- Home

- »

- Medical Devices

- »

-

U.S. External Defibrillators Market, Industry Report, 2030GVR Report cover

![U.S. External Defibrillators Market Size, Share & Trends Report]()

U.S. External Defibrillators Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Manual, Automated, Wearable), By End-use (Hospital, Prehospital, Public Access Market), And Segment Forecasts

- Report ID: GVR-4-68040-267-1

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. External Defibrillators Market Trends

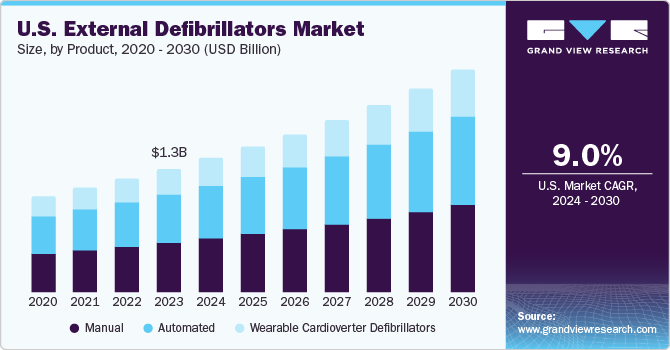

The U.S. external defibrillators market size was estimated at USD 1.27 billion in 2023 and is projected to grow at a CAGR of 9.0% from 2024 to 2030. This can be attributed to technological advancements, rising healthcare expenditure, increased awareness and training programs, and increasing incidences of cardiac arrest. As per the Centers for Disease Control and Prevention (CDC), every year in the U.S., over 356,000 people suffer from cardiac arrest out-of-hospital, and 60 to 80% of them die before reaching the hospital. Advancements in technology are key factors driving the market growth. The continuous technological advancements have led to the development of innovative external defibrillator devices that are more user-friendly, portable, and efficient. Features, such as automated external defibrillators (AEDs) with voice prompts & visual instructions, make these devices more accessible to a wider range of users, including non-medical personnel.

For instance, in August 2021, Kestra Medical Technologies, Inc. announced that its ASSURE Wearable Cardioverter Defibrillator (WCD) system received premarket Approval from the FDA. The wearable device has a cardiac rhythm monitor, sensors, and a miniature AED. Increasing healthcare expenditure and investments in emergency medical services infrastructure have bolstered the product demand. Hospitals, clinics, and other healthcare facilities are investing in modern defibrillator technologies to enhance patient outcomes and emergency response capabilities. According to the Centers for Medicare & Medicaid Services, healthcare expenditure in the U.S. increased by 4.1% in 2022, amounting to a total of USD 4.5 trillion or USD 13,493 per person.

As a proportion of the country's Gross Domestic Product, healthcare expenditure accounted for 17.3%. Growing awareness about the importance of early defibrillation in saving lives has led to an increase in training programs for CPR (Cardiopulmonary Resuscitation) and AED use. This heightened awareness among both healthcare professionals and the general public has driven the adoption of external defibrillators in various settings, including public spaces, schools, and workplaces. For instance, in September 2023, the Spearfish Community Foundation initiated the first phase of their Public Access AED Community Project. The project involved placing 11 AED towers in strategic locations around Spearfish, South Dakota. The project aims to aid in saving lives by providing an AED in case of emergencies within the community.

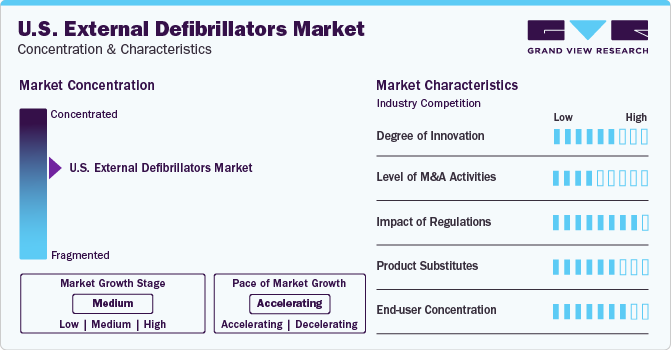

Market Concentration & Characteristics

The market growth stage is high, and the pace of its growth is accelerating. The U.S. market for external defibrillators is characterized by a high degree of innovation due to technological advancements that have made defibrillators more portable, user-friendly, and cost-effective. Innovations in defibrillators include wireless connectivity and data management, integration with telemedicine services, improved design, and ergonomics.

The U.S. external defibrillator market is also characterized by a moderate level of merger and acquisition (M&A) activity by the market players to strengthen market position, expand product portfolios, and enhance technological capabilities.

The level of government scrutiny in the is high due to the critical nature of these medical devices in saving lives. The Food and Drug Administration (FDA) closely regulates external defibrillators to ensure their safety, effectiveness, and quality standards. The FDA classifies AEDs as Class III medical devices, which means they are subject to the highest level of regulatory control. Manufacturers must comply with various requirements, such as demonstrating safety and effectiveness through clinical trials, implementing quality control procedures, and submitting premarket approval applications.

There are limited direct product substitutes, such as implantable cardioverter defibrillators (ICDs). These surgically implanted devices can detect abnormal heart rhythms and deliver a shock to restore a normal heartbeat. They are typically used for people who have a high risk of sudden cardiac death due to a heart condition. While ICDs are not substitutes for external defibrillators, they can provide ongoing protection against SCA.

End-user concentration is a significant factor in this market. There are several end-user industries that are driving the product demand. This is due to the diverse end-user base, widespread adoption, regulatory requirements, training programs, and technological advancements that promote accessibility and usability among a range of individuals in healthcare settings.

Product Insights

The AED segment dominated the overall market and accounted for the highest share of 39.4%, in terms of revenue, in 2023. The segment is anticipated to remain dominant expanding at the fastest CAGR from 2024 to 2030. On the basis of products, the market has been further categorized into manual, automated, and wearable cardioverter defibrillators.

The growth of the automated product segment is driven by factors, such as increasing prevalence of cardiovascular diseases (CVDs), technological advancements, and growing public awareness & training programs. For instance, in July 2023, Make Them Know Your Name Foundation launched an initiative to provide AED training to sports programs in schools in the northeastern Ohio region.

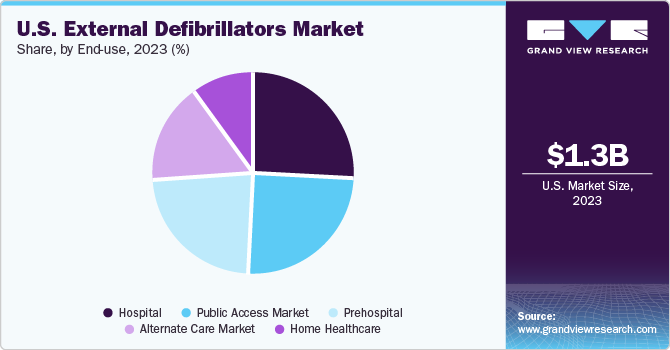

End-use Insights

The hospital end-use segment accounted for the largest revenue share in 2023. This is attributed to several factors including growing installations in hospitals, increasing hospital admissions due to cardiac conditions, and strategies implemented by key manufacturers. Moreover, poor eating habits that subsequently lead to heart conditions, diabetes, and hypertension are significantly contributing to defibrillator usage in hospitals. The public access segment is expected to register the fastest CAGR from 2024 to 2030 owing to supportive initiatives by healthcare institutions, local communities, regulatory agencies, and governments to increase the availability of public access AEDs.

Moreover, in the U.S., the Federal Aviation Administration (FAA) mandates the installation of AEDs on all commercial airliners. Similarly, the American Heart Association (AHA) recommends the placement of AEDs in public places, such as airports, schools, and sports stadiums. For instance, in November 2023, the Houston Housing Authority (HHA) and Cardiac Solutions partnered to become the first housing agency in North America to install AEDs in all of its public housing complexes to improve emergency response for SCA incidents.

Key U.S. External Defibrillator Company Insights

Some of the key companies operating in the U.S. external defibrillator market include Koninklijke Philips N.V.; Stryker; and ZOLL Medical Corporation.

-

Philips N.V. offers a range of external defibrillators under the HeartStart AED solutions. Its products include the HeartStart FRx, HeartStart OnSite, and HeartStart FR3. These devices are designed for both professional and public access use, and they offer features, such as clear voice prompts, quick shock delivery, and CPR guidance

-

ZOLL Medical Corp. offers external defibrillators under the AED Plus and R Series. Its products include the AED Plus, AED Pro, and X Series defibrillators. These devices feature Real CPR Help technology, which provides real-time feedback on the depth and rate of chest compressions during CPR

Nihon Kohden Corporation; Shenzhen Mindray Bio-Medical Electronics; and Schiller Americas, inc. are some of the other market participants in the U.S. external defibrillators market.

-

Nihon Kohden Corporation is a Japanese multinational corporation specializing in manufacturing and distributing medical electronic equipment. One of their key products is the external defibrillator. The company has a strong presence in the U.S. market and offers a range of defibrillators such as cardiolife EMS EMS-1052, cardiolife TEC-8300K series, and cardiolife TEC-5600 series

-

Shenzhen Mindray Bio-Medical Electronics is known for providing a variety of medical devices, including defibrillators, to the healthcare industry. Its product line includes AEDs and manual defibrillators. Some of their notable product names in the defibrillator category include BeneHeart D60, BeneHeart D30, and BeneHeart D6, among others

Key U.S. External Defibrillator Companies:

- Koninklijke Philips N.V.

- ZOLL Medical Corporation

- Stryker

- Nihon Kohden Corporation

- Shenzhen Mindray Bio-Medical Electronics

- Schiller Americas, Inc.

- Medtronic

- Amiitalia

- MEDIANA Co., Ltd.

Recent Developments

-

In February 2023, Shenzhen Mindray Bio-Medical Electronics launched the BeneHeart D60 and D30, its new defibrillation solutions with high-definition capacitive large-screen buttons essential for critical operations

-

For instance, in January 2023, Avive Solutions, Inc. announced receiving pre-market approval from the FDA for its Avive AED, a handheld AED

U.S. External Defibrillators Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.33 billion

Growth rate

CAGR of 9.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Key companies profiled

Koninklijke Philips N.V.; ZOLL Medical Corp.; Stryker; Nihon Kohden Corp.; Shenzhen Mindray Bio-Medical Electronics; Schiller Americas, inc.; Medtronic; Amiitalia; MEDIANA Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. External Defibrillators Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. external defibrillators market report based on product and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Automated

-

Semi-automated

-

Fully-automated

-

-

Wearable Cardioverter Defibrillators

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Prehospital

-

Public Access Market

-

Alternate Care Market

-

Home Healthcare

-

Frequently Asked Questions About This Report

b. The U.S. external defibrillators market size was valued at USD 1.27 billion in 2023.

b. The U.S. external defibrillators market is projected to grow at a compound annual growth rate (CAGR) of 9.0% from 2024 to 2030.

b. The automated segment dominated the market and accounted for a share of 39.4% in 2023 driven by factors such as increasing prevalence of cardiovascular diseases, technological advancements, and growing public awareness & training programs.

b. Some of the key companies operating in the U.S. external defibrillator market include Koninklijke Philips N.V.; Stryker; ZOLL Medical Corporation, Nihon Kohden Corporation; Shenzhen Mindray Bio-Medical Electronics; and Schiller Americas, Inc.

b. Some of the key drivers contributing to the market growth include technological advancements, rising healthcare expenditure, increased awareness and training programs, and increasing incidences of cardiac arrest.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.