- Home

- »

- Medical Devices

- »

-

U.S. Apheresis Equipment Market Size & Share Report, 2030GVR Report cover

![U.S. Apheresis Equipment Market Size, Share & Trends Report]()

U.S. Apheresis Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Disposable Apheresis Kits, Device), By Application (Renal Disease, Neurology), By Procedure, By Technology, And Segment Forecasts

- Report ID: GVR-4-68040-281-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

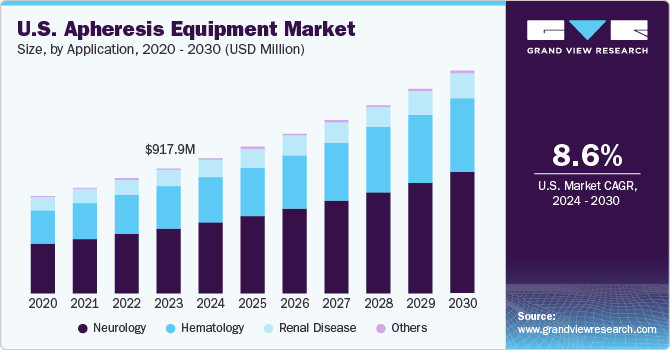

The U.S. apheresis equipment market size was estimated at USD 917.9 million in 2023 and is projected to grow at a CAGR of 8.6% from 2024 to 2030. Cancer, autoimmune disorders, and kidney diseases are becoming more common, and apheresis is often used in the treatment of these diseases. According to the American Kidney Fund, approximately 37 million Americans have a kidney disease and about 807,000 Americans are living with kidney failure. As the U.S. population ages and lifestyle-related diseases become more prevalent, the demand for apheresis equipment will continue to rise. This treatment option that utilizes apheresis offers targeted therapy with fewer side-effects compared to traditional methods, making it an attractive choice for both patients and healthcare providers.

Autoimmune diseases and cancer are on the rise, further boosting the market growth. According to National Library of Medicine, in 2023, approximately 1,958,310 new cancer cases were diagnosed in the U.S. and according to the same source, around 609,820 cancer deaths are expected to occur in the country. As technology continues to improve, apheresis equipment is becoming more efficient, user-friendly, and cost-effective. This makes it more accessible to a wider range of healthcare facilities, further increasing the demand for this equipment.

In the U.S., there is a continuous demand for blood and platelets. The number of blood cell units collected in the U.S. increased by 1.7% between the years, 2019 and 2021. Sickle cell disease, affecting approximately 100,000 Americans in the U.S., often requires lifelong blood transfusions, highlighting the essential role of apheresis equipment in providing these components. Factors such as increased awareness of platelet donations impact on patient care and growing dependence on platelet transfusions by healthcare facilities contribute to the rising number of platelet donors, in turn, driving the market growth.

Moreover, the increased demand for apheresis has presented challenges for adapting to these new modalities. One key area of growth is the rise in photopheresis treatments for Graft-Versus-Host Disease (GVHD), which has been spurred by the growth of stem cell transplant programs, leading to a significant increase in apheresis procedures and necessitating the expansion of equipment and capacity.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The rise in chronic diseases such as cancer, kidney failure, and autoimmune disorders in the U.S. has led to a higher demand for apheresis procedures. These diseases require specialized treatments that involve the separation of blood components, which can only be achieved through apheresis equipment. Apheresis plays a crucial role in the organ transplantation process, as it helps to remove antigens from the patient's blood before transplantation, reducing the risk of rejection. The growth in organ transplantation rates has, in turn, contributed to the increased demand for apheresis equipment.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. For instance, in June 2022, Asahi Kasei Medical acquired Bionova Scientific, LLC. This acquisition leveraged its existing bioprocess consumables, equipment and biosafety testing services and enabled the companies to expand the business in the process design of biologics.

In the U.S., the FDA regulates apheresis equipment through the Center for Devices and Radiological Health (CDRH). They oversee the premarket approval, clearance, and notification processes, ensuring that devices meet safety and performance standards before they are available for use. They establish guidelines and requirements for healthcare facilities and providers that use apheresis equipment, ensuring that patients receive appropriate and safe care.

There are not many substitutes for apheresis equipment market in the U.S. but substitute blood collection methods, such as blood collection or direct plasma collection allow for the separation of specific blood components and may not be as specific and exact as the processes conducted by the apheresis equipment.

Major players such as Asahi Kasei Clinical Co., Ltd., Terumo BCT, Haemonetics Corporation, Fresenius Kabi AG, B. Braun SE, Mallinckrodt Plc, and Nikkiso Europe GmbH, hold significant shares in the market. This predominant presence is due to their well-established brands, and distribution networks. The market is experiencing strong expansion in the country due to the rising predominance of infections and the improving healthcare infrastructure.

Product Insights

Disposable apheresis kits dominated the market and accounted for a share of 71.9% in 2023. Disposable kits eliminate the risk of cross-contamination and infection transmission between patients, as each kit is used only once and then discarded. This is particularly important in medical procedures involving blood or blood components. Disposable kits are designed for easy assembly and use, which streamlines the apheresis process and reduces the time required for set-up and clean-up. This allows healthcare professionals to focus on providing quality care to their patients. These kits may have a higher initial cost compared to reusable kits, the reduced maintenance and infection control benefits often result in lower overall costs for healthcare providers in the long run.

In April 2023, Fresenius Kabi launched its venous system for the amicus extracorporeal photopheresis (ECP) system that uses a single- needle for blood and marrow transplantation. This launch enabled the company to provide a versatile, multi-procedural instrument to address patients’ needs.

The device segment is expected to register the fastest CAGR during the forecast period. Apheresis devices offer a high level of precision and accuracy in separating blood components. This is crucial, as even minor errors can lead to ineffective treatments or potential harm to the patient. Devices provide a consistent and reliable process, ensuring that the desired blood components are separated effectively and efficiently every time.

Application Insights

The neurology segment accounted for the largest market share in 2023 and is expected to register the fastest CAGR during the forecast period. In conditions such as Guillain-Barré Syndrome and Multiple Sclerosis, the immune system mistakenly attacks the nerves, causing inflammation and damage. Apheresis helps to remove the disease-causing antibodies or immune cells, thus reducing inflammation and protecting the nerves.

In certain neurological conditions, such as acute inflammatory demyelinating polyneuropathy (AIDP), plasma exchange therapy is used to remove damaging substances or antibodies from the blood. This process involves separating plasma from blood cells using an apheresis machine and replacing it with a plasma substitute or donor plasma. According to an article from Yale Medicine, in May 2023, Guillain-Barré Syndrome affects approximately 3,000 to 6,000 people a year in the U.S., which, in turn requires the treatment of this syndrome using apheresis kits.

Procedure Insights

The plasmapheresis segment accounted for the largest market share in 2023. Plasmapheresis is often considered a personalized treatment, as it targets specific components of the patient's blood. The rise in plasmapheresis in the U.S. can be attributed to increased awareness, a growing prevalence of certain medical conditions, improved accessibility, the development of new indications, and a general trend toward personalized medicine.

Photopheresis is expected to register the fastest CAGR during the forecast period. Photopheresis has been effective in treating specific diseases, particularly cutaneous T-cell lymphoma. The combination of UV light exposure and blood manipulation leads to the activation of immune cells, which helps in controlling the disease progression. Apheresis machines can be easily modified or adapted to perform photopheresis. The existing infrastructure and technology used for apheresis make it convenient to incorporate photopheresis as a treatment option.

In February 2019, Mallinckrodt Pharmaceuticals collaborated with Transimmune AG to enhance the understanding of the photopheresis effect on immune modulation. Moreover, the agreement aimed to develop activities for next- generation photopheresis system. Several regulatory approvals for positioning photopheresis as a better option in the market are anticipated to contribute to the market growth.

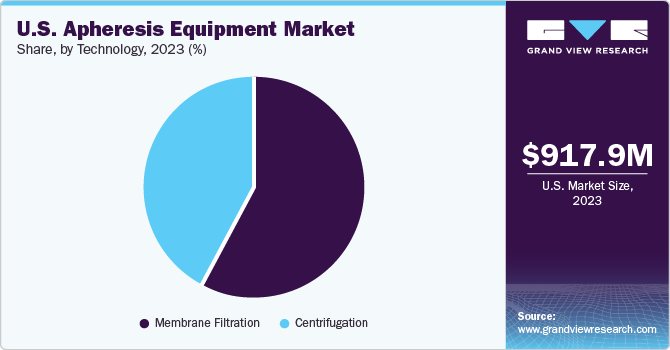

Technology Insights

The membrane filtration technology segment dominated the market with the largest share in 2023. Membrane filtration allows for the selective separation of different components in blood, such as cells, proteins, and smaller molecules. This selectivity is crucial in apheresis, where the goal is to isolate and remove specific substances from the blood, such as plasma or specific cell types. This technology is widely used in apheresis due to its selectivity, efficiency, safety, scalability, and cost-effectiveness. These factors make it an ideal choice for the separation and processing of blood components in various medical applications. Membrane filtration technology is relatively cost-effective compared to other separation techniques, making it an attractive option for apheresis procedures. This cost-effectiveness is particularly important in healthcare settings where resources are often limited.

The centrifugation segment is projected to grow at the fastest CAGR over the forecast period. Centrifugation allows for efficient separation of blood components based on their densities. This is crucial in apheresis, as the goal is to isolate specific cells or components from the blood for therapeutic purposes. Centrifuges are generally cost-effective and widely available, making them a practical choice for apheresis equipment in various healthcare settings. Moreover, it minimizes the risk of contamination and damage to the blood components.

Key U.S. Apheresis Equipment Company Insights

Some of the key companies operating in the U.S. apheresis equipment market include Asahi Kasei Medical Co., Ltd.; Terumo BCT.

Key U.S. Apheresis Equipment Companies:

- Haemonetics Corporation

- Fresenius Kabi

- B. Braun SE

- Mallinckrodt Pharmaceuticals

- Nikkiso Co., Ltd.

Recent Developments

-

In August 2023, Terumo BCT announced its approval from the U.S. FDA for its new automated whole blood processing system, Reveos. This launch helped the U.S. blood centers to regulate the platelet supply and the overall efficiency.

-

In February 2023, AllCells expanded its apheresis infrastructure in the aim to keep pace with the expanding network of the industry. Moreover, it expanded its collection sites and apheresis capacity to meet the increasing requirements of the sector.

-

In September 2022, Terumo BCT announced the launch of its Quantum Flex Cell Expansion System. This launch was a platform that supported commercial manufacturing for cell and gene therapies.

-

In March 2022, Terumo BCT announced its approval from the U.S. FDA for its new plasma collection technology, Rika Plasma Donation System. This system was designed to ensure better support and comfort for the donor.

-

In February 2019, Terumo BCT launched a device to accelerate the manufacturing of cell therapy. The launch is a first-of-its-kind automated solution for the production and the delivery of gene therapies.

U.S. Apheresis Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 994.6 million

Revenue forecast in 2030

USD 1.64 million

Growth rate

CAGR of 8.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, procedure, technology, country

Country scope

U.S.

Key companies profiled

Haemonetics Corporation; Fresenius Kabi; B. Braun SE; Mallinckrodt Pharmaceuticals; Nikkiso Co., Ltd.; Asahi Kasei Medical Co., Ltd.; Terumo BCT

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Apheresis Equipment Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. apheresis equipment market report based on product, application, procedure, technology, and regions:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable Apheresis Kits

-

Device

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Renal Disease

-

Neurology

-

Hematology

-

Others

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Photopheresis

-

Plasmapheresis

-

LDL Apheresis

-

Plateletpheresis

-

Leukapheresis

-

Erythrocytapheresis

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Membrane Filtration

-

Centrifugation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. apheresis equipment market size was valued at USD 917.9 million in 2023 and is expected to reach USD 994.6 million in 2024.

b. The U.S. apheresis equipment market is projected to grow at a compound annual growth rate (CAGR) of 8.6% from 2024 to 2030 to reach USD 1.64 million by 2030.

b. Disposable apheresis kits dominated the market and accounted for a share of 71.9% in 2023 as they eliminate the risk of cross-contamination and infection transmission between patients, as each kit is used only once and then discarded. This is particularly important in medical procedures involving blood or blood components.

b. Some of the key companies operating in the U.S. apheresis equipment market include Asahi Kasei Medical Co., Ltd.; Terumo BCT; Haemonetics Corporation; and Fresenius Kabi; among others.

b. The diseases such as cancer, autoimmune disorders, and kidney diseases are becoming more common, and apheresis is often used in their treatment. Apheresis offers targeted therapy with fewer side effects compared to traditional methods, making it an attractive choice for both patients and healthcare providers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.