- Home

- »

- Medical Devices

- »

-

U.S. Cardiology Procedures Market, Industry Report, 2030GVR Report cover

![U.S. Cardiology Procedures Market Size, Share & Trends Report]()

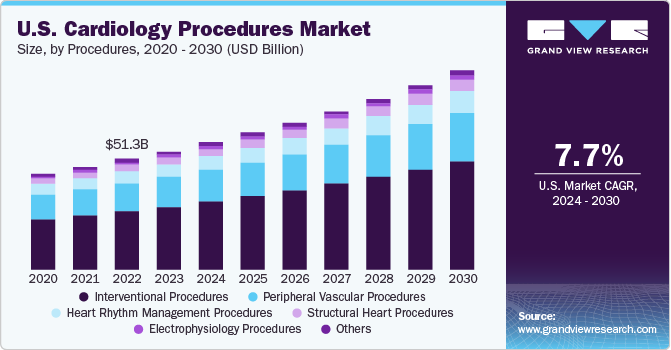

U.S. Cardiology Procedures Market (2024 - 2030) Size, Share & Trends Analysis Report By Procedures (Interventional Procedures, Peripheral Vascular Procedures, Heart Rhythm Management Procedures), And Segment Forecasts

- Report ID: GVR-4-68040-289-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cardiology Procedures Market Trends

The U.S. cardiology procedures market size was estimated at USD 55.01 billion in 2023 and is expected to grow at a CAGR of 7.7% from 2024 to 2030. The expanding geriatric demographic, the rise in cardiovascular conditions, and the advancements in cardiology device technology propel the market's growth. The uptick in clinical research focusing on cardiovascular solutions presents an opportunity for further market expansion.

An increase in the prevalence of cardiovascular diseases (CVDs), such as coronary artery disease (CAD), heart arrhythmias, heart failure, heart valve disease, congenital heart disease, cardiomyopathy (heart muscle disease), and pericardial disease, is expected to boost the market growth over the forecast period. According to the CDC, in 2023, around 20.5 million adults in the U.S. suffered from CAD, making it the most prevalent form of heart disease. In addition, around 366,000 people in the U.S. died due to CAD. Currently, the CABG procedure is recommended by physicians to their patients for treatment. Thus, the rising prevalence of CAD is anticipated to drive market growth. Furthermore, the growing number of deaths and rising awareness about the benefits of early cardiovascular treatment among the general U.S. population are expected to boost the demand for cardiology procedures during the forecast period.

Table 1 Heart Disease Mortality By Major U.S. States, 2021

State

Deaths

Death Rate Per 100,000 Population

California

65,471

147.8

Texas

50,584

180.7

Florida

50,100

151.3

New York

42,434

162.3

Pennsylvania

32,478

180.6

Ohio

30,578

204.7

The growing geriatric population has a significant impact on U.S. healthcare systems. The growing geriatric population is increasing the prevalence of age-related conditions, such as heart disease. According to the U.S. Census Bureau, by 2030 around 82 million Americans will be aged 65 or older. In the U.S., the burden of cardiovascular disease is anticipated to grow with the rising geriatric population, which may necessitate advanced life support measures, such as surgical procedures. Aging can cause changes in the heart and blood vessels, which may increase a person’s chances of developing cardiovascular disease. Thus, the rising geriatric population is projected to fuel demand for cardiology procedures nationwide during the forecast period.

Market Concentration & Characteristics

The market is experiencing significant growth, driven in part by advancements in medical technology, particularly in innovative devices used for interventional cardiology procedures and diagnostic imaging tools. Furthermore, competition among market players to introduce advanced products for improved treatment options is intensifying. Many companies have substantially invested in research and development programs to enhance their product lines and introduce new portfolios.

In February 2022, Cardiovascular Systems, Inc. partnered with Innova Vascular, Inc. (Innova) to develop a comprehensive range of novel thrombectomy devices. Similarly, MedAlliance launched ORIGIN SC and ORIGIN NC in July 2021, two high-performance balloons designed for vessel preparation, targeting patients with life-threatening coronary and peripheral arterial disease. These developments are anticipated to propel market growth during the forecast period.

The market has seen a notable surge in merger and acquisition (M&A) activities in recent years, reflecting the industry's dynamic landscape and the strategic imperatives of market players. These M&A activities aim to strengthen market positions, expand product portfolios, and drive innovation in cardiovascular care. For instance, in October 2023, the Mayo Clinic partnered with Oxford Nanopore Technologies in a multi-year collaboration to develop novel clinical tests for various diseases and enhance patient care. Concurrently, Walgreens and the Cardiovascular Research Foundation (CRF) announced a joint effort to propel the PREVUE-VALVE study forward, which focuses on conducting a population-based clinical trial to assess the prevalence of valvular heart disease (VHD) among older adults. Additionally, Qnovia initiated a drug development collaboration with the University of Virginia (UVA) to advance innovative inhaled-drug candidates targeting bacterial lung infections, among other collaborations and initiatives unveiled during the period.

Regulations play a pivotal role in shaping the U.S. cardiology procedures industry landscape. The stringent regulatory framework established by government bodies such as the Food and Drug Administration (FDA) significantly influences the development, approval, and adoption of new cardiovascular technologies and procedures. While these regulations aim to ensure patient safety and efficacy, they also pose challenges for market players, particularly in navigating complex approval processes and compliance requirements.

Procedures Insights

Based on procedure, the interventional procedures segment dominated the market and accounted for the largest revenue share of 53.74% in 2023. Moreover, this segment is anticipated to grow at the fastest CAGR of 8.1% over the forecast period. The market is poised for growth driven by several factors, including new product launches, supportive government initiatives, and the increasing prevalence of conditions like peripheral artery disease, coronary artery disease (CAD), and cardiac valve disease. Additionally, the rising adoption of minimally invasive surgeries (MIS) is expected to contribute to market expansion.

According to the American College of Cardiology, approximately 1.2 million angioplasties were performed in the U.S. in 2023. Unhealthy lifestyles, obesity, and diabetes are significant factors driving the demand for angioplasties and contributing to the increase in CAD cases. Government and non-profit medical associations are also playing a role in fostering market growth by promoting early diagnosis and treatment of cardiac diseases. Organizations like the American Heart Association (AHA) are working towards reducing disabilities and fatalities caused by heart disease and stroke through various initiatives, including advocacy for cardiac care, consumer education on healthy living, and funding cardiovascular research.Moreover, leading healthcare facilities such as Cleveland Clinic, Cedars-Sinai Medical Center, Mayo Clinic-Rochester, Mount Sinai Hospital, and NYU Langone Hospitals provide safe and effective cardiac interventional procedures in the U.S.

Key U.S. Cardiology Procedures Company Insights

Key U.S. cardiology procedures hospitals include Cleveland Clinic, Mayo Clinic, Johns Hopkins Hospital, Massachusetts General Hospital, Stanford Health Care, Cedars-Sinai Medical Center, and Northwestern Memorial Hospital.

Key U.S. Cardiology Procedures Companies:

- Cleveland Clinic

- Mayo Clinic

- Johns Hopkins Hospital

- Massachusetts General Hospital

- Stanford Health Care

- Cedars-Sinai Medical Center

- Northwestern Memorial Hospital

Recent Developments

-

In January 2024, K Health, a primary care company leveraging Artificial Intelligence (AI), collaborated with Mayo Clinic to address the prevention and management of heart-related ailments. The focus is on jointly developing an AI-powered solution for cardiac clinical applications to prevent untimely fatalities due to heart disease and stroke. The cardiac program's objective is to employ K Health's proprietary algorithms to drive sophisticated AI-ECG (Artificial Intelligence-enhanced electrocardiography) technology, conduct risk assessments, and facilitate remote patient monitoring.

-

In October 2023, the Icahn School of Medicine at Mount Sinai revealed a memorandum of understanding with the Chiba Institute of Technology (CIT) for joint efforts in utilizing artificial intelligence (AI) for cardiovascular disease research. The aim is to enhance the efficiency of clinical trials, accelerate progress in patient care, and expedite the potential introduction of new treatments for individuals with heart conditions.

U.S. Cardiology Procedures Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 92.32 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Base year of estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, growth factors, and trends

Segments covered

Procedures

Country scope

U.S.

Key hospitals profiled

Cleveland Clinic; Mayo Clinic; Johns Hopkins Hospital; Massachusetts General Hospital; Stanford Health Care; Cedars-Sinai Medical Center; and Northwestern Memorial Hospital.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cardiology Procedures Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cardiology procedures market report based on procedures:

-

Procedures Outlook (Revenue, USD Billion, 2018 - 2030)

-

Interventional Procedures

-

Peripheral Vascular Procedures

-

Heart Rhythm Management Procedures

-

Structural Heart Procedures

-

Electrophysiology Procedures

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. cardiology procedures market size was estimated at USD 55.01 billion in 2023 and is expected to reach USD 92.32 billion in 2024.

b. The global U.S. cardiology procedures market is expected to grow at a compound annual growth rate of 7.7% from 2024 to 2030 to reach USD 92.32 billion by 2030.

b. The interventional procedures segment dominated the market and accounted for the largest revenue share of 53.74% in 2023. The market is poised for growth driven by several factors, including new product launches, supportive government initiatives, and the increasing prevalence of conditions like peripheral artery disease, coronary artery disease (CAD), and cardiac valve disease.

b. Some key hospitals operating in the U.S. cardiology procedure market include Cleveland Clinic, Mayo Clinic, Johns Hopkins Hospital, Massachusetts General Hospital, Stanford Health Care, Cedars-Sinai Medical Center, and Northwestern Memorial Hospital.

b. Key factors that are driving the market growth include increasing geriatric demographic, the rise in cardiovascular conditions, and the advancements in cardiology device technology propel the market's growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.