- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Construction Silicone Sealants Market Size Report, 2033GVR Report cover

![U.S. Construction Silicone Sealants Market Size, Share & Trends Report]()

U.S. Construction Silicone Sealants Market (2026 - 2033) Size, Share & Trends Analysis Report By Sector (Residential, Commercial, Industrial), By Application (Interior, Exterior), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-519-9

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Construction Silicone Sealants Market Summary

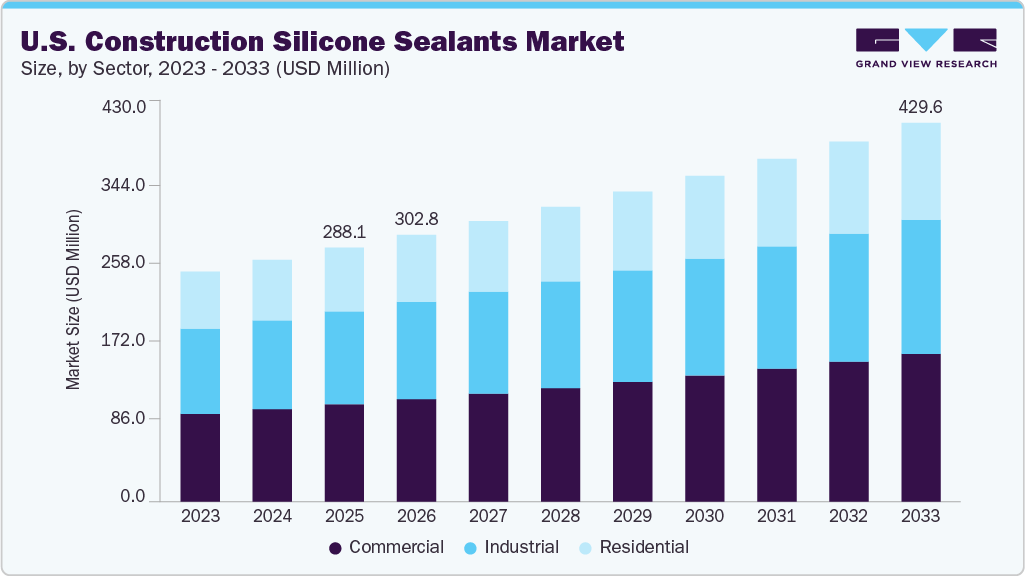

The U.S. construction silicone sealants market size was estimated at USD 288.1 million in 2025 and is projected to reach USD 429.6 million by 2033, growing at a CAGR of 5.1% from 2026 to 2033. The increasing preference for silicone sealants in the construction industry is expected to be a key factor driving the growth.

Key Market Trends & Insights

- The U.S. construction silicone sealants industry is expected to grow at the fastest CAGR of 5.1% from 2026 to 2033.

- By sector, the commercial sector segment held the largest revenue share of 38.3% in 2025.

- By end use, the interior segment is expected to grow at the fastest CAGR of 5.5% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 288.1 Million

- 2033 Projected Market Size: USD 429.6 Million

- CAGR (2026-2033): 5.1%

Moreover, several benefits offered by the product owing to its unique properties are expected to further fuel the demand. Silicone sealants are multi-purpose products that have gained wide acceptance in various applications such as the industrial and domestic areas. They are solvent-free, low-temperature flexibility, fire-resistant and have excellent UV stability. In addition, these sealants are also waterproof and able to withstand high temperatures. Easy application and the effective end result have augmented its demand in the real estate industry. They are available in varied forms in order to suit the specific requirements of industries and households.

The growing construction industry has positively impacted the utilization of silicone sealants, which is expected to drive growth. Various raw materials including polysiloxane and additives & cross-linkers are utilized in the manufacturing process. The construction silicone sealants industry is highly competitive in nature owing to the presence of a large number of established manufacturers, suppliers, and new entrants. The rapidly growing market in the U.S. is pushing key players, such as Wacker Chemie AG and Dow Corning Corporation, to adopt joint venture strategies in an attempt to increase their presence and expand share.

Integration through the entire value chain is projected to be a key element in the market as most of the players are trying to optimize costs and, therefore, backward and forward integration will be essential. Factors such as strong manufacturer-supplier relationships and tie-ups at multiple distribution levels are expected to be critical for companies to gain a competitive advantage over the forecast period.

Silicone sealants are widely used in various end-use industries including building, automotive, and glass. They are manufactured from two important raw materials, which comprise siloxane & polysiloxane and additives & cross-linkers. The raw materials have different properties, which are highly essential for manufacturing silicone sealants and combined to impart adhesion, elongation, and thermal resistant properties to the product. The manufacturers ensure to incorporate properties such as resistance to extreme temperature & chemicals, compression, strength, high stretching traits, and tolerance into the end product.

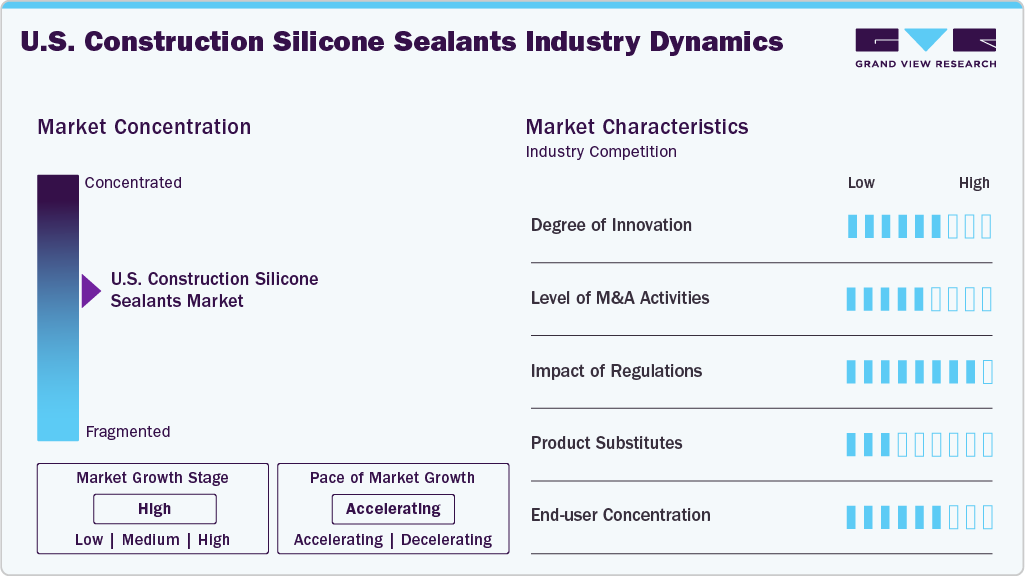

Market Concentration & Characteristics

The U.S. construction silicone sealants industry is moderately to highly concentrated, with a small group of multinational manufacturers accounting for a significant share of total revenues. Leading players such as Dow, Wacker Chemie, Sika, Henkel, and Momentive dominate the market through strong brand recognition, broad product portfolios, and long-standing relationships with contractors, distributors, and OEMs. These companies benefit from vertically integrated silicone raw material supply, extensive R&D capabilities, and compliance with stringent U.S. building codes and performance standards, creating high entry barriers for new participants.

However, despite this concentration at the top, the market also includes numerous regional and niche manufacturers catering to localized construction demand, private-label products, and cost-sensitive applications. These smaller players primarily compete in standard glazing, weatherproofing, and interior sealing applications where price competitiveness outweighs advanced performance differentiation. As a result, while Tier-1 suppliers command a strong share in high-performance and specification-driven projects (commercial buildings, façades, infrastructure), the long tail of regional suppliers ensures that the overall market remains moderately concentrated rather than monopolistic, with competition intensifying through distribution reach, contractor loyalty, and pricing strategies rather than purely technological differentiation.

Sector Insights

The commercial segment led the market with the largest revenue share of 38.3% in 2025. This segment is driven by strong activity in office buildings, retail complexes, healthcare facilities, and institutional infrastructure. These projects require high-performance silicone sealants for glazing, façades, expansion joints, and weatherproofing, where durability, UV resistance, and long service life are critical. In addition, stringent building codes and specification-driven procurement in commercial construction favor premium silicone products over alternatives. Higher project sizes and recurring renovation cycles further contribute to the segment’s leading revenue position.

The residential segment is the fastest-growing segment, registering a CAGR of 5.5% during the forecast period. This growth is driven by sustained housing starts, renovation, and remodeling activity. Rising demand for energy-efficient and weather-resistant homes is increasing the use of silicone sealants in windows, doors, kitchens, and bathrooms. In addition, growth in DIY home improvement and residential retrofitting supports higher consumption of easy-to-apply, long-lasting sealant products. Increased adoption of premium sealants for durability and aesthetics further accelerates segment growth.

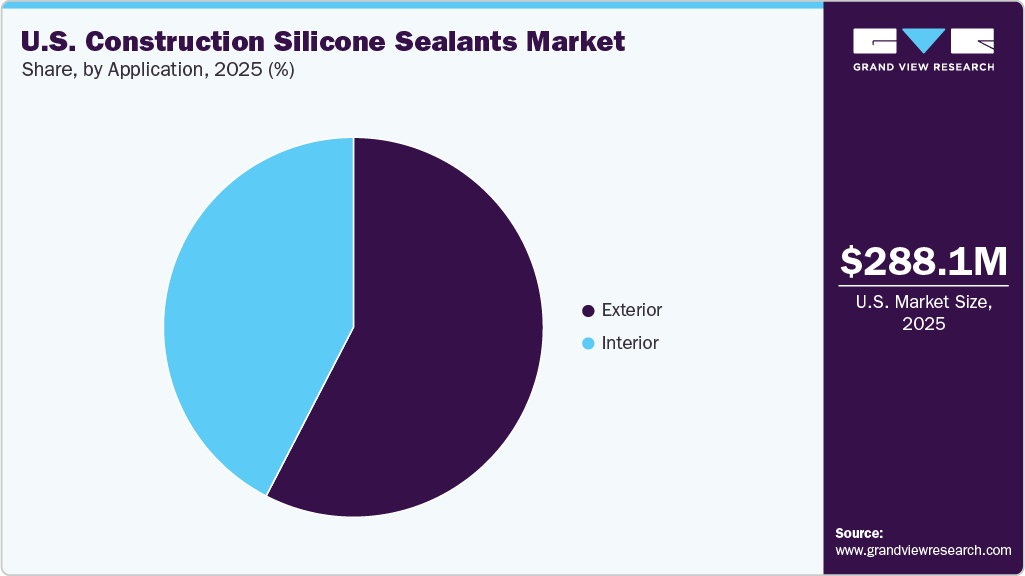

Application Insights

The exterior segment led the market with the largest revenue share of 57.6% in 2025. This segment is driven by extensive use in façades, curtain walls, glazing, roofing, and expansion joints. Exterior applications demand high-performance silicone sealants due to continuous exposure to UV radiation, temperature fluctuations, moisture, and wind loads. Stringent building envelope performance and durability requirements favor silicone over alternative sealant chemistries. In addition, large-scale commercial projects and infrastructure refurbishment activities contribute to higher sealant volumes and premium pricing in exterior applications.

The interior segment is the fastest-growing segment with a CAGR of 5.5% during the forecast period. supported by rising residential renovation and remodeling activity. Increased use of silicone sealants in kitchens, bathrooms, flooring joints, and interior glazing is driven by demand for mold resistance, flexibility, and long service life. Growth in urban housing upgrades and commercial interior refurbishments further supports consumption. In addition, preference for low-VOC and easy-to-apply formulations accelerates adoption in interior applications.

Key U.S. Construction Silicone Sealants Company Insights

Some of the key players operating in the market include Pecora Corporation, Dow, Sika AG, 3M Company, American Sealants, Inc., Wacker Chemie AG, among others.

- 3M operates through four business segments: safety & industrial, transportation & electronics, health care, and consumer. It caters to the automotive, communication, design & construction, electronics, energy, healthcare, manufacturing, mining, oil & gas, safety & graphics, and transportation industries. The consumer segment includes stationery & office supplies, home care, home improvement, and consumer healthcare products. The company has corporate operations in over 70 countries and sales in 200 countries across North America, Europe, Asia Pacific, and the Middle East & Africa.

Key U.S. Construction Silicone Sealants Companies:

- Pecora Corporation

- DoW

- Sika AG

- 3M Comapany

- American Sealants, Inc.

- Wacker Chemie AG

- C.R. Laurance Co., Inc.

- General Electic Company (GE) Company

- CSL Silicones Inc.

- Selena Group

Recent Developments

- In November 2025, Sika AG announced launch of new product in construction sealants range. The products are SIKA AG Construction Silicone, Sika Seal Construction Silicone+, and SikaSeal Construction Silicone Ultra are the range of products which offers reliable solution for every building application.

U.S. Construction Silicone Sealants Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 302.8 million

Revenue forecast in 2033

USD 429.6 million

Growth rate

CAGR of 5.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2025

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Regional scope

Northeast; Southwest; Mideast; Southeast; West

Key companies profiled

Pecora Corporation; Dow; Sika AG; 3M Company; American Sealants, Inc.; Wacker Chemie AG; C.R. Laurance Co., Inc.; General Electric Company (GE); CSL Silicones Inc.; Selena Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to the country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Construction Silicone Sealants Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. construction silicone sealants market report based on sector, application, and region:

-

Sector Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Interior

-

Exterior

-

Frequently Asked Questions About This Report

b. The U.S. construction silicone sealants market size was estimated at USD 288.1 million in 2025 and is expected to reach USD 302.8 million in 2026.

b. The U.S. construction silicone sealants market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 429.6 million by 2025.

b. The commercial segment led the U.S. Construction Silicone Sealants industry with the largest revenue share of 38.3% in 2025. This segment is driven by strong activity in office buildings, retail complexes, healthcare facilities, and institutional infrastructure. These projects require high-performance silicone sealants for glazing, façades, expansion joints, and weatherproofing, where durability, UV resistance, and long service life are critical.

b. Some key players operating in the U.S. construction silicone sealants market include Wacker Chemie AG, 3M Company, General Electric Company, Selena Group.

b. The increasing preference for silicone sealants in the construction industry is expected to be a key factor driving the growth. Moreover, several benefits offered by the product owing to its unique properties are expected to further fuel the demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.