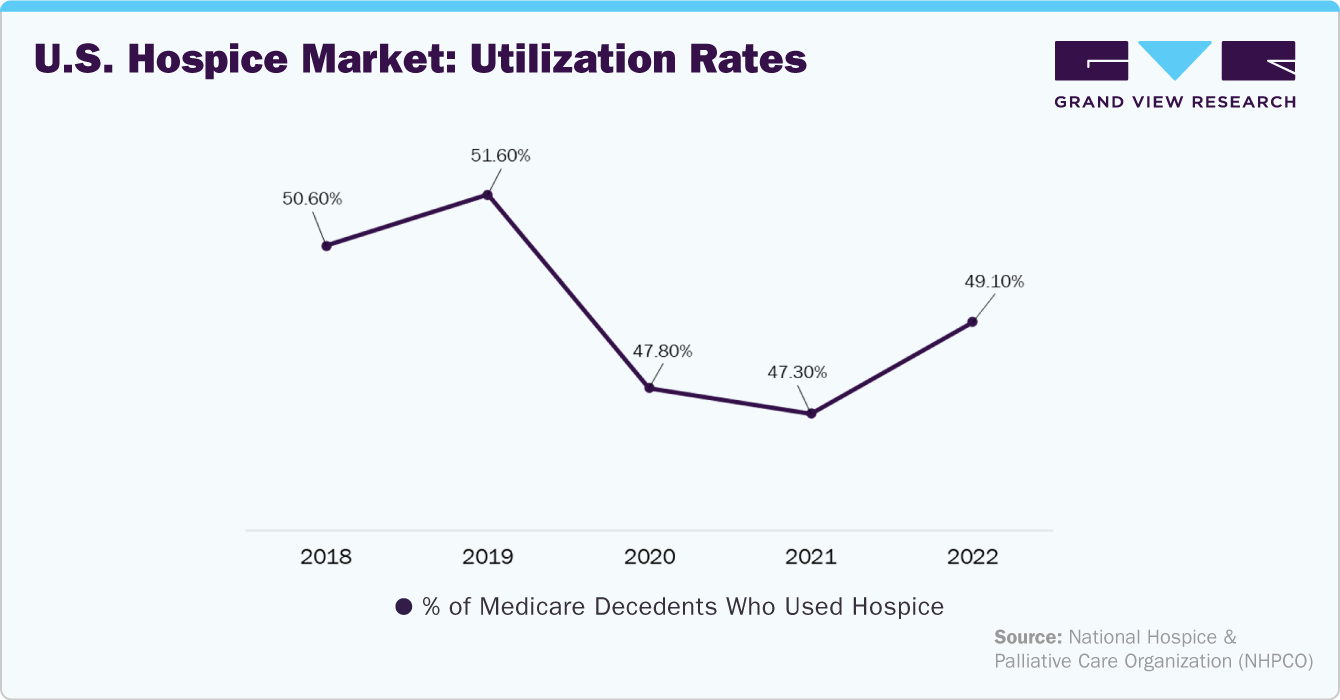

The geriatric population is predicted to grow considerably in the future as life expectancy increases. However, this growing population leads to a higher prevalence of chronic conditions such as cancer, dementia, and cardiovascular diseases. These conditions often necessitate specialized end-of-life care, which is effectively provided by hospice services. For instance, according to the National Hospice and Palliative Care Organization (NHPCO), in 2021, about 47.8% of Medicare hospice patients were aged 75 and above. However, the 85 and older age category has climbed the highest since 60.8%.

The number of hospice centers in the U.S. has been steadily increasing over the years. According to the Biennial Overview of Post-acute and Long-term Care in the United States, as of 2020, there were approximately 5,200 hospice care agencies operating in the U.S. In 2022, this number amplified to 5,899 Medicare-certified hospice agencies. This growth is largely attributed to the aging population and an increasing prevalence of chronic diseases, which drive demand for hospice services. Moreover, the market is experiencing a significant shift towards home-based care, driven by technological advancements and evolving patient preferences. Remote patient monitoring tools and telehealth services enable healthcare providers to deliver effective care without requiring patients to leave their homes. These innovations improve care quality and reduce hospital stay costs, making home-based hospice care an attractive option for many families.

Share of Medicare Decedents Who Used Hospice, by State

State

Hospice Beneficiaries

Hospice Utilization

Utah

15,126

59.61%

Florida

150,304

55.97%

Rhode Island

6,528

55.14%

Wisconsin

36,900

54.31%

Iowa

20,029

54.24%

Arizona

45,760

54.08%

Delaware

6,656

54.02%

Ohio

78,330

52.87%

Texas

145,160

52.23%

Furthermore, the growing awareness of end-of-life care options, particularly hospice care, has significantly influenced its utilization in the U.S. This trend is driven by several factors, including public perceptions, healthcare system dynamics, and the evolving reform for hospice care. As awareness of hospice benefits increases, healthcare providers are more expected to recommend hospice services to patients and families. Organizations such as the National Hospice and Palliative Care Organization (NHPCO) are organizing awareness campaigns that focus on educating both patients and healthcare providers. For instance, the Palliative Care Awareness Campaign initiative provides resources to empower patients and caregivers, emphasizing the importance of integrating palliative care early in treatment rather than associating it solely with end-of-life scenarios. Thus, as awareness continues to increase, it is expected that hospice care will become an even more integral part of end-of-life planning for many Americans.

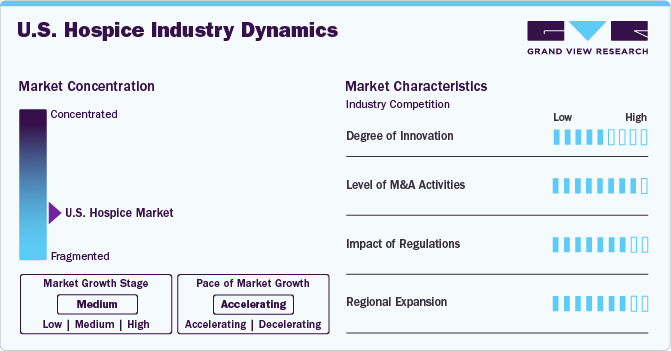

Market Concentration & Characteristics

The U.S. Hospice industry experiences a moderate degree of innovation. Companies are engaged in developing innovative models and programs to enhance patient care. For instance, the National Partnership for Hospice Innovation (NPHI) launched an Innovation Lab in May 2019, to study the best practices among nonprofit hospices and promote innovative care models. This includes developing home-based primary care programs for patients who are not yet in hospice but require significant support due to chronic illnesses.

The industry is experiencing a high level of merger and acquisition activities undertaken by several key players. This strategy enables companies to increase their capabilities, expand their service portfolios, and improve their competencies. For instance, in June 2023, Amedisys and Optum announced their merger, combining two organizations committed to deliver compassionate, value-based, and comprehensive care to patients and their families.

The U.S. hospice industry is growing, coupled with continuous changes in regulatory framework. Key regulatory changes include 36-month ownership rule, special focus program, increased quality reporting requirements, and launch of new measurement tools. Furthermore, state hospice care regulations, which are normally found in administrative codes, cover standards for hospices contracting with state Medicaid programs as well as patient guidelines.

The industry is witnessing high regional expansion. Market players adopt this strategy to expand their service reach and enhance availability across diverse geographical regions by partnering with healthcare providers and practitioners. For instance, in October 2024, VITAS Healthcare, the nation’s provider of end-of-life care, expanded its services to Pasco County. This growth addresses the increasing need for compassionate hospice care in Northern Tampa Bay, providing residents with a trusted option that honors patients’ end-of-life preferences.

Type Insights

Based on type, Routine Homecare (RHC) segment dominated the market in 2024 and accounted for the largest revenue share of 92.98%. This growth can be attributed to various factors, such as favorable reimbursement policies and increased comfort. RHC is paid under Medicare for each day till the patient is under the hospice program. Furthermore, it involves regular visits by registered nurses, hospice physicians, and hospice aids to patient locations. It provides advantages of companionship, family involvement, constant attention, and more.

The inpatient respite care segment is expected to grow at the fastest CAGR from 2025 to 2030. Inpatient Respite Care (IRC) intends to provide temporary or short-term relief to primary care providers. The patient temporarily stays in inpatient hospice centers, such as assisted living facilities or nursing homes, to give primary caregivers a break. This enables primary caregivers to reduce burnout and work efficiently. Recent initiatives in inpatient respite care within U.S. hospice settings are focused on enhancing support for caregivers and addressing the growing demand for specialized care, particularly for patients with dementia and other complex needs.

Location Insights

The hospice center segment held the largest market share of 86.32% in 2024, owing to the various benefits offered by these facilities. These centers prevent the need for hospitalization and offer more balanced & controlled care settings. In addition, growing awareness regarding various advantages, such as 24/7 availability of professional care and emotional support from family members is projected to propel market growth. Many service providers offer hospice inpatient facilities. Hospice centers can be helpful to patients who need round-the-clock care or do not have a caregiver. Rising demand for respite care in order to give personal space to the primary caregiver is contributing to segment growth.

The skilled nursing facility segment is anticipated to grow at the fastest CAGR during the forecast period. High-quality nursing services provided in skilled nursing facilities and increasing occupancy are among factors expected to drive segment growth. Apart from hospitals, skilled nursing facilities have the capability to offer comprehensive care. A rising geriatric population and improving access to skilled nursing facilities owing to supportive reimbursement framework are some of the factors anticipated to drive market growth in the coming years.

Diagnosis Insights

The dementia segment held the largest market share of 25.17% in 2024, owing to the dependency and disability among the elderly, with significant physical and psychological effects on individuals, their families, and caregivers. The rising prevalence of dementia, coupled with an aging population, is driving growth in this segment. According to the Alzheimer’s Association, nearly 7 million Americans currently live with Alzheimer’s disease, a figure expected to increase to approximately 13 million by 2050. In 2021, Alzheimer’s disease ranked as the fifth-leading cause of death among individuals aged 65 and older. In addition, health and long-term care costs for dementia patients are projected to reach USD 360 billion in 2024, escalating to nearly USD 1 trillion by 2050.

The cancer segment is expected to grow significantly over the forecast period. This growth can be attributed to the rising number of cancer diagnoses and the increasing need for palliative care services. Hospice care plays a vital role in managing cancer symptoms, alleviating treatment-related side effects, and ensuring comfort and dignity for patients during the final stages of life. In 2024, the National Cancer Institute estimates that 2,001,140 new cancer cases will be diagnosed in the U.S., with 611,720 deaths expected. Prostate, lung, and colorectal cancers are projected to account for 48% of all new cancer cases in men, while breast, lung, and colorectal cancers will make up 51% of diagnoses among women.

Key U.S. Hospice Company Insights

Key players operating in the U.S. hospice industry is undertaking various initiatives to strengthen their market presence and increase the reach of their services. Strategies such as expansion activities and partnerships play a key role in propelling market growth.

Key U.S. Hospice Companies:

- Chemed Corporation (VITAS Healthcare)

- LHC Group, Inc. (UnitedHealth Group)

- Amedisys

- Gentiva

- Brookdale Senior Living, Inc

- Crossroads Hospice (Agape Care Group)

- Seasons Hospice

- Oklahoma Palliative & Hospice Care

- Compassus

- Chapters Health System

Recent Developments

-

In October 2024, Compassus and Providence announced a joint venture to enhance home-based care services, including hospice, palliative care, home health, and private-duty caregiving.

-

In October 2024, Chemed Corporation (VITAS Healthcare) launched premier hospice services in Bakersfield and Fresno. Local interdisciplinary teams now provide clinical and spiritual care for seriously ill patients in homes, nursing facilities, assisted living communities, and inpatient settings.

-

In September 2024, South Carolina-based Agape Care Group acquired multiple Crossroads Hospice locations across Oklahoma, Missouri, Kansas, and Georgia. Agape, backed by private equity firm Ridgemont Equity Partners, completed the transaction for an undisclosed amount. Crossroads retained its locations in Tennessee, Ohio, and Pennsylvania.

“The addition of Crossroads Hospice solidifies our decision to expand into the Kansas, Missouri and Oklahoma markets, where we have spent more than a year building the infrastructure to support this acquisition.”

-Troy Yarborough, CEO of Agape Care Group.

-

In May 2024, Bon Secours Mercy Health and Compassus announced they have signed terms to form a joint venture partnership for Bon Secours Mercy Health Hospice.

-

In April 2024, Chemed Corporation (VITAS Healthcare) acquired all hospice operations and an assisted living facility from Covenant Health and Community Services, Inc.

-

In October 2023, VITAS Healthcare expanded its inpatient hospice care at Broward Health Medical Center. The new VITAS hospice wing is expected to care for around 550 patients annually.

U.S. Hospice Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 31.21 billion

Revenue forecast in 2030

USD 39.09 billion

Growth Rate

CAGR of 4.61% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, location, diagnosis

Country scope

U.S.

Key companies profiled

Chemed Corporation (VITAS Healthcare); LHC Group, Inc. (UnitedHealth Group); Amedisys; Gentiva; Brookdale Senior Living, Inc; Crossroads Hospice (Agape Care Group); Seasons Hospice; Oklahoma Palliative & Hospice Care; Compassus; Chapters Health System

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hospice Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hospice market report based on type, location, and diagnosis.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Routine Home Care

-

Continuous Home Care

-

Inpatient Respite Care

-

General Inpatient Care

-

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospice Center

-

Hospital

-

Home Hospice Care

-

Skilled Nursing Facility

-

-

Diagnosis Outlook (Revenue, USD Million, 2018 - 2030)

-

Dementia

-

Circulatory/Heart

-

Cancer

-

Respiratory

-

Stroke

-

Chronic Kidney Disease

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. hospice market size was estimated at USD 29.92 billion in 2024 and is expected to reach USD 31.21 billion in 2025.

b. The U.S. hospice market is expected to grow at a compound annual growth rate of 4.61% from 2025 to 2030 to reach USD 39.09 billion by 2030.

b. Routine home care segment dominated the U.S. hospice market with a share of 92.98% in 2024 owing to increased comfort, favorable reimbursement policies, and routine visits by licensed nurses, physicians, and aides.

b. Some key players operating in the U.S. hospice market include Kindred Healthcare, Inc.; Chemed Corporation; Amedisys; LHC Group, Inc.; Brookdale Senior Living Solutions; Seasons Hospice & Palliative Care; Crossroads Hospice; AccentCare; Heart to Heart Hospice; and Oklahoma Palliative & Hospice Care.

b. Key factors that are driving the U.S. hospice market growth include rising geriatric population, growing prevalence of chronic conditions, and increasing number of hospice centers.

b. Hospice center dominated the U.S. hospice market with a share of 86.32% in 2024. This is attributable to the increasing demand for hospice centers and strategies adopted by key players to expand their geographical footprints.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.