- Home

- »

- Medical Devices

- »

-

U.S. Endoscope Cleaning Timers Market Size Report, 2030GVR Report cover

![U.S. Endoscope Cleaning Timers Market Size, Share & Trends Report]()

U.S. Endoscope Cleaning Timers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (1-Hour Cleaning Timers, 5/7-Day Cleaning Timers), Consumer Behavior, Segment Forecasts And Competitive Analysis

- Report ID: GVR-4-68040-550-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

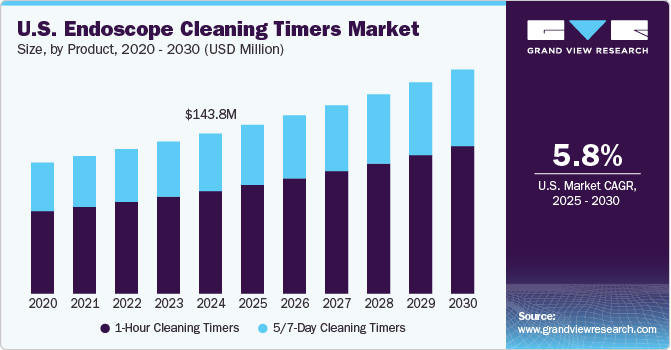

The U.S. endoscope cleaning timers market size was estimated at USD 143.80 million in 2024 and is projected to grow at a CAGR of 5.82% from 2025 to 2030. The market is expected to grow significantly owing to the increasing prevalence of gastrointestinal diseases and cancers, which necessitates a higher volume of endoscopic examinations, driving the demand for effective cleaning solutions to prevent infections associated with these procedures. In addition, growing demand for minimally invasive surgeries, regulatory compliance requirements, technological advancements in cleaning equipment, increased healthcare expenditures, and a strong focus on infection prevention strategies further propel market growth.

The increasing preference for minimally invasive surgeries is another significant driver for this market. Endoscopic procedures are favored due to their benefits, such as reduced recovery times, less pain, and minimal scarring compared to traditional surgeries. According to U.S. Department of Health and Human Services, it is estimated that more than 20 million GI endoscopies are performed yearly in the U.S. As more patients opt for these procedures, there is a corresponding need for reliable cleaning practices that ensure the safety and efficacy of endoscopic instruments. This trend drives demand for devices like cleaning timers that help maintain stringent hygiene standards.

Advancements in technology related to automated cleaning systems have also contributed significantly to market growth. Modern automated endoscope reprocessors (AERs) often incorporate integrated timers that enhance operational efficiency by ensuring that each phase of the cleaning process is completed within specified timeframes. This technological integration not only improves compliance but also reduces human error during reprocessing. In October 2020, Olympus announced the market availability of its next-generation automated endoscope reprocessor (AER), named the OER-Elite. This development is significant as it addresses critical aspects of patient safety and infection control in medical settings.

Rising healthcare expenditures in the U.S. enable hospitals and surgical centers to invest in advanced medical technologies, including endoscope cleaning solutions. For instance, as per the U.S. Centers for Medicare & Medicaid Services, the total health care spending in the U.S. reached USD 4.9 trillion in 2023. This figure reflects a robust increase of 7.5 percent compared to the previous year. Such growth is indicative of various factors including rising costs of medical services, pharmaceuticals, and an aging population that requires more extensive health care services. As healthcare facilities allocate more funds towards improving patient safety and infection control measures, there is a greater willingness to purchase sophisticated equipment like cleaning timers that facilitate effective reprocessing.

Moreover, there is an increasing emphasis on infection prevention strategies across healthcare settings due to heightened awareness following recent global health crises, such as COVID-19. This focus led institutions to adopt comprehensive infection control measures, including rigorous endoscope reprocessing protocols supported by reliable timing mechanisms.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including degree of innovation, industry competition, product substitutes, and impact of regulations, level of partnerships & collaborations activities, and geographic expansion. For instance, the U.S. endoscope cleaning timers industry is fragmented, with small players entering the market and launching new innovative products. The degree of innovation is medium, the level of partnerships & collaborations activities is low, the impact of regulations on the market is medium, and regional expansion of the market is medium.

Innovations include multi-mode washing cycles and eco-friendly detergent options, and automated alerts which cater to sustainability concerns without compromising efficacy. For instance, PENTAX Medical’s PlasmaTYPHOON+ Storage System uses advanced drying and storage technologies to extend endoscope storage times while providing automated alerts for reprocessing after the designated 5/7-day period.

The degree of partnerships and collaborations in the development and implementation of endoscope cleaning timers is significant, as these devices are essential for ensuring effective reprocessing of endoscopes. Manufacturers often collaborate with healthcare institutions, infection control experts, and regulatory bodies to create timers that meet stringent safety and efficacy standards. These partnerships facilitate the sharing of best practices and technological advancements, leading to improved designs that enhance user experience and compliance with cleaning protocols.

The impact of regulations on the industry is high, with strict guidelines influencing device development and deployment. Regulatory bodies in the U.S., such as the Centers for Disease Control and Prevention (CDC) and the Food and Drug Administration (FDA), have established strict guidelines regarding the reprocessing of endoscopes. Compliance with these regulations necessitates precise timing in cleaning processes to ensure thorough disinfection. The implementation of cleaning timers aids healthcare facilities in adhering to these guidelines, thus driving their adoption.

The level of regional expansion in the market is low due to various government programs and initiatives. Regions such as North America and Europe are leading this trend due to stringent regulatory requirements and heightened awareness among healthcare professionals regarding infection prevention. In North America, for instance, hospitals are increasingly investing in sophisticated endoscope washer disinfectors equipped with timers that ensure compliance with cleaning protocols, thereby enhancing patient safety.

Product Insights

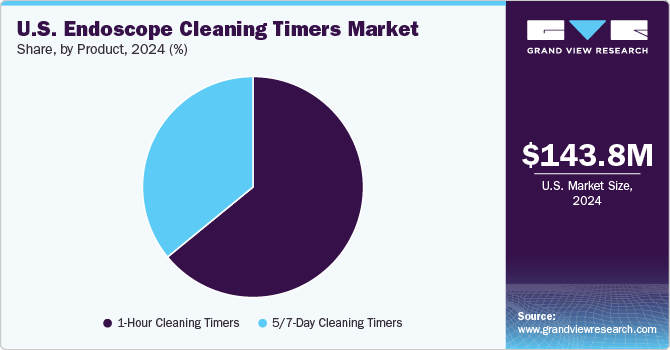

The 1-hour cleaning timers segment led the market with the largest revenue share of 64.1% in 2024 and is expected to grow at the fastest CAGR during the forecast period. 1-hour cleaning timers are designed to ensure that the manual cleaning process of an endoscope begins within an hour of its last use. This is a crucial step in the reprocessing workflow, as delaying cleaning can lead to the formation of biofilm, which harbors bacteria and significantly reduces the efficacy of disinfection processes. The SGNA and AAMI recommend that pre-cleaning should commence immediately post-procedure, and that manual cleaning should not be delayed beyond an hour to prevent organic matter from drying on the device, making decontamination more difficult.

The 5/7-day cleaning timers segment is expected to grow at a significant CAGR during the forecast period. 5/7-day cleaning timers monitor the duration an endoscope remains in storage after undergoing high-level disinfection (HLD). According to industry standards, if an endoscope is not used within a defined period typically 5 to 7 days it must be reprocessed before its next use. This requirement prevents the risk of microbial contamination and ensures that endoscopes remain sterile and safe for subsequent procedures. For instance, Olympus OER-Pro Series incorporates an intelligent storage monitoring system that tracks disinfection and storage durations, sending notifications when reprocessing is required.

Key U.S. Endoscope Cleaning Timers Company Insights

The market is fragmented, with the presence of multiple major players. Key players are adopting growth strategies to enhance their market presence, including collaborations and mergers & acquisitions.

Key U.S. Endoscope Cleaning Timers Companies:

- Ruhof

- Boston Scientific

- Health Mark Industries

- Steris

- Advanced Sterilization Products (ASP)

- Olympus

- Cantel Medical (Medivators)

- Stericool Technologies (Getinge)

- CIVCO Medical Solutions

- Medline Industries

- Ecolab (Microtek Medical)

- Belimed AG, Steelco (Miele Group)

- Wassenburg Medical (Hoya Corporation)

Recent Developments

-

In March 2025, the U.S. Food and Drug Administration (FDA) granted de novo clearance for Nanosonics’ automated endoscope cleaning system known as CORIS. This marks a significant advancement in the field of medical device sterilization, particularly for flexible endoscopes used in procedures such as colonoscopy. The de novo clearance for Nanosonics’ approach initially greenlights CORIS’ use with an Olympus video endoscope designed for colonoscopy, the Evis Exera III. The company said it plans to cover all major categories of flexible endoscopes in time.

-

In March 2023, PENTAX Medical, a division of the HOYA Group, developed an innovative automated pre-cleaning solution known as AquaTYPHOON. This device has recently received a CE mark, indicating its compliance with European health, safety, and environmental protection standards. The AquaTYPHOON was created in collaboration with PlasmaBiotics, aiming to enhance the efficiency and effectiveness of endoscope reprocessing.

U.S. Endoscope Cleaning Timers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 151.62 million

Revenue forecast in 2030

USD 201.17 million

Growth rate

CAGR of 5.82% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product

Country scope

U.S.

Key companies profiled

Ruhof; Boston Scientific; Health Mark Industries; Steris; Advanced; Sterilization Products (ASP); Olympus; Cantel Medical (Medivators); Stericool Technologies (Getinge); Medline Industries; Ecolab (Microtek Medical); Belimed AG; Steelco (Miele Group); Wassenburg Medical (Hoya Corporation), etc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Endoscope Cleaning Timers Market Report Segmentation

This report forecasts revenue growth, country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. endoscope cleaning timersmarket report based on product.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

1-Hour Cleaning Timers

-

5/7-Day Cleaning Timers

-

Frequently Asked Questions About This Report

b. The U.S. endoscope cleaning timers market size was estimated at USD 143.80 million in 2024 and is expected to reach USD 151.62 million in 2025

b. The U.S. endoscope cleaning timers market is expected to grow at a compound annual growth rate of 5.82% from 2025 to 2030 to reach USD 201.17 million by 2030.

b. The 1-Hour Cleaning Timers segment dominated the market with the highest revenue share of 64.09% in 2024. 1-hour cleaning timers are designed to ensure that the manual cleaning process of an endoscope begins within an hour of its last use.

b. Some key players operating in the U.S. endoscope cleaning market include TRuhof , Boston Scientific, Health Mark Industries, Steris , Advanced Sterilization Products (ASP), Olympus, Cantel Medical (Medivators), Stericool Technologies (Getinge), CIVCO Medical Solutions, Medline Industries, Ecolab (Microtek Medical), Belimed AG, Steelco (Miele Group), Wassenburg Medical (Hoya Corporation).

b. The U.S. endoscope cleaning market is expected to grow significantly owing to the increasing prevalence of gastrointestinal diseases and cancers, which necessitates a higher volume of endoscopic examinations, driving the demand for effective cleaning solutions to prevent infections associated with these procedures

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.