- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Bioplastics Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Bioplastics Market Size, Share & Trends Report]()

U.S. Bioplastics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Biodegradable, Non-biodegradable), By Application (Packaging, Agriculture, Consumer Goods, Textile, Automotive, Building & Construction), And Segment Forecasts

- Report ID: GVR-4-68040-209-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Bioplastics Market Size & Trends

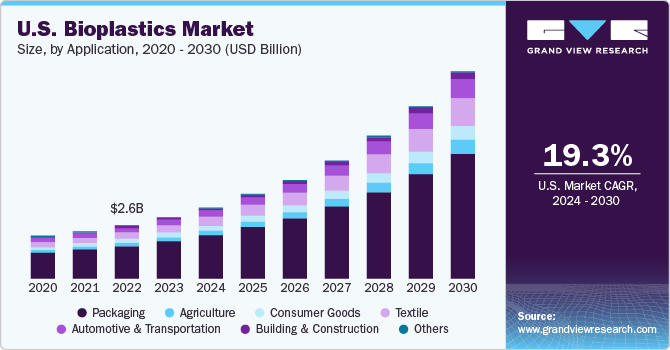

The U.S. bioplastics market size was estimated at USD 3.07 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 19.3% from 2024 to 2030. Bioplastics typically have a lower carbon footprint as compared to traditional plastics. They biodegrade into biomass, carbon dioxide (CO2), and water in a stipulated timeframe. Bioplastics are gaining high demand due to rising concerns about depleting crude oil resources and petrochemical toxicity. Since plastics are a prominent material in modern manufacturing, they play an integral role in the switch to a circular economy. Bioplastics manufacturers are focused on product innovations in the plastics industry to develop greener bioplastics solutions.

Bioplastics obtained from biobased polymers have the same functional qualities as the polymers produced from fossil sources. Common non-bio-based polymers with partially or fully biobased equivalents are polyethylene terephthalate (PET), polyethylene (PE), and several types of polyamides. Since these bioplastics have the same processing characteristics as their fossil-sourced counterparts, they are often referred to as “drop-in replacements”.

Developing bio resin as a sustainable substitute to polyurethane-based plastic is the most notable step towards a green future. Furthermore, Boston, Phoenix, and New York have started charging fees for extra plastic bags at retail stores. Other USA cities that have banned plastic bags include Chicago, Los Angeles, Seattle, Washington, San Francisco, Brownsville, and Portland. Such stringent measures are supporting the growth of the market for bioplastics in the U.S.

As bioplastics are proliferating in the U.S., misleading ‘green marketing’ claims in product packaging still remain a public concern and have a threat of contaminating the recycling stream. Most bioplastics and PET plastics cannot be easily distinguished from each other. However, to combat this, several scientific standards and general government regulations have been well-established in the U.S. The American Society for Testing and Materials (ASTM) has put forth a regime of metrics that distinguishes compostable, marine degradable, and plastic coatings/linings products.

Furthermore, bioplastic enforcement campaigns such as the Californians Against Waste (CAW) are educating consumers about different advertising and labeling terminologies. The CAW initiative is undertaken collaboratively by the California Attorney General's Office, District Attorneys, Federal Trade Commission (FTC), and local government Attorneys to fight plastics pollution in California.

Market Concentration & Characteristics

The market growth stage is high, and the growth pace is accelerating. It is a fairly niche market, with multiple players making it moderately fragmented. U.S. plastic manufacturers are actively implementing strategic initiatives such as mergers & acquisitions, new product launches, and production expansion, among others.

Key players are investing in research & development to formulate better and more sustainable products, which is likely to provide them an edge over other participants. The competitive rivalry is high as global players are entering the U.S. market.

For instance, in March 2022, ABB technology automates NatureWorks LLC with its integrated process from fermentation to polymerization technology in a new bioplastics production facility with a capacity of 75 kilotons in Thailand. This automation is expected to strengthen the supply chain of NatureWorks. ABB technology will also help to improve energy and production efficiency in bioplastics manufacturing, which is expected to grow by more than 260% by 2026.

The adoption of conventional plastics as substitutes remains low due to the growing government mandates and general regulations to address plastic pollution. Some of the key U.S. regulatory programs include:

U.S. Environmental Protection Agency (EPA)

-

National Recycling Strategy: In November 2021, EPA launched the National Recycling Strategy to implement the Resource Conservation and Recovery Act (RCRA) and increase the recycling rate by 50% by 2030.

-

Sustainable Materials Management (SMM) program: The SSM is an annual report published by the EPAtoprovide information on municipal solid waste generation, composting, recycling, combustion, and landfilling.

-

WasteWise Program and Trash Free Waters: These programs focus on promoting environmental stewardship in the U.S. and international communities.

U.S. Department of Agriculture (USDA)

USDA supports bioplastics R&D and buyer/consumer education on the subject. Its BioPreferred Program emphasizes biobased product purchases through federal certification, procurement, and labeling initiative called USDA Certified Biobased Product label.

Application Insights

Packaging held the largest revenue share of 60.69% in 2023 due to its widespread use in food and beverage packaging, household care items, and packaging for personal care goods. Starch blends, polylactic acid (PLA), PET, PBAT, PE, and PB are the most popularly used bioplastics in the packaging industry. Single-use bottles made with PLA are biodegradable, unlike petroleum-based packaging. This is expected to drive the segment growth during the forecast period.

The automotive & transportation segment is projected to exhibit the fastest CAGR from 2024 to 2030. This is attributed to the widespread development of under-the-hood components and interior parts using bioplastics. They offer UV resistance, impact resistance, high gloss finish, and dimensional stability. These factors make them an optimal alternative to conventional plastics including acrylonitrile butadiene styrene, polycarbonate, and polybutylene terephthalate.

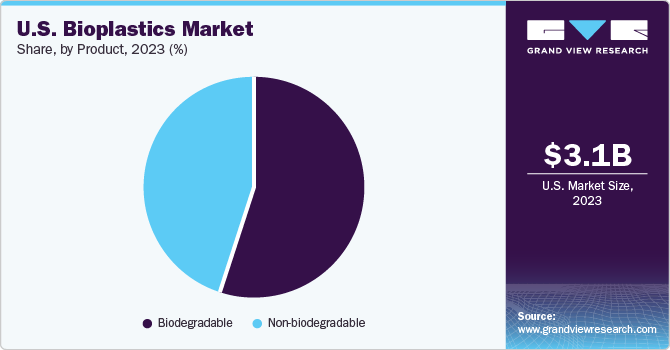

Product Insights

Biodegradable products dominated the market, accounting for a share of 54.63% in 2023. Rising use of biodegradable plastics in manufacturing personal protective equipment (PPE) and packaged food is fostering segment growth. Biodegradable plastics comprise PHA, PBS, PBAT, cellulose acetate, and polycaprolactone. Starch blends led the biodegradable product segment in 2023. Starch-based plastics are made from different natural resources including wheat, tapioca, rice, potato, and corn. The abundant availability of resources makes starch blends an ideal alternative to traditional plastics.

The non-biodegradable product segment is expected to grow at a significant CAGR during the forecast period. Non-biodegradable plastics include polyethylene, polyethylene terephthalate, polytrimethylene terephthalate, polyamide, polypropylene, polyethylene furanoate and polyvinyl chloride. Corn, sugarcane, and castor oil are used to make these polymers are made from basic ingredients that are environmentally friendly, like. Non-biodegradable bioplastics are typically used in automotive interiors, food packaging, bottles, shopping bags, films, consumer goods, disposables, carry bags, and electronics.

Key U.S. Bioplastics Company Insights

Players adopt this strategy to increase the reach of their products in the market and increase the availability of their products & services in diverse geographical areas. Players adopt this strategy to increase the reach of their products in the market and increase the availability of their products & services in diverse geographical areas. Key market players adopting this inorganic growth strategy include NatureWorks LLC and CJ Biomaterials.

For instance, in November 2022, NatureWorks LLC and CJ Biomaterials signed a Master Collaboration Agreement to manufacture sustainable material solutions based on NatureWorks’ Ingeo biopolymers and CJ Biomaterials’ Phact Biodegradable Polymers for applications including personal care, packaging, films, and others.

Key U.S. Bioplastics Companies:

- NatureWorks LLC

- Trinseo

- Danimer Scientific

- Dow Inc.

- Hallstar Industrial

- Genomatica

- Amcor Rigid Plastics USA, LLC

- Glycosbio

- Lanzatech

- Myriant

Recent Developments

-

In April 2023, NatureWorks LLC launched Ingeo 6500D, a biopolymer that reduces carbon footprint by 62% and improves softness by 40% in hygiene products.

-

In March 2023Amazon Climate Pledge Fund invested USD 50 million in Genecis to develop biodegradable bioplastic packaging solutions and support Amazon’s initiative to achieve net-zero carbon emissions by 2040.

-

In March 2023, Genomatica received funding from L’Oréal to develop bio-based ingredients for cosmetic formulas and packaging materials. This collaboration aligns with L’Oréal’s aims to recycle and produce 100% bio-based plastics by 2030.

U.S. Bioplastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.58 billion

Revenue forecast in 2030

USD 10.55 billion

Growth rate

CAGR of 19.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, application

Key companies profiled

NatureWorks LLC; Trinseo; Danimer Scientific; Dow Inc.; Hallstar Industrial; Genomatica; Amcor Rigid Plastics USA, LLC; Glycosbio; Lanzatech; Myriant

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Bioplastics Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. bioplastics market report based on product, and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biodegradable

-

Polylactic Acid

-

Starch Blends

-

Polybutylene Adipate Terephthalate (PBAT)

-

Polybutylene Succinate (PBS)

-

Others

-

-

Non-biodegradable

-

Polyethylene

-

Polyethylene Terephthalate

-

Polyamide

-

Polytrimethylene Terephthalate

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Agriculture

-

Consumer Goods

-

Textile

-

Automotive & Transportation

-

Building & Construction

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. bioplastics market was valued at USD 3.07 billion in the year 2023 and is expected to reach USD 3.58 billion in 2024.

b. The U.S. bioplastics market is expected to grow at a compound annual growth rate of 19.3% from 2024 to 2030 to reach USD 10.55 billion by 2030.

b. Biodegradable product segment emerged with a value share of 54.63% in 2023 due to increasing use in manufacturing personal protective equipment (PPE) and packaged food is fostering segment growth.

b. The key market player in the plastic compounding market includes NatureWorks LLC, Trinseo, Danimer Scientific and Dow Inc.

b. The key factors that are driving the U.S. bioplastics market include, lower carbon footprint as compared to traditional plastics and rising concerns about depleting crude oil resources.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.