- Home

- »

- Next Generation Technologies

- »

-

U.S. Cryptocurrency Payment Apps Market Size Report 2030GVR Report cover

![U.S. Cryptocurrency Payment Apps Market Size, Share & Trends Report]()

U.S. Cryptocurrency Payment Apps Market (2023 - 2030) Size, Share & Trends Analysis Report By Cryptocurrency Type (Bitcoin, Ethereum), By Operating System (iOS, Android), By Payment Type, By End-user, And Segment Forecasts

- Report ID: GVR-4-68040-163-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

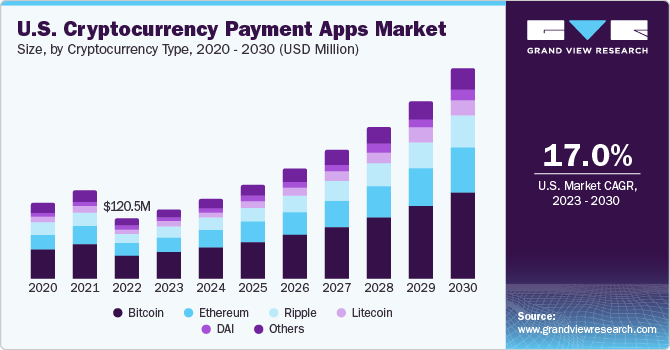

The U.S. cryptocurrency payment apps market size was estimated at USD 120.5 million in 2022 and it is projected to grow at a compound annual growth rate (CAGR) of 17.0% from 2023 to 2030. One of the primary drivers of market growth is the growing acceptance of cryptocurrencies as a form of payment by both consumers and businesses. Major corporations and retailers are now embracing digital currencies as payment options, significantly boosting their utility. This growing acceptance is due, in part, to the rising demand for more flexible and efficient payment methods, and cryptocurrencies offer an attractive alternative.

The demand for cryptocurrency payment apps is fueled by several factors, including the increasing popularity and acceptance of cryptocurrencies as a means of payment and investment. The remarkable surges in the values of cryptocurrencies like Bitcoin have garnered substantial public attention and sparked widespread interest in the broader cryptocurrency ecosystem. Consequently, an increasing number of individuals are actively seeking user-friendly cryptocurrency payment applications. These apps serve various purposes, including investment, facilitating transactions for the purchase of goods and services, and simplifying cross-border payments.

In addition, the U.S. market is experiencing substantial benefits from the dynamic innovation within the blockchain and fintech sectors. Companies operating in these domains are at the forefront of pioneering cutting-edge payment solutions. These solutions focus on enhancing security measures, reducing transaction fees, and significantly expediting processing times. As a consequence of this relentless innovation, the cryptocurrency payment app landscape has evolved into a highly competitive environment. Providers within this space strive to outdo each other by offering the most advanced features and services, intensifying the drive for innovation within the sector.

Furthermore, the market is experiencing a boost from the increasing demand for international payments. Cryptocurrencies have emerged as a highly efficient solution for cross-border transactions, effectively overcoming the usual delays and high fees associated with traditional banking systems. This attribute holds immense appeal for international businesses, enterprises with foreign partners or clientele, and entities involved in global trade. As a result, the adoption of cryptocurrency payment apps is on the rise, catering to the growing necessity for swift and cost-effective international transactions.

A notable restraint in the U.S. market is the lingering regulatory uncertainty and varying compliance standards across states and federal bodies. The complex and evolving regulatory landscape can pose challenges for market participants, leading to confusion and potential legal risks. To overcome this hurdle, the industry would benefit from proactive collaboration between industry players and regulatory authorities. Establishing clear, standardized guidelines and working closely with regulators can foster a more secure and compliant environment, instilling confidence in both businesses and consumers.

Cryptocurrency Type Insights

The bitcoin segment dominated the market in 2022 with a revenue share of more than 39.0%. Bitcoin is the pioneering cryptocurrency and the most recognized globally, instilling a sense of trust and familiarity among users. It has a long-standing track record of security and reliability, which makes it an appealing choice for both individual and institutional users. Bitcoin's widespread adoption, particularly as a digital store of value, further cements its position in the market.

The Ethereum segment is anticipated to register a significant CAGR over the forecast period. Ethereum extends beyond its native cryptocurrency, Ether, to offer a unique feature known as smart contracts. These self-executing contracts enable agreements to be coded directly into the blockchain, allowing for automated and secure transactions. This innovative capability is attractive to developers and businesses, promoting the integration of Ethereum into payment apps.

Payment Type Insights

The in-store payment segment dominated the U.S. market in 2022 with a revenue share of more than 67.0%. In-store payments offer a tangible and seamless user experience, bridging the gap between traditional brick-and-mortar businesses and the digital cryptocurrency world. This familiarity and convenience make it an attractive option for both merchants and customers, ensuring widespread adoption. Furthermore, in-store payment apps leverage Point-of-Sale (POS) systems and hardware to accept cryptocurrency payments, enabling broader acceptance across various retail outlets. With secure and swift transaction processing, they have become a preferred choice for users seeking real-time payments.

The online payment segment is anticipated to register significant growth over the forecast period. The convenience of making payments online, coupled with the growing popularity of online shopping, has made online payment apps an appealing choice for a wide range of consumers. Users appreciate the ability to seamlessly conduct transactions in the digital realm, making them well-suited for the modern, tech-savvy generation. Moreover, online payment apps facilitate a broader range of transactions, from e-commerce purchases to subscription services, bill payments, and peer-to-peer transfers.

Operating System Insights

The Android segment dominated the market in 2022 with a revenue share of over 56.0%. The Android operating system's open-source nature has enabled a wide range of cryptocurrency payment app developers to create and distribute their apps on the platform. This has led to a plethora of options available to Android users, fostering healthy competition and innovation in the market. Furthermore, Android's extensive user base plays a crucial role. The widespread adoption of Android smartphones in the U.S. means that a significant portion of the population has easy access to cryptocurrency payment apps.

The iOS segment is anticipated to register significant growth. Apple's stringent security and privacy measures have earned the trust of users, making iOS a preferred choice for those concerned about the safety of their cryptocurrency assets. This trust element is pivotal in the cryptocurrency landscape, where security is of paramount importance. Moreover, the reputation of iOS as a platform known for high-quality and user-friendly apps has attracted both cryptocurrency developers and users. This has led to the creation of a range of well-designed, intuitive cryptocurrency payment apps that cater to the specific needs and preferences of iOS users.

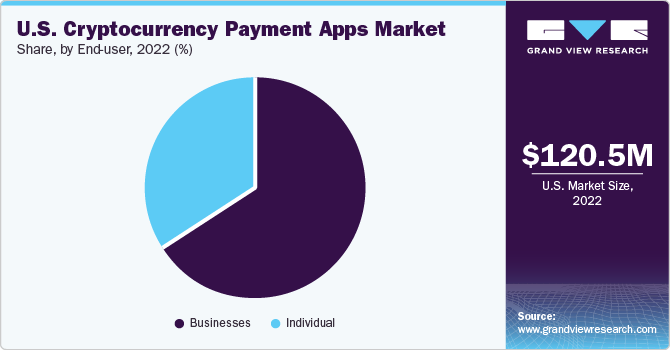

End-user Insights

The businesses segment dominated the U.S. market in 2022 with a revenue share of over 66.0%. Businesses have recognized the growing acceptance of cryptocurrencies as a legitimate mode of payment and are increasingly integrating them into their operations. This integration includes accepting cryptocurrency payments from customers and utilizing them for various business transactions. Moreover, businesses often require more sophisticated and versatile cryptocurrency payment solutions to handle a broader range of financial activities, such as payroll, vendor payments, and cross-border transactions.

The individual segment is anticipated to register significant growth over the forecast period. The increasing recognition of cryptocurrencies as viable investment assets has spurred individuals to explore and adopt cryptocurrency payment apps. Many individuals are investing in cryptocurrencies and subsequently seeking convenient solutions to manage their digital assets. Moreover, the user-friendly interfaces and accessibility of cryptocurrency payment apps have made it easier for individual users to engage with the digital currency ecosystem.

Key Companies & Market Share Insights

The competitive landscape of the U.S. market is marked by a dynamic environment driven by innovation and evolving user preferences. Several key players are actively competing to gain a foothold in this burgeoning market. Established names such as Coinbase, Circle Internet Financial Limited, and Binance have made significant strides in offering comprehensive and user-friendly platforms for cryptocurrency transactions. These industry players continue to refine their offerings, enhance security measures, and expand the range of supported cryptocurrencies to meet the growing demands of users. However, competition is not limited to these incumbents. New entrants and fintech startups are continually entering the market with fresh and innovative approaches to cryptocurrency payment solutions.

In February 2023, Mastercard, a prominent player in the payments industry, joined forces with Immersve, a Web3 payment protocol. This partnership empowers Mastercard users to engage in cryptocurrency payments across both the digital realm and the Metaverse. Facilitating these transactions, USDC tokens will play a central role within the Mastercard network.

Key U.S. Cryptocurrency Payment Apps Companies:

- Coinbase Global, Inc.

- BitPay

- Coinomi

- Ripple

- SecuX Technology, Inc.

- Circle Internet Financial Limited

- Binance

- Cryptopay Ltd

- Crypto.com

- CoinPayments, Inc.

U.S. Cryptocurrency Payment Apps Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 418.5 million

Growth rate

CAGR of 17.0% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Cryptocurrency type, payment type, operating system, end-user

Key companies profiled

Coinbase Global, Inc.; BitPay; Coinomi; Ripple; SecuX Technology, Inc.; Circle Internet Financial Limited; Binance; Cryptopay Ltd.; Crypto.com; CoinPayments, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cryptocurrency Payment Apps Market Report Segmentation

The report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. cryptocurrency payment apps market report based on cryptocurrency type, payment type, operating system, and end-user.

-

Cryptocurrency Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Bitcoin

-

Ethereum

-

Litecoin

-

DAI

-

Ripple

-

Others

-

-

Payment Type Outlook (Revenue, USD Million, 2017 - 2030)

-

In-store Payment

-

Online Payment

-

-

Operating System Outlook (Revenue, USD Million, 2017 - 2030)

-

iOS

-

Android

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Individual

-

Businesses

-

Frequently Asked Questions About This Report

b. Bitcoin dominated the U.S. cryptocurrency payment apps market with a share of 39.47% in 2022. Bitcoin is the pioneering cryptocurrency and the most recognized globally, instilling a sense of trust and familiarity among users.

b. Some key players operating in the U.S. cryptocurrency payment apps market include Coinbase Global, Inc.; BitPay; Coinomi; Ripple; SecuX Technology, Inc.; Circle Internet Financial Limited; Binance; Cryptopay Ltd.; Crypto.com; CoinPayments, Inc.

b. Key factors that are driving the market growth include increasing demand for cryptocurrency payment options and growing demand for easier and faster digital payment transactions.

b. The U.S. cryptocurrency payment apps market size was estimated at USD 120.5 million in 2022 and is expected to reach USD 139.1 million in 2023.

b. The U.S. cryptocurrency payment apps market is expected to grow at a compound annual growth rate of 17.0% from 2023 to 2030 to reach USD 418.5 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.