- Home

- »

- Medical Devices

- »

-

U.S. Compounding Pharmacies Market Size Report, 2030GVR Report cover

![U.S. Compounding Pharmacies Market Size, Share, & Trends Report]()

U.S. Compounding Pharmacies Market (2024 - 2030) Size, Share, & Trends Analysis Report By Type (503A, 503B), By Therapeutic Area, By Age Cohort, Compounding Type, By Sterility, And Segment Forecasts

- Report ID: GVR-4-68040-422-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

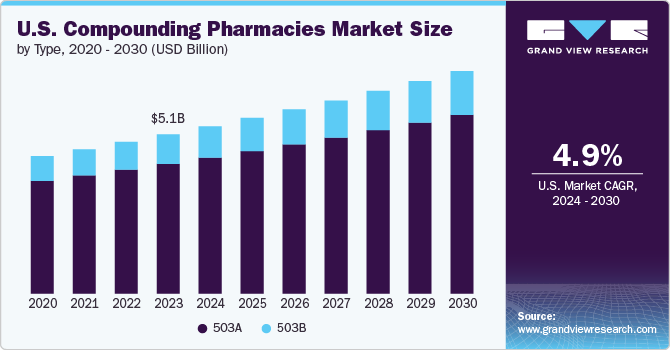

The U.S. compounding pharmacies market size was estimated at USD 5.13 billion in 2023 and is projected to grow at a CAGR of 4.89% from 2024 to 2030. The market is expected to grow significantly, driven by increasing demand for personalized medications, rising chronic disease prevalence, and the growing geriatric population. Regulatory advancements supporting customized drug formulations and a shift towards patient-centric care are further boosting the market. Additionally, the shortage of commercially available drugs and advancements in pharmaceutical compounding technologies are anticipated to have a positive impact on market growth.

The demand for custom-made medicines, especially for sterile formulations used for injections, intravenous infusions, and intraocular or intrathecal administration, is increasing. According to the statistics published by the American Pharmacists Association in October 2021, over 56,000 community pharmacies were operating in the U.S., with 7,500 offering advanced compounding services. Compounding pharmacies need to use pharmaceutical-grade ingredients from FDA-registered facilities to maintain high standards of quality and safety.

The market is poised for growth due to the rise in drug shortages across critical categories such as oncology, cardiovascular, and antimicrobials. Factors such as supply-demand imbalances, regulatory issues, and manufacturing challenges have created a public health crisis by delaying necessary care. In response, compounding pharmacies are stepping in to fill supply gaps. For instance, the University of Utah identified 129 pharmaceutical shortages in 2020, and the FDA noted 41 new cases in 2021. As these shortages continue, compounding pharmacies is expected to become more important in providing access to necessary medications.

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, impact of regulations, level of mergers & acquisition activities, and geographic expansion. The industry is highly fragmented, with numerous smaller, independent pharmacies alongside a few larger players offeringa variety of specialized services and customized solutions. The degree of innovation is high, and the impact of regulations on the industry is high. The level of merger & acquisition activities is high, the impact of service substitutes is low, and the geographic expansion of the industry is high.

The degree of innovation in the market is high. Advanced drug formulations, personalized medicine, and enhanced safety standards foster increased demand. New technologies such as automation and 3D printing improve production efficiency and customization, offering better patient outcomes and expanding the market's potential for personalized and niche medications.

The impact of regulations on the market is expected to remain high. Stringent federal and state regulations are designed to ensure the safety and efficacy of compounded medications. In response to the 2012 fungal meningitis outbreak, the Drug Quality and Security Act of 2013 was enacted, increasing regulatory scrutiny. This has led to higher operational costs, stricter compliance requirements, and a more limited range of compounded medications. While these measures enhance patient safety, they also present challenges to innovation and accessibility in the compounding pharmacy sector.

The M&A activity in the market is high, driven by consolidation trends, regulatory pressures, and the demand for personalized medicine. Larger entities are actively acquiring smaller compounding pharmacies to expand service offerings and navigate regulatory complexities more effectively, indicating a robust M&A environment in this sector. For instance, in May 2020, Wedgewood Pharmacy acquired Leiters Enterprises' 22,000-square-foot FDA-registered 503B facility in San Jose to operate as Wedgewood Connect. This strategy enhanced the company's product portfolio, thereby propelling the market growth.

Geographic expansion in the market is high. As demand for personalized medication solutions grows, many compounding pharmacies are expanding their reach to serve new regions and increase their market presence. This expansion is driven by opportunities to access underserved areas, enhance service delivery, and leverage economies of scale. Companies are also acquiring existing facilities or opening new ones in different states to broaden their customer base and improve distribution networks, reflecting a dynamic and growing market landscape.

Type Insights

The 503A segment dominated the market with a revenue share of over 81% in 2023. This segment’s growth is fueled by the rising demand for individualized medication solutions. 503A pharmacies cater to patient-specific needs, providing customized formulations for patients requiring unique dosages, allergy-free compounds, or treatments for rare conditions. As personalized healthcare and the prevalence of chronic illnesses continue to rise, the 503A segment is poised for continued expansion, offering critical tailored solutions.

The 503B segment is expected to witness the fastest CAGR from 2024 to 2030. These pharmacies cater to hospitals and healthcare facilities by producing bulk, non-patient-specific compounded medications under strict regulatory standards. With the increasing need for sterile, ready-to-use medications for critical care, the 503B segment addresses the demand for reliable, large-scale drug production. Hospitals seeking consistent medication supplies for high patient volumes are driving the rapid growth of the 503B segment, ensuring its expanding role in the market.

Sterility Insights

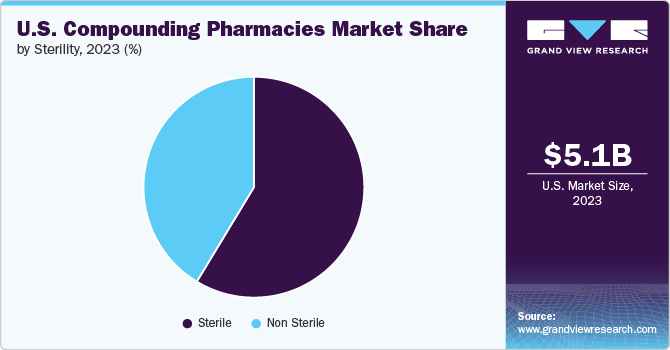

The sterile segment held the largest revenue share of over 58% in 2023. Sterile compounding is crucial for preparing medications intended for sensitive areas such as the bloodstream, eyes, lungs, or heart. This process requires highly trained pharmacists to work in controlled, sterile environments using specialized products to ensure the medications are completely free from contaminants. The growing emphasis on maintaining rigorous safety and efficacy standards for pharmaceuticals targeting these sensitive areas is driving increased demand for sterile compounding services.

The non-sterile segment is expected to witness significant growth from 2024 to 2030. This segment includes processes such as reconstituting, combining, diluting, admixing, pooling, or otherwise modifying drugs or bulk substances to produce non-sterile preparations that differ from manufacturer specifications. This highlights the widespread use of non-sterile compounding in the market and emphasizes the critical need to adhere to regulatory standards to maintain product safety and effectiveness.

Therapeutic Area Insights

The pain management segment holds the largest revenue share of over 32% in 2023, primarily due to the increasing prevalence of chronic pain conditions and the limitations of standard pain relievers. Compounding pharmacies provide customized solutions, offering personalized dosages and tailored formulations that cater to patients’ specific needs. These pharmacies are particularly crucial for individuals requiring unique drug combinations, and delivery methods, or those with ingredient intolerances. As personalized pain management becomes more vital, the demand for customized treatments from compounding pharmacies continues to rise, driving market growth.

Furthermore, the nutritional supplements segment is projected to grow the fastest during the forecast period. The surge in demand for personalized medicine and custom nutritional formulations is fueling this segment's expansion. Compounding pharmacies are well-positioned to meet these demands, offering personalized supplements to address individual health concerns. The increasing focus on health consciousness and preventive healthcare among Americans further supports this trend, making tailored nutritional solutions a popular option for optimizing wellness and overall health.

Age Cohort Insights

The adult segment holds the largest revenue share of over 44% in 2023. Adults are increasingly experiencing chronic lifestyle-related diseases linked to sedentary lifestyles and poor dietary habits, along with growing nutritional deficiencies. Adults are increasingly seeking customized compounded medications to address nutritional deficiencies and manage health conditions more effectively. Awareness campaigns by companies are further boosting demand for compounded nutritional supplements that offer comprehensive nutritional support.

Furthermore, the pediatric segment is poised for the fastest CAGR from 2024 to 2030. Pediatric patients often require specific dosages and formulations that standard medications do not offer. Compounding pharmacies meet these needs by providing tailored dosages, improved flavors for compliance, and allergen-free options for sensitive children. As the demand for personalized medications increases, compounding pharmacies are becoming essential in addressing the unique healthcare requirements of both adult and pediatric populations.

Compounding Type Insights

The Pharmaceutical Ingredient Alteration (PIA) segment held the largest revenue share of over 37% in 2023. The rising demand for personalized medication stems from the recognition that standard treatments often fall short, leading patients and healthcare providers to seek customized solutions. Compounded medications, which allow for tailored dosages, preservative-free options, and enhanced formulations, are increasingly vital. This trend highlights the critical role of the PIA segment in addressing specific patient needs and reinforces its leading position in the market.

The Pharmaceutical Dosage Alteration (PDA) segment is expected to witness significant growth from 2024 to 2030. The growth of this segment is driven by the growing demand for tailored pharmaceutical solutions that address specific patient requirements, respond to medication shortages, and offer alternatives for patients with allergies or sensitivities to commercial medication formulations. Additionally, technological advancements in compounding equipment and techniques further boost this segment's growth, ensuring more accurate and safe medication customization.

Key U.S. Compounding Pharmacies Company Insights

The market is fragmented due to diverse service offerings and varying state-based regulations. Specialized sectors like pediatrics, dermatology, and veterinary medicine heighten this fragmentation, each demanding unique skills and equipment. State-level regulatory complexities further escalate competitiveness among numerous local and regional pharmacies. Some emerging players are ScriptCo, Horizon Pharmacy, Eledon Pharmaceuticals, Inc., W.P Malone, Inc., and VITA PHARMACEUTICALS.

Key U.S. Compounding Pharmacies Companies:

- Avella Specialty Pharmacy

- Central Admixture Pharmacy Services, Inc.

- Clinigen Limited

- Fagron

- Fresenius Kabi USA

- ImprimisRx (Harrow Health, Inc.)

- PenCol Pharmacy

- Sixth Avenue Medical Pharmacy

- Triangle Compounding

- Vertisis Custom Pharmacy

Recent Developments

-

In April 2024, Myonex acquired Saveway Compounding Pharmacy to enhance its portfolio and strengthen its position in the customized medication market. This acquisition aims to expand Myonex's service capabilities and market reach.

-

In May 2023, Fresenius Kabi launched Diazepam Injection, USP in 10 mg per 2 mL Simplist prefilled syringes, available in the U.S. This new addition to the Simplist portfolio aims to streamline medication delivery and reduce the risk of errors with its ready-to-administer design.

-

In February 2022, Fagron, a provider of pharmaceutical compounding, acquired Letco Medical, based in Wayne, PA, which supplies pharmaceutical raw materials and equipment for USD 34 million. This acquisition enhances Fagron's position in the U.S. Brands & Essentials market.

U.S. Compounding Pharmacies Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.39 billion

Revenue forecast in 2030

USD 7.18 billion

Growth rate

CAGR of 4.89% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/ billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, therapeutic area, compounding type, age cohort, sterility

Country scope

U.S.

Key companies profiled

Avella Specialty Pharmacy; Central Admixture Pharmacy Services, Inc.; Clinigen Limited; Fagron; Fresenius Kabi USA; ImprimisRx (Harrow Health, Inc.); PenCol Pharmacy; Sixth Avenue Medical Pharmacy; Triangle Compounding; Vertisis Custom Pharmacy

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Compounding Pharmacies Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. compounding pharmacies market report based on type, therapeutic area, compounding type, age cohort, and sterility.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

503A

-

503B

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Hormone replacement therapy

-

Pain management

-

Specialty drugs

-

Dermatology

-

Nutritional Supplements

-

Others

-

-

Age Cohort Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric

-

Adult

-

Geriatric

-

-

Compounding Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Ingredient Alteration (PIA)

-

Currently Unavailable Pharmaceutical Manufacturing (CUPM)

-

Pharmaceutical Dosage Alteration (PDA)

-

Others

-

-

Sterility Outlook (Revenue, USD Million, 2018 - 2030)

-

Sterile

-

Non sterile

-

Frequently Asked Questions About This Report

b. The U.S. compounding pharmacies market size was estimated at USD 5.13 billion in 2023 and is expected to reach USD 5.39 billion in 2024.

b. The U.S. compounding pharmacies market is expected to grow at a compound annual growth rate of 4.89% from 2024 to 2030 to reach USD 7.18 billion by 2030.

b. 503A dominated the market with a share of 81.50% in 2023. This is attributable to the rising demand for personalized medications tailored to individual patient needs group.

b. Some key players operating in the U.S. compounding pharmacies market include Avella Specialty Pharmacy; Central Admixture Pharmacy Services, Inc.; Clinigen Limited; Fagron; Fresenius Kabi USA; ImprimisRx (Harrow Health, Inc.); PenCol Pharmacy; Sixth Avenue Medical Pharmacy; Triangle Compounding; and Vertisis Custom Pharmacy.

b. Key factors that are driving the U.S. compounding pharmacies market growth include the increasing supportive government policies, the increasing demand for personalized medications, and the growing importance of pharmaceutical compounding in promoting medication adherence.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.