- Home

- »

- Automotive & Transportation

- »

-

U.S. Agricultural Tractor Market Size & Share, Report, 2030GVR Report cover

![U.S. Agricultural Tractor Market Size, Share & Trends Report]()

U.S. Agricultural Tractor Market (2024 - 2030) Size, Share & Trends Analysis Report By Engine Power (Less than 40 HP, 41 to 100 HP, More than 100 HP), By Driveline (2WD, 4WD), By Propulsion, And Segment Forecasts

- Report ID: GVR-4-68040-207-4

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Agricultural Tractor Market Trends

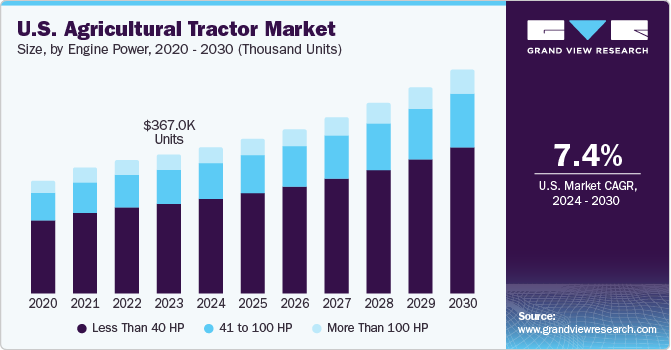

The U.S. agricultural tractor market size was 367.04 thousand units in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.4% from 2024 to 2030. In 2023, the U.S. market accounted for 11.8% share of the global agricultural tractors market. The increasing mechanization in the farm industry has propelled the growth of compact tractors, which are flexible for use and can be customized according to the customer’s needs. Technical developments such as the integration of telematics and automation with agricultural tractors are expected to drive market growth.

In addition, the shortage of skilled farm labor also leads to increased mechanization of farming, which in turn, leads to fueling the market growth.

Farming productivity is increasing with the rising adoption of mechanization and other farming equipment into farming practices. The rapid adoption of mechanization is also further enhanced by the technological advancements offered by AI, Big Data, and ML. Agricultural tractors are an integral part of the farming equipment and play an important role in mechanizing many farming activities thereby increasing the productivity in farming. This has led to the increased demand for tractors, which in turn has led to the growth of the market.

As farm equipment such as combiners, tractors, and harvesters are expensive, it is challenging for farmers to buy the equipment with their limited financing sources. Therefore, the government is providing various monetary and non-monetary benefits to farmers, such as subsidies for the purchase of seeds, fertilizers, and farm equipment. For instance, the U.S. Farm Service Agency (FSA) provides guaranteed and direct farm ownership and operating loans to family-size farmers, who are incompetent to obtain commercial credit from a Farm Credit System institution, bank, or other lenders. Loans from FSA can also be utilized to purchase livestock, equipment, land, feed, seed, and supplies.

Farm power, equipment, and machinery constitute the major costs in agriculture. The introduction of larger machines, advancements in technology, increased costs of parts and new machinery, and the substantial increase in energy prices over the years have resulted in an increase in power and machinery costs in recent years. Moreover, the use of tractors also involves timely repair and maintenance costs due to routine wear and tear and additional costs resulting from accidents. Hence, the high costs associated with agricultural tractors can act as a restraint to market growth.

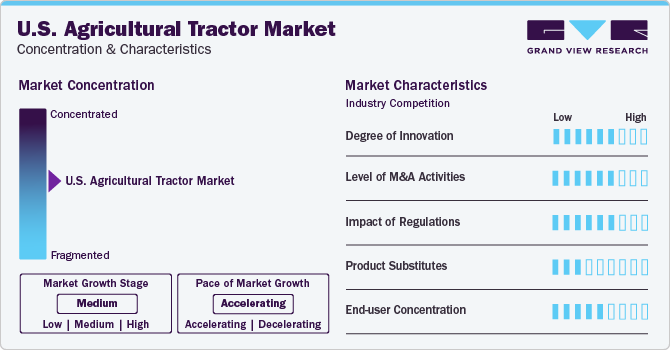

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The market is characterized by a significant degree of innovation owing to the rapid technological advancements in farming mechanization and equipment, driven by factors such as advancements in machine learning algorithms, availability of big data, and increasing computing power.

The U.S. market for agricultural tractor is highly competitive with many large and big players. The market also witnesses a high level of M&A activities by the leading players. This can be attributed to the desire to grow a customer base, increase product offerings, and consolidate in a growing market.

The market is also subject to increasing regulatory scrutiny due to concerns about the environmental damage due to ICE tractor engines. The United States Environmental Protection Agency (US EPA) has developed regulations related to emissions from heavy vehicles such as tractors and commercial vehicles. Such regulations force manufacturers to alter components in vehicles, resulting in increased costs of vehicles.

There are no direct product substitutes for agriculture tractors. In addition, advances in robotic technology are anticipated to lead to the development of advanced autonomous tractors. Precision farming technologies, including autonomous tractors, drones, and robotic systems, are emerging as alternatives that offer more efficient and precise farming operations. These technologies aim to optimize resource use, enhance productivity, and reduce environmental impact.

Compact-sized tractors are witnessing an increase in demand as their compact size allows manufacturers to try different technologies and components in this segment before moving on to high-powered tractors. All these high-production, cost-effective, and user-friendly small tractors are being used by parks, landscapers, schools, cemeteries, and hobby farmers.

Engine Power Insights

The less than 40 HP segment held more than 64% of the market share in terms of volume in 2023. This large share is due to the low cost, compact size, and greater convenience offered by less than 40HP tractors to perform all basic farming operations. In addition, the electrification of tractors in the less than 40 HP segment is anticipated to pick up momentum over the coming years. This segment is also anticipated to witness the fastest CAGR of 7.5% over the forecast period.

The 40 HP to 100 HP segment is anticipated to witness a substantial CAGR from 2024 to 2030. Tech-savvy farmers, rising income levels, and better after-sales services are projected to fuel the segment growth over the coming years. The growing demand for high-power tractors for farm sizes of more than 10 hectares is anticipated to be a long-term factor, which can drive the segment growth over the projected period.

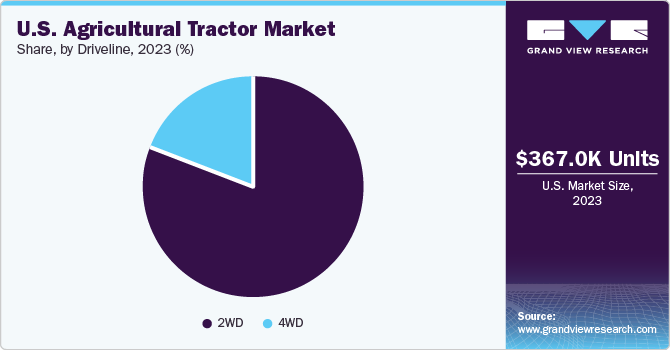

Driveline Insights

The 2WD segment held more than 80% market share in terms of volume in 2023. The segment is also anticipated to register the fastest CAGR from 2024 to 2030. Low upfront costs and better maneuverability are major factors that are projected to fuel the demand in this segment. The 2WD tractors are best suited for primary farming operations such as sowing, planting, etc. The 2WD tractors can be used on livestock, orchards, vineyard or crop farms for jobs where maneuverability and a sharp turning circle are more important than pulling power.

Followed by the 2WD, the 4WD tractors offer enhanced traction, greater pulling power, and versatility. The 4WD variants offer superior traction, distributing power to all four wheels. This enables them to tackle challenging terrains such as hills, mud, snow, or uneven surfaces more effectively. The feature of added traction allows the 4WD variants to pull heavier loads or work without getting stuck or losing traction, making them indispensable for heavy-duty tasks.

Propulsion Insights

A general tractor consists of many auxiliaries, that include hydraulic and coolant pumps, air brake and A/C compressors, and a radiator fan. Conventionally, these auxiliaries have been coupled to the engine and their performance depends on the speed of the engine. With fully electric tractors, there is no constantly running engine to power the auxiliaries. Therefore, electrification of the auxiliaries can decrease the required size of the engine, and decoupling the auxiliaries enables the engine to operate at a more fuel-efficient operating point while also enabling the auxiliaries to operate at their independent operating points, all with power on demand.

Electric tractors offer high compatibility with evolving regulatory standards and present a cost-effective solution with lower maintenance requirements. This shift reflects the industry's commitment to sustainability and aligns with global efforts to reduce carbon emissions and promote greener technologies in the agricultural sector.

Key U.S. Agricultural Tractor Company Insights

Key companies in the U.S. agricultural tractor market space, such as Deere & Company, CLAAS KGaAmbH, SOLECTRAC, and Monarch, have commercially launched concepts for their autonomous and electric tractors.

-

In July 2023, Deere & Company acquired Smart Apply, Inc., a precision spraying equipment company based in Indianapolis, Indiana. The company developed the Smart Apply Intelligent Spray Control System, an upgrade kit that can improve the precision and performance of virtually any air-blast sprayer used in orchard, vineyard, and tree nursery spraying applications. Smart Apply helps growers reduce chemical use, airborne drift, and run off while optimizing high-value crop yields and meeting sustainability objectives.

-

In February 2024, AGCO, a global leader in agricultural machinery and precision ag technology, introduced the Massey Ferguson 3 Series Specialty tractor. Designed to meet the unique challenges of vineyards and orchards, the MF 3 Series brings straightforward dependability to a new market with seven models ranging from 75-115 HP.

Iron Ox and Monarch Tractors are some of the emerging market participants in the target market.

-

Iron Ox is a global service provider of agriculture technology. The company provides automated robotic arms for tasks such as planting, harvesting, and packaging.

-

In May 2023, Monarch Tractors, the maker of the MK-V, the fully electric, driver-optional, connected tractor, announced a new financial services agreement with CNH Industrial Capital America, LLC. Owing to this new agreement between Monarch Tractor and CNH Industrial, Monarch Tractor’s technology will reach new farmers in expansive geographies across the country, and leverage CNH Industrial Capital’s expertise in agricultural equipment finance.

Key U.S. Agricultural Tractor Companies:

- AGCO Corp.

- CNH Industrial N.V.

- Deere & Company

- International Tractors Ltd.

- YanmarCo., Ltd.

- KubotaCorp.

- Mahindra & Mahindra Ltd.

- Tractors and Farm Equipment Ltd.

- CLAAS KGaA mbH

Recent Developments

-

In August 2023, Kalmar, part of Cargotec, signed an agreement to acquire the product rights of the electric terminal tractor product line from Lonestar Specialty Vehicles (LSV) in the United States. As part of the transaction, LSV will transfer the immaterial assets for Kalmar and act as Kalmar’s contract manufacturing partner for the acquired electric terminal tractor product range.

-

In October 2023, Yanmar America, a leading provider of innovative agricultural and industrial solutions, is set to dazzle attendees at Equipment Expo 2023 with the debut of its cutting-edge e-tractor concept. This all-new development from Yanmar marks the first public appearance of the innovative electric tractor concept, offering users a versatile powertrain selection tailored to their specific work needs.

U.S. Agricultural Tractor Market Report Scope

Report Attribute

Details

Market size volume in 2024

385.63 thousand units

Revenue forecast in 2030

591.62 thousand units

Growth rate

CAGR of 7.4% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in thousand units, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Engine power, driveline, propulsion

Country scope

U.S.

Key companies profiled

AGCO Corp.; CLAAS KGa AmbH; CNH Industrial N.V.; Deere & Company; International Tractors Ltd; Kubota Corp.; Mahindra & Mahindra Ltd.; Tractors and Farm Equipment Ltd.; YanmarCo., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Agricultural Tractor Market Report Segmentation

This report forecasts revenue and volume growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. agricultural tractor market report based on engine power, driveline, and propulsion:

-

Engine Power Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

-

Less Than 40 HP

-

41 to 100 HP

-

More Than 100 HP

-

-

Driveline Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

-

2WD

-

4WD

-

-

Propulsion Outlook (Volume, Thousand Units, Revenue, USD million 2017 – 2030)

-

Electric

-

ICE

-

Frequently Asked Questions About This Report

b. The U.S. agricultural tractor market demand was estimated at 367.04 thousand units in 2023 and is expected to reach 385.63 thousand units in 2024.

b. The U.S. agricultural tractors market is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030 to reach 591.62 thousand units by 2030.

b. Less than 40 hp tractors dominated the agricultural tractor market with a share of 64.83% in 2023. This is attributable to the benefits associated with these agricultural tractors, such as compact size, low cost, and ability to perform all the basic agricultural activities.

b. Some key players operating in the U.S. agricultural tractors market include Deere & Company; AGCO Corporation; and CLAAS KGaA mbH

b. The agriculture tractor market in the U.S. is expected to account for a significant revenue share in North America agricultural tractor market. Several factors influence the U.S. tractor market, including agricultural trends, technological advancements, regulatory policies, economic conditions, and consumer preferences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.