- Home

- »

- Biotechnology

- »

-

U.S. Biopreservation Market Size, Industry Report, 2030GVR Report cover

![U.S. Biopreservation Market Size, Share & Trends Report]()

U.S. Biopreservation Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Laboratory Information Management Systems), By Application (Regenerative Medicine, Biobanking, Drug Discovery), And Segment Forecasts

- Report ID: GVR-4-68040-283-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Biopreservation Market Size & Trends

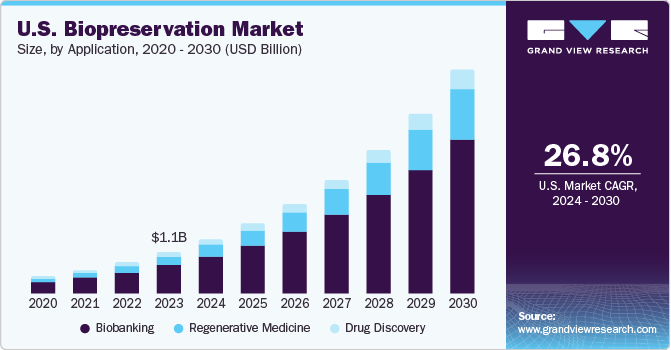

The U.S. biopreservation market size was estimated at USD 1.13 billion in 2023 and is expected to grow a CAGR of 26.81% from 2024 to 2030. The combination of rising demand for biopreservation services, technological advancements, strategic business approaches, government support, and a conducive regulatory environment is driving the market growth significantly.

In 2023, The U.S. accounted for nearly 40% of the global biopreservation market. The increasing incidence of chronic diseases and the growing adoption of regenerative therapies are fueling the demand for biopreservation services in the healthcare sector. Biopreservation techniques play a crucial role in maintaining the integrity and functionality of biological samples used in regenerative medicine, research, and clinical trials. Consequently, pharmaceutical companies, biotechnology firms, and hospitals in the U.S. are adopting advanced biopreservation solutions, driven by developments in next-generation cryopreservation methods, hypothermic storage formulations, and nanoscale technologies.

Market participants are engaging in research and development, strategic mergers, acquisitions, and partnerships to broaden their market presence and enhance profitability. Through active involvement in these initiatives, companies aim to strengthen their market standing, drive growth, and capitalize on emerging opportunities within the industry. Moreover, favorable government initiatives and the increasing adoption of biopreservation techniques from expanding biobanks are contributing to the market growth.

The National Institutes of Health (NIH) and the National Cancer Institute (NCI) provide funding and support for biospecimen collection in biorepositories and biobanks. These institutions contribute to managing bio-banking programs, which in turn support research and clinical trial programs in the United States. This increased demand for biopreservation techniques enhances the efficiency and effectiveness of biobank-related activities, ultimately benefiting the market.

Ongoing research focused on the longevity of products preserved using biopreservation techniques, along with regulatory considerations ensuring quality standards and safety in biopreservation practices, further propels market forecasts. The 2023, Bold Goals for U.S. Biotechnology and Biomanufacturing highlight a rising demand for precision medicine and, consequently, biopreservation firms to aid its progression. Initiatives like the Cancer Genome Atlas and Cancer Moonshot fuel precision medicine advancements. To achieve comprehensive precision medicine at scale, biotechnology and biomanufacturing innovations are crucial, thus emphasizing diverse population representation in biopreservation practices. This makes the U.S. an ideal environment for biopreservation companies to explore new products and services.

Market Concentration & Characteristics

The U.S. biopreservation market is fairly concentrated with few large players accounting for most of the market. These players are constantly engaged in various strategic initiatives such as M&A, new product/technology development, and geographic expansion to improve their market presence.

The industry is characterized by a high degree of innovation, as is evident with advancements such as the development of new microbial cultures, incorporation of bioprotective agents in food packaging, and the utilization of bacteriophages as biocontrol agents. These developments demonstrate the industry’s continuous efforts to enhance technology and find more efficient preservation solutions. For instance, in January 2023, Essent Biologics introduced its Human Native Tissue-Derived Type I Atelocollagen for the cell and tissue engineering industry, which has various applications in cell culture, labware coating, drug delivery, bioprinting, and tissue engineering.

Key players are implementing strategic initiatives such as mergers and acquisitions, product development, and business expansions, indicating a trend of strategic moves by companies to expand their reach and enhance their business operations. For instance, in August 2023, Thermo Fisher Scientific Inc. completed the acquisition of CorEvitas, LLC, a leading real-world evidence provider for medical treatments, enhancing decision-making and accelerating innovation in the industry.

Key participants in the industry are not only enriching their product lines with innovative preservation technologies but also broadening their service scope to address varied customer requirements. This adaptability helps them cater to a wider client base and stay competitive in the industry. For instance, in January 2023, the Thermo Fisher Scientific Inc. merger with The Binding Site Group, a prominent player in specialty diagnostics, not only expanded Thermo Fisher’s presence in specialty diagnostics but also strengthened its service offerings by incorporating The Binding Site Group’s expertise.

Companies in the U.S. biopreservation industry are broadening their horizons by expanding across different regions within the country. This strategic move aims to explore diverse industries, utilize local resources more effectively, and fortify their overall presence. Furthermore, American biopreservation firms are extending their product offerings globally, thereby enhancing their geographical influence. For instance, in March 2024, X-Therma Inc., a biotech company specializing in regenerative medicine and organ preservation, successfully concluded an oversubscribed USD 22.4 million Series B funding round, which helped them expand their global commercial operations and advanced them into the clinical stage with FDA Breakthrough Device status.

Application Insights

In 2023, biobanking emerged as the largest application of biopreservation, accounting for a substantial 70.5% of the market revenue share. The considerable healthcare expenditure in the country highlights the significance of advanced biopreservation techniques in supporting medical research and development. This importance is further emphasized by government healthcare initiatives that provide funding and support for research contracts, actively promoting the establishment and growth of biobanks within the country.

The regenerative medicine segment is expected to witness the fastest CAGR over the forecast period. Regenerative medicine offers innovative treatment options for various conditions, complementing traditional methods. Thus, the segment growth is fueled by rapid advancements in stem cell research, including discovering new stem cell sources and enhancing safety and efficacy through improved manipulation techniques. As regenerative medicine often relies on preserving biological materials like stem cells for research and treatment, there is a growing need for advanced biopreservation technologies to support the progress of regenerative medicine.

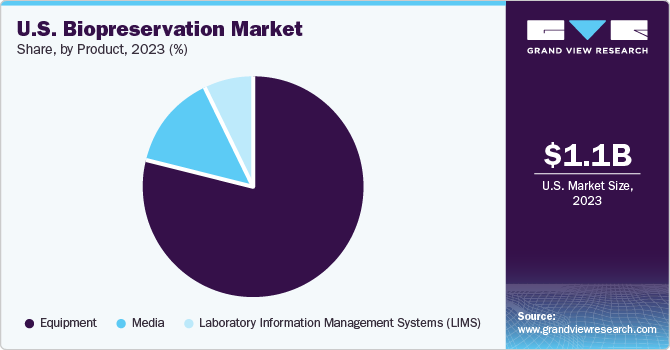

Product Insights

Biopreservation equipment occupied the largest share of the market in 2023, accounting for over 75% of the revenue generated. This growth is attributable to the escalating demand for bio-banking and preservation of valuable biological materials such as stem cells, DNA, plasma, and tissue culture. The widespread acceptance and utilization of biopreservation techniques have significantly contributed to the growth of this market segment. Adequate storage capacity and the low maintenance requirements associated with biopreservation equipment are expected to further boost its market dominance in the coming years.

Media segment is expected to exhibit the fastest compound annual growth rate (CAGR) between 2024 and 2030, the biopreservation media segment is poised to significantly contribute to the overall market expansion. This rapid growth can be attributed to the increasing adoption of media applications in research, which provide enhanced features and detailed information. These advanced applications enable researchers to access and share research data and analyses more effectively, ultimately improving their ability to investigate, diagnose, monitor, and treat various health disorders. This trend is expected to drive the growth of the biopreservation media segment and the market as a whole during the forecast period.

Key U.S. Biopreservation Company Insights

The U.S. biopreservation market exhibits consolidation, characterized by continuous strategic collaborations and mergers & acquisitions. Companies actively pursue these moves to gain a competitive edge by seizing untapped opportunities in the market. Azenta US, Inc.; Biomatrica, Inc.; BioLife Solutions Inc.; MVE Biological Solutions; LabVantage Solutions, Inc.; Taylor-Wharton; and Thermo Fisher Scientific, Inc. are some key companies operating in the U.S. biopreservation market.

Companies in the U.S. biopreservation market are strongly motivated to broaden their service offerings, penetrate new markets, benefit from economies of scale, and fortify their competitive positions. These objectives drive their expansion strategies and contribute to the industry’s growth and diversification.

For instance, in January 2022, Ori Biotech Ltd., a CGT manufacturing technology leader, secured over USD 100 million in an oversubscribed Series B funding round, led by Novalis LifeSciences with Puhua Capital and Chimera Abu Dhabi as new investors. This platform, designed for automation and standardization, enhanced CGT manufacturing efficiency, quality, and cost-effectiveness.

Key U.S. Biopreservation Companies:

- Azenta US, Inc.

- Biomatrica, Inc.

- BioLife Solutions Inc.

- MVE Biological Solutions

- LabVantage Solutions, Inc.

- Taylor-Wharton

- Thermo Fisher Scientific, Inc.

- Panasonic Corporation

- X-Therma Inc.

- PrincetonCryo

- BioCision LLC

- Lifeline Scientific Inc.

- Merck KGaA

- VWR International, LLC

Recent Developments

-

In September 2023, Merck became the first CTDMO to offer fully integrated services for all stages of mRNA development, manufacturing, and commercialization. With new sites in Darmstadt and Hamburg, Merck’s recent expansion is expected to aid the U.S. market with pre-clinical as well as commercial offerings.

-

In June 2023, BioLife Solutions launched the IntelliRate i67C, a large-capacity controlled-rate freezer that catered to the growing need for higher volume production of cell therapies, expanding its product line to three form factors.

-

In March 2023, BioLife Solutions introduced Ultraguard, a groundbreaking non-toxic, non-hazardous, and non-flammable −70°C phase change material for ultra-low temperature protection. This innovation serves two primary applications: providing temperature holdover support during power outages in ULT freezers and offering a safer, more cost-effective alternative to dry ice for benchtop biologic material storage

-

In February 2022, OriGen Biomedical Inc. introduced the FLEX Freezing Bag from CryoStore in both Europe and the U.S. This innovative product, contributing to advancements in cell culture, cryopreservation, and respiratory devices, showcases the company’s commitment to driving progress in these fields.

U.S. Biopreservation Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 6.19 billion

Growth rate

CAGR of 26.81% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Azenta US, Inc.; Biomatrica, Inc.; BioLife Solutions Inc.; MVE Biological Solutions; LabVantage Solutions, Inc.; Taylor-Wharton; Thermo Fisher Scientific, Inc.; Panasonic Corporation; X-Therma Inc.; PrincetonCryo; BioCision LLC; Lifeline Scientific Inc.; Merck KGaA; VWR International, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biopreservation Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. biopreservation market report based on product, and application.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Freezers

-

Refrigerators

-

Consumables

-

Vials

-

Straws

-

Microtiter

-

Bags

-

-

Liquid Nitrogen

-

-

Media

-

Pre-formulated

-

Home-brew

-

-

Laboratory Information Management Systems (LIMS)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Regenerative Medicine

-

Cell Therapy

-

Gene Therapy

-

Others

-

-

Biobanking

-

Human Eggs

-

Human Sperm

-

Veterinary IVF

-

-

Drug Discovery

-

Frequently Asked Questions About This Report

b. The U.S. biopreservation market size was estimated at USD 1.13 billion in 2023 and is expected to reach USD 1.49 billion in 2024.

b. The U.S. biopreservation market is expected to grow at a compound annual growth rate of 26.81% from 2024 to 2030 to reach USD 6.19 billion by 2030.

b. Bio preservation equipment occupied the largest share of the market in 2023. The large share is attributable to the escalating demand for bio-banking and preservation of valuable biological materials such as stem cells, DNA, plasma, and tissue culture.

b. The key players in U.S. biopreservation market include Azenta US, Inc.; Biomatrica, Inc.; BioLife Solutions Inc.; MVE Biological Solutions; LabVantage Solutions, Inc.; Taylor-Wharton; Thermo Fisher Scientific, Inc.; Panasonic Corporation; X-Therma Inc.; PrincetonCryo; BioCision LLC; Lifeline Scientific Inc.; Merck KGaA; VWR International, LLC

b. The combination of rising demand for biopreservation services, technological advancements, strategic business approaches, government support, and a conducive regulatory environment is driving the U.S. Biopreservation market growth significantly.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.