- Home

- »

- Medical Devices

- »

-

U.S. Cannula Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Cannula Market Size, Share & Trends Report]()

U.S. Cannula Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Cardiac, Dermatology), Type (Neonatal Cannulae, Straight Cannulae), By Material (Plastic, Metal, Silicone), By Size (14G, 16G, 18G, 20G, 22G, 24G, 26G), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-276-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cannula Market Size & Trends

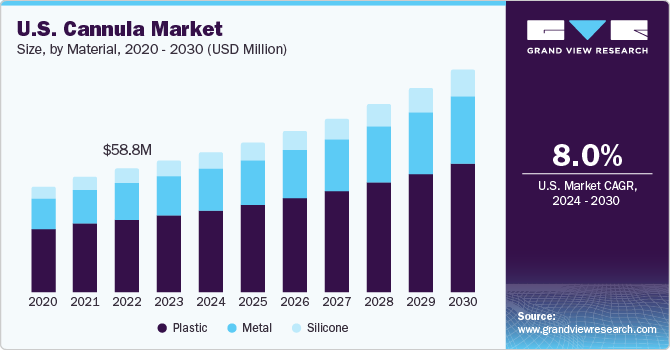

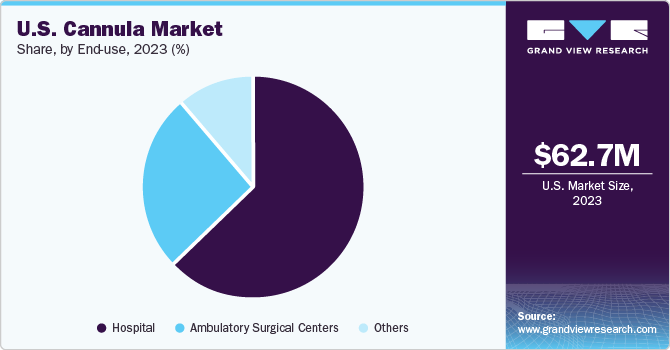

The U.S. cannula market was valued at USD 62.7 million in 2023 and is anticipated to grow at a CAGR of 8.0% from 2024 to 2030. Factors such as advancements in healthcare infrastructure, increase in the number of patients undergoing surgeries, and surge in the number of minimally invasive procedures are driving the market growth.

Minimally invasive surgeries are gaining popularity in the healthcare industry. There has been a rapid increase in the preference for minimally invasive surgeries for the treatment of cardiovascular diseases. This is due to the fact the minimally invasive surgeries cause less surgical trauma and result in better aesthetic appearance. It offers advantages such as smaller incisions, minimized infection risks, smaller scars, lesser amount of bleeding and lesser pain and trauma.

In 2023, U.S. accounted for a market share of over 35% in the global cannula market. Cardiovascular disease is among the leading causes of death. As per the New York State Department of Health, over 695,000 people die every year of cardiovascular disease in the U.S. In addition, over 92.1 million adults in America are living with after-effects of a cardiac stroke or one or another form of cardiovascular disease. High occurrence of cardiovascular diseases paired with increased hospitalizations and related mortality & morbidity rate are leading to soaring demand for cardiac cannulas for delivery of intravenous drugs.

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of growth depicts an accelerating trend. Recent approvals for new products in the U.S. and strategic acquisitions by key players for expanding product portfolio are factors fueling the industry growth.

Advancements in anesthetic, surgical, intensive care techniques have led to an increase in the number of elderly people undergoing surgical procedures. Furthermore, increasing facial filling treatment and preference for aesthetic cannula is creating new growth opportunities for the industry. Facial fillings are minimally invasive aesthetic procedures in dermatological treatments. A microcannula is like a needle with lateral opening and blunt tip is used in the treatment of skin-related issues such as expression lines and wrinkles. Filling materials such as Calcium Hydroxyapatite (CaHA), hyaluronic acid, poly-L-lactic acid, and collagen can be easily injected through it.

The U.S. cannula industry has been witnessing a lot of M&A activities initiated by major players. This trend can be attributed to various factors such as the growing focus on improving companies' portfolios and the need for consolidation in a fast-growing industry. Many companies in the country are adopting this strategy to strengthen their portfolios. For example, in May 2023, Convatec partnered with Beta Bionics to launch iLet Bionic Pancreas, which automates insulin delivery. The device has an inbuilt insertion mechanism and a soft cannula with skin-friendly adhesive tape.

Cannulas are classified under class I medical devices. As per the U.S. FDA regulations, most of the class I devices are exempt from 510(k) notification, while manufacturers of some of these devices are required to submit the notification. For every device with 510(k) notification, the manufacturer must receive order of clearance before distributing the device. Stringent regulations can create challenges for innovators, manufacturers, and exporters to receive approval for market distribution in developing economies.

Product Insights

The cardiac segment held the largest market share of 46.3% in 2023. Growth in this segment is attributable to the high prevalence of cardiovascular diseases. Factors such as shift towards sedentary lifestyle, consumption of processed foods, and reduced amounts of physical activities are leading to a rise in cases of cardiovascular disease. In addition, the increase in geriatric population is also contributing to a significant rise in cardiovascular diseases.

The dermatology segment is expected to register a significant growth rate over the forecast period. This is due to the increasing use of microcannula to avoid complications during and after procedures. Moreover, there is a significant rise in the number of cosmetic surgeries being carried out which is anticipated to further boost the demand for dermatology segment. According to a research paper published in 2023, every year providers carry out more than 15 million cosmetic surgery procedures in the U.S. Increase in penetration of minimally invasive surgeries is expected to drive the segment growth over the forecast period.

Type Insights

The straight cannulae segment dominated the market with highest market share of 35.5% in 2023. The dominance is attributable to the design benefits offered by the product that makes it simpler to use. Straight cannulae’s extra-sharp needle makes it easier to insert as well. These types of cannulae are used in cardiac surgeries to avoid any mishap and cut down any unnecessary delay that may lead to interrupting the entire process.

Neonatal cannulae is expected to register the fastest CAGR during the forecast period. The primary factor contributing towards the growth of this segment is the increase in prevalence of respiratory problems among the neonates. The soft and flexible nature of neonatal cannulae makes it highly suitable for use in high flow oxygen therapy for newborns.

Material Insights

The plastic segment held the highest market share of 59.2% in 2023 due to its increased adoption rate in both in-patient and outpatient procedures. Most plastic cannulas are translucent and allow surgeons to visualize instrumentation & sutures passing through the cannula in shoulder arthroscopy. Thus, making is suitable for using it in maximum procedures, which is leading to its dominance throughout the forecast period.

The silicone segment is anticipated to experience significant growth during the forecast period. This is attributed to the increasing usage of silicone cannulas in oxygen therapies, in order to ensure continuous supply of oxygen to patients during surgery and for people suffering from respiratory disorders. Moreover, silicone cannulas are soft and flexible which makes them a preferred choice for adoption among healthcare professionals and patients.

Size Insights

The 18G size accounted for highest market share of 28.8% in 2023. The 18G size cannula is most widely used in hospitals for adults as well as adolescents. 18G cannulas are used to infuse blood products and deliver medications. These cannulas enable quick blood transfusion. Moreover, these are also used for computed tomography/pulmonary embolism protocols or other testing that needs large IV sizes.

The 22 G size segment is expected to experience the fastest growth rate over the forecast period. This can be attributed to its small gauge size, which allows faster flow of fluid in patients with hard-to-find veins and in children. 22G cannulas are used for intravenous infusion with moderate flow rates in adolescents, older children, and the elderly. These cannulas are blue in color and have a length of 25mm, external diameter of 0.9mm, and flow rate of over 36ml/min.

End-use Insights

The hospitals segment held the largest market share of 54.6% in 2023. This is due to the rise in hospitalization rate for a variety of causes and treatments. Cannulas are used in a wide range of specialty departments in the hospitals, which include orthopedic surgery, cardiovascular surgery, neurology, gynecology, general surgery, oxygen therapy, dermatology and others.

The ambulatory surgical centers segment is projected to witness fastest growth throughout the forecast period. Ambulatory surgical centers are modern healthcare facilities that offer same-day surgical care, along with preventive and diagnosis procedures. Thus, there is a rise in shift towards ambulatory surgical centers to undergo treatment and avoid hospitalization. This in turn is leading to a rise in the number of ambulatory surgical centers. As per the Texas Ambulatory Surgery Center Society, currently, there are over 5,900 Medicare-certified ambulatory surgical centers in the U.S, performing around 22.5 million surgeries per year.

Key U.S. Cannula Company Insights

Key U.S. cannula companies in the market are focusing on launching new products in the market to strengthen their portfolio and gain a stronger foothold in the market. For instance, in May 2020, Medtronic announced the U.S. launch of Kyphon Assist Directional Cannula for balloon kyphoplasty. The market players are also focusing on market consolidation activities such as acquisitions and strategic partnerships, which will help them to hold a dominant position in the market.

Key U.S. Cannula Companies:

- Medtronic

- Becton Dickinson (BD)

- Edward Lifesciences

- LivaNovaca

- Smiths Medical

- Boston Scientific Corporation

Recent Developments

-

In August 2023, AngioDynamics, Inc. announced that the FDA granted Breakthrough Device designation for AngioVac System of the company, to include the non-surgical vegetation removal from the right heart. The system uses a venous drainage cannula for removing emboli or thrombi during extracorporeal bypass.

-

In April 2023, Intuitive Surgical announced that it had received the FDA approval for the da Vinci SP surgical system for simple prostatectomy. The system comprises three, wristed, multi-jointed instruments and one fully wristed 3D HD camera. The instruments and camera are integrated via a single cannula.

U.S. Cannula Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 67.1 million

Revenue forecast in 2030

USD 107.5 million

Growth rate

CAGR of 8.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, material, size, end-use

Country scope

U.S.

Key companies profiled

Medtronic; Becton Dickinson (BD); Edward Lifesciences; LivaNova; Smiths Medical; Boston Scientific Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cannula Market Report Segmentation

This report forecasts revenue growth of the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cannulamarket based on product, type, material, size, and end-use:

-

Product Outlook (Revenue in USD Million, 2018 - 2030)

-

Cardiac

-

Arterial

-

Venous

-

Cardioplegia

-

Femmoral

-

-

Dermatology

-

Nasal

-

Others

-

-

Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Neonatal Cannulae

-

Straight Cannulae

-

Winged Cannulae

-

Wing with Port

-

Winged with Stop Cork

-

-

Material Outlook (Revenue in USD Million, 2018 - 2030)

-

Plastic

-

Metal

-

Silicone

-

-

Size Outlook (Revenue in USD Million, 2018 - 2030)

-

14G

-

16G

-

18G

-

20G

-

22G

-

24G

-

26G

-

-

End-use Outlook (Revenue in USD Million, 2018 - 2030)

-

Hospital

-

Ambulatory Surgical Centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. cannula market size was estimated at USD 62.7 million in 2023 and is expected to reach USD 67.1 million in 2024.

b. The U.S. cannula market is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 to reach USD 107.5 million by 2030.

b. Cardiac dominated the product segment with a share of 46.3% in 2023. This is attributable to the increasing demand and adoption for cardiac cannula.

b. Some key players operating in the U.S. cannula market include Medtronic, Becton Dickinson (BD), Edward Lifesciences, LivaNova, Smiths Medical, and Boston Scientific Corporation.

b. Key factors that are driving the U.S. cannula market growth include a surge in awareness about minimally invasive surgeries, increasing infant mortality rate, improving healthcare infrastructure in emerging economies, and a rising number of hospitals and clinics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.