- Home

- »

- Advanced Interior Materials

- »

-

U.S. Coated Steel Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Coated Steel Market Size, Share & Trends Report]()

U.S. Coated Steel Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Galvanized, Pre-painted), By Application (Building & Construction, Appliances, Automotive), And Segment Forecasts

- Report ID: GVR-2-68038-748-3

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Coated Steel Market Size & Trends

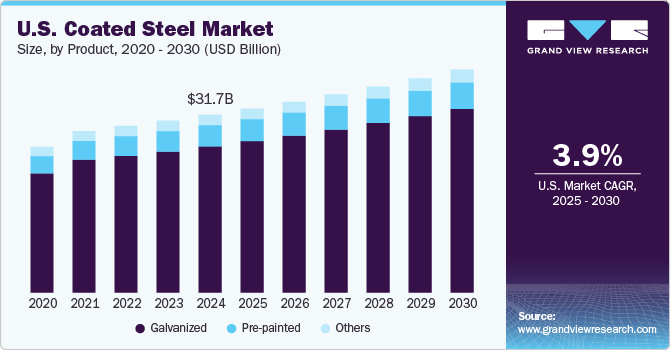

The U.S. coated steel market size was valued at USD 31.71 billion in 2024 and is expected to grow at a CAGR of 3.9% from 2025 to 2030. This growth is attributed to the increased construction activities and the demand for durable materials propelling coated steel use in residential and commercial projects. Furthermore, the automotive industry's expansion, particularly in electric vehicles, is boosting the need for lightweight and corrosion-resistant coated steel components. Moreover, the focus on sustainability and eco-friendly building materials further enhances market growth, as coated steel effectively meets these requirements.

Coated steel, often pre-painted steel, is used as a protective and decorative organic coating for steel coils. This process enhances the steel's resistance to corrosion, making it suitable for various applications, including construction, automotive, and appliances. Coatings typically consist of materials such as zinc and tin, which extend the product's lifecycle while maintaining its structural integrity. The demand for lightweight automotive components and aesthetically pleasing steel products drives market growth in the U.S.

Among the different types of coated steel, galvanized steel holds the largest market share due to its robust characteristics, making it ideal for doors and windows. Its high strength and low thermal expansion coefficient contribute to its popularity in construction, especially for metal roofing systems that perform well in extreme weather conditions. The advantages of metal roofs, such as fire resistance, lightweight nature, and energy efficiency, further boost the demand for galvanized steel.

The increasing focus on sustainability and eco-friendly building practices also plays a significant role in the coated steel market's expansion. Coated steel has become preferred as industries seek materials that offer performance and environmental benefits. The construction sector's growth, rising urbanization, and infrastructure development are expected to fuel demand for coated steel products in the coming years.

Product Insights

The galvanized steel segment led the market with the largest revenue share of 82.3% in 2024. This growth is attributed to the increasing demand for metal roofing, which offers advantages such as fire resistance, lightweight properties, and low heat conduction. These benefits make galvanized steel ideal for residential and commercial buildings, especially in regions prone to extreme weather. Furthermore, the construction industry's expansion and urbanization trends are propelling the use of galvanized steel for structural applications such as doors and windows. Moreover, the durability and corrosion resistance of galvanized steel further enhances its appeal, ensuring its continued dominance in the market.

The pre-painted steel segment is expected to grow at a CAGR of 4.2% from 2025 to 2030, driven by rising demand in various sectors. The surge in warehouse construction due to e-commerce growth has significantly increased the need for pre-painted steel in roofing and wall applications. Furthermore, the aesthetic appeal of pre-painted steel makes it a preferred choice for architectural projects, enhancing building designs while providing excellent corrosion resistance. Moreover, the ongoing trend toward sustainable construction practices also supports the growth of pre-painted steel, as it offers long-lasting performance with minimal environmental impact.

Application Insights

The building and construction segment dominated the market and accounted for the largest revenue share of 45.2% in 2024. This growth is attributed to increasing urbanization and infrastructure development. The demand for durable, corrosion-resistant materials is rising as new residential and commercial projects emerge. In addition, coated steel is favored for roofing, siding, and structural components because of its strength and low maintenance requirements. Furthermore, the trend toward sustainable and energy-efficient building practices further accelerates the adoption of coated steel in construction applications.

The building and construction segment is categorized into facades, sidings, roofing, and decking. The facade and sidings segment led the segment and accounted for the largest revenue share in 2024, due to the increasing demand for aesthetic appeal and durability in building exteriors. Coated steel offers excellent weather resistance and low maintenance, making it ideal for various architectural designs.

The appliances segment is expected to grow at a CAGR of 4.0% over the forecast period, owing to the rising demand for durable and aesthetically appealing materials. Coated steel is extensively used in manufacturing various household appliances, such as refrigerators, washing machines, and air conditioners, due to its corrosion resistance and ease of maintenance. In addition, as consumers increasingly prioritize quality and design in appliances, manufacturers are turning to coated steel for its versatility and ability to enhance product longevity. Furthermore, this trend, combined with ongoing innovations in appliance technology, is expected to boost coated steel consumption in this sector.

State Insights

South U.S. Coated Steel Market Trends

South U.S. coated steel market dominated the market and accounted for the largest revenue share of 37.1% in 2024. This growth is attributed to a booming construction industry fueled by population growth and urbanization. In addition, the region's favorable climate conditions encourage using durable materials such as coated steel for residential and commercial buildings, particularly in roofing and siding applications. Furthermore, the rise of manufacturing facilities and automotive plants, including electric vehicle production, further increases demand for coated steel. Moreover, the emphasis on energy-efficient and sustainable building practices also contributes to adopting coated steel products in this region.

Northeast U.S. Coated Steel Market Trends

The coated steel market in the Northeast U.S. is expected to grow at a CAGR of 4.9%, owing to ongoing infrastructure projects and a resurgence in construction activities following pandemic-related slowdowns. In addition, the region's focus on modernizing aging infrastructure, such as transportation systems and public buildings, drives demand for durable coated steel materials. Furthermore, stringent building codes and regulations promote the use of corrosion-resistant materials, enhancing the appeal of coated steel.

West U.S. Coated Steel Market Trends

The growth of the West U.S. coated steel market is expected to be driven by a strong emphasis on sustainable construction practices and innovative architectural designs. The region's commitment to green building initiatives encourages the use of coated steel for its energy efficiency and recyclability. In addition, rapid urbanization and population growth in cities such as San Francisco and Los Angeles also increase demand for residential and commercial construction projects that utilize coated steel products. Furthermore, the region's susceptibility to extreme weather conditions also necessitates durable roofing and siding solutions, further propelling coated steel adoption in various applications.

Key U.S. Coated Steel Company Insights

Key players in the U.S. coated steel industry include JSW Steel, United States Steel, ArcelorMittal, Salzgitter AG, and others. These companies are adopting various strategies to enhance their competitive edge. These include expanding production capacities through new facilities and technological upgrades, investing in sustainable practices to meet environmental regulations, and developing innovative products that cater to evolving consumer demands. Furthermore, companies are pursuing strategic partnerships and acquisitions to strengthen their market presence and diversify their product offerings, ensuring they remain responsive to industry trends and customer preferences.

-

ArcelorMittal manufactures Magnelis, Alusi, and Ultragal coatings, which provide exceptional corrosion resistance and durability, particularly in the automotive and construction sectors.

-

Salzgitter AG produces hot-dip galvanized and pre-painted steel products that are widely used in construction, automotive, and appliance manufacturing. The company operates within the building and construction segment, emphasizing high-quality coatings that effectively protect against corrosion and enhance aesthetic appeal.

Key U.S. Coated Steel Companies:

- JSW Steel

- United States Steel

- Nippon Steel & Sumitomo Metal Corporation

- SSAB

- ArcelorMittal

- Salzgitter AG

- NLMK

- Steel Dynamics, Inc

- VOESTALPINE

- California Steel Industries

- Metals USA

- MST Steel Inc.

- POSCO

- SeAH Group

- The Thompson Companies

- AK Steel Corporation

- Commercial Metals Company

- EVRAZ plc.

- GERDAU S.A.

- JFE Steel Corporation.

Recent Developments

-

In September 2024, United States Steel Corporation announced the launch of a new coated steel product, ZMAG, designed to resist tough conditions. This innovative carbon flat-rolled coated steel features a zinc-aluminum-magnesium coating that offers up to 5x the corrosion resistance of standard galvanized steel. ZMAG-coated steel is aimed at industries such as solar, automotive, and construction, promising enhanced durability and reduced maintenance costs.

-

In May 2024, JSW Steel launched JSW Magsure, India's first Zinc-Magnesium-Aluminum alloy coated steel product, to reduce imports of specialized coated steel. Manufactured in Karnataka and Maharashtra, this innovative product offers superior corrosion protection and is suitable for applications in solar installations, silos, and guard rails. With a production capacity of 0.9 million tonnes per annum, JSW Magsure is positioned to meet the growing domestic demand for coated steel, which has surged significantly in recent years.

-

In December 2023, Nippon Steel Corporation (NSC) announced its acquisition of United States Steel Corporation (U.S. Steel) in an all-cash deal valued at approximately USD 14.9 billion, including debt. This transaction aimed to enhance both companies' capabilities in producing high-quality coated steel and other steel products.

U.S. Coated Steel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 32.86 billion

Revenue forecast in 2030

USD 39.71 billion

Growth Rate

CAGR of 3.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Country scope

U.S.

Regional scope

South U.S., West U.S., Midwest U.S., and Northeast U.S.

Key companies profiled

JSW Steel; United States Steel; Nippon Steel & Sumitomo Metal Corporation; SSAB; ArcelorMittal; Salzgitter AG; NLMK; Steel Dynamics, Inc; VOESTALPINE; California Steel Industries; Metals USA; MST Steel Inc.; POSCO; SeAH Group; The Thompson Companies; AK Steel Corporation; Commercial Metals Company; EVRAZ plc.; GERDAU S.A.; JFE Steel Corporation.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Coated Steel Market Report Segmentation

This report forecasts revenue growth at country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. coated steel market report based on product and application and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Galvanized

-

Pre-painted

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Appliances

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

South U.S.

-

West U.S.

-

Midwest U.S.

-

Northeast U.S.

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.