- Home

- »

- Medical Devices

- »

-

U.S. Disposable Syringes Market Size, Industry Report 2030GVR Report cover

![U.S. Disposable Syringes Market Size, Share & Trends Report]()

U.S. Disposable Syringes Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Conventional Syringes, Safety Syringes), By Application (Immunization Injections, Therapeutic Injections), And Segment Forecasts

- Report ID: GVR-4-68040-029-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Disposable Syringes Market Trends

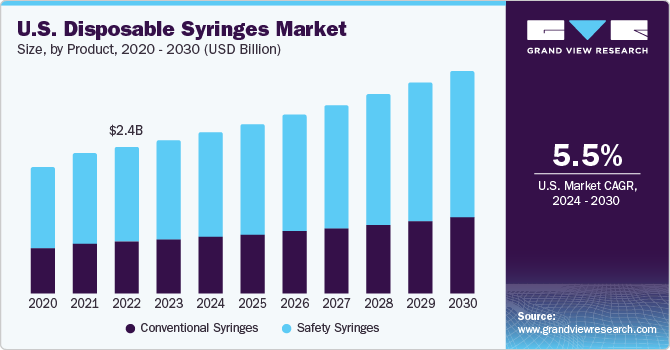

The U.S. disposable syringes market size was valued at USD 2.55 billion in 2023 and is expected to grow at a CAGR of 5.5% from 2024 to 2030. The rapid increase in prevalence of chronic illnesses,growing number of surgeries, and increasing adoption of safety syringes are significantly driving the market growth. In 2023, U.S. disposable syringes market accounted for over 27% of the global disposable syringes market. Increasing investments by governments, growing R&D activities, rising prevalence of chronic diseases such as diabetes & cancer, and presence of key companies are among the factors driving the market growth.

Need for disposable syringes in different healthcare settings is projected to surge with the increasing geriatric population, a demographic that is highly vulnerable to chronic disorders including diabetes and other lifestyle-associated health conditions. In addition, according to the CDC, population base aged 65 years and above are more likely to acquire diabetes, heart disease, cancer, COPS, neurological problems, and other chronic conditions. Patients with such illnesses require emergency and non-emergency hospital services which are likely to boost the market growth in the upcoming years.

Rise in number of government initiatives aimed at ensuring the highest level of infection prevention is expected to create opportunities for market growth. Both the U.S. government and organizations such as the World Health Organization (WHO) and United Nations Programme on HIV/AIDS (UNAIDS) have implemented numerous initiatives to promote safe drug delivery. Some of the programs conducted by these organizations are needle and syringe programs; prevention & treatment of sexually transmitted infections; targeted information; and education & communication for people who abuse drugs and their sexual partners. To address safety issues, the government mandated the use of safety engineered devices in healthcare facilities.

Market Concentration & Characteristics

The industry is currently in a medium growth stage (CAGR: 5-10%). Moreover, the pace of growth indicates an accelerating trend. Syringes are required for numerous diagnostic and therapeutic approaches for chronic diseases as they play a crucial role during medication administration and tests, resulting in rising demand for the product. A huge percentage of the U.S. population is currently at danger of developing chronic diseases, as a result of high blood pressure, obesity, smoking, diabetes, sedentary lifestyle and excessive alcohol consumption.

Technological breakthroughs such as improvement in design and safety technology aimed at improving functionality and efficacy offer significant opportunities for companies. For instance, in October 2022, Terumo Pharmaceutical Solutions, a manufacturer of primary container, injection, and infusion therapy devices, announced the launch of a polymer ready-to-fill syringe for use in larger volume biotech drugs.

The disposable syringes industry is characterized by a high level of M&A activities undertaken by leading companies. This is due to factors including the increasing focus on enhancing companies' portfolio and the need to consolidate in a rapidly growing industry. Several companies are undertaking this strategy to strengthen their portfolio. For instance, in January 2022, ICU Medical Inc. announced the completion of the acquisition of Smiths Medical. The business areas of Smiths Medical includes syringes, ambulatory infusion devices, vital care products, and vascular access.

Presence of robust healthcare institutions as well as political bills such as, the Healthcare Reform Bill is expected to drive the sale of disposable syringes and other basic medical supplies. Syringes and other medical devices used to inject medications into the body are regulated by FDA. This includes insulin delivery systems, injectable drugs, and other medical treatments. The FDA guarantees that these devices are both safe and effective in their intended use. Syringes are classified as Class II medical device. A syringe must meet specific safety and quality requirements set by the FDA in order to be approved. The approval process is intended to assure the sale of only safe and effective syringes in the country.

Product Insights

The safety syringes held the largest market share of 64.5% in 2023.Safety syringes eliminate the risk of patient-to-patient infections transmission due to which these syringes are likely to retain its dominance throughout the forecast period. These syringes are primarily used for administering medications with the help of specialized and standard techniques. Unsafe practices including multiple use of a needle and syringe without precautionary measures can cause needle stick injuries.

The WHO has issued guidelines for the use of safety syringes to prevent needlestick injuries. The main aim of these guidelines is to prevent the reuse of conventional syringes. The International Organization for Standardization (ISO) has also issued a set of requirements for manufacturers of safety syringes to ensure safety and high performance level of the products. Such safety mandates are projected to be opportunistic for the product demand.

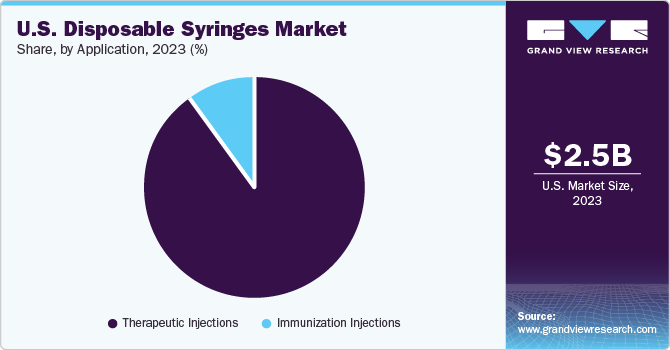

Application Insights

The therapeutic injections led the market and accounted for 86.2% share in 2023. Increasing awareness about blood donations is among the significant factors driving the product demand. Injections are used in almost every medical procedure, from diagnosis to treatment. Increasing prevalence of diseases including malaria, tuberculosis, AIDS, and dengue leads to increasing need for injections as they are among the essential requirements for diagnosis and treatment.

The immunization injections segment is projected to exhibit the fastest growth over the forecast period. Vaccination drive is primarily a mass activity, which can thereby increase the risk associated with contamination from blood-borne pathogens. In these cases, the multiple use of needles and syringes is to be prevented to avoid the risk of needle stick injuries. Furthermore, the type of injections used also depends on the cost, safety, and type of vaccine to be administered. Prefilled auto-disable syringes are mainly preferred, provided all the vaccines are available in the same form. This prevents contamination, increases the dosage accuracy, and reduces the waste generated from a large number of vials.

Key U.S. Disposable Syringes Company Insights

Some of the key U.S. disposable syringes companies include MEDTRONIC, B. Braun Melsungen AG, Terumo Corporation, Retractable Technologies, and Baxter International, Inc.among others. Companies are adopting various strategies, such as product launches, partnerships, mergers & acquisitions, and innovations, such as introduction of prefilled syringe products to strengthen their foothold in the market. Companies are reinforcing their R&D capabilities in order to deploy safe and simple medical practices, which is expected to enhance market growth in the upcoming years.

Key U.S. Disposable Syringes Companies:

- MEDTRONIC (Covidien)

- Nipro Corporation

- Fresenius Kabi AG

- Baxter International, Inc.

- B. Braun Melsungen AG

- BD

- Terumo Corporation

- Novo Nordisk

- UltiMed, Inc.

- Henke-Sass, Wolf

- Retractable Technologies

- Flextronics International Vita Needle Company

Recent Developments

-

In November 2022, F. Hoffmann-La Roche Ltd. announced its strategic partnership with Mark Cuban Cost Plus Drug Company to provide affordable access to supplies of blood glucose testing in the U.S.

-

In July 2021, Owen Mumford Pharmaceutical Services announced the launch of its cutting-edge Aidaptus auto-injector platform. Aidaptus is a single-use, two-step, spring-powered auto-injector with a versatile design fitting both 2.25 mL and 1 mL prefilled glass syringes in the same device.

U.S. Disposable Syringes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.68 billion

Revenue forecast in 2030

USD 3.69 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Medtronic; Nipro Corp.; Fresenius Kabi AG; Baxter; Braun Medical, Inc.; Becton, Dickinson and Company (BD); Flextronics International Vita Needle Company; Terumo Corp.; Novo Nordisk; Ultimed, Inc.; Henke-Sass Wolf; Retractable Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Disposable Syringes Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. disposable syringes market report on the basis of product and application:

-

Product Outlook (Revenue USD Million; 2018 - 2030)

-

Conventional Syringes

-

Safety Syringes

-

Retractable Safety Syringes

-

Non-retractable Safety Syringes

-

-

-

Application Outlook (Revenue USD Million; 2018 - 2030)

-

Immunization Injections

-

Therapeutic Injections

-

Frequently Asked Questions About This Report

b. The global U.S. disposable syringes market size was estimated at USD 2.55 billion in 2023 and is expected to reach USD 2.68 billion in 2024.

b. The global U.S. disposable syringes market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 3.69 billion by 2030.

b. Safety syringes dominated the U.S. disposable syringes market with a share of 64.5% in 2023. The safety syringes are majorly used for administering medications by utilizing specialized and standard techniques. The unsafe injection practices lead to almost 33,800 HIV infections, 315,000 hepatitis C transmissions, and 1.7 million hepatitis B infections every year globally.

b. Some key players operating in the U.S. disposable syringes market include Cardinal Health, B. Braun Melsungen, Terumo Corporation, ICU Medical, Inc. (Smiths Medical), Nipro Corporation, BD, Sol-Millennium Medical, CODAN Medizinische Geräte GmbH & Co KG, Cole-Parmer Instrument Company, LLC, Henke-Sass, Wolf, UltiMed, Inc., among other players.

b. The growth of U.S. disposable syringes market is attributed due to growing prevalence of chronic disorders, increasing adoption of safety syringes, and growing number of surgeries in U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.