- Home

- »

- Homecare & Decor

- »

-

U.S. Car Wash Services Market Size, Industry Report, 2030GVR Report cover

![U.S. Car Wash Services Market Size, Share & Trends Report]()

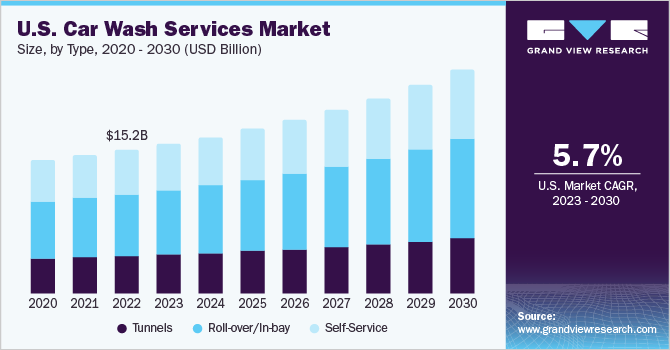

U.S. Car Wash Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Tunnels, Roll-over/In-bay, Self-service), By Mode of Payment (Cash Payment, Cashless Payment), By Country, And Segment Forecasts

- Report ID: GVR-4-68039-355-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Car Wash Services Market Trends

The U.S. car wash services market size was estimated at USD 14.74 billion in 2024 and is expected to grow at a CAGR of 2.1% from 2025 to 2030. The growing consumer focus on vehicle maintenance, as well as damage caused to the car body due to bird droppings, dirt, acid raindrops, particulate matter, and salt deposits during the winter months have increased the demand for car wash services in the U.S. The COVID-19 outbreak significantly impacted the business of car washers in the country. A survey conducted by Womply, an auto wash and detailing company in the U.S., suggested that their weekly revenue dropped by 48% in April 2020 as compared to the same period in 2019.

Additionally, in the week of March 16, 2020, the weekly revenue dropped by 53%, as compared to the same period in the preceding year. This led to many car washing operators providing free vehicle disinfection services, and value-added services to stay ahead in the competition. For instance, seven Southern California carwashes reopened in May 2020, included free vehicle disinfection service to help customers safeguard themselves from the virus.

The demand for car washing in the region has surged, especially in the last decade. This can be attributed to enhanced convenience along with a wide range of service packages as well as affordable alternatives. Due to strict environmental standards that prohibit household car washing methods, the need for professional car cleaning services is expected to rise. As purchasing power of consumers increases, their attention toward regular vehicle maintenance will keep growing. Moreover, many consumers can’t find time to wash their cars themselves, owing to hectic schedules.

SEKO, a car washing service provider reports that more than 80,000 professional car washing establishments are located in North America. More than 8 million vehicles are washed at car washing establishments each day. In North America, more than 2 billion cars are washed every year. According to a blog by DetailPro published in May 2021, in the U.S., 66% of people wash their cars 13 times a year on average. According to this, there are typically one or two washes per month. More than 70% of car owners switched to car washing facilities from handwashing in the last decade.

New technological developments are bringing changes in on-demand car wash services. Consumer adoption of the service via mobile applications and online portals has resulted from the e-commerce industry's tremendous growth. For instance, WashCard developed payment portals, especially for car wash service providers that allowed customers to make mobile payments and set up automated billing and cleaning schedules.

As sustainability continues to govern purchase decisions, car washes have also followed suit and started eco-friendly car washing services. Car washing service providers have started moving towards regulated water essentials. Traditional car washing uses 15 to 80 gallons of water per vehicle, whereas the environment-friendly version uses only 8 to 70 gallons per vehicle when equipped with filtration technology or water reclamation. Though originated decades back, water reclamation technology is being adopted by various brands today as consumers, brands, and lawmakers continue to strive for quality control and conservation.

Type Insights

Roll-over/in-bay car wash services accounted for a revenue share of over 42% in 2024, driven by Roll-overs/in-bay are one of the most widespread express car wash types. They feature compact machines with brushes, water jets, wheel-wash, and the application of products such as waxes, dryers, or foams. Also, these types offer very versatile machines and their compact nature ensures a thorough washing in a small area. Automatic in-bay car washes are the most common type of car wash in the U.S., with nearly 29,000 facilities across the country by 2020. It provides a variety of wash options and is a quick, convenient, and inexpensive way to clean a vehicle.

Self-service car wash revenue is projected to grow at a CAGR of 2.1% from 2025 to 2030. This segment is witnessing healthy traction owing to the range of customization it offers to consumers when it comes to cleaning vehicles neatly. Self-service car wash facilities are widely popular among customers who prefer to detail their cars themselves. According to a blog by JBS Industries, there were more than 36,000 facilities in the U.S. in 2020 offering car owners the ability to wash their cars’ exteriors and options for vacuuming the interiors.

Mode of Payment Insights

Cashless payments accounted for over 70% of the revenue share in 2024. With the deep rooting of online payments among consumers, car wash service owners have increasingly started installing integrated payment solutions, across pay stations. Along with boosting sales, these payment systems also offer detailed insights into their clientele. Millennial consumers especially expect the availability of convenient methods, including tokens, debit cards, loyalty cards, EMV-enabled credit card payments, or mobile payment options.

The majority of car washing services have coin-operated machines installed to get car cleaning done. As per the Pew Research Center, in 2019, 30% of Americans made cash payments at car wash centers. Although cash payments were common in the past decade, due to the growing popularity of digital transactions, demand for cash payments in the U.S. car wash services market is projected to record low volume during the forecasted period.

Country Insights

The increasing demand for 24-hour car wash services has been driven by the fast-paced urban lifestyle of consumers and the constantly growing suburban districts. Car wash companies catering to consumers in the Northeastern part of the U.S. are expanding their offerings to meet this rising demand.

For instance, the self-service bays and automatic car wash services at Spotless Auto Laundries in Hackensack, New Jersey are operational 24 hours a day. The car wash service provider also offers other services such as quick lube, oil change, and soft cloth wash. In addition, regular customers can make the most of unlimited car wash passes and coupons for oil change and detailing services. The presence of such players fuels the regional market for car wash services.

Key U.S. Car Wash Services Company Insights

The market is characterized by the presence of significant domestic service providers. Large players are acquiring local establishments to aid in reaching a wider audience in the country. To expand the consumer base, market players have recognized the importance and dominance of regional players.

Players operating in this market are focusing on service differentiation owing to the growing competition and the varying needs of clients fueling the market growth in the West part of the U.S. Subscription-based car wash facilities are an exciting new opportunity for new players to enter the market. For instance, California Hand Wash, a car wash facility based in California, offers customers monthly membership subscription-based plans. The full-service wash options offered by the company are California Dream Plus+, California Dream, California Gold, California Exterior, and other unlimited monthly membership packages.

Key U.S. Car Wash Services Companies:

- Driven Brands, Inc.

- Tommy’s Express

- Splash Car Wash

- Zips Carwash

- Autobell Car Wash, Inc.

- Quick Quack Car Wash

- True Blue Car Wash

- Magic Hands Car Wash

- Wash Depot

- SSCW Enterprises (Super Star Car Wash)

Recent Developments

-

In August 2022, Mister Car Wash, Inc. acquired three express exterior locations in Anoka, Fridley, and Champlin, Minnesota of Top Wash. The acquisition increased Mister Car Wash's presence in Minneapolis' northern suburbs.

-

In June 2022, Mister Car Wash, Inc. expanded to a new location in Oviedo, Florida. Mister's signature products, including the waterfall HotShine Carnauba wax, Repel Shield, and Platinum Seal, are available in the new location as part of the Platinum package. Mister's proprietary cleaning systems are used in the new location's cutting-edge tunnel experience.

-

In November 2021, Driven Brands, Inc. acquired its 100th car wash, bringing the total number of Driven Brands Car Washes in the United States to 300.

U.S. Car Wash Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.28 billion

Revenue forecast in 2030

USD 16.95 billion

Growth rate

CAGR of 2.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, mode of payment

Country scope

U.S.

Key companies profiled

Driven Brands, Inc.; Tommy’s Express; Splash Car Wash; Zips Carwash; Autobell Car Wash, Inc.; Quick Quack Car Wash; True Blue Car Wash; Magic Hands Car Wash; Wash Depot; SSCW Enterprises (Super Star Car Wash)

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Car Wash Services Market Report Segmentation

This report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. car wash services market on the basis of type, and mode of payment:

-

Type Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

Tunnels

-

Roll-over/In-Bay

-

Self-Service

-

-

Mode of Payment Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

Cash Payment

-

Cashless Payment

-

Frequently Asked Questions About This Report

b. The U.S. car wash services market was valued at USD 14.74 billion in 2024 and is expected to reach USD 15.28 billion by 2025.

b. The U.S. car wash services market is expected to grow at a compound annual growth rate (CAGR) of 2.1% from 2025 to 2030 to reach USD 16.95 billion by 2030.

b. Roll-over/in-bay car wash services accounted for a revenue share of over 42% in 2024, driven by Roll-overs/in-bay are one of the most widespread express car wash types. They feature compact machines with brushes, water jets, wheel-wash, and the application of products such as waxes, dryers, or foams

b. Some key players operating in the U.S. car wash services market include Driven Brands, Inc., Tummy’s Express, Splash Car Wash, Zips Carwash, Autobell Car Wash, Inc., Quick Quack Car Wash, True Blue Car Wash, Magic Hands Car Wash, Wash Depot, Mister Car Wash, SSCW Enterprises (Super Star Car Wash)

b. The demand for car wash services in the U.S. has been rising over the past decade due to their increased convenience and a greater array of budget and luxury options. The increasing environmental regulations prohibiting residential car washing practices are anticipated to expand the customer base for professional car washes, thereby driving the demand for the services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.