- Home

- »

- Biotechnology

- »

-

U.S. Consumer Genomics Market, Industry Report, 2030GVR Report cover

![U.S. Consumer Genomics Market Size, Share & Trends Report]()

U.S. Consumer Genomics Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Genetic Relatedness, Ancestry, Diagnostics, Sport Nutrition & Health, Reproductive Health), And Segment Forecasts

- Report ID: GVR-4-68040-243-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Consumer Genomics Market Trends

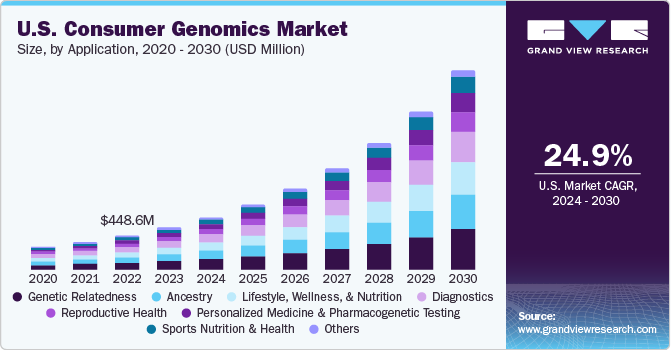

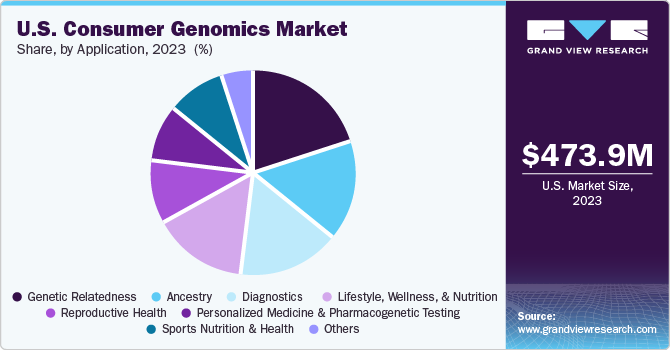

The U.S. consumer genomics market size was estimated at USD 473.9 million in 2023 and is expected to grow at a CAGR of 24.9% from 2024 to 2030. Ongoing innovations in the genomic analysis field simplify consumer DNA analysis, supplementing market growth. Advancements in genetic research help raise awareness among physicians and consumers about the use of gene-based testing. Genomics testing enables the determination of common traits by studying a DNA molecule, makes predictions about health, and offers evidence of a person’s ancestry. Rising awareness about DNA testing has driven the adoption rate, providing healthy growth prospects for implementing DNA tests in home settings.

U.S. accounted for over 31.1% of the global consumer genetics market in 2023. Recently, there's been a surge in the demand for genetic testing services offered directly to consumers. These tests usually examine a person's DNA to reveal information about potential health risks, genetic characteristics, and lineage. As the consumer genomics sector grows, several companies are providing DNA tests directly to customers by which they have access to their genetic information without involving the healthcare professional. However, it's essential to carefully assess the reliability and quality of these services before opting for any testing, given the current lack of stringent regulation over direct-to-consumer genetic testing firms.

Following the outbreak of the COVID-19 pandemic, public health concerns have intensified, leading to a surge in interest in advanced methods such as consumer genomics. This escalating consciousness about health matters and the significance of genetics has fueled the continuous expansion of the market. A primary element propelling this growth is the increasing emphasis on DNA-centric research and development (R&D) initiatives, especially in bioinformatics, for developing diagnostic instruments and effective treatments, including those pertinent to COVID-19.

The market's growth is chiefly driven by various elements, such as a rise in interest from consumers and doctors in direct-to-consumer (DTC) kits, technological advancements, the broadening scope of consumer genomics applications, favorable government policies, and the escalating trend of personalized genomics. For instance, the popularity of DTC tests significantly rose in 2022, as they could be bought without a doctor's prescription, making them more readily available and user-friendly for the public.

Growth in the variety of uses for direct-to-consumer (DTC) genetic tests greatly contributes to the market's development. Genetic testing covers numerous services, such as tracing ancestry, determining race, and exploring familial connections. The wide range of applications has resulted in a higher adoption rate in clinical settings. Moreover, reliable consumer genetics tests are applicable across clinical, genealogical, forensic, research, sports, nutrition, and numerous other sectors. Many companies provide adaptable DTC tests for these diverse fields.

Market growth is anticipated to receive additional backing from notable advancements in product innovation and partnerships between major industry participants. An example is July 2022, when 1health.io Inc. notably broadened its testing capacities within clinical and direct-to-consumer domains. Furthermore, the company collaborated with Apollo Health Group to expand the clinical market for Apollo's advanced Next-Generation Sequencing (NGS) assays, encompassing pharmacogenetics screenings (PGx) and hereditary cancer genetic screenings (CGx). These developments are playing a significant role in driving the expansion of the market.

Several companies, including My Gene Diet, Halo Health International, and Smart DNA, offer customized diet services and meal plans based on an individual's genetic makeup. The popularity of direct-to-consumer (DTC) personalized genomic testing is on the rise, fueled by the accessibility of these tests, with prices varying from as low as USD 100 to over USD 2000, depending on the test's intricacy and scope. Companies like My Gene Diet, Smart DNA, and Halo Health International offer customized dietary services and meal plans based on a person's genetic makeup. The popularity of personalized genomic testing sold directly to consumers (DTC) is on the rise, fueled by the cost-effectiveness of these tests. The prices vary widely, from as little as USD 100 to more than USD 2000, depending on the intricacy and extent of the tests.

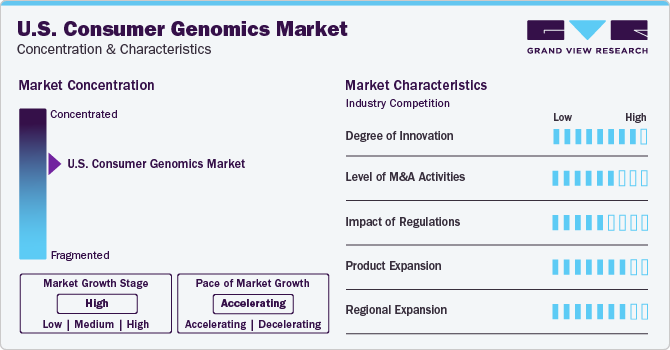

Market Concentration & Characteristics

The U.S. consumer genomics industry is relatively concentrated, with key players dominating the industry. Companies like 23andMe and Ancestry have established significant industry presence, offering direct-to-consumer genetic testing services. These major players have captured a substantial share of the industry, leading to a more consolidated landscape than a highly fragmented one.

The industry exhibits a high degree of innovation. Companies continuously introduce new technologies and services to enhance genetic testing accuracy, expand test offerings, and improve user experience. These innovations include advancements in DNA sequencing techniques, the development of personalized health reports based on genetic data, and the integration of artificial intelligence for data analysis, reflecting a dynamic and innovative industry environment.

In recent years, the industry has seen notable mergers and acquisitions, collaboration, and partnerships. For instance, in January 2021, myDNA Inc., a US-based parent company, acquired Gene by Gene. Gene by Gene and myDNA Life Private Ltd., an Australian company, operates as subsidiaries under myDNA Inc. These strategic moves indicate ongoing consolidation within the industry as companies aim to strengthen their positions through mergers and acquisitions.

Regulations on medical devices do impact consumer genomics manufacturers significantly in the U.S. The FDA's standard-making process for medical digital health technologies has influenced how these companies operate. The FDA's evolving guidelines and standards for digital health technologies have direct implications for consumer genomics manufacturers, shaping their product development processes and industry entry strategies.

The industry is experiencing both product and service expansion. Companies are diversifying their offerings beyond basic ancestry tests to include health-related genetic testing services. For instance, 23andMe expanded its product line to include health reports that provide insights into genetic predispositions for certain health conditions. This shift towards offering comprehensive genetic testing services demonstrates a trend of product expansion within the industry.

Companies in the industry are expanding across various parts of the U.S. and further into other regions to reach a broader customer base and tap into regional industries with specific demands. For instance, 23andMe has expanded its presence nationwide by offering genetic testing services across different states to cater to diverse consumer preferences. This expansion strategy allows companies to increase their industry reach, establish brand recognition in new regions, and effectively adapt their services to meet local needs.

Application Insights

Genetic relatedness dominated the market and held the largest revenue share of 19.9% in 2023. Paternity and maternity tests, often available online, are expected to increase the market growth. Many customers use DTC genetic testing to learn about their genetic traits and find distant relatives. Moreover, a 2021 study by the University of Cambridge found that genome sequencing from a single blood test could detect 31% more rare genetic disorders than standard tests. The U.S. is expected to have almost 2 million new cancer cases in 2022, as estimated by the American Cancer Society. The International Agency for Research on Cancer (IARC) estimates that over 30 million cancer cases will remain undiagnosed by the year 2040. Therefore, identifying potential cancer risks and determining the hereditary nature of the disease through genetic testing is crucial.

The lifestyle, wellness, & nutrition segment is expected to grow at the fastest CAGR of 26.6% during the forecast period. Numerous companies, including Natures Remedies Ltd, Pathway Genomics, Helix, Toolbox Genomics, and others, provide nutrigenetic testing services. These services encompass fitness tests and extend to diet, wellness, and several nutrition plans. Some of these firms also specialize in delivering personalized diets, meals, and even plans for food supplements. Genetic tests based on lifestyle and nutrition are viewed as promising and are broadly accessible to aid with diet and lifestyle strategies.

Key U.S. Consumer Genomics Company Insights

The U.S. consumer genomics market is characterized by intense competition, with a major share being held by numerous manufacturers. Market players employ key business strategies such as product introductions, approvals, strategic takeovers, and innovations to sustain and expand their global presence. For instance, Grifols, in May 2023, introduced AlphaIDAt Home, enabling American consumers to self-test for genetic COPD.

Key U.S. Consumer Genomics Companies:

- Ancestry

- Gene By Gene, Ltd. (FamilyTree DNA)

- 23andMe, Inc.

- Color Health, Inc

- Myriad Genetics, Inc

- Mapmygenome

- Helix OpCo LLC

- MyHeritage Ltd.

- Pathway Genomics

- Veritas

- Amgen, Inc.

- Diagnomics, Inc.

- Toolbox Genomics

- SomaLogic, Inc.

- inui Health (formerly Scanadu)

- QuickCheck Health

- Illumina, Inc.

Recent Developments

-

In November 2023, 23 and Me launched 23 and Me+ Total Health, their cutting-edge health membership focused on prevention. This membership offers clinical-grade exome sequencing, biannual blood testing, and unparalleled access to genetics-driven clinical services.

-

In September 2023, Ancestry launched an update to the 2023 Ethnicity Estimate. This update featured a revised algorithm and reference panels, and it utilized a greater quantity of DNA samples to develop the reference panels compared to previous results.

-

In June 2023, Color Health and the American Cancer Society (ACS) announced their partnership established to offer convenient, accessible, and thorough cancer prevention and screening services for over 150 million Americans covered by their employer or union, focusing on the most prevalent cancers such as breast, prostate, lung, cervical, and colorectal.

-

In March 2023, Gene by Gene collaborated with Verogen to expedite the integration of forensic investigative genetic genealogy. This alliance significantly increases the pool of profiles accessible for FIGG matching, effectively doubling its capacity.

U.S. Consumer Genomics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.24 billion

Growth rate

CAGR of 24.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application

Country scope

U.S.

Key companies profiled

Ancestry; Gene By Gene, Ltd. (FamilyTree DNA); 23andMe, Inc.; Color Health, Inc; Myriad Genetics, Inc; Mapmygenome; Helix OpCo LLC; MyHeritage Ltd.; Pathway Genomics; Veritas; Amgen, Inc.; Diagnomics, Inc.; Toolbox Genomics; SomaLogic, Inc.; inui Health (formerly Scanadu); QuickCheck Health; Illumina, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Consumer Genomics Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. consumer genomics market report based on application:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Genetic Relatedness

-

Ancestry

-

Lifestyle, Wellness, & Nutrition

-

Diagnostics

-

Sports Nutrition & Health

-

Reproductive Health

-

Personalized Medicine & Pharmacogenetic Testing

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. consumer genomics market size was estimated at USD 473.9 million in 2023.

b. The U.S. consumer genomics market is expected to grow at a compound annual growth rate (CAGR) of 24.9% from 2024 to 2030 to reach around USD 2.24 billion by 2030.

b. Genetic relatedness dominated the market and held the largest revenue share of 19.9% in 2023. Paternity and maternity tests, often available online, are expected to increase the market growth.

b. Some prominent players in the U.S. consumer genomics market include Ancestry; Gene By Gene, Ltd. (FamilyTree DNA); 23andMe, Inc.; Color Health, Inc; Myriad Genetics, Inc; Mapmygenome; Helix OpCo LLC; MyHeritage Ltd.; Pathway Genomics; Veritas; Amgen, Inc.; Diagnomics, Inc.; Toolbox Genomics; SomaLogic, Inc.; inui Health (formerly Scanadu); QuickCheck Health; Illumina, Inc.

b. Advancements in genetic research help raise awareness among physicians and consumers about the use of gene-based testing. Genomics testing enables the determination of common traits by studying a DNA molecule, makes predictions about health, and offers evidence of a person’s ancestry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.