- Home

- »

- Pharmaceuticals

- »

-

U.S. General Anesthesia Drugs Market, Industry Report 2030GVR Report cover

![U.S. General Anesthesia Drugs Market Size, Share & Trends Report]()

U.S. General Anesthesia Drugs Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug (Propofol, Sevoflurane), By Route Of Administration (Intravenous, Inhaled), By End-use (Hospitals, Ambulatory Surgical Centers), By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-451-8

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

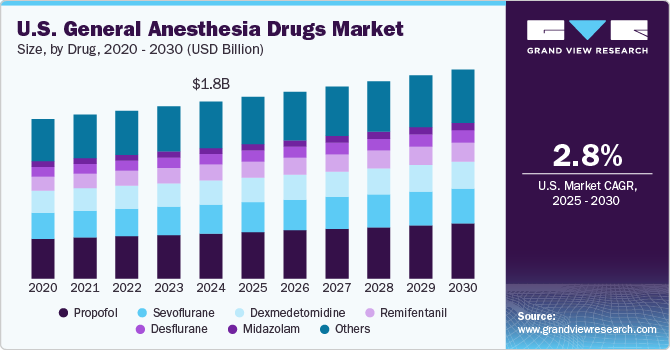

The U.S. general anesthesia drugs market size was valued at USD 1.72 billion in 2024 and is projected to grow at a CAGR of 2.82% from 2025 to 2030. This growth is fueled by several key factors, including a rising number of surgical procedures, technological advancements in anesthesia, regulatory updates, and shifts in healthcare practices. The American Society of Aesthetic Plastic Surgeons (ASPS) reported 26.2 million surgical procedures in the U.S. in 2022. In addition, data from the National Library of Medicine indicated that, in 2021, nearly nine major surgeries were performed per 100 older adults, with over one in seven Medicare beneficiaries undergoing major surgery within five years, highlighting a substantial and growing demand for effective general anesthesia drugs.

The market is primarily driven by the rising volume of surgical procedures conducted each year. The American Society of Anesthesiologists (ASA) attributes this increase to several factors, including an aging population, a higher prevalence of chronic diseases, and advancements in surgical techniques. According to the CDC, adults aged 65 and older are increasingly affected by conditions such as heart disease, COPD, diabetes, cancer, and neurological disorders. Consequently, there is a growing demand for general anesthesia due to the rising frequency of orthopedic, cardiovascular, and elective surgeries.

Technological innovation in anesthesia is another significant driver of market growth. Recent advancements include the development of new, safer, and more effective anesthetic agents and delivery systems. For instance, modern anesthetic drugs offer better control over anesthesia depth and duration, which enhances patient safety and recovery times. The introduction of ultra-short-acting anesthetics and advanced monitoring systems has improved patient outcomes and expanded the scope of surgeries performed under general anesthesia. The ongoing research and development by pharmaceutical companies contribute to the evolution of these technologies, fueling market growth.

Government initiatives and healthcare reforms also impact the market. The U.S. government has invested in healthcare infrastructure improvements and funding for surgical procedures, which indirectly boosts the demand for anesthesia. Programs like Medicare and Medicaid cover a wide range of surgical procedures, including those requiring general anesthesia, thus increasing the number of procedures performed and the demand for anesthesia drugs. Furthermore, the focus on improving surgical outcomes and patient safety drives the adoption of advanced anesthesia techniques and drugs.

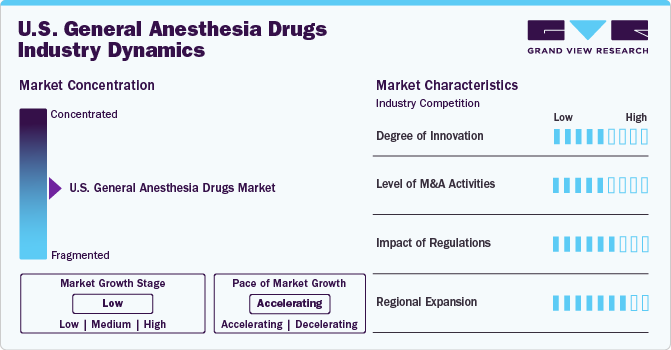

Market Concentration & Characteristics

The degree of innovation in the market is marked by significant advancements in drug development and technology. Recent innovations include the creation of novel anesthetic agents with enhanced safety profiles and reduced side effects. For instance, the development of ultra-short-acting anesthetics, such as remifentanil, allows for more precise control over anesthesia depth and quicker recovery times. In May 2021, the FDA approved ZYNRELEFTM, a novel extended-release local anesthetic combining bupivacaine and meloxicam in fixed, low doses. This medication demonstrated a significant reduction in pain for up to 72 hours following surgeries, including inguinal herniorrhaphy and total knee arthroplasty.

Mergers and acquisitions (M&A) are pivotal in shaping the market. Major industry players such as Baxter International and AbbVie are strategically pursuing M&A to broaden their product offerings and enhance market positioning. For instance, in April 2024, Baxter expanded its pharmaceutical portfolio in the U.S. with the launch of Ropivacaine Hydrochloride Injection, USP. This new product comes in a convenient, ready-to-use, single-dose infusion bag. Ropivacaine is indicated for providing local or regional anesthesia during surgery and for managing acute pain in adults. These activities facilitate access to advanced technologies, diversify product portfolios, and bolster competitive strength.

Regulatory bodies, particularly the U.S. Food and Drug Administration (FDA), have a profound impact. The FDA’s stringent approval process ensures that only safe and effective anesthetic drugs are introduced to the market. Regulatory guidelines also shape drug labeling, dosage recommendations, and clinical trial requirements, all of which influence the development and application of anesthetic agents. For instance, in March 2023, Lupin Ltd's partner, Caplin Steriles, received FDA approval to market Rocuronium Bromide Injection and Thiamine Hydrochloride Injection USP. Rocuronium Bromide Injection is used to aid rapid sequence intubation and muscle relaxation during surgery. Following this, in November 2023, Lupin Ltd's stock rose by 3% succeeding the U.S. launch of Rocuronium Bromide Injection, highlighting the market impact of regulatory approvals.

The expansion of the U.S. market is being driven by improved healthcare access and advancements in surgical care across the country. High-demand regions such as New York, California, and Texas are leading this growth due to their large volume of surgical procedures and prominent medical institutions. Various Government initiatives, including funding for rural health programs and investments in healthcare infrastructure, support this regional growth. Collaborations between hospitals and anesthesia providers are also working to improve the availability and quality of anesthesia care nationwide. This expansion is further supported by the U.S.'s robust healthcare infrastructure; for instance, the Urgent Care Association reported in May 2024 that approximately 14,714 urgent care centers across the country provide diagnostic services and care to over 100 million patients annually.

Drug Insights

In 2024, the propofol segment dominated the market with a substantial share of 25.52% and is also expected to grow at the fastest CAGR during the forecast period. This is driven by its widespread use as a preferred agent for induction and maintenance of general anesthesia. Its rapid onset, short duration of action, and smooth recovery profile make it highly desirable for both routine and complex procedures. Propofol has a well-established safety profile and is supported by extensive clinical data, which helps maintain its market dominance. Regulatory approvals and guidelines from the U.S. Food and Drug Administration (FDA) ensure that propofol remains a reliable and safe option for anesthesia.

Recent developments in propofol formulations, such as improved delivery systems and enhanced stability, have further bolstered its market position. Innovations aimed at minimizing side effects and enhancing patient safety have contributed to its continued popularity in clinical settings. The cost-effectiveness of propofol compared to other anesthetics also drives its market growth. Its widespread availability and competitive pricing make it a preferred choice in both high- and low-resource settings.

Route Of Administration Insights

The intravenous (IV) segment held the largest revenue share in 2024 and is also expected to grow at the fastest CAGR of 3.03% during the forecast period. This dominance is largely attributed to the efficiency and reliability of IV administration in clinical settings. IV administration provides a rapid onset of anesthesia, which is crucial for the smooth induction and maintenance of anesthesia during various surgical procedures. The ability to achieve immediate systemic absorption ensures precise control over the depth and duration of anesthesia, making it a preferred choice among anesthesiologists.

Advancements in intravenous drug delivery technologies, such as automated infusion pumps and advanced syringe drivers, have enhanced the safety and precision of IV anesthesia. These innovations minimize dosing errors and reduce complications, thus supporting the segment's growth. The preference for IV administration is also driven by its cost-effectiveness and operational simplicity compared to other routes, such as inhalational anesthesia, which often involves more complex equipment and higher costs.

Application Insights

In 2024, the knee and hip replacement segment dominated the U.S. general anesthesia drugs market, capturing a substantial revenue share. The primary driver of this dominance is the rising incidence of osteoarthritis and other degenerative joint conditions, which necessitate surgical interventions such as knee and hip replacements. According to the Centers for Disease Control and Prevention (CDC), over 32.5 million adults in the U.S. are affected by osteoarthritis, creating a substantial demand for joint replacement surgeries.Additionally, the aging population plays a crucial role in this trend. The U.S. Census Bureau reports that the proportion of adults aged 65 and older is increasing, and this demographic is more susceptible to joint-related ailments. As the elderly population grows, the frequency of elective joint replacement surgeries, including total knee arthroplasties (TKAs) and total hip arthroplasties (THAs), is rising. These procedures often require general anesthesia for effective pain management and to facilitate a smooth surgical process.

The cancer segment is anticipated to grow at the fastest CAGR from 2024 to 2030. The treatment for cancer often involves complex surgeries, including tumor resections, organ removals, and reconstructive surgeries, all of which require effective anesthesia management to ensure patient safety and optimize outcomes. The increasing prevalence of cancer diagnoses across the country drives the growth of general anesthesia drug. According to the American Cancer Society, nearly 2,001,140 new cancer cases are projected to occur in 2024. This rising incidence fuels demand for surgical interventions, which in turn drives the need for general anesthesia.

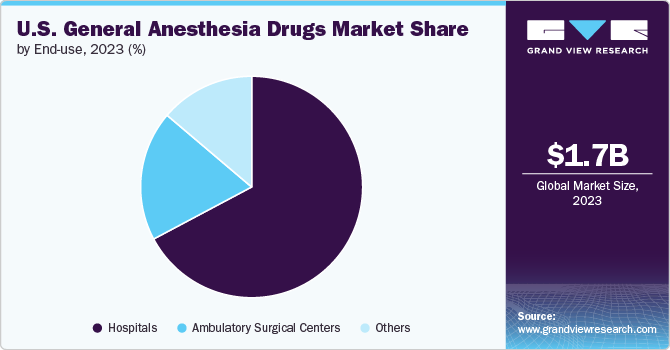

End-use Insights

In 2024, the hospitals segment dominated the U.S. general anesthesia drugs market, capturing a substantial revenue share of 67.05%. Hospitals are the primary settings for major surgeries and complex medical procedures that require general anesthesia. According to the American Hospital Association (AHA), there are over 6,000 hospitals in the U.S., which handle a vast volume of surgical cases annually.

Hospitals perform a significant proportion of elective and emergency surgeries, including orthopedic, cardiovascular, and oncological procedures, all of which require advanced anesthesia management. This high volume of surgical procedures directly drives the demand for general anesthesia drugs.Moreover, hospitals are equipped with specialized facilities and personnel trained to manage the complexities associated with general anesthesia. The presence of anesthesiologists, specialized surgical teams, and advanced monitoring equipment ensures that patients receive high-quality anesthesia care.

Ambulatory surgical centers (ASCs) are anticipated to achieve the fastest CAGR of 3.6% during the forecast period. ASCs offer a cost-effective alternative to traditional hospital-based surgeries, which is a significant driver of their growth According to the report published by the Commonwealth of Massachusetts in February 2024, procedures conducted in Ambulatory Surgical Centers (ASCs) are significantly more cost-effective compared to Hospital Outpatient Departments (HOPDs), with prices generally 30-55% lower. This cost efficiency appeals to both patients and insurers, contributing to the increasing preference for ASCs for various procedures, including orthopedic, ophthalmic, and gastrointestinal surgeries. ASCs are designed to streamline the surgical process, providing patients with quicker access to care and faster recovery times. This efficiency is further enhanced by the focused nature of ASCs, which specialize in specific types of procedures, leading to shorter wait times and improved patient experiences.

Key U.S. General Anesthesia Drugs Company Insights

The U.S. market is dominated by several major pharmaceutical companies that collectively account for a significant market share. These leading players established themselves through extensive research and development efforts, resulting in the introduction of innovative treatment options. They also expanded their drug portfolios through strategic collaborations, mergers, and acquisitions.

Key U.S. General Anesthesia Drugs Companies:

- Baxter International Inc.

- AstraZeneca

- AbbVie Inc.

- B. Braun Melsungen AG

- Fresenius SE & Co. KgaA

- Pfizer

- Hospira Inc.

- Aspen Pharmacare Holdings Limited

- Hikama Pharmaceuticals plc

- Abbott Laboratories

Recent Developments

-

In September 2024, Eugia Steriles, a subsidiary of Aurobindo Pharma received USFDA approval for Lidocaine Hydrochloride injection. The injection is used as an anesthetic on the body to help reduce discomfort and pain caused by invasive procedures such as needle punctures, insertion of breathing tube or catheter, and surgery.

-

In August 2024, Amneal Pharmaceuticals, Inc. announced FDA approval for its Propofol Injectable Emulsion USP in three single-dose vial concentrations and it is widely used in hospitals for inducing and maintaining anesthesia and sedation.

-

In February 2024, Hikma Pharmaceuticals PLC launched Fentanyl Citrate Injection, USP, in the US. This medication is designed for short-duration analgesia during anesthesia, premedication, induction, maintenance, and immediate postoperative recovery.

U.S. General Anesthesia Drugs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.76 billion

Revenue forecast in 2030

USD 2.03 billion

Growth rate

CAGR of 2.82% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug, route of administration, end-use, application

Country scope

U.S.

Key companies profiled

Baxter International Inc.; AstraZeneca; AbbVie Inc.; B. Braun Melsungen AG; Fresenius SE & Co. KgaA; Pfizer; Hospira Inc.; Aspen Pharmacare Holdings Limited; Hikama Pharmaceuticals plc; Abbott Laboratories

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. General Anesthesia Drugs Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. general anesthesia drugs market report based on drug, route of administration, application, end-use, and country:

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Sevoflurane

-

Propofol

-

Dexmedetomidine

-

Remifentanil

-

Desflurane

-

Midazolam

-

Others - (Sufentanil, Fentanyl, Ketamine, Isoflurane, Thiopental, etc.)

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous

-

Inhaled

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Heart Surgeries

-

Cancer

-

General Surgery

-

Knee and hip replacements

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. general anesthesia drugs market was estimated at USD 1.76 billion in 2024 and is expected to reach USD 1.72 billion in 2025.

b. The U.S. general anesthesia drugs market is expected to grow at a compound annual growth rate of 2.82% from 2025 to 2030 to reach USD 2.03 billion by 2030.

b. In 2024, the hospitals segment dominated the U.S. general anesthesia drugs market, capturing a substantial revenue share of 67.05%. Hospitals are the primary settings for major surgeries and complex medical procedures that require general anesthesia

b. Some of the prominent players in the U.S. general anesthesia drugs market are Baxter International Inc., AstraZeneca, AbbVie Inc., B. Braun Melsungen AG, Fresenius SE & Co. KgaA, Pfizer, Hospira Inc., Aspen Pharmacare Holdings Limited, Hikama Pharmaceuticals plc

b. This growth is fueled by several key factors, including a rising number of surgical procedures, technological advancements in anesthesia, regulatory updates, and shifts in healthcare practices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.