- Home

- »

- Consumer F&B

- »

-

U.S. And Canada Premium Bottled Water Market Report 2033GVR Report cover

![U.S. And Canada Premium Bottled Water Market Size, Share & Trends Report]()

U.S. And Canada Premium Bottled Water Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Spring Water, Sparkling Water, Mineral Water), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-144-7

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. And Canada Premium Bottled Market Summary

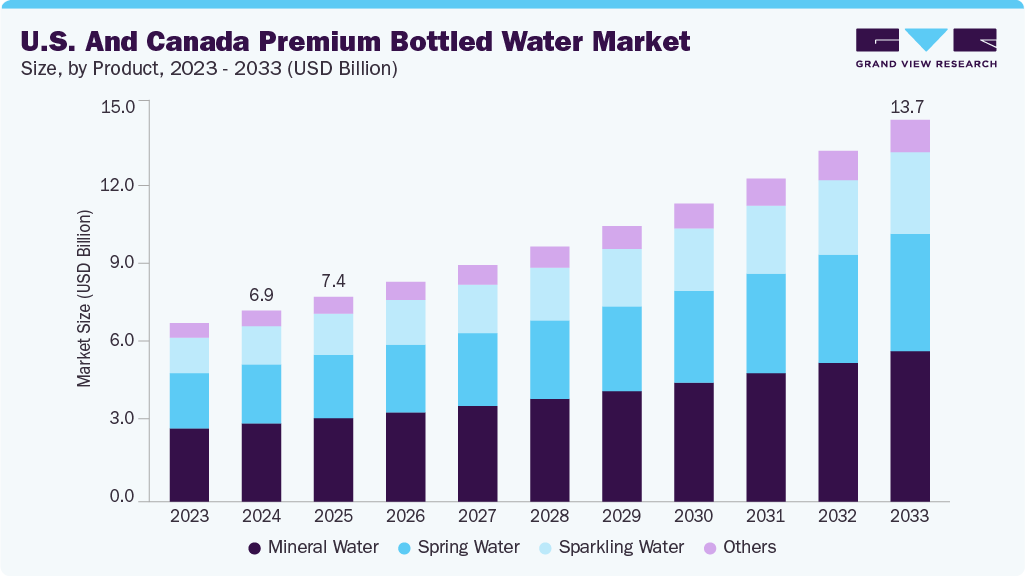

The U.S. and Canada premium bottled water market size was estimated at USD 6.88 billion in 2024 and is expected to reach USD 13.74 billion by 2033, growing at a CAGR of 8.1% from 2025 to 2033. Premium bottled waters distinguish themselves from mass-market options through unique selling propositions that appeal to a specific consumer segment, allowing them to command higher prices.

Key Market Trends & Insights

- By product, mineral water led the largest market with a share of 40.92% in 2024.

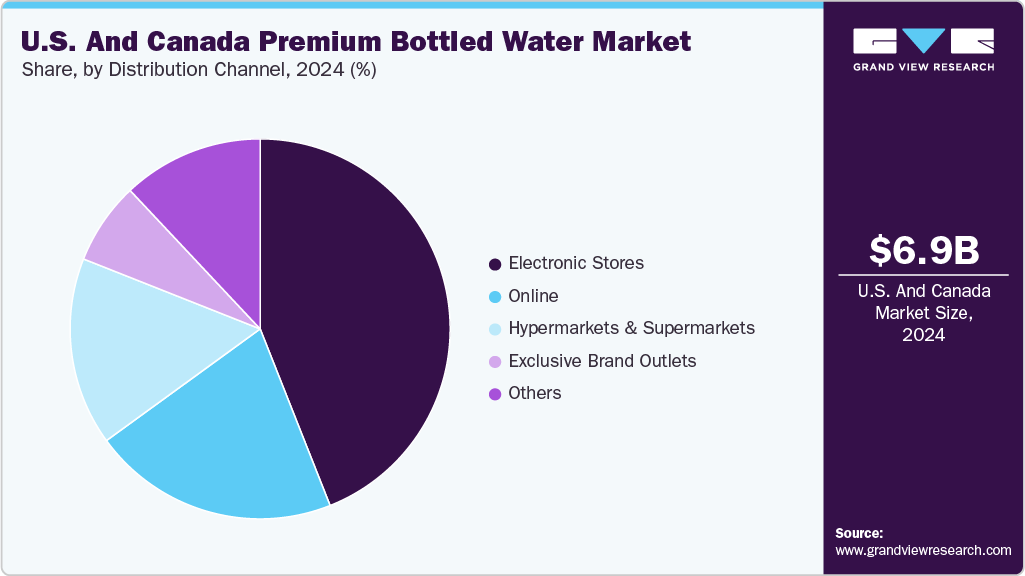

- By distribution channel, the supermarkets & hypermarkets held the largest share of 37.40% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.88 Billion

- 2033 Projected Market Size: USD 13.74 Billion

- CAGR (2025-2033): 8.1%

The rising demand for premium bottled water over beverages like coffee, tea, and soft drinks is driven by factors such as its perceived naturalness, superior taste compared to tap water, added mineral content, and purity. Additionally, the shift in consumer preference toward healthier drink options has contributed to increased bottled water consumption over carbonated soft drinks, a trend expected to continue throughout the forecast period.According to a 2024 report by the International Bottled Water Association (IBWA), based on Beverage Marketing Corp. (BMC) data, bottled water remained the leading beverage by volume in the U.S. for the ninth consecutive year. It recorded a consumption of 16.4 billion gallons in 2024, reflecting a 2.9% growth, outpacing all other beverage categories, most of which saw a decline in volume.

Bottled water is favored for its convenience and portability, making it ideal for on-the-go consumption. Its widespread availability through stores, vending machines, and multiple distribution channels ensures easy regional access. The strong presence of supermarkets and hypermarkets further enhances this accessibility, offering consumers a wide variety of premium bottled water options in one place, enabling easy comparison of brands, types, and prices. Moreover, the availability of various sizes, from single-serve bottles to larger multi-packs, caters to diverse consumer preferences and usage needs.

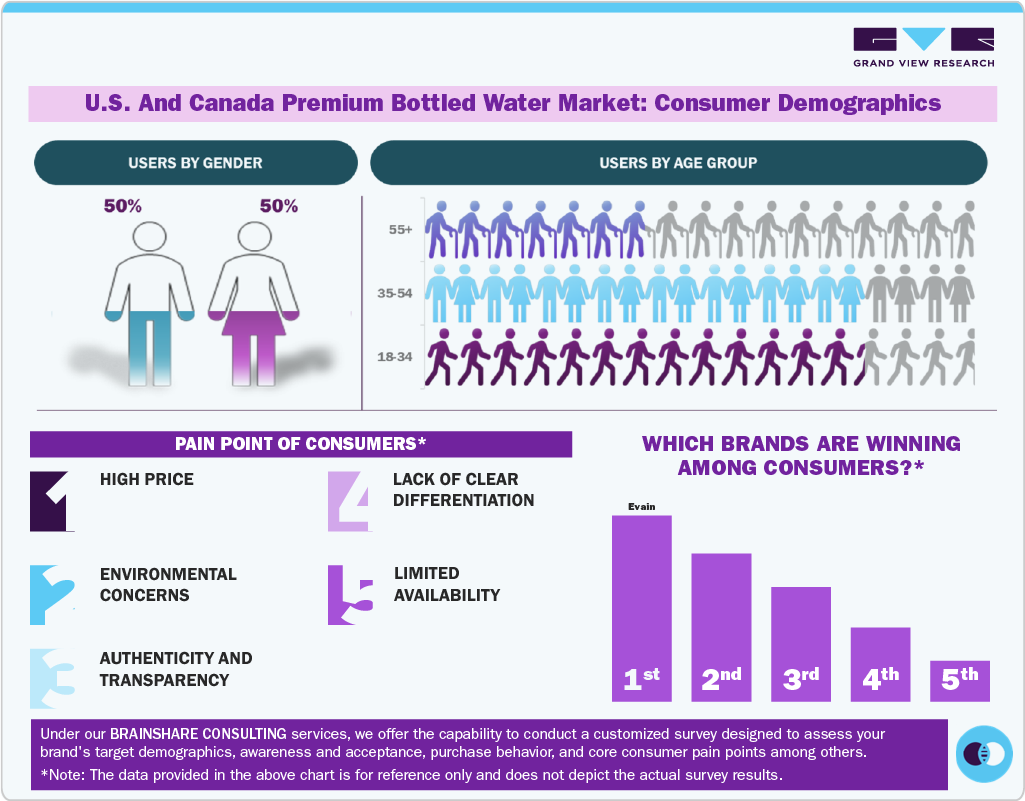

Consumer Demographic Insights

As consumers increasingly prioritize healthier lifestyles, manufacturers are introducing innovative water products as ideal substitutes for sugary sodas and carbonated beverages. Premium bottled water, typically free from sweeteners, preservatives, and calories, offers safety and quality assurance, making it especially appealing to health-conscious individuals.

There is a growing demand for nutrient-enriched water, driven by heightened awareness around health and wellness. Products such as caffeinated, alkaline, electrolyte-infused, and water enhanced with hydrogen or oxygen have gained popularity, particularly among travelers and busy professionals.

Additionally, mineral and spring water are becoming more favored due to their clean, refreshing taste. As more consumers seek healthy alternatives that still deliver the fizzy texture of carbonated drinks, mineral water is seeing increased traction.

Product Insights

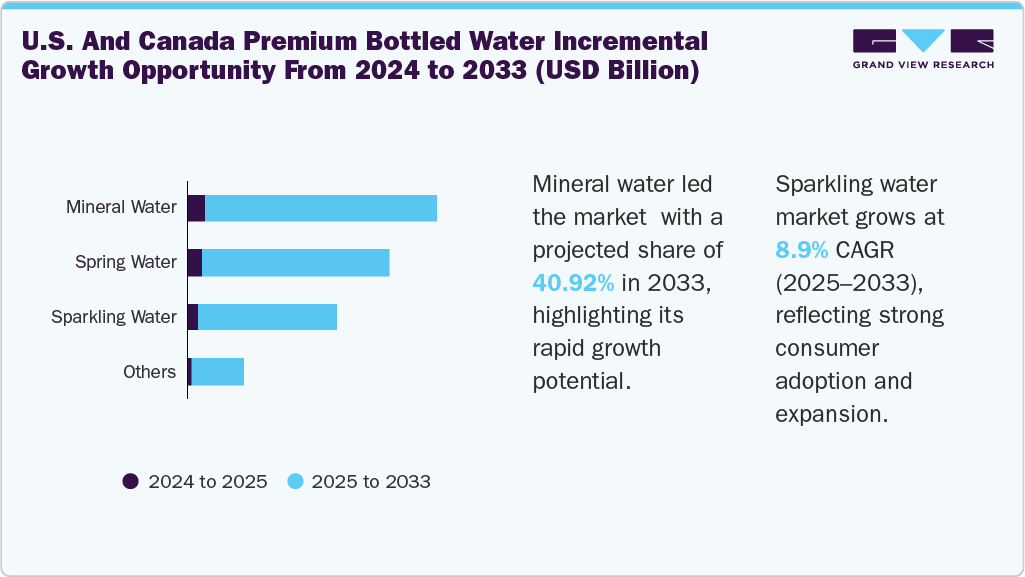

Mineral water emerged as the largest segment and accounted for a revenue share of 40.92% in 2024. Mineral water provides health benefits like lowering blood pressure, improving circulation, and strengthening bones due to its rich calcium, magnesium, sodium, and zinc content. With rising health awareness and increased spending on premium products, including elegantly packaged premium mineral water, demand is expected to grow over the forecast period. According to the U.S. Food and Drug Administration (FDA), mineral water is defined as water that contains a minimum of 250 parts per million (ppm) of total dissolved solids (TDS) and is sourced from naturally occurring, geologically and physically protected underground sources. In Canada, Mineral water is water from a geologically protected underground source containing 500 mg/L or more of total dissolved solids.

The sparkling water market is anticipated to witness a CAGR of 8.9% from 2025 to 2033. With the growing emphasis on healthy lifestyles across all age groups, consumers worldwide are increasingly shifting toward more nutritious and innovative beverages like sparkling water. This rising preference for sparkling water over traditional sodas and sugary carbonated drinks is expected to drive market growth during the forecast period. Sparkling water is water that retains the same level of carbon dioxide as its source after treatment. For Instance, brands like Spindrift in the U.S. and Montellier in Canada offer premium sparkling water with clean ingredients and eye-catching packaging that appeals to health-conscious consumers.

Distribution Channel Insights

The sales of premium bottled water through hypermarkets & supermarkets are the fastest-growing segment with a revenue share of around 37.40% in 2024 in the U.S. and Canada. Supermarkets and hypermarkets serve as ideal distribution channels for premium bottled water, thanks to their wide accessibility and convenience. As consumers increasingly prioritize healthier and more refined beverage choices, premium bottled water has become a favored option. These retail formats provide a one-stop shopping experience, allowing customers to easily explore and compare a diverse selection of bottled water brands and types.

The online segment is expected to record the highest CAGR of 9.7% during the forecast period, reflecting its growing significance in premium bottled water sales. E-commerce platforms provide convenience, broad accessibility, and the ability to cater to specific consumer groups. Additionally, many traditional supermarkets and grocery chains now offer online ordering and doorstep delivery services, further boosting premium bottled water sales through digital channels.

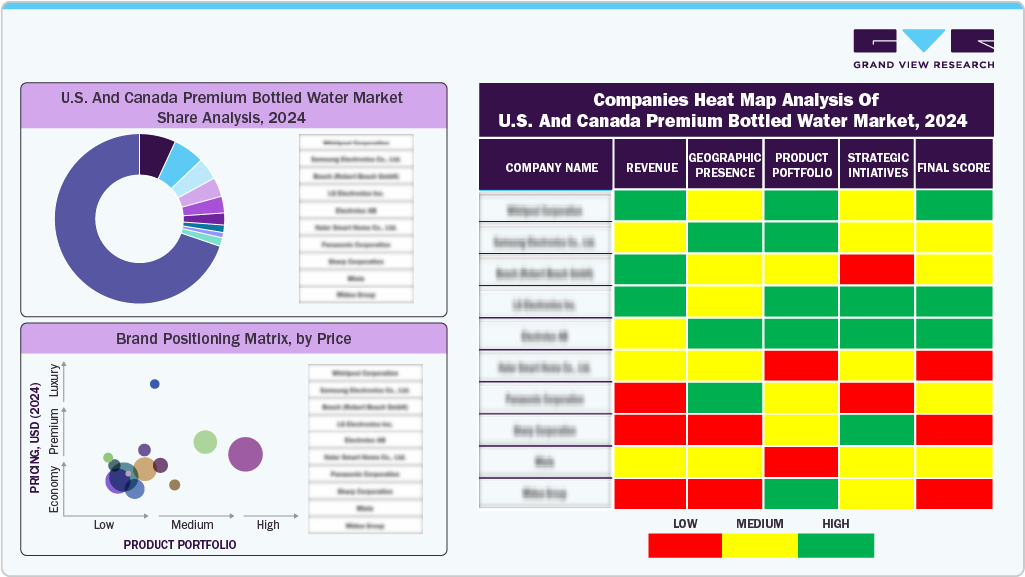

Key U.S. And Canada Premium Bottled Water Company Insights

The premium bottled water market in the U.S. and Canada features a mix of major multinational and regional players, with leading manufacturers holding a substantial share. To stay competitive, companies are pursuing strategies such as mergers and acquisitions, marketing collaborations, capacity expansion, and enhancing their online presence.

Key U.S. And Canada Premium Bottled Water Companies:

- Danone Waters of America (Evian)

- FIJI Water Company LLC

- Sanpellegrino S.p.A.

- Perrier International

- Acqua Panna

- CORE Nutrition LLC

- The Coca‑Cola Company

- Voss USA, Inc.

- Flow Hydration

- Icelandic Glacial, Inc.

Recent Developments

-

In October 2024, Evian solidified its premium positioning in the U.S. market by entering a multi-year official partnership with the MICHELIN Guide. As the exclusive still and sparkling water served at MICHELIN award ceremonies, Evian's presence reinforces its association with fine dining and luxury experiences. The collaboration showcases Evian's glass-format sparkling offerings at high-end culinary venues, aligning the brand with excellence, refinement, and sustainability in the upscale hospitality sector.

-

In September 2024, Evian entered a two-year partnership with the MICHELIN Guide in Canada, further cementing its status as a premium water brand. As the official water served at MICHELIN Guide ceremonies in Toronto and Vancouver, Evian showcased its 750 ml glass bottles in acclaimed fine-dining establishments such as Alo and Edulis.

U.S. And Canada Premium Bottled Water Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.37 billion

Revenue Forecast in 2033

USD 13.74 billion

Growth rate

CAGR of 8.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, country

Key companies profiled

Danone Waters of America (Evian); FIJI Water Company LLC; Sanpellegrino S.p.A.; Perrier International; Acqua Panna; CORE Nutrition LLC; The Coca‑Cola Company; Voss USA, Inc.; Flow Hydration; Icelandic Glacial, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. And Canada Premium Bottled Water Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the U.S. and Canada premium bottled water market report based on product, distribution channel:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Spring Water

-

Sparkling Water

-

Mineral Water

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2021 - 2033)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The U.S. and Canada premium bottled water market size was estimated at USD 6.88 billion in 2024 and is expected to reach USD 7.37 billion in 2025.

b. The U.S. and Canada premium bottled water market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2033 to reach USD 13.74 billion by 2033.

b. Mineral water emerged as the largest segment in 2024, accounting for a revenue share of 40.9%. Mineral water provides health benefits like lowering blood pressure, improving circulation, and strengthening bones due to its rich calcium, magnesium, sodium, and zinc content.

b. Some key players operating in the U.S. and Canada premium bottled water market include Danone Waters of America (Evain); FIJI Water Company LLC; Sanpellegrino S.p.A.; Perrier International; Acqua Panna; CORE Nutrition LLC; The Coca‑Cola Company; Voss USA, Inc. ; Flow Hydration; Icelandic Glacial, Inc.

b. The rising demand for premium bottled water over beverages like coffee, tea, and soft drinks is driven by factors such as its perceived naturalness, superior taste compared to tap water, added mineral content, and purity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.