- Home

- »

- Next Generation Technologies

- »

-

U.S. Group Level Term Insurance Market Size Report, 2030GVR Report cover

![U.S. Group Level Term Insurance Market Size, Share & Trends Report]()

U.S. Group Level Term Insurance Market (2025 - 2030) Size, Share & Trends Analysis Report By Distribution Channel (Tied Agents And Branches, Brokers), Key Companies, Competitive Analysis, And Segment Forecasts

- Report ID: GVR-4-68040-050-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

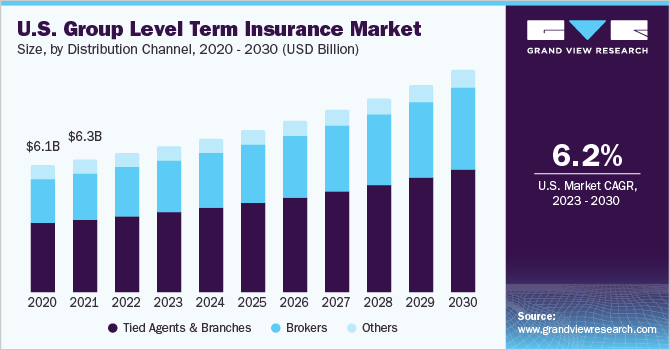

The U.S. group level term insurance market size was estimated at USD 7.32 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. The need for financial security among employees, increasing healthcare costs, employer-sponsored benefits, and an aging population are prominent attributes contributing to market growth. As healthcare costs continue to rise, many employees seek ways to protect their financial security in the event of an unexpected illness or death. Moreover, group term-level insurance provides a cost-effective way for employees to obtain coverage, often at a lower cost than individual policies, thereby driving its demand. This, in turn, is expected to contribute to the growth of the U.S. group level term insurance industry.

Employer-sponsored benefits are becoming increasingly important as companies seek to attract and retain top talent. Group term-level insurance is often included in these benefits, providing employees with peace of mind and financial security while enhancing their overall compensation package. With increasing competition for skilled professionals, businesses, especially in industries such as technology, healthcare, and finance, offer group term life insurance as an affordable, tax-efficient way to enhance employee financial security. The growing awareness of financial wellness and the role of life insurance in comprehensive benefits programs continues to fuel demand.

The digital transformation of the insurance industry significantly impacts the U.S. group level term insurance industry. Insurtech companies and traditional insurers alike are leveraging AI-driven underwriting, automated enrollment processes, and mobile-first platforms to streamline policy issuance and claims processing. This technological advancement reduces administrative costs, improves efficiency, and enhances accessibility for small and mid-sized businesses, encouraging more employers to offer group policies. Thus, expansion of Insurtech and digital underwriting is expected to contribute to the growth of the U.S. group level term insurance industry.

Another driver of these markets is the increasing demand for voluntary benefits. Many employees are looking for additional coverage beyond their employer-sponsored plans, and group level term insurance can provide a cost-effective way to obtain this coverage. Voluntary plans allow employees to purchase coverage at discounted rates, often with no medical exam required. Furthermore, many insurance companies are using technology to streamline the underwriting process and make it easier for employees to obtain coverage. Online applications and electronic signatures have made it faster and more convenient for employees to enroll in group policies. At the same time, predictive analytics and data mining are used to improve underwriting accuracy and reduce costs.

However, the lack of awareness and understanding among employees regarding the importance and benefits of having such coverage is restraining the U.S. group level term insurance industry’s growth. Many employees may not fully understand the risks they face and may not be aware of the financial protection that group level term insurance can provide for their families in the event of their death or unexpected illness. To overcome this restraint, insurers and employers can focus on education and communication efforts to raise awareness of the importance of group level term insurance and its benefits. This can include offering educational seminars or webinars, distributing informational materials, and providing one-on-one consultations with employees to help them understand their options and make informed decisions.

Distribution Channel Insights

The tied agents and branches segment accounted for the largest share of 55.3% in 2024. This is partly due to the complex nature of group level term insurance policies and the need for personalized guidance and advice during enrollment. Agents and branches are able to provide this level of support and guidance to employers and employees, helping them to navigate the enrollment process and select the coverage that best meets their needs. In addition, agents and branches can build relationships with employers and employees, providing ongoing support and assistance throughout the policy's life.

The brokers segment is expected to grow at the highest CAGR during the forecast period. The growth is attributed to brokers offering a wide range of products from multiple insurance carriers, giving employers and employees access to a broad range of coverage options. This has made brokers an attractive distribution channel for employers and employees, driving segment growth and making group level term insurance more accessible to a broader audience. With the continued growth of the broker channel, it is likely to play an increasingly important role in the distribution of group level term insurance over the projected period.

Key U.S. Group Level Term Insurance Company Insights

Some key companies in the U.S. group level term insurance industry include MetLife, Prudential Financial, Inc., and Lincoln National Corporation. Key players differentiate themselves through pricing strategies, product flexibility, technological advancements, and customer service innovations.

-

MetLife is a prominent provider in the U.S. group level term insurance market, offering comprehensive and customizable insurance solutions designed to meet the needs of businesses and their employees. With a strong presence in the corporate benefits space, the company has established itself as a trusted partner for group term insurance, providing both large-scale and tailored solutions to meet a variety of employer and employee needs.

-

Prudential Financial, Inc. group level term insurance offerings are tailored to meet the needs of businesses of all sizes, offering affordable, flexible, and comprehensive coverage options for their employees. With its extensive expertise in providing financial solutions across various segments, including retirement, investment management, and insurance, the company has positioned itself as a key competitor in the group level term insurance space.

Key U.S. Group Level Term Insurance Companies:

- MetLife

- Prudential Financial, Inc.

- Lincoln National Corporation

- Unum Group

- New York Life Insurance Company

- Voya Services Company

- United Healthcare Services, Inc.

- Securian Financial Group, Inc.

- Reliance Standard Life Insurance Co.

- The Guardian Life Insurance Company of America

Recent Developments

- In July 2023, Aflac Incorporated, a prominent U.S. provider of supplemental health insurance, announced the launch of Aflac Group Life Term to 120. This product provides worksite life insurance with affordable rates and flexible living benefits that remain stable throughout employees' lifetimes.

U.S. Group Level Term Insurance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.73 billion

Revenue forecast in 2030

USD 10.57 billion

Growth rate

CAGR of 6.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Distribution channel

Key companies profiled

MetLife; Prudential Financial, Inc.; Lincoln National Corporation; Unum Group; New York Life Insurance Company; Voya Services Company; United Healthcare Services, Inc.; Securian Financial Group, Inc.; Reliance Standard Life Insurance Co.; The Guardian Life Insurance Company of America

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Group Level Term Insurance Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. group level term insurance market report based on distribution channel.

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Tied Agents and Branches

-

Brokers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. group level term insurance market size was estimated at USD 7.32 billion in 2024 and is expected to reach USD 7.73 billion in 2025.

b. The U.S. group level term insurance market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2030 and is expected to reach USD 10.57 billion by 2030.

b. The tied agents and branches segment accounted for the maximum share of 55.3% in 2024. This is partly due to the complex nature of group-level term insurance policies and the need for personalized guidance and advice during the enrollment process.

b. Some key players operating in the banking system software market include MetLife, Prudential Financial, Inc., Lincoln National Corporation, Unum Group, New York Life Insurance Company, Voya Services Company, United Healthcare Services, Inc., Securian Financial Group, Inc., Reliance Standard Life Insurance Co., and The Guardian Life Insurance Company of America.

b. Key factors that are driving the U.S. group level term insurance market growth is the need for financial security among employees, increasing healthcare costs, employer-sponsored benefits, and an aging population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.