- Home

- »

- Clinical Diagnostics

- »

-

U.S. Autoimmune Disease Diagnostics Market, Industry Report, 2030GVR Report cover

![U.S. Autoimmune Disease Diagnostics Market Size, Share & Trends Report]()

U.S. Autoimmune Disease Diagnostics Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Systemic Autoimmune Disease Diagnostics, Localized Autoimmune Disease Diagnostics), By Test Type, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-285-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

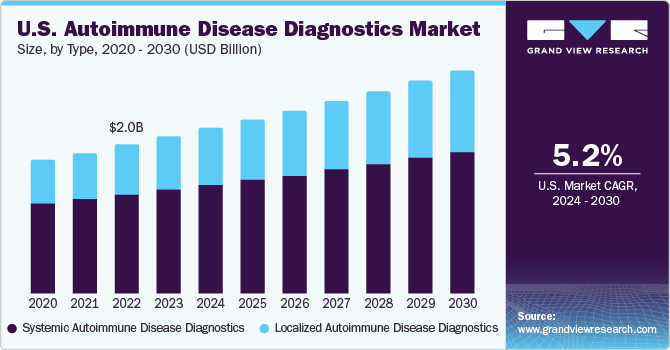

The U.S. autoimmune disease diagnostics market size was estimated at USD 2.11 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. The rising prevalence & awareness of autoimmune diseases, increasing emphasis on early diagnosis, and a shift towards personalized & precision medicine are driving the market growth worldwide. According to the study published by the University of Oxford, in May 2023, autoimmune diseases affect 1 in 10 people among the total population of 22 million people. Autoimmune diseases including type 1 diabetes have registered to occur more frequently over the recent years.

According to the Atlas of Multiple Sclerosis Report, nearly 1.0 million in the U.S. are currently living with multiple sclerosis. Autoimmune diseases are becoming more prevailing, which is a challenge for the country. One of the main factors driving use rates is the increased understanding of autoimmune diseases as an outcome of programs for education, research, activism, and support.

The development and introduction of advanced diagnostic technologies, such as molecular diagnostics, next-generation sequencing, and immunodiagnostics, have significantly improved the accuracy and efficiency of autoimmune disease detection. These advancements have fueled the growth of the market. For instance, in October 2023, WellTheory, a platform dedicated to alleviating symptoms of autoimmune diseases introduced a new enterprise solution tailored for employers and payers seeking to provide autoimmune care. The newly launched product is designed to address the hidden expenses and productivity repercussions associated with untreated autoimmune conditions. It will encompass a community-centered initiative that grants members access to various resources such as events, tools, experts, and peer support.

Furthermore, the increasing concerns over autoimmune conditions in the country, together with growing alertness about diseases and health generates the requirement for diagnostics for prompt disease detection and therefore propels the market growth. The American Autoimmune Related Disease Association (AARDA), a prominent organization dedicated to the elimination of autoimmune diseases and the alleviation of pain associated with these conditions, designates the month of March as the Autoimmune Disease Awareness Month (ADAM). This initiative aims to raise public awareness, support those affected by autoimmune diseases, and encourage research and advancements in treatment options in the country. In February 2021, the American Kidney Fund (AKF) introduced a patient-focused awareness and education movement on lupus nephritis, a kidney illness.

The market in the U.S. is expected to grow substantially over the forecast period due to the growing focus on the effective treatment options for autoimmune diseases. According to the Penn Medicine News published in August 2023, Penn Medicine has shifted its focus to autoimmunity, which includes over 80 illnesses that impact over 20 million Americans. By focusing on the underlying causes of patients' illnesses, cutting-edge researchers like Payne hope to give patients less harmful, possibly longer-lasting, or even permanent treatment.

The market is poised for growth in the forecast period, despite challenges such as slow result turnaround times. However, the necessity for multiple diagnostic tests, high costs, reimbursement issues, and regulatory uncertainties are expected to impede its progress.

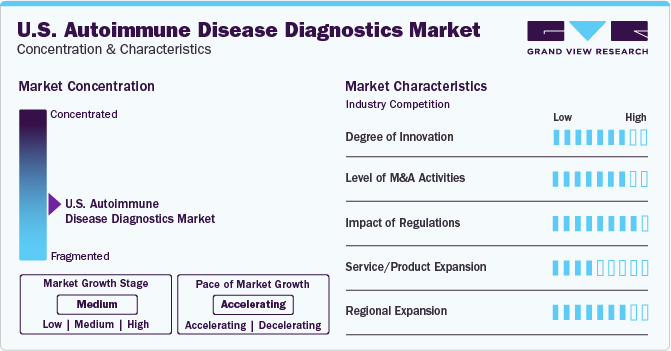

Market Concentration & Characteristics

Market growth stage is moderate and pace of the industry growth is accelerating. Advances in diagnostic technologies, such as next-generation sequencing, biomarker identification, and molecular diagnostics, have significantly improved the accuracy and efficiency of autoimmune disease diagnostics. These technological innovations have attracted new players to enter the market and have expanded the range of diagnostic options available to healthcare providers.

The U.S. autoimmune disease diagnostics market is highly fragmented, with numerous small and medium-sized companies operating in the space. Mergers and acquisitions allow larger companies to consolidate their market share and expand their product offerings.Companies are highly involved in M&A activities to diversify their product portfolios and offer a comprehensive range of autoimmune disease diagnostic solutions. This diversification can help companies cater to a broader customer base and serve different market segments.

The market is subject to increasing regulatory scrutiny. The Food and Drug Administration (FDA), International Organization for Standardization (ISO), College of American Pathologists (CAP) and others are responsible toensure that the tests and technologies used for diagnosis are safe, effective, and accurate. Compliance with these regulations demonstrates a commitment to quality and safety in the development and distribution of diagnostic tests for autoimmune diseases.

There are a limited number of direct product substitutes for autoimmune disease diagnostics. However, there are a number of alternatives that can be used to achieve similar outcomes to these diagnostics. Tests including self-diagnosis tools, such as online symptom checkers, can provide individuals with preliminary information about their potential health issues before they seek medical attention. Alternative therapies, such as acupuncture or herbal remedies, can provide symptom relief for individuals with autoimmune disorders. These technologies can be used as substitutes for autoimmune disease diagnostics in certain applications, but they typically do not offer the same level of performance or flexibility.

Type Insights

Localized autoimmune disease diagnostics dominated the market and accounted for a share of 66.0% in 2023. This high share can be attributed to the rising adoption of advanced imaging techniques, such as ultrasound, MRI, and PET scans, for detailed visualization of affected tissues or organs. The development of molecular diagnostic tools, such as polymerase chain reaction (PCR) and next-generation sequencing (NGS), enables the identification of specific autoantibodies or genetic markers associated with localized autoimmune diseases. In the medical field, there are various specialists who concentrate on particular organs or systems of the body. These specialists include endocrinologists, gastroenterologists, neurologists, and rheumatologists, among others. They are responsible for diagnosing, managing, and treating diseases related to their specific organ or system.

The systemic autoimmune disease diagnostics is expected to grow at the fastest CAGR over the forecast period. The growth is attributed to the growing advancements in technology, rising demand for systemic autoimmune disease diagnostics, and supportive government policies. The systemic autoimmune disease diagnostics is further segmented into rheumatoid arthritis, ankylosing spondylitis diagnostics, systemic lupus erythematosus (SLE), and others.

In an extremely competitive landscape, a wide array of players, ranging from established industry giants to innovative startups, compete for market dominance. This intense competition fosters a continuous drive for innovation and excellence as companies aim to position themselves apart through maximum product quality, strategic pricing approaches, and exceptional customer satisfaction. In September 2021, Scipher Medicine entered into a partnership with Ventegra Inc. with the aim of benefiting Ventegra’s customers by providing them access to Scipher’s PrismRA liquid molecular signature test. This test plays a crucial role in determining the most effective treatment options for patients suffering from rheumatoid arthritis (RA). As a result of this strategic alliance, the market growth for personalized medicine and rheumatoid arthritis treatments is expected to grow substantially.

Test Type Insights

Antinuclear antibody tests accounted for the largest market revenue share in 2023 and are expected to grow at the fastest CAGR over the forecast period. This is attributable to the growing government initiatives and the increasing incidences of autoimmune diseases. As these disorders become more prevalent, the demand for ANA testing grows, as it is a crucial diagnostic tool for identifying and monitoring these conditions. For instance, as per a CDC study, approximately 3,000 to 6,000 individuals in the U.S. are diagnosed with Guillain-Barre syndrome (GBS) each year.

Furthermore, according to a study published by the National Institute of Health (NIH) in April 2020, the most prevalent indicator of autoimmunity, antinuclear antibodies (ANA), was becoming much more widespread in the U.S. overall and in some specific populations. The study examined how the presence of ANA changes over time in a representative sample of Americans, including males, non-Hispanic Whites, adults aged 50 and above, and teenagers.

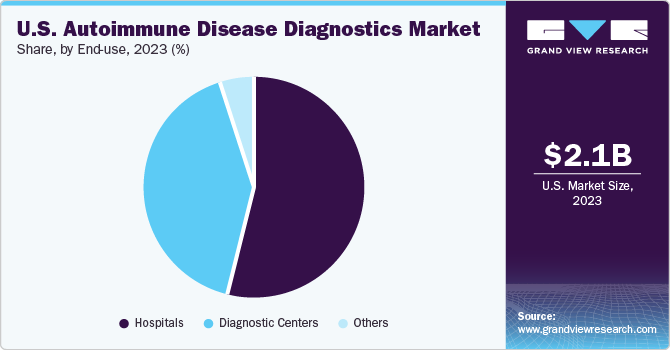

End-use Insights

The hospitals segment dominated the market in 2023. This is attributable to the growingneed for accurate and precise testing methods. Autoimmune diseases often present with nonspecific symptoms, making it crucial to rely on specific diagnostic tests to confirm the presence of these conditions. Hospitals prioritize the use of reliable laboratory tests, such as autoantibody assays and immunological markers, to accurately diagnose autoimmune diseases and differentiate them from other disorders.

Diagnostic centers are projected to grow at the fastest CAGR over the forecast period. The growing demand for easyaccessibility and convenience is driving the segment growth.Centers that offer convenient appointment scheduling, shorter wait times for test results, and easy access to follow-up consultations with specialists are often favored by patients. Diagnostic centers offer a wide range of specialized tests for autoimmune diseases and are often preferred by end users. These tests include autoantibody testing, inflammation markers, genetic testing, and specific antigen tests that are essential for diagnosing different autoimmune conditions accurately further driving the market growth.

Key U.S. Autoimmune Disease Diagnostics Company Insights

Some of the key players operating in the market include Merck, Prometheus Biosciences, Inc., BioMed X, CerraCap Ventures, PEPperPrint GmbH, Predicta Med, NeoDx Biotech, Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd., Quest Diagnostics Inc., and Siemens Healthcare GmbH among others.

-

Thermo Fisher Scientific provides innovative tools and solutions that enable accurate and early detection of autoimmune diseases. These solutions are designed to help clinicians make informed decisions for effective patient care. It offers a variety of products and solutions that aid in the detection, diagnosis, and monitoring of autoimmune diseases.

-

Siemens Healthcare GmbH offers a wide range of diagnostic solutions, including in vitro diagnostics (IVD) for detecting and monitoring autoimmune diseases detection, such as immunoassays, clinical chemistry analyzer, molecular diagnostics.

Key U.S. Autoimmune Disease Diagnostics Companies:

- Abbott Laboratories

- Biomerieux

- Trinity Biotech

- Bio-rad Laboratories

- Thermo Fisher Scientific

- BD Biosciences

- Beckman Coulter

- F. Hoffmann-La Roche Ltd.

- Quest Diagnostics Inc.

- Siemens Healthcare GmbH

- Werfen

Recent Developments

-

In April 2023, Merck and Prometheus Biosciences, Inc. entered into an agreement, under which Merck announced to acquire Prometheus through a subsidiary. The acquisition is aimed to accelerate the company’s presence in immunology, fulfill unmet patient needs, and strengthen the sustainable development engine that is expected to drive Merck’s growth into the future.

-

In February 2023, CerraCap Ventures, a Venture Capital fund, made a strategic investment in Predicta Med, a prominent early-stage startup specializing in assisting medical clinics and institutions in the early detection and management of immune-related diseases.

-

In August 2022, KSL Beutner Laboratories (Beutner) introduced a blood test designed to identify an antigen associated with the autoimmune blistering condition known as mucous membrane pemphigoid (MMP), which commonly leads to painful sores in the mouth.

-

In May 2022, Thermofisher launched the new Phadia 2500+ series of instruments in the U.S. for autoimmune testing, providing unmatched high throughput and reliability for both allergy diagnostics and autoimmune testing.

U.S. Autoimmune Disease Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.23 billion

Revenue forecast in 2030

USD 3.01 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, test type, end-use, region

Country scope

U.S.

Key companies profiled

Abbott Laboratories; Biomerieux; Trinity Biotech; Bio-rad Laboratories; Thermo Fisher Scientific; BD Biosciences; Beckman Coulter; F. Hoffmann-La Roche Ltd.; Quest Diagnostics Inc.; Siemens Healthcare GmbH; Werfen

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Autoimmune Disease Diagnostics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. autoimmune disease diagnostics market report based on type, test type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Systemic Autoimmune Disease Diagnostics

-

Rheumatoid Arthritis

-

Ankylosing Spondylitis Diagnostics

-

Systemic Lupus Erythematosus (SLE)

-

Others

-

Localized Autoimmune Disease Diagnostics

-

Multiple Sclerosis

-

Type 1 Diabetes

-

Hashimoto's Thyroiditis

-

Idiopathic Thrombocytopenic Purpura

-

Others

-

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Antinuclear Antibody Tests

-

Autoantibody Tests

-

C-Reactive Protein (CRP)

-

Complete Blood Count (CBC)

-

Urinalysis

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. autoimmune diseases diagnostics market size was valued at USD 2.1 billion in 2023 and is expected to reach USD 2.23 billion in 2024.

b. The U.S. autoimmune diseases diagnostics market is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030 to reach USD 3.01 billion by 2030.

b. Localized autoimmune disease diagnostics dominated the market and accounted for a share of over 65% in 2023 owing to the rising adoption of advanced imaging techniques such as ultrasound, MRI, and PET scans that allows for detailed visualization of affected tissues or organs.

b. Some of the key players operating in the market include Merck, Prometheus Biosciences, Inc., BioMed X, CerraCap Ventures, PEPperPrint GmbH, Predicta Med, NeoDx Biotech, Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd., Quest Diagnostics Inc., and Siemens Healthcare GmbH, among others.

b. The rising prevalence of autoimmune diseases, the increasing emphasis on early diagnosis, the rising awareness regarding autoimmune diseases, and shift towards personalized and precision medicine is driving the market growth worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.