- Home

- »

- Electronic Devices

- »

-

U.S. Fire Alarm And Detection Market Size Report, 2030GVR Report cover

![U.S. Fire Alarm And Detection Market Size, Share & Trends Report]()

U.S. Fire Alarm And Detection Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Fire Detectors, Smoke & Heat Detectors, Fire Alarms, Audible & Visible Alarms), By Application (Commercial, Industrial), And Segment Forecasts

- Report ID: GVR-4-68040-148-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

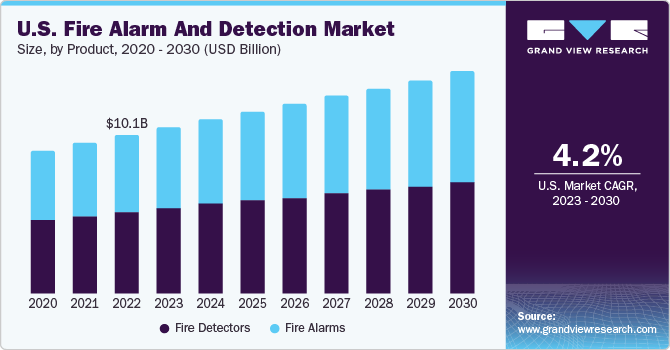

The U.S. fire alarm and detection market size was estimated at USD 10.11 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. The expansion of the market can be attributed to the increasing prevalence of home automation in residential areas across the country. This surge in home automation has resulted in a higher demand for fire alarm & detection systems. Property owners can centralize the control, monitoring, and management of various building functions, including entertainment systems, lighting, and most importantly, fire safety by integrating fire alarm & detection systems. This integration improves the overall effectiveness and efficiency of fire alarm and detection processes, such as notification and evacuation, leading to safer buildings. The added accessibility and convenience provided by these advanced systems also serve as incentives for homeowners to invest in them, as they align with the broader trend of creating smart homes.

Another factor fueling the growth of the market is the fire policies provided by the insurance companies. Insurance companies often mandate the installation of fire alarm and detection systems as a prerequisite for obtaining coverage. These systems reduce the risk of fire-related losses, making properties safer and more insurable. Compliance with insurance requirements encourages property owners and businesses to invest in fire alarm and detection technologies to reduce potential liabilities and protect their assets. This mutual benefit drives the demand for the U.S. fire alarm and detection industry.

The adoption of wireless communication technologies such as voice-to-text and text-to-voice communications, and Voice over Internet Protocol (VOIP) is increasing. These technologies are used across various end-use industries as well as commercial and residential sectors which allow timely, reliable, secure, and clear communication, and swift deployment of fire alarm and detection systems. The growing shift from a risk-based approach to Inspection/Testing/Maintenance (ITM) is estimated to proliferate demand for such smart fire safety solutions across this sector.

Building codes across several nations are being enforced and adopted, which have incorporated layers of changes in codes that reflect modern security threats and concerns. Key issues ahead of the residential sector in meeting the code changes include the increase in building area dedicated to the new requirements and the added cost associated with code changes. This inefficiency is owing to the newly added requirements found in the code mandating fire service access elevators, and an additional exit capacity. These additional code requirements add more square footage to the building and less rental square footage (RSF), as compared to previous building code requirements. Thus, a new building design today needs a larger footprint to accomplish the same RSF.

Regulatory Framework

The U.S. has well-established building safety regulations and codes that require the installation of fire alarm and detection systems in various types of buildings. National and local building codes, such as the National Fire Protection Association (NFPA) codes and the U.S. Fire Administration (USFA), provide specific fire safety guidelines, including inspecting, installing, and maintaining fire alarm and detection systems. Compliance with these regulations is mandatory, ensuring that buildings prioritize fire safety. Hence, such factors drive the growth of the U.S. fire safety equipment sector.

The NFPA has established approximately 300 codes and standards for installing and maintaining fire safety equipment, which local governments and insurance companies use to enforce fire safety regulations. The Federal Fire Prevention and Control Act of 1974 established the U.S. Fire Administration and authorized the agency to develop and implement fire prevention and control programs. The Occupational Safety and Health Act of 1970 requires employers to provide their employees with a safe and healthful workplace. This includes taking steps to prevent fires and protect employees from fire-related injuries.

Product Insights

Based on product, the fire detection market segment dominated with a revenue share of over 51% in 2022. The U.S. commercial sector relies heavily on fire detection systems, thus making it the primary domain for their extensive use. The commercial sector includes various infrastructures such as hotels, office buildings, shopping malls, educational institutions, hospitals, industrial facilities, and public spaces. Fire detectors enable the quick detection of smoke or fire incidents and help in managing an orderly evacuation by triggering fire alarms to minimize damage. As a result, the demand for fire detectors is expected to increase over the forecast period.

The fire alarms segment is anticipated to register the highest growth rate over the forecast period. The segment is driven by the increasing popularity of smart fire alarm systems, their integration with other smart devices, and the advanced monitoring and control features they offer. These systems make use of Internet of Things (IoT) technology, connecting fire alarm devices to a centralized management platform. This connection enables real-time analysis of data and allows for remote management capabilities. By leveraging these advantages, smart fire alarms can promptly send alerts to property owners, fire departments, or authorized individuals, resulting in quicker response times and a decrease in false alarms. As a result, these factors are anticipated to propel the growth of the fire alarms segment over the forecast period.

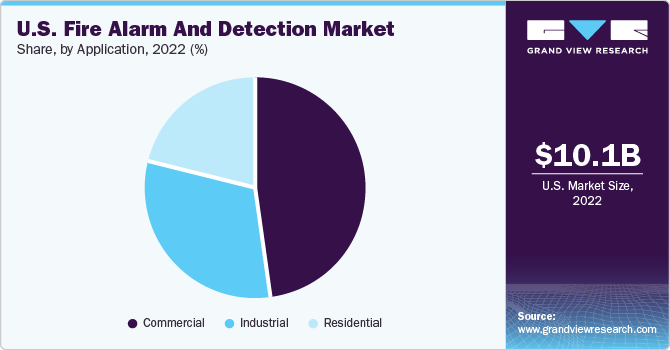

Application Insights

Based on application, the commercial segment dominated the market with a share of over 48% in 2022. The demand for fire alarms and detectors has surged in response to the stringent fire safety regulations implemented by the U.S. government for commercial buildings. These regulations make it mandatory for commercial establishments to have fire alarms and detectors in place. Additionally, insurance companies frequently mandate the installation of fire safety equipment in commercial buildings to mitigate the potential for fire-related damages. As a result, businesses are increasingly seeking fire safety equipment to comply with insurance requirements and mitigate the financial risks associated with fire incidents.

The residential segment is expected to register the highest growth over the forecast period. Several improvements in the real estate sector in the U.S. are expected to boost the demand for fire safety equipment for residential applications. Residential buildings are increasing their spending on fire protection to safeguard their infrastructure and reduce the risk of fire accidents. Moreover, the growing trend of smart cities focusing on the intelligent infrastructure of residential applications is expected to drive the market demand over the forecast period.

Key Companies & Market Share Insights

The market players are entering into mergers & acquisitions, strategic collaborations, new product launches, and partnerships to expand their organization’s footprint and stay competitive in the market. For instance, in May 2023, Honeywell International, Inc. announced the launch of an updated suite of solutions to increase airport efficiency and safety. These cyber-secure airport solutions facilitate improved arrival preparation, support during the docking process, efficient turnaround, and effective departure management.

Notably, their advanced visual docking technology provides more precise and informed decision-making capabilities for gate operations. Moreover, in April 2023, Siemens AG launched IoT-enabled fire control panels with cloud connectivity to send data from devices and systems. An IoT-enabled fire detector conducts regular disturbance-free tests, provides enriched data such as danger level and soiling statistics, and eliminates false alarms.

Key U.S. Fire Alarm And Detection Companies:

- Carrier (Kidde)

- Fike Corporation

- Gentex Corporation

- Hochiki America Corporation

- Honeywell International, Inc.

- Johnson Controls International PLC

- Napco Security Technologies, Inc.

- Rotarex

- Siemens

- The Bosch Group

U.S. Fire Alarm and Detection Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 14.13 billion

Growth rate

CAGR of 4.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

The Bosch Group; Gentex Corporation; Hochiki America Corporation; Honeywell International, Inc.; Johnson Controls International PLC; Siemens AG; Rotarex; Carrier (Kidde); Napco Security Technologies, Inc.; Fike Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Fire Alarm And Detection Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. fire alarm and detection market report based on product and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fire Detectors

-

Flame Detectors

-

Smoke Detectors

-

Heat Detectors

-

-

Fire Alarms

-

Audible Alarms

-

Visual Alarms

-

Manual Call-points Alarms

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Industrial

-

Residential

-

Frequently Asked Questions About This Report

b. The U.S. fire alarm and detection market size was estimated at USD 10.11 billion in 2022 and is expected to reach USD 10.61 billion in 2023.

b. The U.S. fire alarm and detection market is expected to grow at a compound annual growth rate of 4.2% from 2023 to 2030 to reach USD 14.13 billion by 2030.

b. The commercial sector dominated the U.S. fire alarm and detection market owing to stringent government regulations on installing fire alam and detection in commercial buildings.

b. Some key players operating in the U.S. fire alarm and detection market include The Bosch Group; Gentex Corporation; Hochiki America Corporation; Honeywell International, Inc.; Johnson Controls International PLC; Siemens; Rotarex; Carrier (Kidde); Napco Security Technologies, Inc.; and Fike Corporation.

b. Key factors that are driving the U.S. fire alarm and detection market growth are attributed to the increasing home automation in residential buildings, rising government regulations, and rising safety concerns among process and non-process industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.