- Home

- »

- Homecare & Decor

- »

-

U.S. Cat Litter Products Market Size, Industry Report, 2030GVR Report cover

![U.S. Cat Litter Products Market Size, Share & Trends Report]()

U.S. Cat Litter Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Clumping, Conventional), By Raw Material (Clay, Silica, Wood/Bamboo/Sawdust), By Distribution Channel, And Segment Forecast

- Report ID: GVR-4-68040-232-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cat Litter Products Market Summary

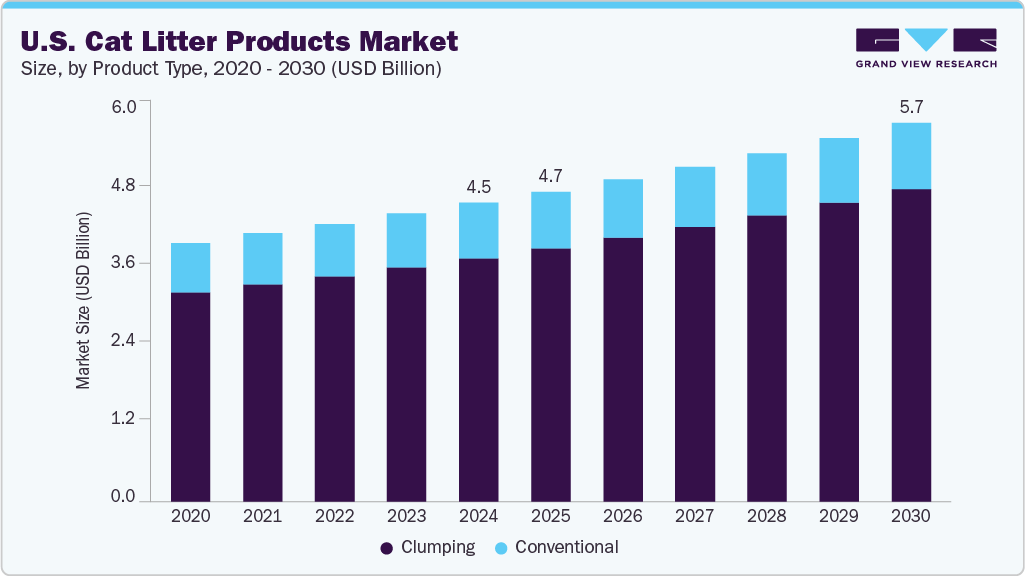

The U.S. cat litter products market size was estimated at USD 4.53 billion in 2024 and is projected to reach USD 5.74 billion by 2030, growing at a CAGR of 4.1% from 2025 to 2030. Rising pet ownership in the U.S. is driving the demand for cat litter products. Younger generations, especially millennials and Gen Z, are driving this trend, as they are more likely to own multiple pets compared to older generations.

Key Market Trends & Insights

- By product type, the clumping segment led the market with the largest revenue share of 81.6% in 2024.

- By raw material, the clay segment led the market with the largest revenue share of 82.6% in 2024.

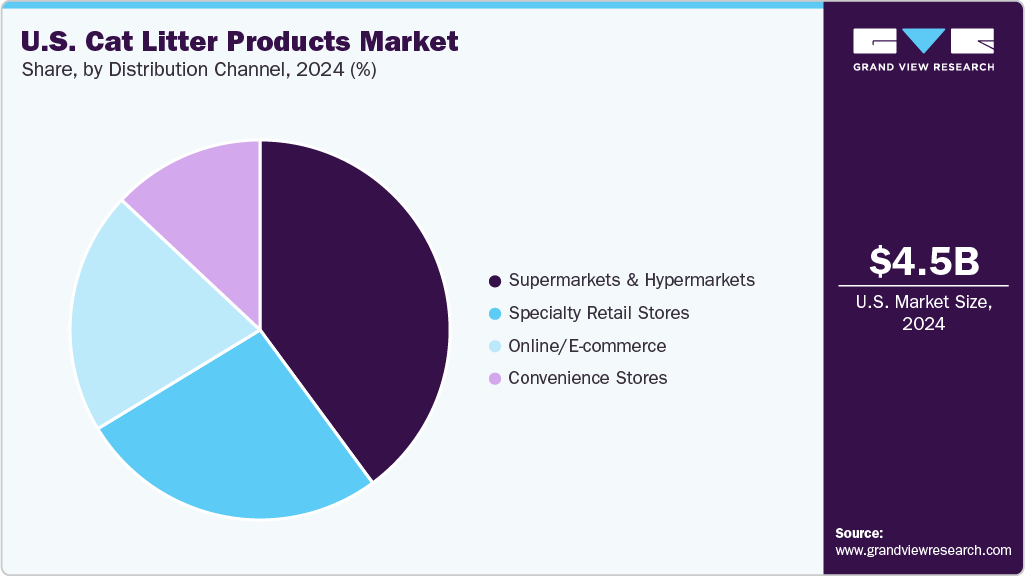

- By distribution channel, the supermarkets and hypermarkets segment led the market with the largest revenue share of 39.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.53 Billion

- 2030 Projected Market Size: USD 5.74 Billion

- CAGR (2025-2030): 4.1%

As more Americans adopt pets and view them as part of the family, the demand for high-quality, convenient, and hygienic litter products has increased. This “pet humanization” trend encourages consumers to invest in premium products that offer better odor control, cleanliness, and comfort for their cats.

Product innovation is another key growth driver. Manufacturers are developing new formulations and formats designed to improve ease of use and meet evolving consumer needs. According to a report published by Spruce Pets, in July 2025, after testing 23 automatic litter boxes in both a New York lab and home environments, the Litter-Robot 4 was identified as the top performer. It features quiet operation, easy cleaning, and a simple, user-friendly app. Both cats and owners responded positively, enjoying the convenience of a self-cleaning litter box that eliminates scooping and effectively controls odors.

Sustainability is becoming a major influence in purchasing decisions. As environmental awareness grows, consumers shift away from traditional clay-based litter toward eco-friendly alternatives made from recycled paper, wood, corn, or other biodegradable materials. Brands that position themselves as environmentally responsible are seeing strong support, especially from younger, eco-conscious buyers willing to pay more for sustainable options.

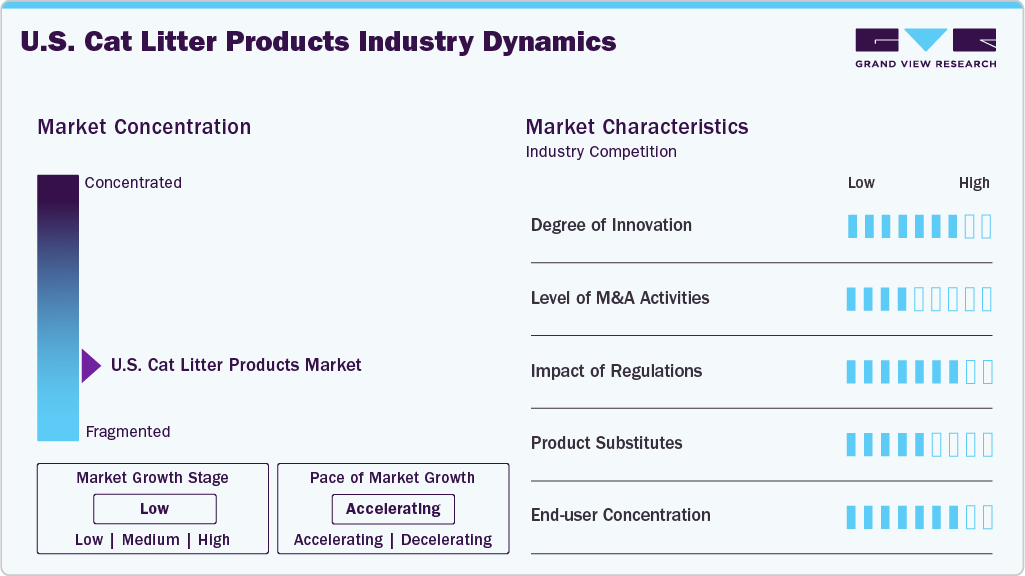

Market Concentration & Characteristics

Technological innovations in U.S. cat litter product industry include incorporating moisture-activated indicators and dust-free formulae, improving convenience, and solving typical problems with conventional litters. Businesses are spending money creating cat litters with alternative materials, including paper, corn, walnut shells, and natural wood, to satisfy consumers who care about the environment and sustainability.

The U.S. cat litter product industry has seen significant merger and acquisition activity as leading firms look to broaden their product lines and market share. In May 2024, Oil-Dri Corporation of America finalized its USD 46 million acquisition of Ultra Pet Company, Inc., one of the key suppliers of silica gel-based crystal cat litter. The transaction, funded through a combination of cash reserves and existing credit lines, strategically enhances Oil-Dri’s market position by expanding its footprint in the high-growth crystal litter category.

The three main areas of regulation in the U.S. cat litter product industry are product safety, environmental effects, and labeling regulations. Regulatory organizations keep a close check on the materials used in cat litter, enforcing strict rules on potentially dangerous compounds to protect pet and environmental safety. Furthermore, labeling requirements require precise and unambiguous information on product composition, safety warnings, and usage instructions.

In the market for cat litter goods, natural fibers, including corn, wheat, and walnut shells, wood pellets, and paper-based litter, are the most common product substitutes. Furthermore, because of their high absorbency and ability to manage odors, silica gel and crystal-based litter are becoming increasingly popular alternatives.

Product Type Insights

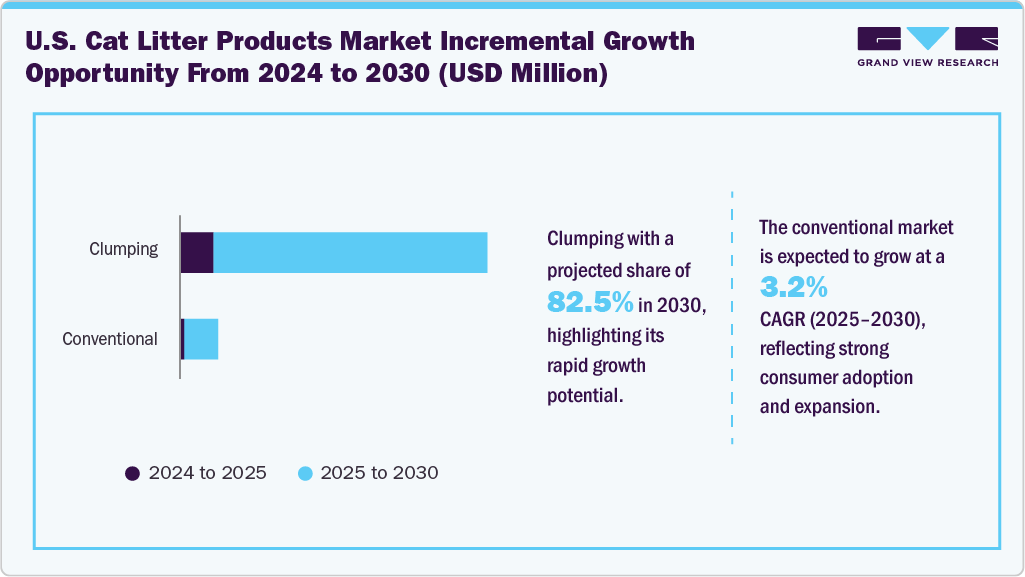

The clumping segment led the market with the largest revenue share of 81. 6% in 2024, and is projected to grow at the fastest CAGR of 4.3% from 2025 to 2030. Customers are becoming more interested in clumping litter since removing cat waste and pee without emptying the litter box is simple. Furthermore, during the projection period, clumping cat litter's growing popularity due to its usefulness and many advantages would attract buyer attention and increase product sales. Cat owners generally prefer hard-clumping cat litter. According to a report published by Church & Dwight Co., Inc. in May 2024, ARM & HAMMER Hardball Clumping Litter expanded nationally after completing successful in-market testing in 2023.

The conventional cat litter segment is projected to grow at a significant CAGR of 3.1% from 2025 to 2030. Growing customer preference for eliminating the smell of cat poop and pee is driving demand for traditional litter products. The increasing preference of consumers for inexpensive litter products due to their frequent use is driving up sales of traditional cat litter. Conventional cat litter is made of wood chips and non-biodegradable clay matter, calcium silicate, and clay crystals. Blue Buffalo Naturally Fresh offers non-clumping cat litter made from walnut shells. The litter is environmentally friendly, biodegradable, and offers superior odor control. It is free from harmful chemicals and synthetic fragrances.

Raw Material Insights

The clay segment led the market with the largest revenue share of 82.6% in 2024. The rise in the market can be attributed to the growing use of clay in cat litter products, as its high absorbency and solid-formation properties support this trend. In addition, clay-based products are more affordable than other materials, which is why middle-class and multi-cat households favor them. These products also have no smell or dust, decreasing the prospect of respiratory problems.

The wood/bamboo/sawdust segment is anticipated to grow at the fastest CAGR of 7.1% from 2025 to 2030. The market for the segment is expanding as customers place a higher value on eco-friendly and sustainable options. The environmentally friendly, multipurpose, and effectively generated pellets are made from reclaimed softwood. A variety of ökocat wood-based clumping and non-clumping cat litters are available from the pet care product brand Healthy Pet. The specifically crafted micro wood pellets in the line of environmentally friendly and biodegradable cat litter are well-known for their superior moisture-absorbing capabilities.

Distribution Channel Insights

The supermarkets and hypermarkets segment led the market with the largest revenue share of 39.9% in 2024. Supermarkets and hypermarkets offer a wide range of products under one roof, allowing consumers to buy cat litter, groceries, and household essentials. This one-stop shopping experience saves time and effort, making it easier for busy pet owners to stock up on litter without making a separate trip to a pet specialty store.

In September 2023, Walmart opened its first-ever Pet Services Center in Dallas, Georgia, offering veterinary care, grooming, and other pet services in a dedicated storefront. This move aimed to provide customers with convenient, affordable access to essential pet care while reinforcing Walmart’s commitment to savings and innovation in the pet category. In addition, large retail chains often offer competitive pricing, discounts, and bulk-buy options for cat litter products. Consumers are attracted to value deals, loyalty programs, and seasonal promotions that help them save money while purchasing a product they use regularly.

The online/e-commerce segment are projected to grow at the fastest CAGR of 5.0% from 2025 to 2030. The segment is expected to grow due to increasing consumer preference for convenience, time-saving shopping, and home delivery. E-commerce platforms offer a wide range of products, including specialty, eco-friendly, and bulk options, allowing consumers to easily compare brands, read reviews, and make informed choices. Subscription services and automated deliveries further enhance convenience, ensuring a consistent supply without repeated store trips.

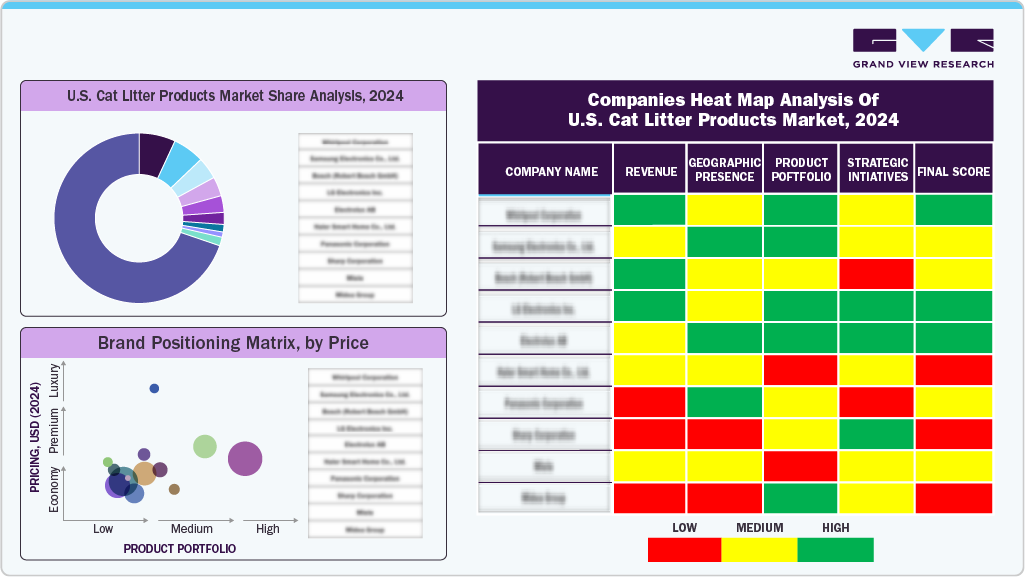

Key U.S. Cat Litter Products Company Insights

There are both new entrants and a few established businesses in the industry. In order to preserve market share, industry participants are growing and diversifying their businesses, launching new products, and using other tactics.

Key U.S. Cat Litter Products Companies:

- Nestlé

- The Clorox Company

- Mars, Incorporated and its Affiliates.

- Oil-Dri Corporation of America.

- Church & Dwight Co., Inc.

- Kent Corporation

- Intersand

- Dr. Elsey's

- Weihai Pearl Silica Gel Co., Ltd

- Pettex Limited

Recent Developments

-

In October 2025, ökocat launched a new Multi-Cat litter formula for homes with multiple cats. It retains the texture of their Original Premium litter but adds patented natural technology for stronger odor control.

-

In February 2024, SoyKitty launched SoyKitty Cat Litter, a 100% eco-friendly, plant-based cat litter. Developed with cat owners in mind, this innovative product addresses the daily challenges of responsible pet care, offering a cleaner, healthier home while maintaining a strong commitment to sustainability.

-

In April 2023, Dr. Elsey's took part in the US-hosted Global Pet Expo. The well-liked pine tree litter, which is composed entirely of kiln-dried pine pellets, and Ultra+ litter, which is intended to suppress strong aromas, are among the company's new products for 2023.

U.S. Cat Litter Products Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 4.70 billion

Revenue Forecast in 2030

USD 5.74 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, raw material, distribution channel

Country scope

U.S.

Key companies profiled

Nestlé.; The Clorox Company; Mars, Incorporated and its Affiliates.; Oil-Dri Corporation of America.; Church & Dwight Co., Inc.; Kent Corporation; Intersand; Dr. Elsey's; Weihai Pearl Silica Gel Co., Ltd.; Pettex Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cat Litter Products Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2030. For this study, Grand View Research has segmented the U.S. cat litter products market report based on the product type, raw materials, and distribution channel

-

Product Type Outlook (Revenue, USD Million, 2021 - 2030)

-

Clumping

-

Conventional

-

-

Raw Material Outlook (Revenue, USD Million, 2021 - 2030)

-

Clay

-

Silica

-

Wood/Bamboo/Sawdust

-

Paper

-

Soy

-

Corn/Grain

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2030)

-

Supermarkets and Hypermarkets

-

Specialty Retail Stores

-

Convenience Stores

-

Online/E-commerce

-

Frequently Asked Questions About This Report

b. Clumping cat litter products dominated the U.S. cat litter products market with a share of around 81.6% in 2024. Customers are becoming more interested in clumping litter since it makes it simple to remove cat waste and pee without needing to empty the litter box.

b. Some of the key players operating in the U.S. cat litter products market include Nestlé.; The Clorox Company; Mars, Incorporated and its Affiliates.; Oil-Dri Corporation of America.; Church & Dwight Co., Inc.; Kent Corporation; Intersand; Dr. Elsey's; Weihai Pearl Silica Gel Co., Ltd.; Pettex Limited

b. The market growth is being significantly influenced by the recent trend of pet humanization, which involves giving pets more attention and cleanliness. In addition, rising cat owners' spending on pet supplies is another reason that is contributing to an increase in the market for cat litter.

b. The U.S. cat litter products market was estimated at USD 4.53 billion in 2024 and is expected to reach USD 4.70 billion in 2025.

b. The U.S. cat litter products market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2030 to reach USD 5.74 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.