- Home

- »

- Advanced Interior Materials

- »

-

U.S. Commercial Heating Equipment Market, Industry Report, 2033GVR Report cover

![U.S. Commercial Heating Equipment Market Size, Share & Trends Report]()

U.S. Commercial Heating Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Heat Pump, Furnace), By Building Floorspace (Up To 5,000 sq. ft., 5,001 To 10,000 sq. ft), By End Use (Retail Shops, Offices), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-051-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Commercial Heating Equipment Market Summary

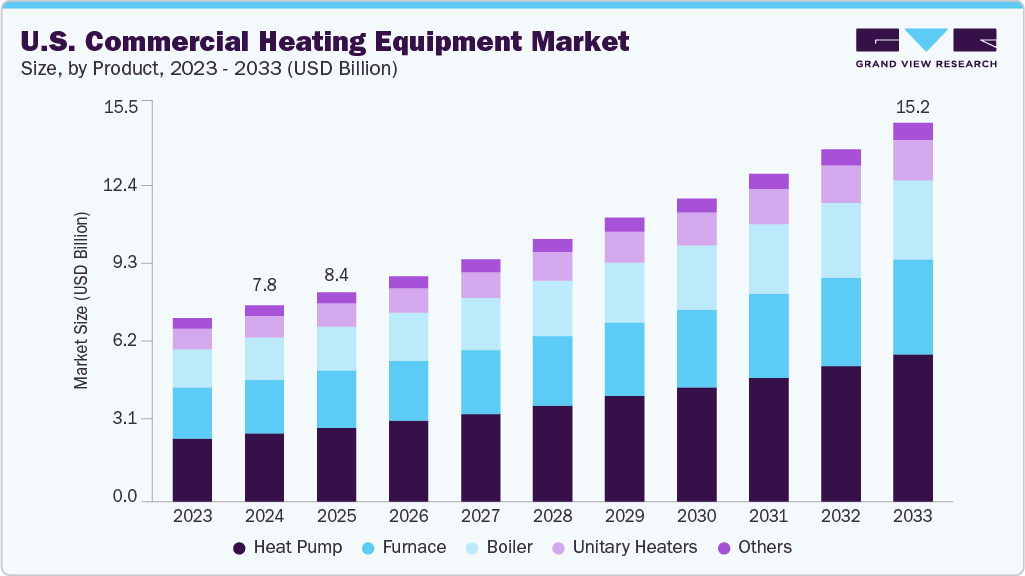

The U.S. commercial heating equipment market size was estimated at USD 7,841.6 million in 2024 and is projected to reach USD 15,164.6 million by 2033, growing at a CAGR of 7.7% from 2025 to 2033. The increasing demand for energy-efficient HVAC systems in the U.S. commercial sector is a key growth driver.

Key Market Trends & Insights

- The Southeast region dominated the U.S. commercial heating equipment market with the largest revenue share of 23.1% in 2024.

- By product, the heat pump segment is expected to grow at a considerable CAGR of 9.0% from 2025 to 2033 in terms of revenue.

- By building floorspace, the 25,001 to 50,000 sq. ft segment is expected to grow at a considerable CAGR of 8.8% from 2025 to 2033 in terms of revenue.

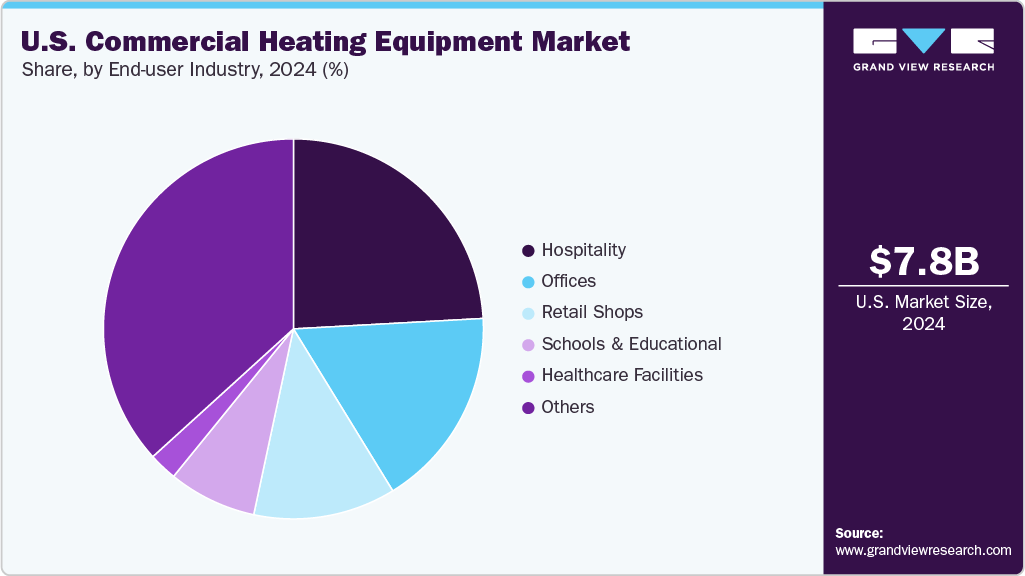

- By end use, the hospitality segment is expected to grow at a considerable CAGR of 8.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 7,841.6 Million

- 2033 Projected Market Size: USD 15,164.6 Million

- CAGR (2025-2033): 7.7%

- Southeast: Largest market in 2024

- Northeast: Fastest growing market

Rising awareness about energy conservation and the implementation of strict federal energy standards have pushed businesses to upgrade to high-efficiency boilers, furnaces, and heat pumps. Moreover, the surge in commercial construction activities across office spaces, hospitality, and retail sectors is fueling market growth. Renovations in aging infrastructure and growing urbanization in major U.S. cities are driving new installations of advanced heating systems. Additionally, demand is supported by incentives at the state and local levels for green building technologies. Integration of smart thermostats and building automation systems is also encouraging the adoption of modern heating solutions.

Market Concentration & Characteristics

The U.S. commercial heating equipment market is moderately concentrated, with a few dominant players holding significant market share. Major companies like Trane Technologies, Carrier, and Lennox International lead due to their strong distribution networks and extensive product portfolios. However, numerous regional manufacturers and specialized firms also operate, contributing to competitive diversity. While large firms influence pricing and innovation, smaller players cater to niche demands and localized services.

The U.S. commercial heating equipment industry exhibits a high degree of innovation, driven by the demand for energy efficiency and smart technologies. Manufacturers are integrating IoT, automation, and AI-based controls into heating systems. Innovations also focus on low-emission and hybrid solutions that align with green building goals. Continuous R&D investment is enabling advancements in heat exchanger design and fuel efficiency.

The market has seen a steady level of M&A activity, primarily led by large players aiming to expand their product offerings and geographic reach. Acquisitions also focus on integrating energy-efficient technologies and strengthening after-sales service capabilities. Recent deals have involved HVAC contractors and software solution providers. M&A is a key strategy to stay competitive in a market driven by sustainability and system integration.

Government regulations significantly influence the U.S. commercial heating equipment market, particularly through energy efficiency mandates and environmental standards. The Department of Energy (DOE) sets minimum efficiency requirements for various heating products. In addition, state-level building codes and emissions regulations drive manufacturers to develop cleaner, compliant systems. Regulatory compliance has become a crucial factor in product design and market entry.

Drivers, Opportunities & Restraints

Growing demand for energy-efficient and low-emission heating systems is a primary growth driver of the U.S. commercial heating equipment industry. Rising utility costs and federal energy standards are encouraging businesses to upgrade outdated systems. Increasing construction of commercial buildings further fuels equipment demand. Technological advancements such as smart controls and remote monitoring also support market growth.

Expansion of green building initiatives and LEED-certified projects presents strong growth opportunities in the U.S. market. There is a rising interest in hybrid and renewable integrated heating solutions across commercial spaces. Demand for retrofitting existing systems with high-efficiency units is growing rapidly. Additionally, digitalization offers opportunities in predictive maintenance and energy management services.

High upfront costs of advanced heating systems can deter small and mid-sized businesses from adoption. The market also faces challenges due to complex regulatory compliance across federal and state levels. Skilled labor shortages in HVAC installation and maintenance can delay project timelines. Furthermore, supply chain disruptions can affect equipment availability and cost.

Product Insights

The heat pump segment accounted for a share of 34.9% in 2024, due to their high energy efficiency and dual heating-cooling functionality. Their ability to reduce operating costs aligns well with sustainability goals in commercial buildings. Supportive federal incentives and climate-friendly technologies have increased adoption. They are especially favored in regions with moderate climates and rising electrification trends.

The boilers segment is experiencing significant growth, particularly in the colder regions of the country where high heating demand persists. Modern condensing boilers offer improved efficiency and lower emissions, making them attractive for retrofitting older systems. Their reliability in large-scale heating for institutions like schools and hospitals supports demand. Increased focus on decarbonizing existing infrastructure also contributes to their rising adoption.

End Use Insights

The hospitality sector segment accounted for a share of 24.1% in 2024, owing to continuous demand for comfortable indoor environments. Hotels and resorts invest heavily in energy-efficient heating to enhance guest experience and reduce operational costs. Frequent renovations and sustainability certifications like LEED drive equipment upgrades. The sector’s emphasis on 24/7 climate control supports steady demand for advanced heating systems.

Heating equipment demand is growing significantly in schools and educational facilities across the U.S. due to increasing infrastructure modernization. Federal and state funding initiatives are supporting HVAC system upgrades for energy efficiency and air quality. Older buildings are being retrofitted with high-performance boilers and heat pumps. The push for healthier indoor environments post-COVID has further accelerated this trend.

Building Floorspace Insights

The up to 5,000 sq. ft. segment accounted for a share of 41.8% in 2024. Buildings with up to 5,000 sq. ft. dominate the U.S. commercial heating equipment industry due to their high volume across retail shops, clinics, and small offices. These spaces require compact and cost-effective heating solutions, making heat pumps and packaged systems ideal. The lower installation complexity and quick ROI support strong adoption. Their prevalence in suburban and urban settings sustains consistent demand.

The 25,001 to 50,000 sq. ft. segment is growing rapidly due to increased construction of mid-sized office complexes, schools, and healthcare centers. These buildings demand scalable, energy-efficient heating systems to meet stricter energy codes. The need for system upgrades in aging infrastructure also drives growth. Integration with smart building technologies is further boosting equipment investments in this category.

Country Insights

The Southeast dominated the U.S. commercial heating equipment market with a 23.1% share in 2024, due to its large concentration of hospitality, retail, and institutional buildings. Moderate winters in this region favor heat pump installations over traditional systems. Continued growth in urban areas like Atlanta, Miami, and Charlotte supports steady equipment demand. The presence of numerous new construction and retrofitting projects further boosts market activity.

The Northeast U.S. is the fastest-growing region, driven by extreme cold winters that require high-performance heating systems. Government incentives for energy-efficient upgrades and electrification are accelerating heat pump and boiler adoption. Aging infrastructure in cities like New York and Boston is undergoing major HVAC system replacements. Strong sustainability regulations and green building standards are also fueling rapid market expansion.

Key U.S. Commercial Heating Equipment Company Insights

Some of the key players operating in the market include Carrier Corporation; Rheem Manufacturing; and Lennox International.

-

Carrier Corporation specializes in advanced HVAC solutions tailored for commercial and industrial environments. The company is known for its innovative heat pump systems and high-efficiency rooftop units, often used in large-scale building projects. Carrier integrates smart controls and IoT-enabled platforms for energy management and predictive maintenance. It actively invests in decarbonization technologies and the electrification of heating systems. The brand is preferred in U.S. retrofitting projects due to its performance, reliability, and sustainability features.

-

Rheem Manufacturing focuses on high-efficiency heating solutions, particularly commercial water heaters and boilers. The company emphasizes low-NOx and condensing technologies that meet strict U.S. emissions regulations. Rheem has expanded its commercial offerings with hybrid systems and integrated smart monitoring features. Its products are widely used in hotels, schools, and light commercial spaces requiring scalable solutions. Rheem’s U.S. manufacturing footprint and service support enhance its reliability among contractors and facility managers.

Key U.S. Commercial Heating Equipment Companies:

- Carrier Corporation

- Rheem Manufacturing

- Lennox International

- Ingersoll-Rand Plc

- DAIKIN INDUSTRIES, Ltd

- Johnson Controls, Inc.

- Robert Bosch GmbH

- Viessmann Group

- Mitsubishi Electric Corporation

- Emerson Electric Co.

Recent Developments

-

In March 2025, DAIKIN INDUSTRIES Ltd expanded its heat pump lineup with a new modular air-to-water model, the EWYK-QZ, designed for sustainability and high performance. Using propane as a refrigerant, this heat pump will be able to provide both heating and cooling for a variety of applications. It can be scaled from smaller installations to large-scale systems. It's designed for easy setup and maintenance, with built-in safety features. Daikin is planning to launch the product at the end of 2025.

-

In February 2025, Carrier introduced a new, eco-friendly heat pump called the AquaSnap 61AQ for commercial buildings. This heat pump uses a natural refrigerant that doesn't harm the environment and can produce high-temperature heating, even in very cold conditions.

-

In April 2023, Carrier acquired Viessmann Climate Solutions for approximately USD 12.9 billion in order to reshape its business. This move strengthens Carrier’s position in Europe’s booming heat pump and renewable energy markets, while simplifying its operations by exiting its non-core businesses-Fire & Security and Commercial Refrigeration

U.S. Commercial Heating Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8,380.6 million

Revenue forecast in 2033

USD 15,164.6 million

Growth rate

CAGR of 7.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, building floorspace, end use, region

Regional scope

Northeast; Southeast; Midwest; Southwest; West

Country scope

U.S.

Key companies profiled

Carrier Corporation; Rheem Manufacturing; Lennox International; Ingersoll-Rand Plc; DAIKIN INDUSTRIES, Ltd; Johnson Controls, Inc.; Robert Bosch GmbH; Viessmann Group; Mitsubishi Electric Corporation; Emerson Electric Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Commercial Heating Equipment Market Report Segmentation

This report forecasts revenue growth at the U.S. level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. commercial heating equipment market report based on product, building floorspace, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Heat Pump

-

By Capacity (Btuh)

-

Up to 75,000

-

75,001 - 120,000

-

120,001 - 240,000

-

240,001 -360,000

-

Above 360,000

-

-

By Type

-

Water-Borne Heat Pump

-

By Temperature

-

Up to 35 °C

-

35 to 45 °C

-

46 to 60 °C

-

61 to 80 °C

-

Above 80 °C

-

-

-

Air-Borne Heat Pump

-

-

-

Furnace

-

By Capacity (Btuh)

-

Up to 75,000

-

75,001 - 120,000

-

120,001 - 240,000

-

240,001 -360,000

-

Above 360,000

-

-

-

Boiler

-

By Capacity (MMBtu/hr)

-

Up to 10 MMBtu/hr

-

10-50 MMBtu/hr

-

50-100 MMBtu/hr

-

100-250 MMBtu/hr

-

Above 250 MMBtu/hr

-

-

By type

-

Condensing

-

Non-condensing

-

-

-

Unitary Heaters

-

By Capacity (Btuh)

-

Up to100,000

-

100,001 - 250,000

-

250,001 - 500,000

-

Above 500,000

-

-

-

Others

-

-

Building Floorspace Outlook (Revenue, USD Million, 2021 - 2033)

-

Up to 5,000 sq. ft.

-

5,001 to 10,000 sq. ft

-

10,001 to 25,000 sq. ft

-

25,001 to 50,000 sq. ft

-

50,001 to 100,000 sq. ft

-

Above 100,000 sq. ft

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail Shops

-

Offices

-

Power Generation

-

Food & Beverage

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

Northeast

-

Southeast

-

Midwest

-

Southwest

-

West

-

Frequently Asked Questions About This Report

b. The U.S. commercial heating equipment market size was estimated at USD 7,841.6 million in 2024 and is expected to be USD 8,380.6 million in 2025.

b. The U.S. commercial heating equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2033 to reach USD 15,164.6 million by 2033.

b. Heat pump segment accounted for a share of 34.9% in 2024, due to their high energy efficiency and dual heating-cooling functionality.

b. Some of the key players operating in the U.S. commercial heating equipment market include Carrier Corporation, Mitsubishi Electric Corporation, Emerson Electric Co., Ingersoll-Rand Plc, Daikin Industries, Ltd., Rheem Manufacturing, Lennox International, Johnson Controls, Inc., Robert Bosch GmbH, Viessmann Group.

b. Growing preference for energy-efficient certified products is anticipated to be one of the major factors influencing growth over the forecast period. Moreover, rising energy consumption in the industrial and residential sectors is projected to drive the preference for solutions that reduce overall operational costs and improve energy savings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.