- Home

- »

- Healthcare IT

- »

-

U.S. Digital Health Market Size, Share, Industry Report 2030GVR Report cover

![U.S. Digital Health Market Size, Share & Trends Report]()

U.S. Digital Health Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Tele-healthcare, mHealth), By Component (Software, Hardware, Services), By Application (Obesity, Diabetes) , By End-use, And Segment Forecasts

- Report ID: GVR-4-68039-823-5

- Number of Report Pages: 171

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Digital Health Market Size & Trends

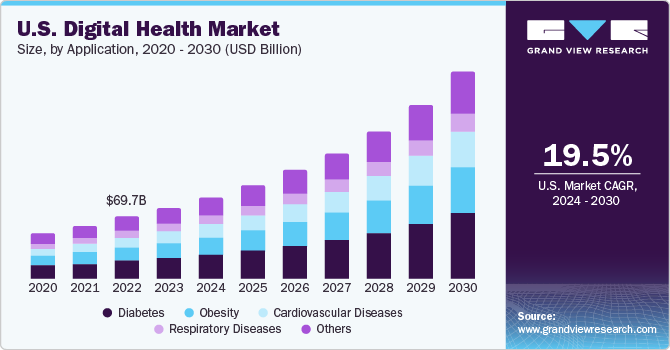

The U.S. digital health market size was estimated at USD 81.17 billion in 2023 and is projected to grow at a CAGR of 19.5% from 2024 to 2030. The supporting conditions for digital healthcare services and enhanced internet connectivity to provide remote healthcare services using digital paths are anticipated to drive market growth. In addition, the increasing adoption of smartphones has encouraged manufacturers to invest and capitalize on their growth opportunities in the global digital health industry. For instance, in May 2023, UC San Diego Health launched a SMART health insurance card that displays real-time insurance data on scanning.

The rising mobile and smartphone subscriptions are expected to drive the market growth. According to Oberlo, smartphone penetration in the U.S. has increased from 83% in 2018 to 91% in 2023. According to the Mobile Economy North America 2023, 53% of North America's 5G internet usage comprises services, including healthcare services. In addition, several network companies are partnering with hospitals to provide their network services. For instance, in July 2023, Verizon deployed a private full spectrum 5G network in the VA Palo Alto Health Care System, a veterans' hospital in California.

In August 2023, the Advanced Research Projects Agency for Health (ARPA-H), a division within the U.S. Department of Health and Human Services (HHS), initiated the Digital Health Security (DIGIHEALS) task to safeguard the electronic infrastructure of the U.S. healthcare system. The project intends to request proposals for proven technologies originally developed for national security purposes through a Broad Agency Announcement (BAA) and implement them within clinical care facilities, civilian health systems, and personal health devices. DIGIHEALS seeks to ensure uninterrupted patient care even in the event of a widespread cyberattack on medical facilities, similar to incidents that have led to the permanent closure of hospitals.

Furthermore, the adoption of artificial intelligence (AI) and machine learning (ML) in the healthcare industry contributes to the growth of the digital health market in the U.S. The U.S. government is undertaking several initiatives to promote AI/ML applications in healthcare. For instance, in October 2023, the U.S. FDA created a Digital Health Advisory Committee to explore the problems related to digital health technologies (DHTs), including augmented reality (AR), virtual reality (VR), AI/ML, digital therapeutics, remote patient monitoring, wearables, and software.

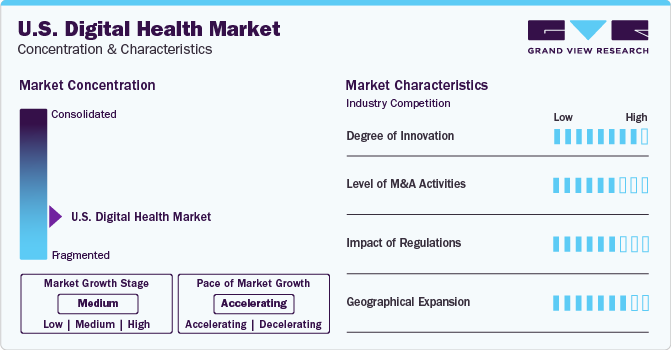

Market Concentration & Characteristics

The U.S. market for digital health is characterized by continuous innovation, particularly emphasizing user-friendly telehealth technologies. These advancements are geared towards streamlining adoption for both patients and healthcare providers. This technological integration into healthcare empowers individuals to oversee their health and engage in medical consultations remotely. Furthermore, digital technologies are used in drug discovery, detection, and several healthcare domains. For instance, In October 2023, the Autism Center of Excellence (North Carolina) researchers developed a digital autism screening app for autism spectrum disorder (ASD). The application demonstrated a sensitivity of 87.8% in detecting ASD, accurately identifying a high proportion of children with the condition. It exhibited a specificity of 80.8%.

Mergers and acquisitions (M&A) activities continue to shape the business landscape, with companies seeking strategic partnerships and acquisitions to enhance market presence and drive growth. Notable strategies include new product launches, expansions, and M&As. The market observes a moderate level of M&A activities among leading players. For instance, in February 2024, Aptar Digital Health acquired Healint, a company specializing in digital health in neurology. The acquisition is expected to broaden Aptar's digital health neurology portfolio, making it a prominent competitor in the U.S. digital health market.

Digital health technologies are subject to various regulatory frameworks across the U.S. The structured regulatory framework positively impacts market access, growth, and compliance. For instance, in the U.S., the Food and Drug Administration (FDA) has developed guidelines for digital health technologies. In October 2023, the U.S. FDA created a new Digital Health Advisory Committee to resolve the digital health technologies (DHTs) issues and ultimately promote digital technologies in healthcare.

The potential for enhanced accessibility, cost-efficiency, and improved outcomes drives the global expansion of the U.S. digital health sector. Established industry frontrunners are penetrating emerging markets, indigenous startups are witnessing significant growth, and technology is being customized to suit various contexts. Achieving alignment through collaborative initiatives and national strategies and tackling issues like data privacy, digital disparity, and regulatory intricacies are essential. Expansion efforts typically involve establishing new facilities or plants in different geographical areas or mergers and acquisitions with companies in diverse regions. Many market participants are embracing geographical expansion strategies to bolster their market positions.

Case Study: Scaling up and sustaining the digital transformation of U.S. hospitals brought about by COVID-19

UC San Diego Health, a private health system affiliated with the University of California, San Diego, initially implemented on-site employee screening due to county health orders. Later, it extended its screening resources to the local community, allowing symptomatic individuals to schedule tests.

The hospital also collaborated with its affiliated university and its 15,000 students, achieving a milestone in August 2019, when UC San Diego’s Student Health Services and Counselling and Psychological Services became the first in the University of California system to share an interoperable electronic health record system with the hospital. This integration streamlined test ordering, result notification, and patient care, facilitating quicker turnaround times for imaging studies and expediting communication of health information for students requiring specialized care.

By integrating health systems, UC San Diego Health facilitated a streamlined testing and tracing initiative, supporting the Return-to-Learn program to facilitate the safe resumption of university attendance and studies.

Technology Insights

The tele-healthcare segment led the market with the highest revenue share of 43.2% in 2023. The growth is attributed to growing investments in tele-healthcare platforms post-COVID-19 pandemic. The companies are adopting digital healthcare platforms to provide remote care for individuals and patients with chronic diseases like diabetes. For instance, in January 2023, the National Institutes of Health (NIH) launched a COVID-19 telehealth program called the Home Test to Treat program. The program offers free COVID-19 health assistance, such as telehealth sessions, rapid tests at home, and at-home remedies.

The mHealth segment is the second largest segment, attributed to the significant penetration of smartphones, growing adoption of mobile health applications, and use of smartwatches and fitness trackers. Smartwatches are often paired with smartphones, enabling users to make calls, receive notifications, control music, send messages, and keep a fitness check directly from the wrist. The integration enhances convenience further boosting the segment growth. In October 2023, b.well Connected Health, a patient-oriented health management platform, announced its integration into the Samsung Health app. This initiative aims to give Galaxy smartphone users a unified platform for accessing health data, receiving insights recommendations, and connecting with care providers virtually and in person.

Component Insights

In 2023, the services segment dominated the market with the highest revenue share of more than 37.8%, owing to the increasing software upgrades and a preference for hardware and software advancements. Developing digital platforms for monitoring, diagnosis, prevention & wellness is also anticipated to support the segment growth. For instance, in January 2024, Eli Lilly and Company launched LillyDirect, a digital healthcare experience for U.S.-based patients, under which LillyDirect Pharmacy Solutions, a digital pharmacy for medications powered by third-party pharmacy fulfillment online services.

The software segment is expected to register the fastest CAGR over the forecast period. The growth is attributed to the increasing software development activities by the service providers and developers to provide better digital healthcare services. In addition, consumers and service providers' growing adoption of healthcare software integrated into the platform to enhance patient care quality is anticipated to drive the segment growth over the forecast period. For instance, in December 2023, Tandem Diabetes Care, Inc. launched an updated insulin pump software, t:slim X2, integrated with Dexcom G7 Continuous Glucose Monitoring (CGM) in the U.S.

Application Insights

The diabetes segment held the largest revenue share of over 24.3% in 2023 and is expected to register the fastest CAGR from 2024 to 2030. The growing diabetes prevalence and associated issues have contributed to the segment's growth. According to the Centers for Disease Control and Prevention (CDC), in 2021, in the U.S., 38.4 million individuals had diabetes, of which 38.1 million were aged 18 and above. Companies are developing digital health technologies to offer innovative solutions to address the needs of individuals with diabetes. For instance, in February 2023, DexCom, Inc. launched the Dexcom G7 continuous glucose monitoring (CGM) System in the U.S. through a Super Bowl commercial starring Nick Jonas, who has diabetes. The commercial was expected to be watched by over 4.8 million diabetic Americans, of which 3.3 million were not using CGM and 2.3 million with CGM coverage.

Obesity is the second largest application segment, due to the high prevalence of the disease coupled with the increasing need for effective weight management solutions. Obesity affects a significant portion of the U.S. population. According to the World Obesity Atlas 2023, approximately 58% of the U.S. population is expected to suffer from obesity. This widespread issue creates a substantial demand for effective solutions to manage and address obesity-related health concerns. Advances in technology have led to the development of innovative digital health tools and platforms designed specifically for managing obesity. For instance, in December 2023, Fauna Bio collaborated with Eli Lilly and Company to integrate Convergence AI from Fauna into preclinical drug discovery for obesity.

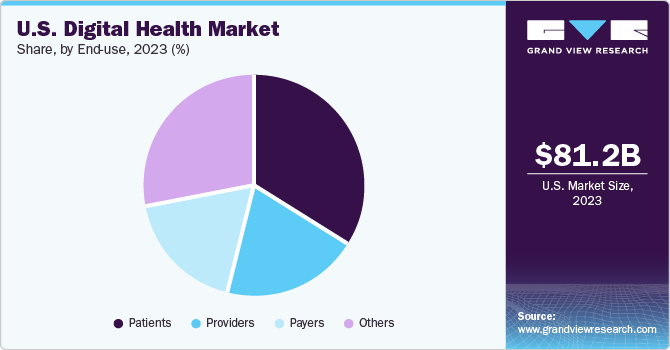

End-use Insights

The patient segment held the largest share of 34.1% in 2023 and is expected to witness the fastest CAGR from 2024 to 2030. The growth is attributed to the increased awareness of health management and patient-centered care. Digital health technologies have transformed the healthcare landscape, empowering patients with remote monitoring tools, self-management capabilities, and readily available health information. For instance, in February 2024, Samsung Electronics received the De Novo approval from the U.S. FDA for the Samsung Health Monitor app's sleep apnea feature. It detects sleep apnea through the Samsung Galaxy Watch and phone.

The providers segment holds a significant share of the U.S. digital health industry and is expected to maintain its market share over the forecast period. The extensive uptake of advanced technologies like digital therapeutics and telemedicine drives the market growth. Healthcare providers are progressively utilizing digital solutions to provide remote consultations, personalized treatment strategies, and evidence-backed therapies beyond conventional care environments. Incorporating digital tools enables providers to deliver more convenient and customized care, ultimately enhancing patient outcomes.

Key U.S. Digital Health Company Insights

Major players, such as Apple, Inc.; Google, Inc.; and Qualcomm Technologies, Inc.; prioritize mergers, acquisitions, technological partnerships, and product innovations to address the growing demand for digital healthcare platforms. Intense competition is evident among these players, with established leaders concentrating on expanding their product portfolios through strategic collaborations, partnerships, and the introduction of new products.

Key U.S. Digital Health Companies:

- Apple, Inc.

- AT&T

- Airstrip Technologies

- Allscripts

- Google, Inc.

- Orange

- Qualcomm Technologies, Inc.

- Softserve

- Samsung Electronics Co. Ltd.

- Telefonica S.A.

- Vodafone Group

- Cerner Corp.

- McKesson Corp.

- Epic Systems Corp.

- NextGen Healthcare, Inc

- Greenway Health LLC

- CureMD Healthcare

- HIMS

- Computer Programs and Systems, Inc.

- Vocera Communications

- IBM Corp.

- Siemens Healthcare GmbH

- Cisco Systems, Inc.

Recent Developments

-

In December 2023, Google, Inc. launched MedLM, a medical generative AI to promote digital technology in healthcare.

-

In September 2023, Enovacom, a subsidiary of Orange Business, acquired NEHS Digital and Xperis and strengthened its e-health portfolio.

-

In March 2023, IBM collaborated with Cleveland Clinic and deployed an IBM-managed onsite quantum computer. It will enable Cleveland Clinic in accelerating biomedical discoveries.

-

In January 2023, Apple Fitness+ launched a whole-body cardio workout, a new Kickboxing workout. The workout is led by two new trainers.

-

In August 2023, Siemens Healthineers, specializing in AI-powered applications and digital healthcare, announced a partnership with SSM Health for ten years to develop the diagnostic imaging and advanced software and technology of SSM Health.

U.S. Digital Health Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 94.95 billion

Revenue forecast in 2030

USD 276.62 billion

Growth rate

CAGR of 19.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Report updated

April 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, component, application, end-use

Country scope

U.S.

Key companies profiled

Apple Inc.; AT&T; Airstrip Technologies; Allscripts; Google Inc.; Orange; Qualcomm Technologies, Inc.; Softserve; Samsung Electronics Co. Ltd.; Telefonica S.A.; Vodafone Group; Cerner Corp.; McKesson Corp.; Epic Systems Corp.; NextGen Healthcare, Inc; Greenway Health LLC; CureMD Healthcare; HIMS; Computer Programs and Systems, Inc; Vocera Communications; IBM Corp.; Siemens Healthcare GmbH; Cisco Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Digital Health Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the U.S. digital health market report based on technology, component, application, and end-use:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Tele-healthcare

-

Tele-care

-

Activity Monitoring

-

Remote Medication Management

-

-

Tele-health

-

LTC Monitoring

-

Video Consultation

-

-

-

mHealth

-

Wearables & Connected Medical Devices

-

Vital Sign Monitoring Devices

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep Monitoring Devices

-

Sleep trackers.

-

Wrist Actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs Fetal & Obstetric Devices

-

Neuromonitoring Devices

-

Electroencephalographs

-

Electromyographs

-

Others

-

-

-

mHealth Apps

-

Medical Apps

-

Women's Health

-

Menstrual Health

-

Pregnancy Tracking & Postpartum Care

-

Menopause

-

Disease Management

-

Others

-

-

Chronic Disease Management Apps

-

Diabetes Management Apps

-

Blood Pressure & ECG Monitoring Apps

-

Mental Health Management Apps

-

Cancer Management Apps

-

Obesity Management Apps

-

Other Chronic Disease Management Apps

-

-

Personal Health Record Apps

-

Medication Management Apps

-

Diagnostic Apps

-

Remote Monitoring Apps

-

Others (Pill Reminder, Medical Reference, Professional Networking, Healthcare Education)

-

-

Fitness Apps

-

Exercise & Fitness

-

Diet & Nutrition

-

Lifestyle & Stress

-

-

-

Services

-

Monitoring Services

-

Independent Aging Solutions

-

Chronic Disease Management & Post-Acute Care Services

-

-

Diagnosis Services

-

Healthcare Systems Strengthening Services

-

Others

-

-

-

-

Digital Health Systems

-

EHR

-

E-prescribing Systems

-

-

Healthcare Analytics

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Obesity

-

Diabetes

-

Cardiovascular Diseases

-

Respiratory Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Patients

-

Providers

-

Payers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. digital health market size was estimated at USD 81.17 billion in 2023 and is expected to reach USD 94.95 billion in 2024.

b. The U.S. digital health market is expected to grow at a compound annual growth rate of 19.5% from 2024 to 2030 to reach USD 276.62 billion by 2030.

b. The Telehealthcare segment dominated the U.S. digital health market and accounted for the largest revenue share of 43.2% in 2023owing to the increasing adoption of digital healthcare platforms to provide remote care for chronic disease patients and geriatric individuals.

b. Some key players operating in the U.S. digital health market include Apple Inc., Google Inc, Greenway Health, American Well, Teladoc Health, McKesson Corporation, Cerner Corporation, Vodafone Group, AT&T, NextGen Healthcare, Allscripts, CureMD Healthcare, and IBM Corporation.

b. Key factors that are driving the U.S. digital health market growth include growing digitalization of healthcare, increasing smartphone penetration, and improved internet connectivity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.